PEPE poised for a breakout: Can the memecoin rally to new highs?

- Pepe’s breakout targets $0.00002187 resistance, with bullish patterns signaling potential upward momentum.

- Technical indicators and liquidation information spotlight robust bullish sentiment, supporting a attainable rally.

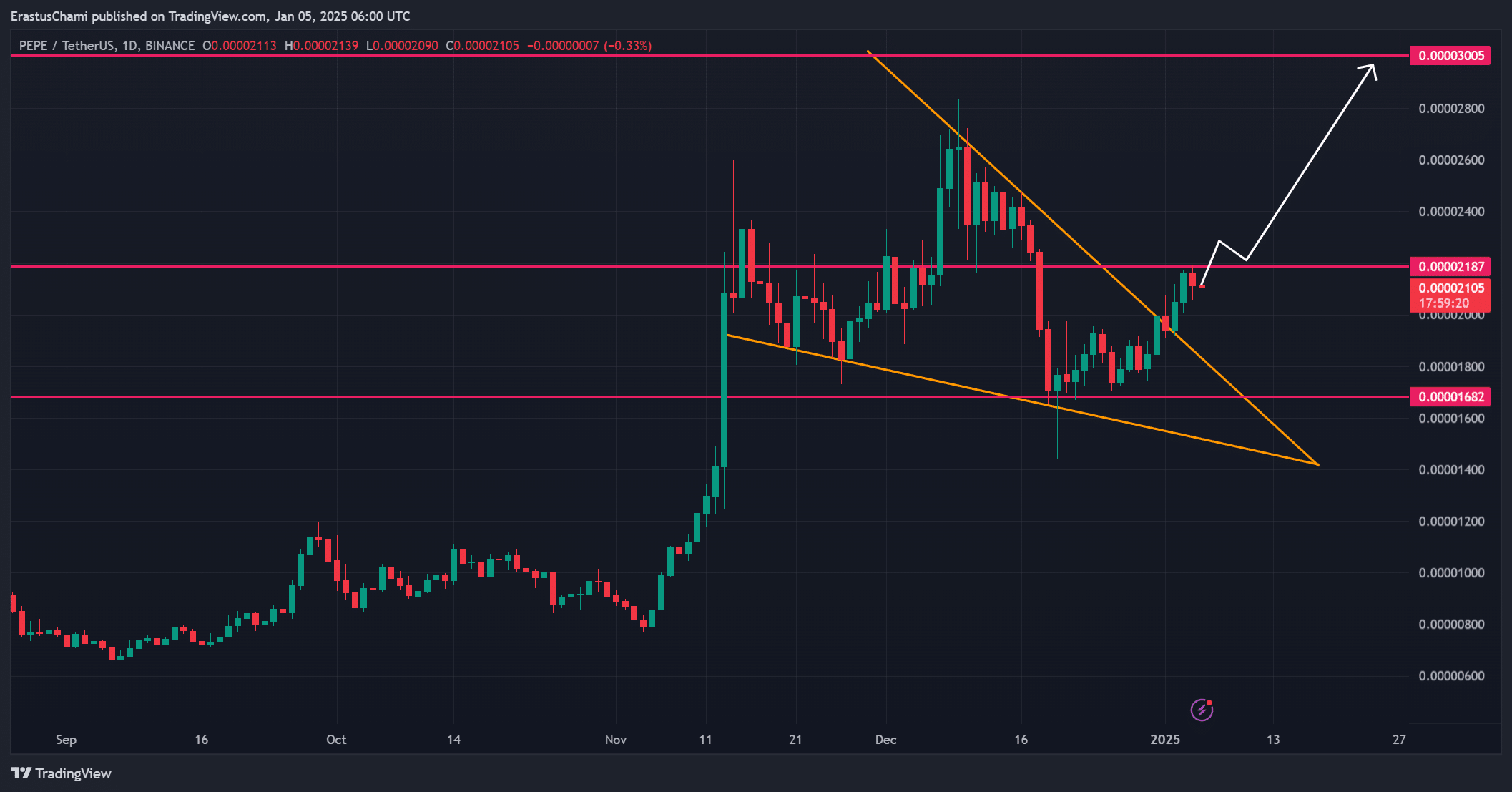

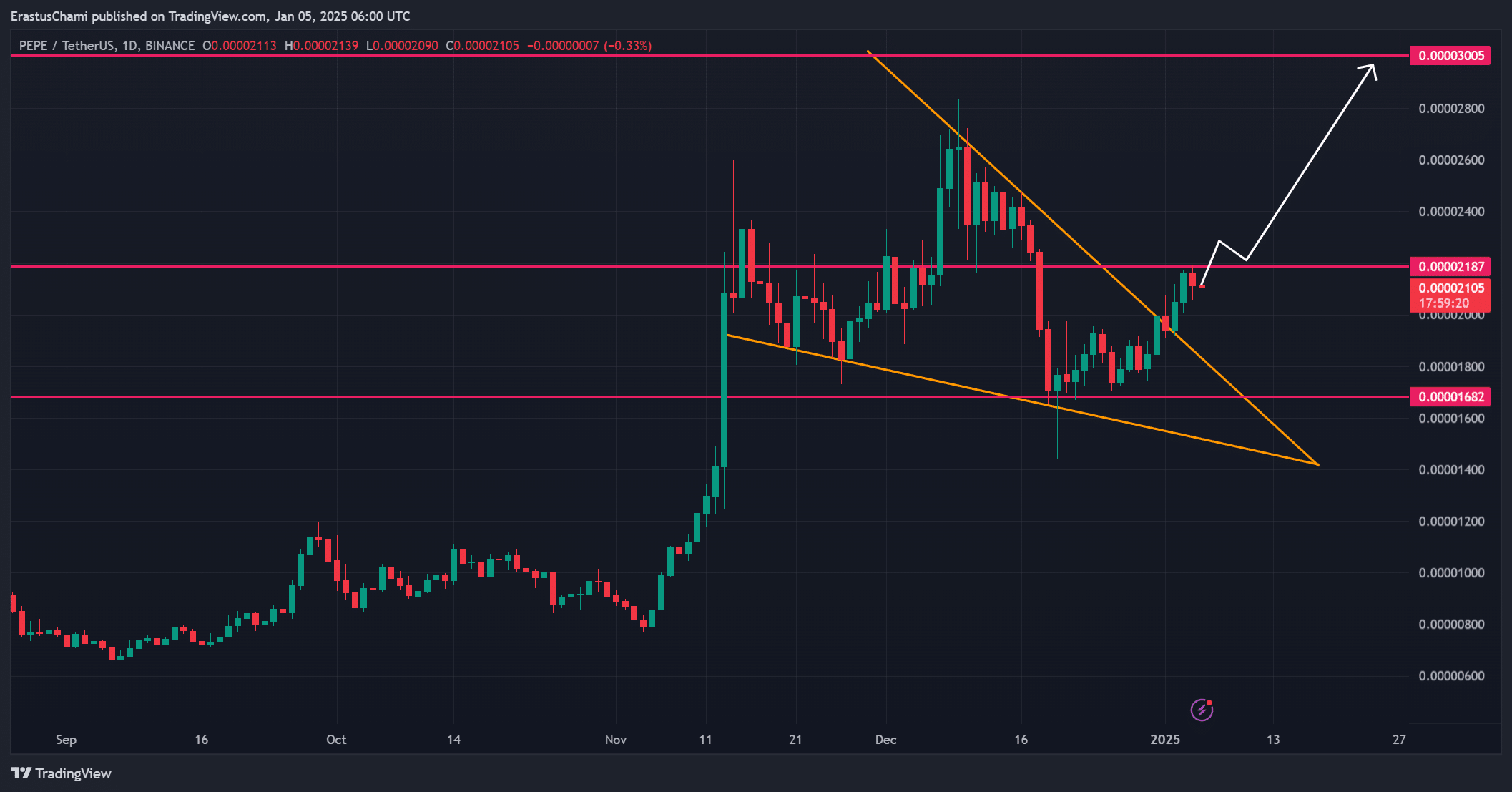

Pepe [PEPE] has emerged from a descending symmetrical triangle, a technical sample usually related to breakout potential in crypto markets.

Buying and selling at $0.00002102, down by 1.18% at press time, the token was displaying indicators of power regardless of minor retracements.

The query now could be whether or not Pepe can maintain its upward momentum and rally to new heights within the coming days.

PEPE’s worth motion reveals potential

Pepe’s worth motion (PA) mirrored a powerful restoration because the token consolidated close to important resistance at $0.00002187.

Breaking above this degree may affirm a bullish breakout, setting the stage for a possible rally towards $0.000030, the following vital resistance.

Moreover, the symmetrical triangle breakout highlighted diminished promoting strain and rising purchaser curiosity.

Nonetheless, failure to surpass $0.00002187 may result in one other consolidation part, testing assist ranges at $0.00001682.

Supply: TradingView

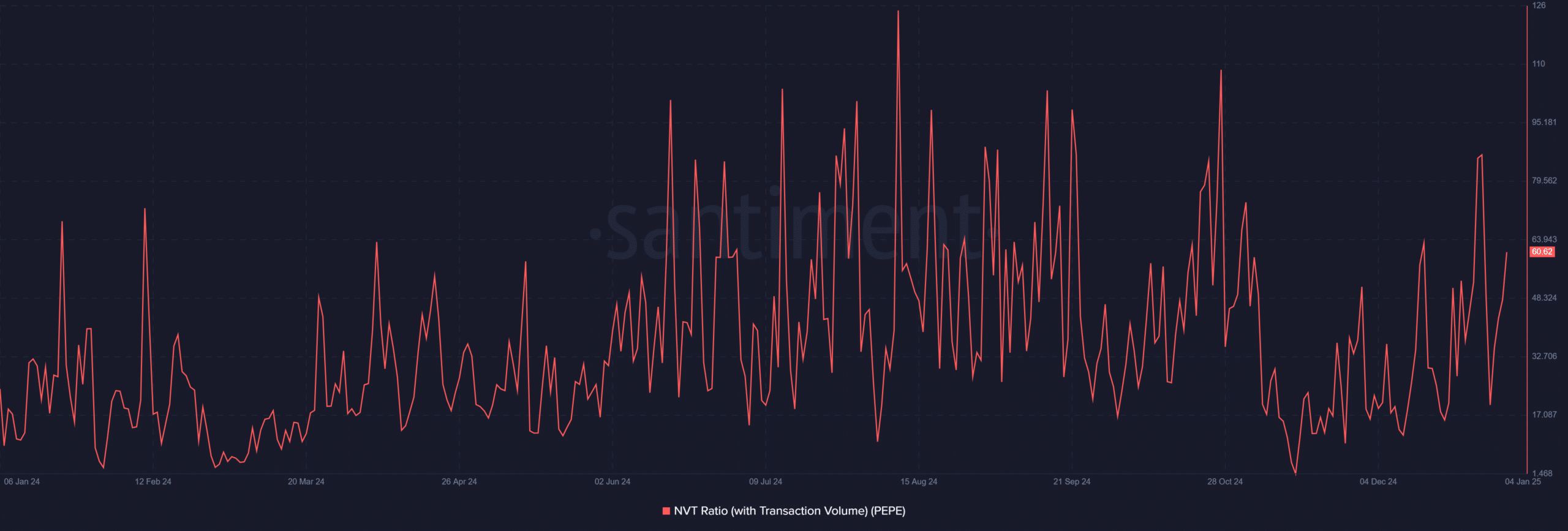

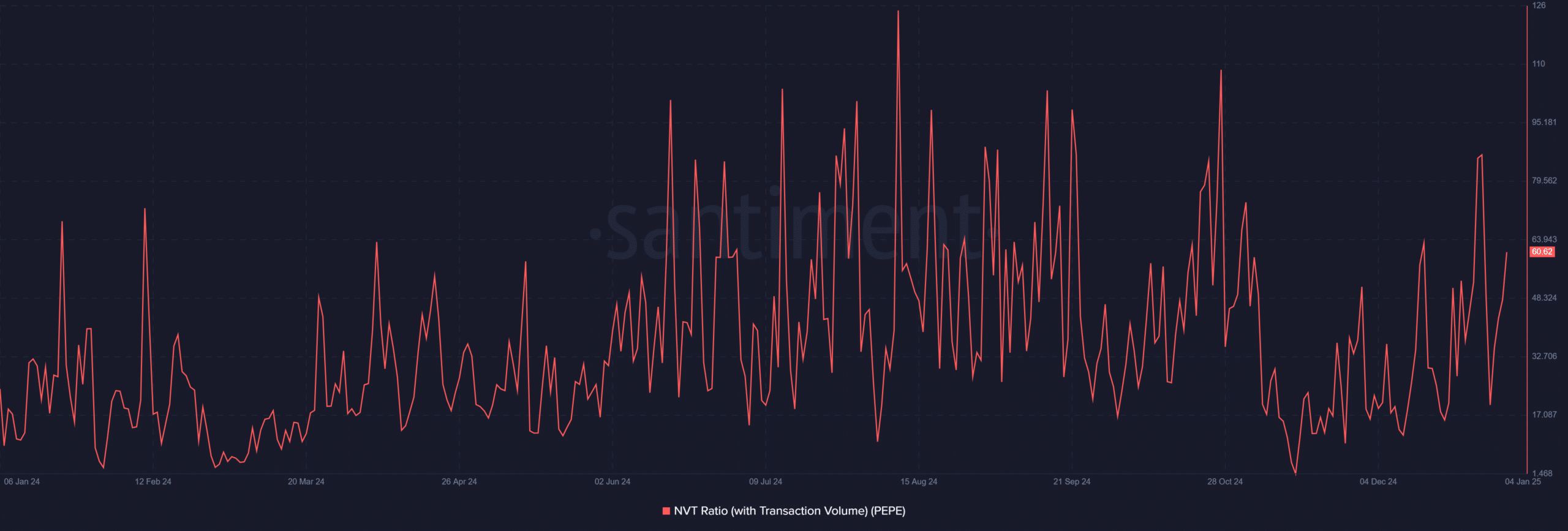

NVT ratio factors to rising market confidence

The community worth to transaction (NVT) ratio has risen from 48 to 60.62, indicating growing on-chain exercise relative to the token’s market valuation.

This recommended renewed investor confidence as transactional exercise supported the worth restoration.

The next NVT ratio usually displays sustained curiosity within the asset, which may bolster bullish sentiment. Nonetheless, for the worth to maneuver larger, the ratio should stay according to rising transaction volumes.

Supply: Santiment

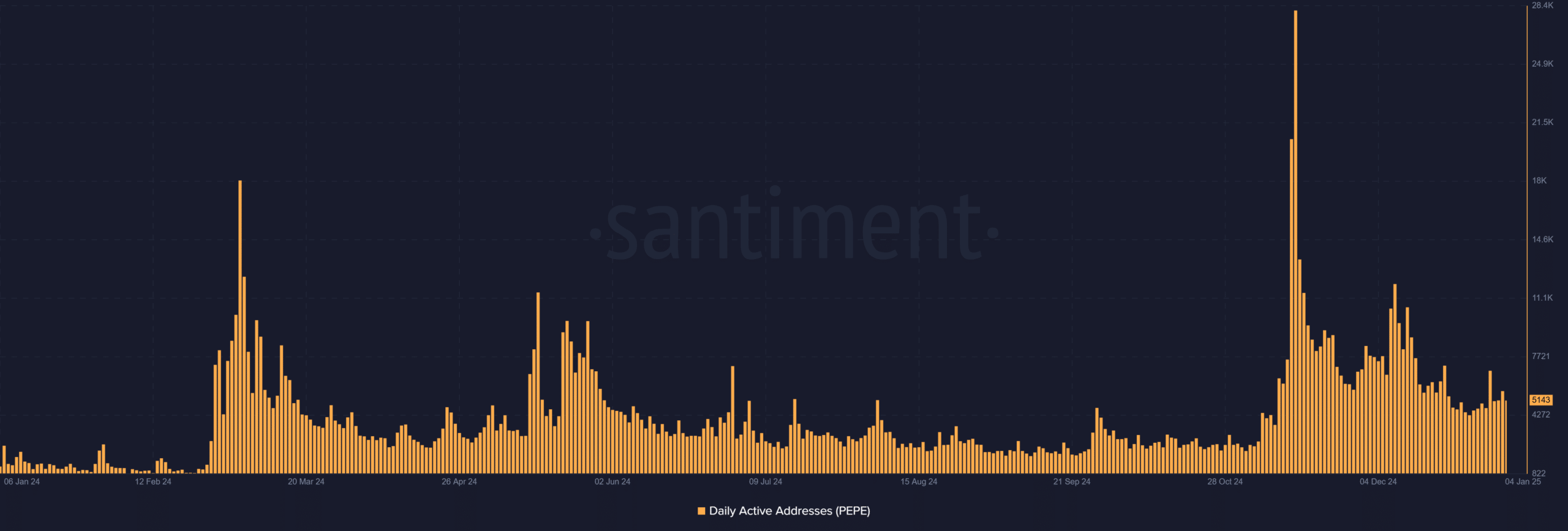

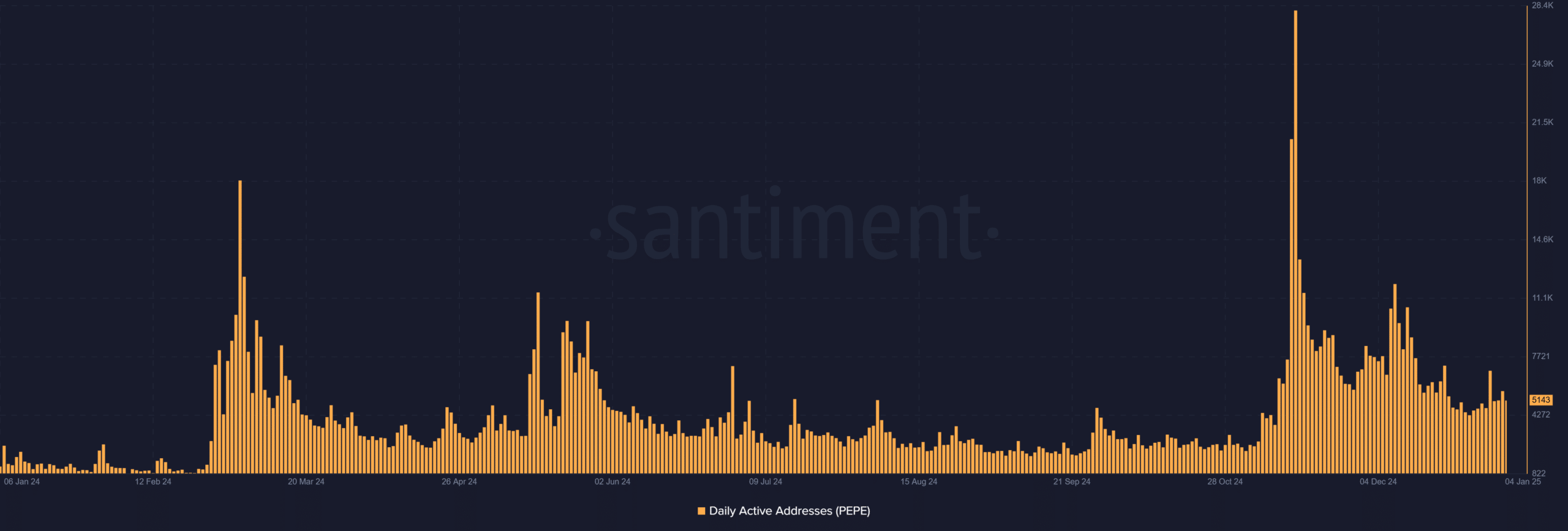

PEPE day by day lively addresses present regular engagement

Day by day lively addresses had been recorded at 5,143, reflecting reasonable however regular participation from customers. This stability signifies {that a} dedicated person base is actively partaking with Pepe, even during times of worth consolidation.

If the token’s worth continues to rise, a surge in day by day lively addresses may add additional validation to the breakout potential. Due to this fact, elevated person exercise within the coming days can be important in sustaining upward momentum.

Supply: Santiment

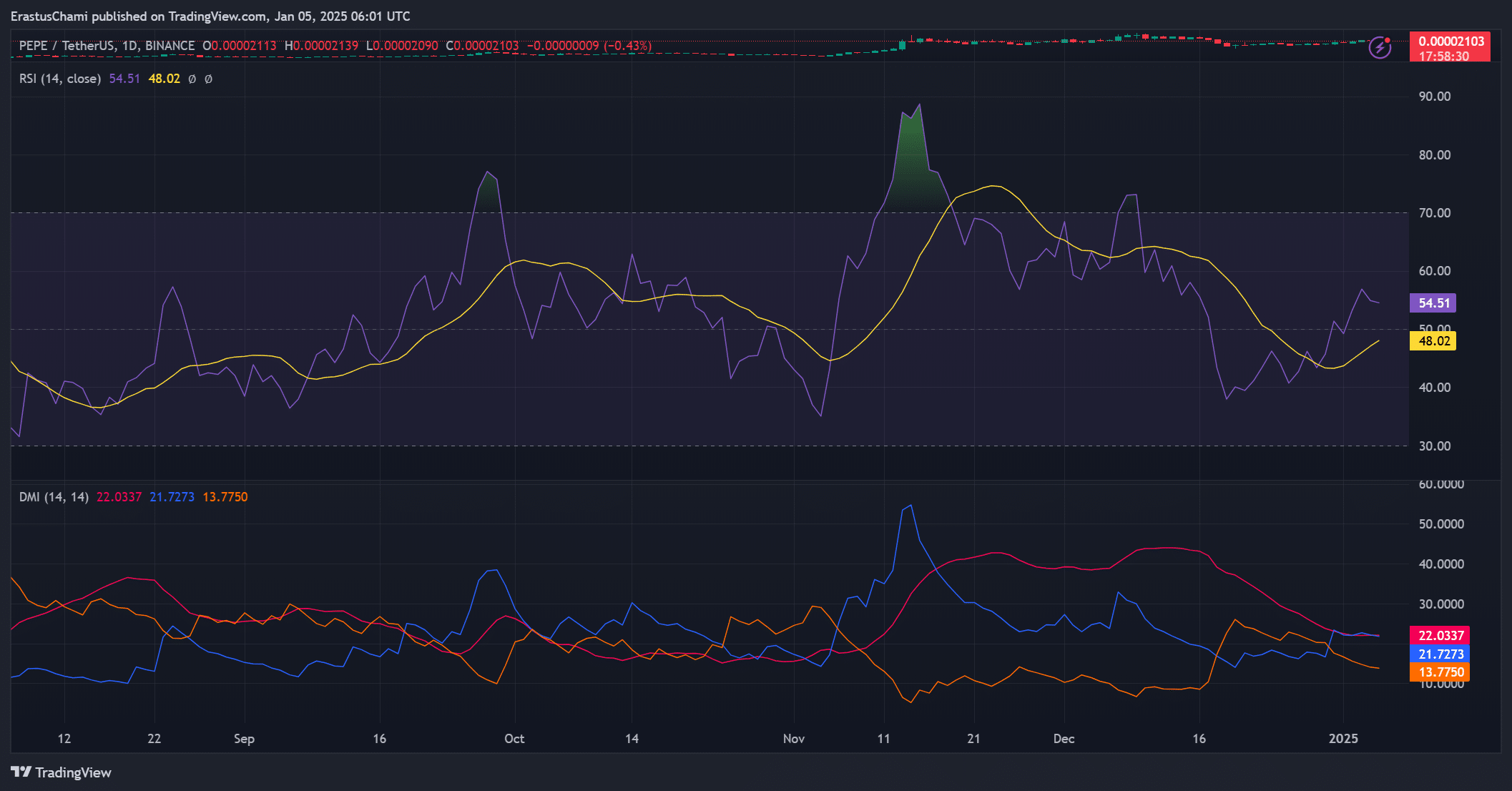

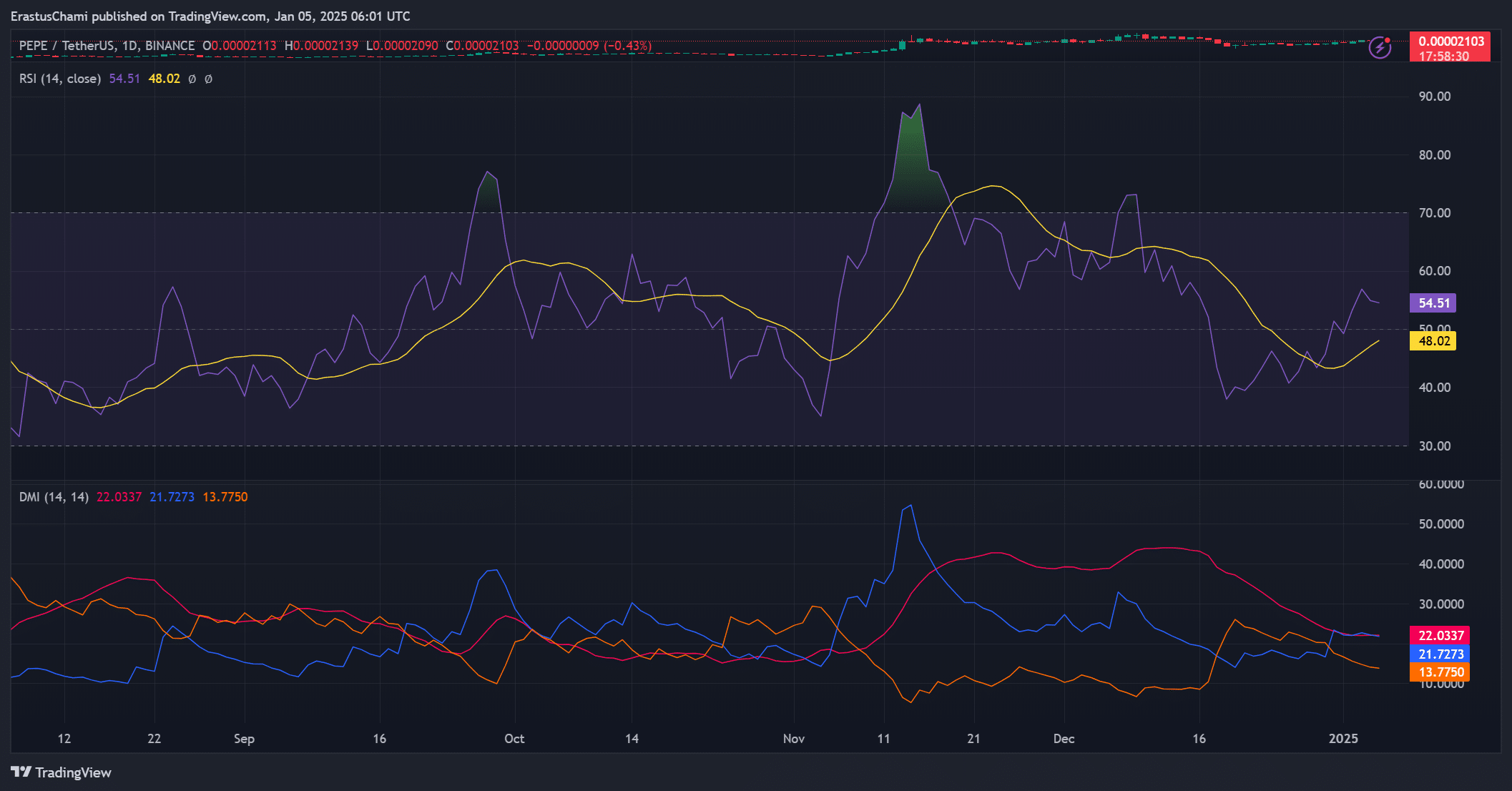

Technical indicators assist bullish momentum

Pepe’s technical indicators recommended a turning level in market dynamics.

The relative power index (RSI) stood at 54.51, indicating reasonable bullish momentum and leaving room for additional upward motion with out overbought situations.

In addition to, the directional motion index (DMI) revealed that the +DI was at 21.7, -DI was at 13, and the typical directional index (ADX) was at 22.

These figures recommended a strengthening development, with patrons gaining management over the market. Nonetheless, for the rally to materialize, ADX should proceed rising to substantiate development power.

Supply: TradingView

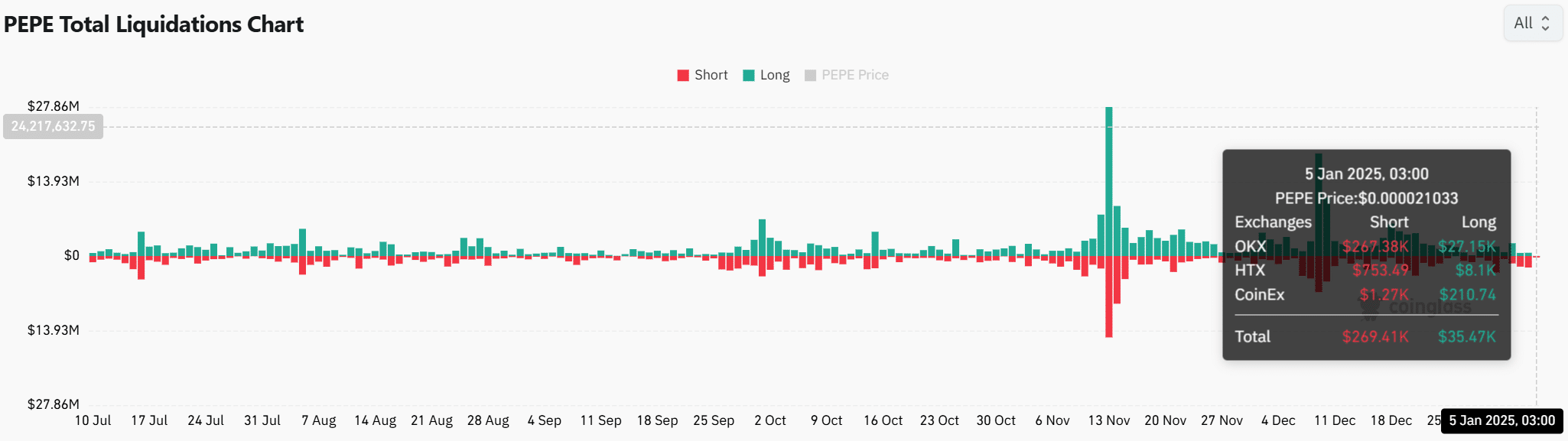

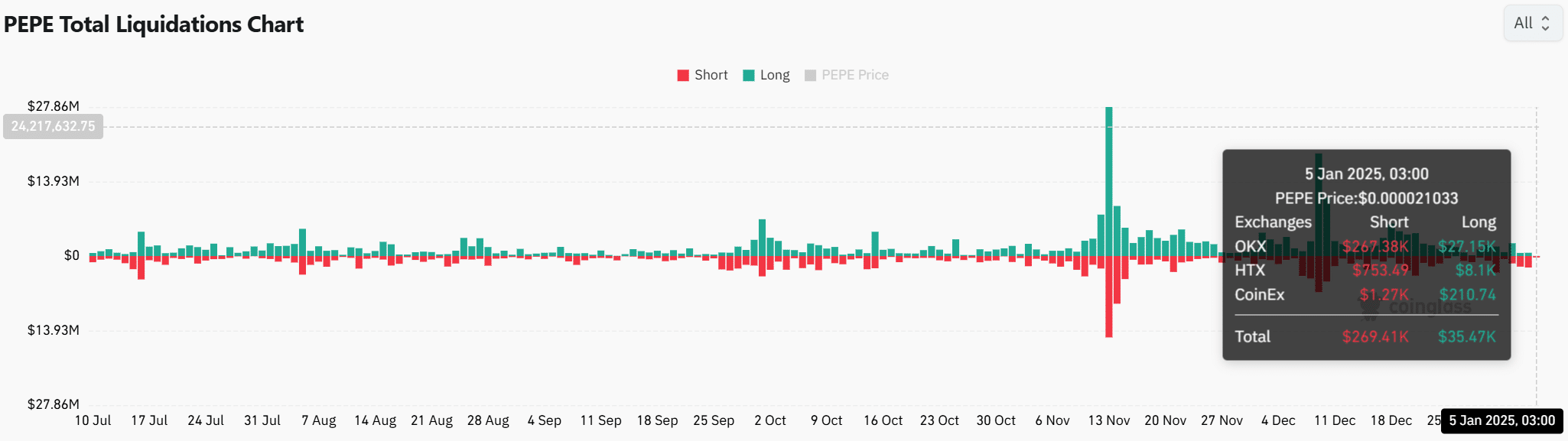

Liquidation information alerts bullish sentiment

Liquidation information confirmed $269.41K briefly positions worn out in comparison with $35.47K in longs, reflecting rising confidence in an upward transfer.

This bullish bias amongst merchants offers further assist for a possible breakout. Nonetheless, continued shopping for strain can be essential to maintain these features and forestall a worth pullback.

Supply: Coinglass

Learn Pepe’s [PEPE] Value Prediction 2025–2026

Conclusion: PEPE is able to take a look at new highs

Pepe’s breakout from the descending symmetrical triangle, coupled with enhancing on-chain metrics and bullish technical indicators, positions it for a possible rally.

If the token can surpass the $0.00002187 resistance, it may pave the best way for a transfer towards $0.000030. Due to this fact, Pepe appears primed for upward momentum, supplied market situations stay supportive within the close to time period.