Polygon’s short-term momentum faces strong resistance HERE – What next?

- Polygon’s token has a bearish outlook on the 1-day and 1-week timeframes.

- The $0.3 psychological resistance stage and the $0.285 resistance must develop into helps earlier than POL can provoke an uptrend.

The Polygon [POL] (beforehand MATIC) token has gained 15% in three days. Its short-term momentum and an almost 40% improve in day by day buying and selling quantity have been good alerts for lower-timeframe merchants.

Nonetheless, the upper timeframe development was bearish. Therefore, swing merchants and POL buyers have to be cautious of vendor dominance within the coming days and weeks.

POL reveals blended alerts throughout timeframes- bulls stay cautious

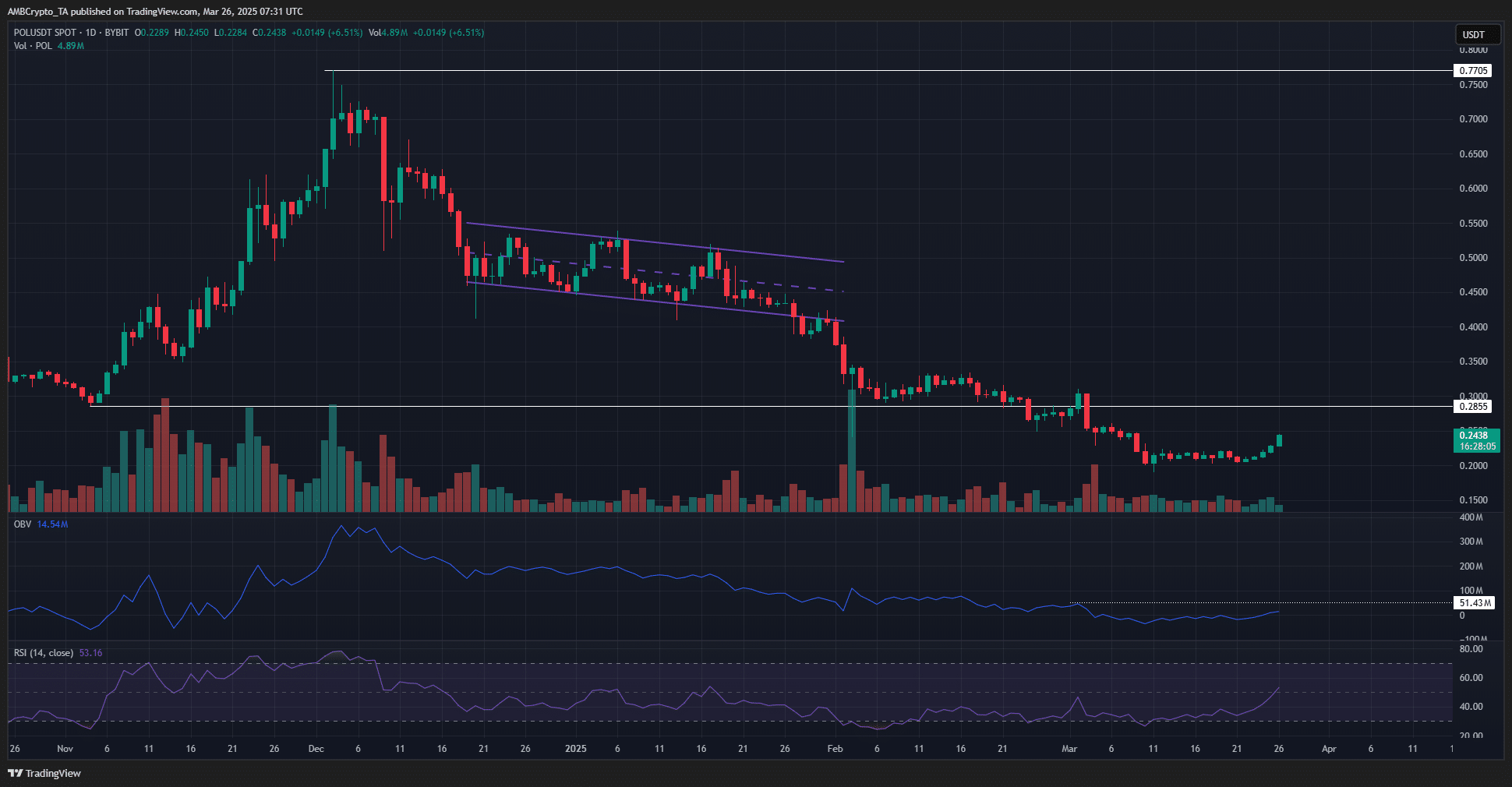

Supply: POL/USDT on TradingView

Within the yr’s early weeks, Polygon traded inside a descending channel. Towards late February, it dipped beneath earlier lows, accelerating the continuing downtrend. The day by day chart reveals that this decline has but to reverse.

Key swing ranges on the weekly chart are marked at $0.285 and $0.77. On the time of writing, POL was buying and selling beneath these ranges, reflecting a bearish market construction on each day by day and weekly timeframes.

Regardless of this, technical indicators counsel brewing bullish momentum. Over the previous ten days, the OBV has been climbing, signaling elevated shopping for stress.

Equally, the RSI was transferring towards the impartial 50 stage, hinting at a possible bullish momentum shift on the 1-day chart.

Nonetheless, the $0.285–$0.3 zone stays a possible sturdy resistance stage. If demand continues to falter within the coming days, the chance of breaking above $0.3 seems low.

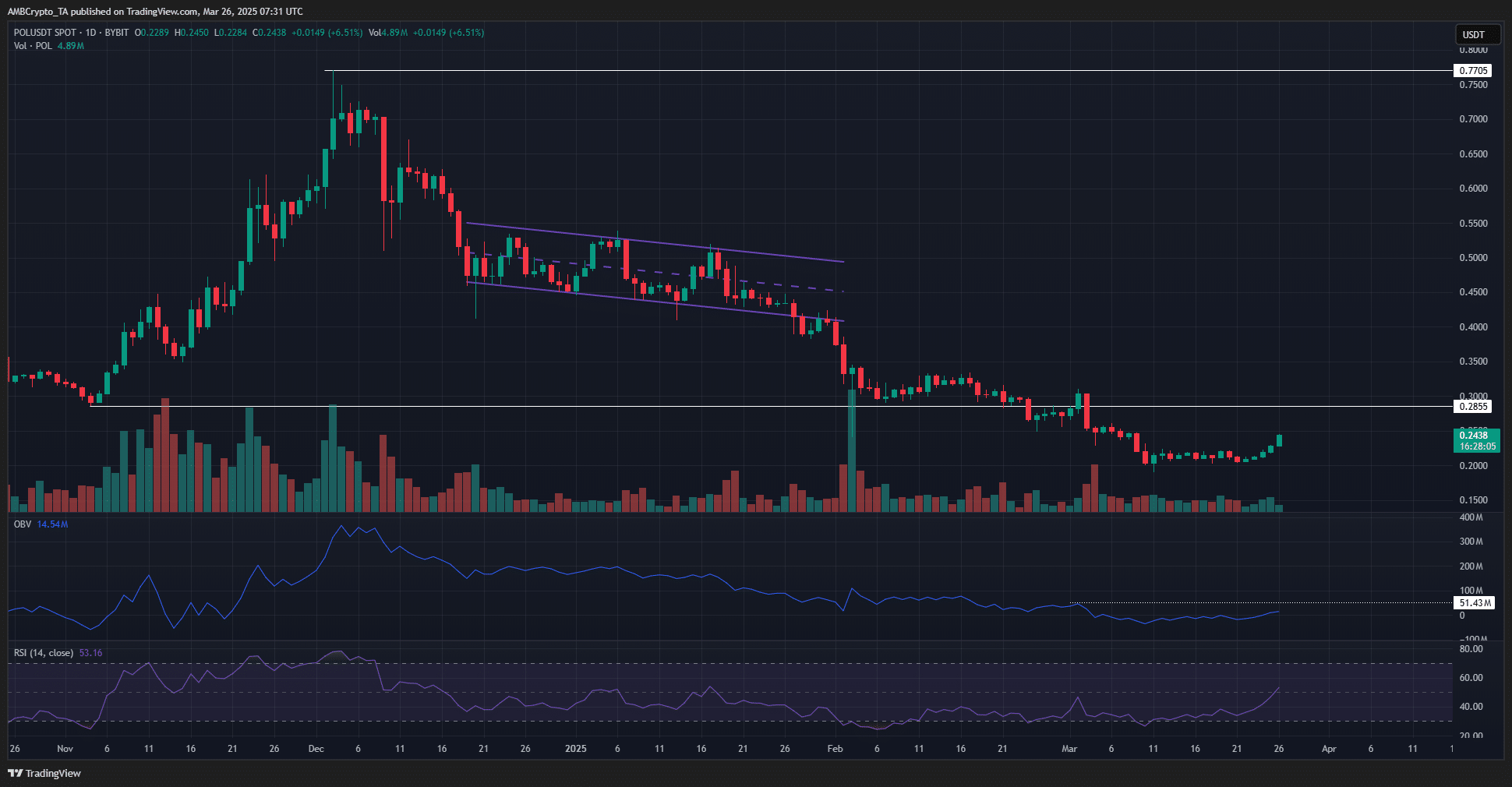

Supply: POL/USDT on TradingView

On the 4-hour chart, the short-term bullish momentum was evident. The RSI has shot greater into the overbought territory, standing at 84 at press time.

he worth has damaged above the native resistance zone at $0.22, marked in orange. On the identical time, the OBV has reached the next excessive in comparison with the previous two weeks.

The sturdy beneficial properties over the previous two and a half days have given POL a bullish construction on the 4-hour timeframe. Nonetheless, the general development stays bearish, as indicated by Fibonacci retracement ranges.

A transfer above $0.26 may shift the H4 swing construction to bullish, although the $0.265 and $0.285 ranges stay important resistance factors.

Due to this fact, bulls ought to be cautious about leaping into lengthy trades amid the present momentum. As a substitute, they might need to observe POL’s response at key resistance ranges round $0.26 and $0.285 to find out whether or not a bearish reversal is probably going.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion