PEPE’s correlation with Ethereum might play out THIS way for the memecoin

- Knowledge revealed that the memecoin’s sturdy ties to ETH might stall additional development

- Excessive alternate outflows would possibly assist PEPE

Frog-themed memecoin Pepe [PEPE] was one of many few top-50 cryptocurrencies to register features within the final 24 hours. At press time, PEPE was buying and selling at a price of $0.000011, following a 3.35% hike its its worth on 21 June.

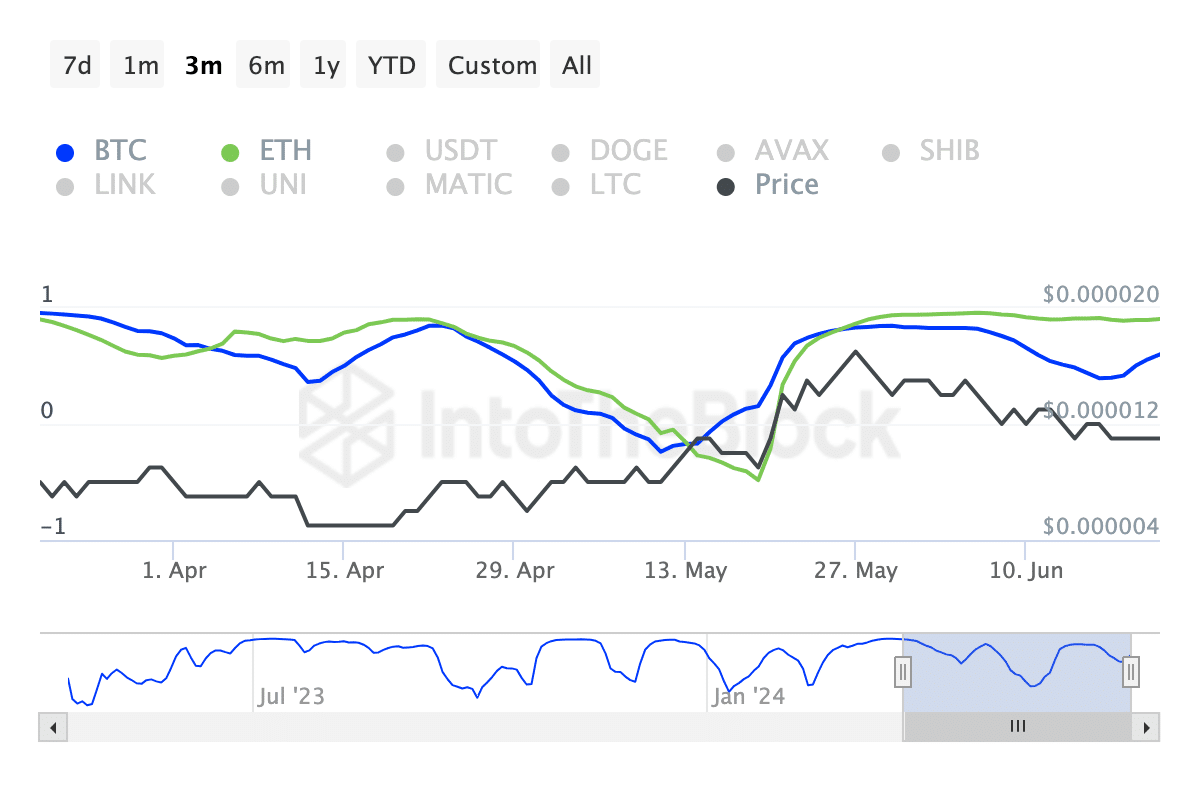

Nonetheless, AMBCrypto discovered that the uptrend may not final. One purpose for a similar will be the memecoin’s correlation with Ethereum [ETH]. In accordance with IntoTheBlock, PEPE’s correlation with ETH was. 0.91 at press time.

ETH has sturdy hyperlinks with PEPE

The aforementioned determine was far above the correlation it shares with Bitcoin [BTC], which stood at 0.60. Values of the correlation ranges from -1. to +1. When the studying is near -1, it implies that costs hardly transfer in the identical path.

Nonetheless, if the studying is near +1, it implies that costs head within the same direction most instances. And that was the case with ETH and PEPE.

However not like PEPE, ETH didn’t recognize on the charts. As an alternative, it moved sideways, buying and selling at $3,502 at press time.

Supply: IntoTheBlock

Ought to the value of the altcoin proceed to consolidate or encounter a decline, PEPE’s value might retrace too. Past that, just a few memecoins additionally jumped, that means quite a lot of capital was not flowing into the class to kickstart a rally.

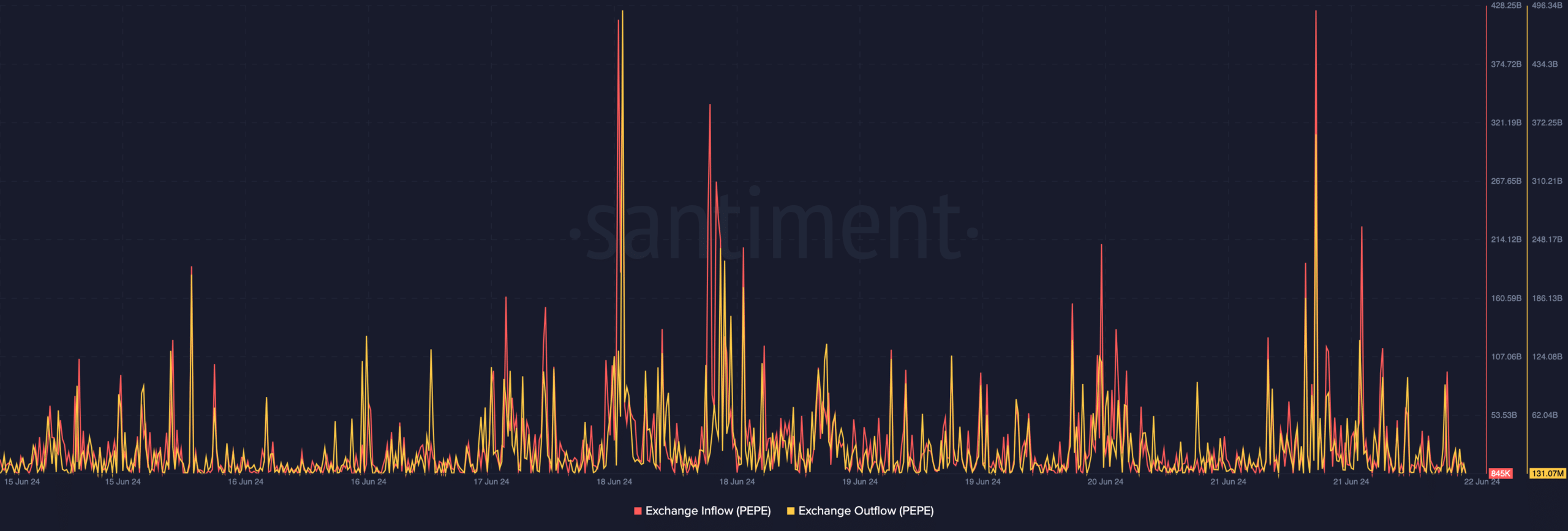

Quite the opposite, alternate flows appeared to recommend that ETH may not be capable of halt the uptrend. At press time, PEPE’s alternate inflows had been 845,000.

Memecoin is in a decent spot

Inflows measure the variety of tokens being despatched into exchanges. When this quantity is excessive, it implies that promoting strain could possibly be intense, and will most likely result in a value decline.

However, Santiment information revealed that the alternate outflows had been a lot increased at 131.07 million. The rise in the outflows implies that these accumulating the token are refraining from holding them on exchanges.

As an alternative, contributors are holding them in non-custodial wallets. Ought to this exercise proceed, PEPE would possibly overlook its sturdy ties with ETH, and the value might recognize on the charts.

Supply: Santiment

If so, the worth of the token might hit $0.000013 within the quick time period. Nonetheless, merchants may not have to be cautious.

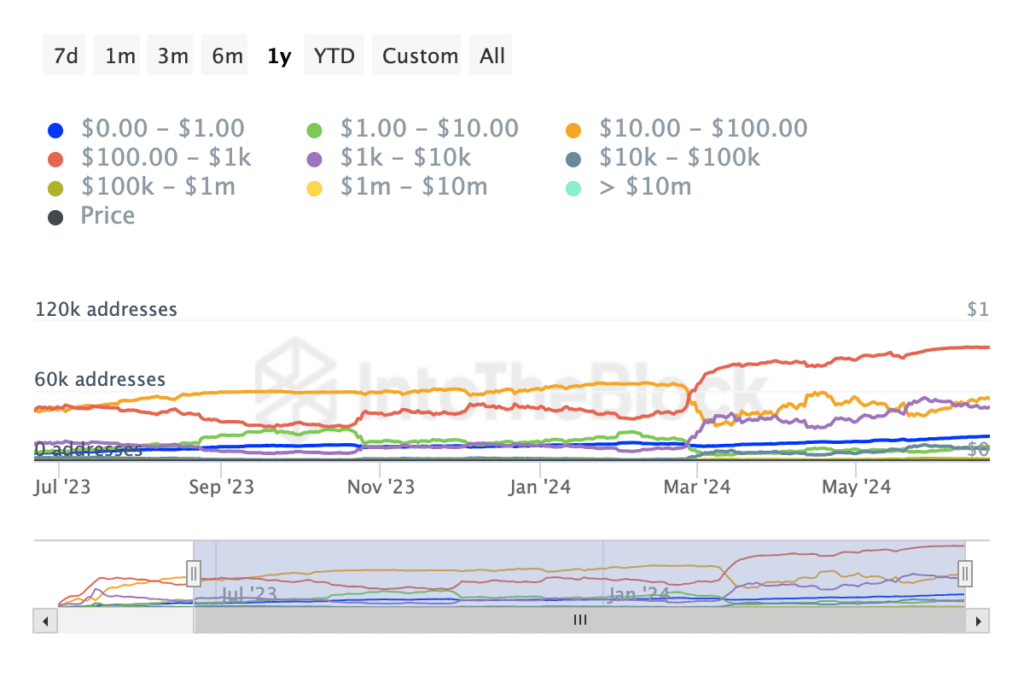

This, due to the holdings distribution data. Think about this – Addresses by holdings revealed the 30-day change of the variety of contributors shopping for extra of a token at a sure threshold.

Usually, the retail cohort not often influence costs like massive buyers. At press time, the variety of addresses holding $1,000 to $10 million price of the token had fallen.

Contemplating the newest sell-offs throughout the market, PEPE would possibly now battle to maintain up with its former bullish momentum.

Supply: IntoTheBlock

Real looking or not, right here’s PEPE’s market cap in ETH phrases

If this occurs, the prediction to $0.000013 talked about above could possibly be invalidated. Due to this fact, PEPE’s value might transfer on the identical tempo as ETH, and its value would possibly stay across the $0.000011 zone.