Bitcoin’s $80B monthly inflows: A sign of stability over speculation?

- Bitcoin noticed document inflows, fueled by institutional inflows and regulatory readability.

- Rising confidence in Bitcoin’s realized cap highlighted its shift from hypothesis to stability.

Bitcoin [BTC], as soon as recognized for wild worth swings, is now drawing $80 billion in capital each month.

Practically half of all of the capital ever invested in Bitcoin has flowed in simply this previous 12 months. This surge alerts a market shift, suggesting Bitcoin could also be evolving from a high-risk asset to a extra steady retailer of worth. Institutional traders are viewing Bitcoin as a extra steady funding.

As this transformation unfolds, one key query stays: What does this imply for Bitcoin’s long-term future?

What’s driving Bitcoin’s unprecedented inflows?

The latest surge in Bitcoin inflows, totaling $80 billion per thirty days, displays a confluence of macroeconomic and market-specific drivers.

Institutional traders are more and more viewing Bitcoin as a hedge in opposition to inflation and a diversification instrument amid monetary market uncertainty.

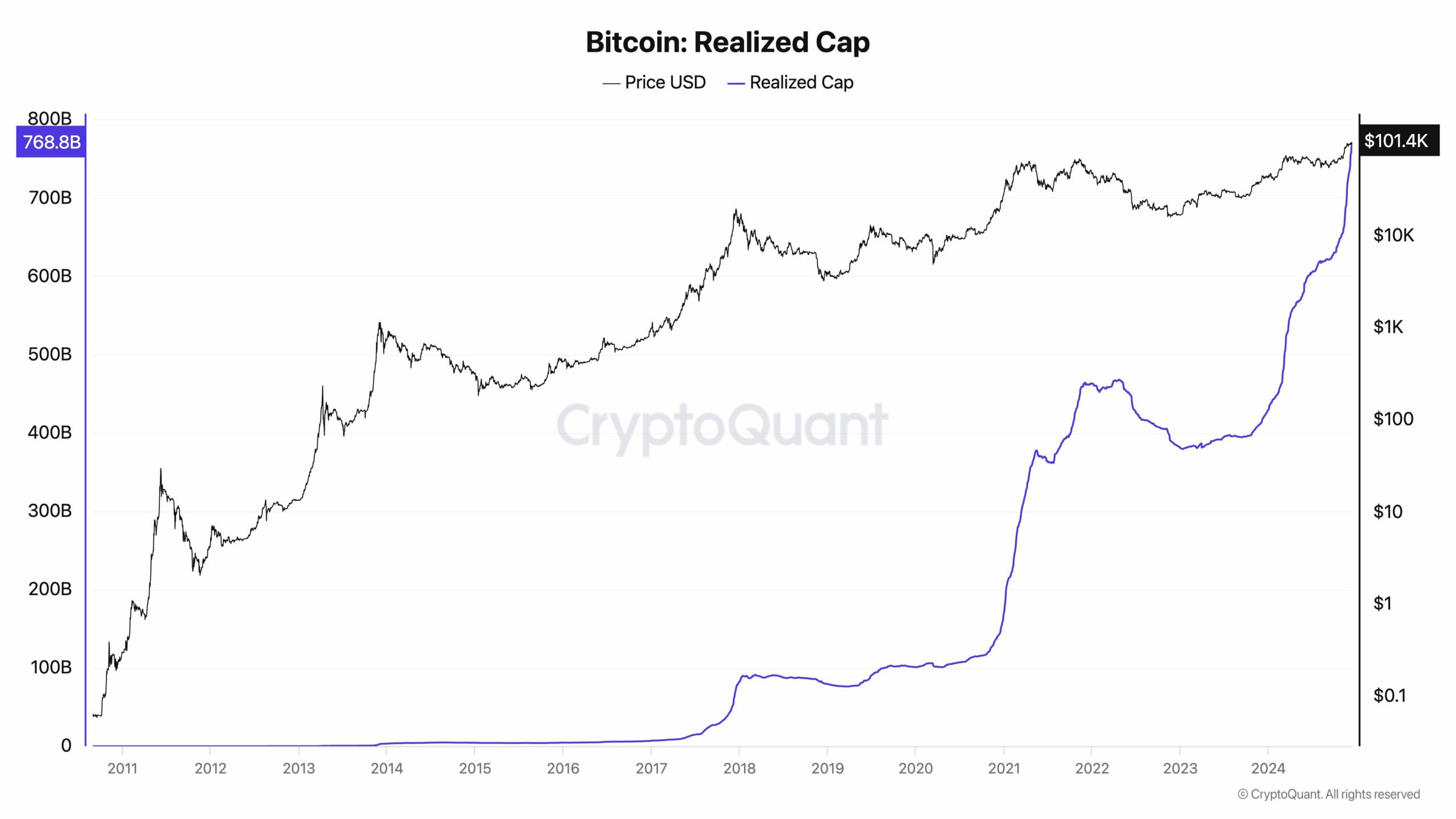

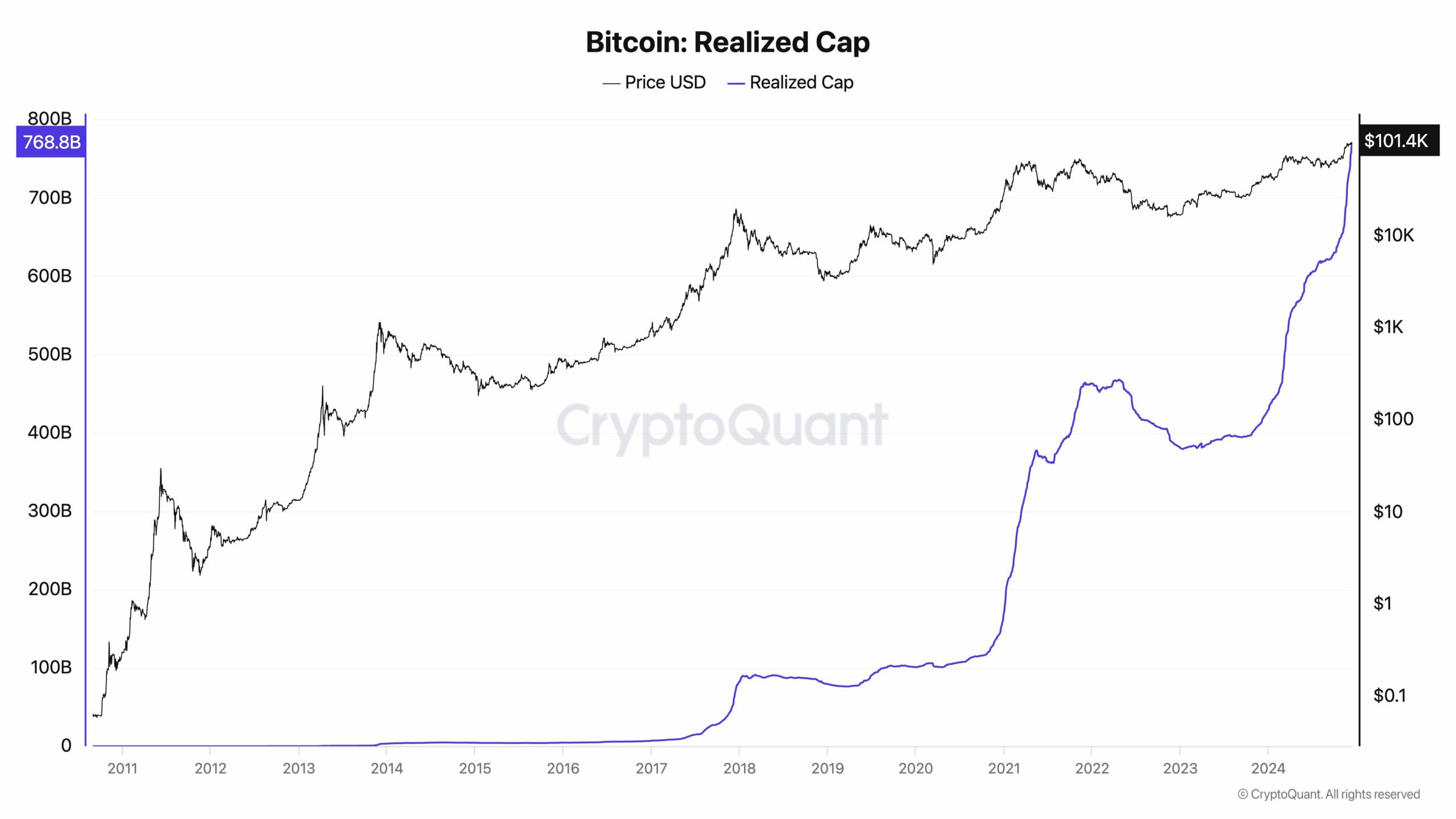

The sharp rise in Bitcoin’s realized cap to $768.8 billion reveals rising confidence in its long-term stability. Contemporary capital from whales and long-term holders is accumulating close to all-time excessive worth ranges.

Supply: CryptoQuant

Notably, regulatory readability in main jurisdictions and the anticipation of Bitcoin ETF approvals have additional legitimized its attraction.

Coupled with a strengthening greenback and declining yields on risk-free belongings, these components sign that Bitcoin is now not the area of hypothesis however a cornerstone within the evolving monetary ecosystem.

Influence of the influx on market cap and the way the latter impacts BTC worth

BTC’s market cap, now edging towards $2 trillion, owes a lot of its latest development to the inflow of institutional capital.

This capital influx amplifies liquidity, stabilizing worth actions and decreasing the chance of sharp corrections, a shift from Bitcoin’s earlier volatility. Because the realized cap reaches $768.8 billion, it signifies a sturdy base of assured long-term holders.

Traditionally, market cap enlargement correlates straight with larger worth potential. Extra capital creates a optimistic suggestions loop, attracting new traders and rising demand.

This dynamic is clear in BTC’s capacity to maintain all-time excessive costs with out important pullbacks, bolstering its popularity as a dependable retailer of worth.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025