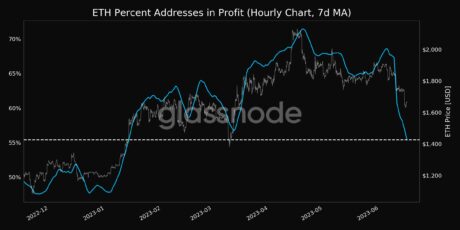

Percentage Of ETH Addresses In Profit Reaches 5-Month Low

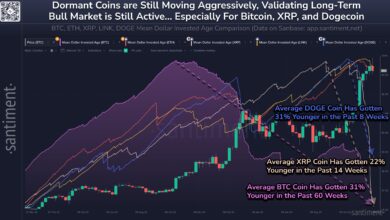

The brutal bear market in crypto over the previous few months has taken a severe toll on ETH’s value and profitability. The value of Ethereum has been caught in a sideways vary not too long ago, and lots of ETH holders have been unfortunate for it. In line with information from Glassnode, the share of Ethereum addresses in revenue has now dropped to a 5-month low.

Proportion Of Addresses In The Inexperienced Drops To 55.414%

Again in 2021, when the worth of ETH was at its highest, the vast majority of addresses held a snug place. Now, two years later, for brand spanking new buyers who purchased at increased costs, the wait for his or her positions to go inexperienced once more has been an extended one.

Glassnode, a crypto analytics platform, reports that the share of Ethereum addresses in inexperienced whereas measuring over a 7-day shifting common is now at a 5-month low of 55.414%.

Proportion of addresses in revenue drop to five-month low | Supply: Glassnode on Twitter

This means that greater than 44 % of the individuals who personal ETH are presently at a loss. In the identical vein, the variety of worthwhile addresses has dropped to its lowest level since March of this yr, standing at 56,311,171.899 for the time being.

Transferring ETH Off Exchanges

The quantity of ETH held on cryptocurrency exchanges has additionally dropped to its lowest degree in over 5 years. This implies much less ETH is out there for buying and selling on exchanges, which might influence the worth and liquidity. Merchants are withdrawing their ETH from exchanges and holding it in non-public digital wallets.

The drop will also be linked to an all-time excessive degree of staking within the ETH 2.0 deposit contract. Information reveals that almost all of ETH held by giant buyers at the moment are shifting ETH into the contract, exhibiting that curiosity in ETH staking is rising. This declining provide, coupled with growing mainstream curiosity in ETH, may drive the worth increased if demand stays robust.

Ethereum Plunges Under $1,700

In the meantime, Ethereum broke under essential value help earlier this week. The value plunged under $1,700 to $1,630 yesterday, marking its lowest worth since March 16. The plunge in value and profitability is basically attributed to adverse sentiment round rising inflation fears and the general weak spot within the crypto market not too long ago.

ETH has since then recovered and is now buying and selling at $1,720, seeking to retest the $1,800 resistance as soon as extra. After all, if $1,700 fails to carry, Ethereum may fall additional to check help at $1,400 and even $1,300. A drop under $1,700 once more can be very bearish and see the profitability proportion drop additional.

Ethereum value recovers above $1,700 | Supply: ETHUSD on TradingView.com

Featured picture from The Cryptoknowmist, chart from TradingView.com