Polkadot (DOT) Circulating Market Cap Rockets To $8.3 Billion, Registers Massive 111% Growth

Polkadot, the computing platform recognized for its interoperability and scalability, has proven exceptional development in key metrics through the latter a part of 2023, as outlined in a current report by Messari.

Outpacing Crypto Market Development

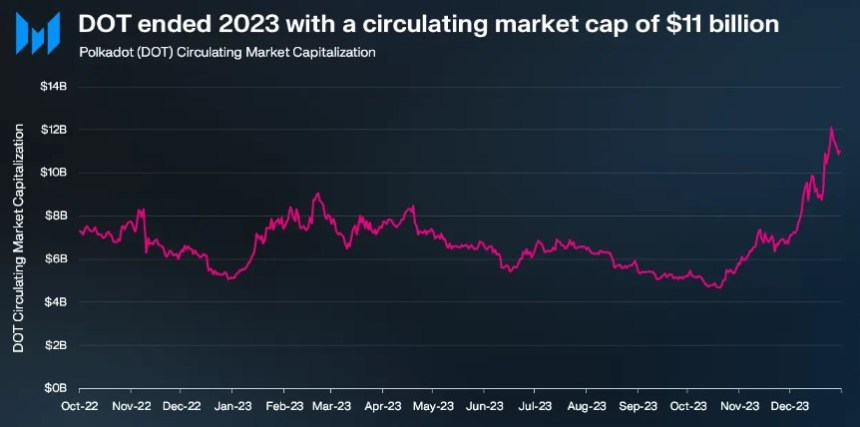

In accordance with Messari’s findings, Polkadot’s circulating market cap skilled a exceptional 111% quarter-on-quarter (QoQ) development, reaching a powerful $8.38 billion.

This development outpaced the general crypto market’s development of 54% throughout the identical interval. Moreover, Polkadot’s year-on-year (YoY) change reached 94%, solidifying its place among the many prime 15 crypto initiatives by market capitalization.

By way of income, Polkadot witnessed a considerable surge of two,880% QoQ, producing $2.8 million in This fall 2023. This surge was primarily attributed to the numerous rise in extrinsic, pushed by the introduction of Polkadot Inscriptions.

Messari means that even excluding the four-day spike from the Inscriptions, Polkadot’s income would have doubled from the earlier quarter. It’s value noting that Polkadot’s income tends to be comparatively decrease in comparison with its opponents because of the structural design of its community.

Polkadot Witnesses Vital Enhance In Energetic Addresses

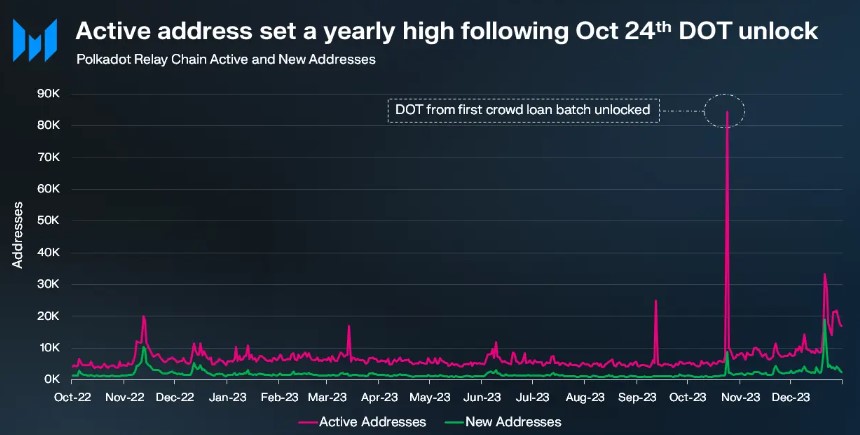

Following the launch of OpenGov – the governance module and framework inside the community – in June, the Polkadot Relay Chain skilled a surge in account exercise, largely resulting from elevated governance participation.

As a result of the Relay Chain is essential in facilitating governance processes, it skilled a spike in lively addresses on October 24, when customers claimed their locked DOT tokens from the primary batch of parachain auctions held two years earlier.

All through This fall, the Polkadot Relay Chain averaged over 10,000 day by day lively addresses, representing a considerable 90% QoQ improve. Excluding the October twenty fourth exercise associated to DOT token claiming, the typical variety of lively addresses nonetheless noticed a big 70% rise in QoQ, reaching 9,000.

Moreover, Cross-Chain Message (XCM) transfers on the platform elevated by 150% QoQ, reaching an all-time excessive of 133,000. The whole variety of lively XCM channels practically tripled in 2023, reaching 203 by the tip of the 12 months.

In accordance with Electrical Capital’s rankings, Polkadot has 800 full-time and a couple of,100 complete builders, making it one of many largest crypto ecosystems in developer participation.

DOT Worth Exhibits Blended Efficiency

Regardless of notable development in key metrics demonstrating the community’s enlargement, the value of Polkadot’s native token, DOT, has not adopted swimsuit and has even skilled declines over longer time frames regardless of constructive developments.

At the moment, DOT is buying and selling at $6.7420, representing a slight 0.3% worth improve previously twenty-four hours, coupled with a 9% year-to-date achieve.

Nonetheless, over the previous fourteen and thirty days, the token has recorded a 6% and 22% worth drop, highlighting the absence of bullish momentum and catalysts that would propel DOT to increased ranges.

Though it reached a 19-month excessive of $9.5711 on December 26, the next worth drop has led DOT to a essential juncture, probably erasing its features over the previous 12 months.

If the present degree and its nearest help at $6.3229 fail to halt additional worth declines, DOT may probably drop to the $5.4830 degree, which serves as the subsequent main help within the token’s 1-day chart.

Conversely, if DOT surpasses its higher resistance at $7.0392, the subsequent goal can be to interrupt the short-term downtrend construction, dealing with the $7.5332 resistance and one other resistance at $8.1631. This could pave the way in which for an additional consolidation section at its 19-month excessive.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site completely at your personal threat.