POPCAT eyes 3x surge as whales invest $80M, but what about spot traders?

- POPCAT lately breached by way of a descending channel and could also be eyeing a significant worth push

- Regardless of whales’ backing from Bybit, Binance, and Hyperliquid, spot merchants available in the market will play a key function

POPCAT gained by 37% within the final 24 hours, along with its bullish motion over the previous week. Owing to the identical, the altcoin is now returning 41% for buyers who bought the asset over the previous month.

Whereas the sentiment stays predominantly bullish, particularly with excessive whale curiosity and a bullish technical setup, AMBCrypto noticed some components that might hinder the asset’s potential rally.

Bullish breakout on the sting

POPCAT has introduced a setup for a doable worth rally on the chart, with the formation of a descending worth channel. This sample is fashioned by parallel assist and resistance traces.

In line with the identical, if the momentum driving POPCAT’s motion is sustained and the asset manages to breach the resistance degree, the value might hit $0.9822. This might characterize a 370% worth increase.

Supply: TradingView

For a 3.7x rally to happen, it’s doubtless that the value retraces alongside the way in which, quite than a single upswing. Nevertheless, if the general bullish market sentiment holds true, POPCAT might ultimately breach this degree, buying and selling as excessive as $2.08.

Whales are after a rally

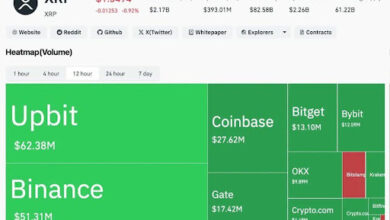

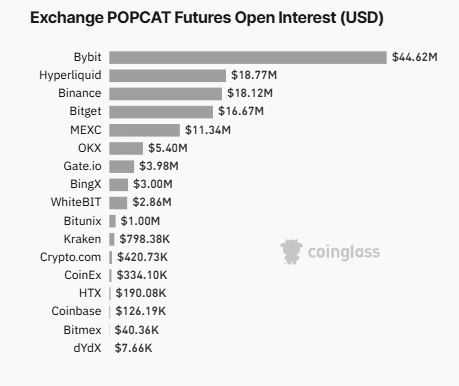

An evaluation of Coinglass’s long-to-short ratio and the market’s Open Curiosity revealed that whales have been pushing for a significant worth rally.

First off, the broader market sentiment stays bullish, with the shopping for quantity available in the market exceeding that from sellers. This was evidenced by the long-to-short ratio having a studying of 1.0513.

When this ratio crosses 1, it implies a bullish market part. Quite the opposite, beneath 1 implies that bears or sellers are dominant, with extra draw back to return.

Additional evaluation confirmed {that a} majority of purchase contracts within the derivatives market are pushed by whales or prime merchants who’ve main positions opened on the asset.

Supply: Coinglass

On the time of writing, Bybit, Binance, and Hyperliquid whales dominated the unsettled contracts available in the market. This cohort of merchants had a collective place of $80.7 million out of the $127.89 million in Open Curiosity available in the market.

With the final market being bullish—significantly with shopping for quantity dominating—it implies that these whales have extra lengthy contracts opened than quick.

In truth, merchants who guess in opposition to these whales noticed main market losses as their positions have been forcefully closed. Quick merchants within the final 24 hours have misplaced $1.24 million as the value moved in opposition to them. One of these main market liquidation underlined the power of the bulls.

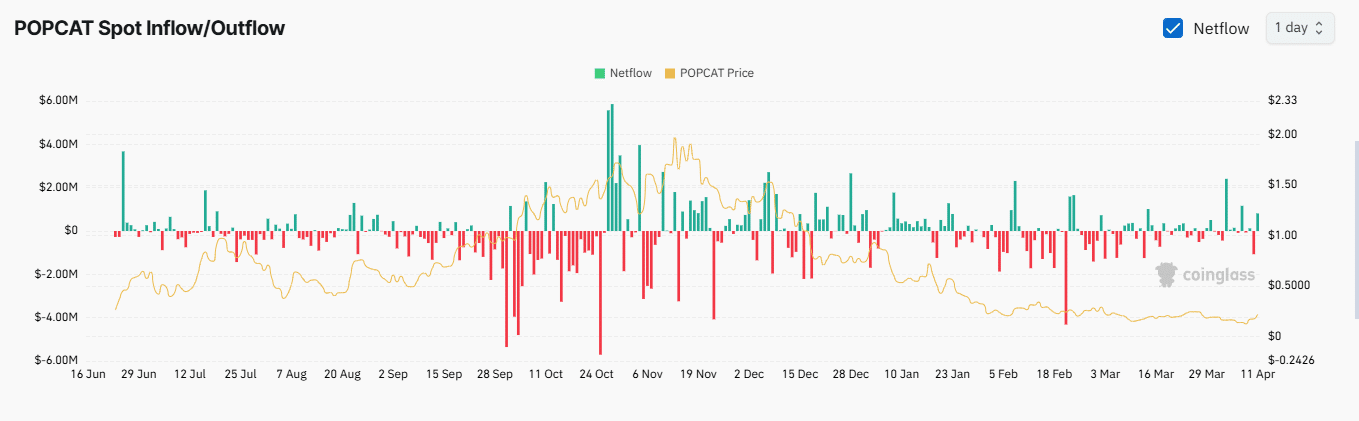

Revenue-taking might decelerate rally

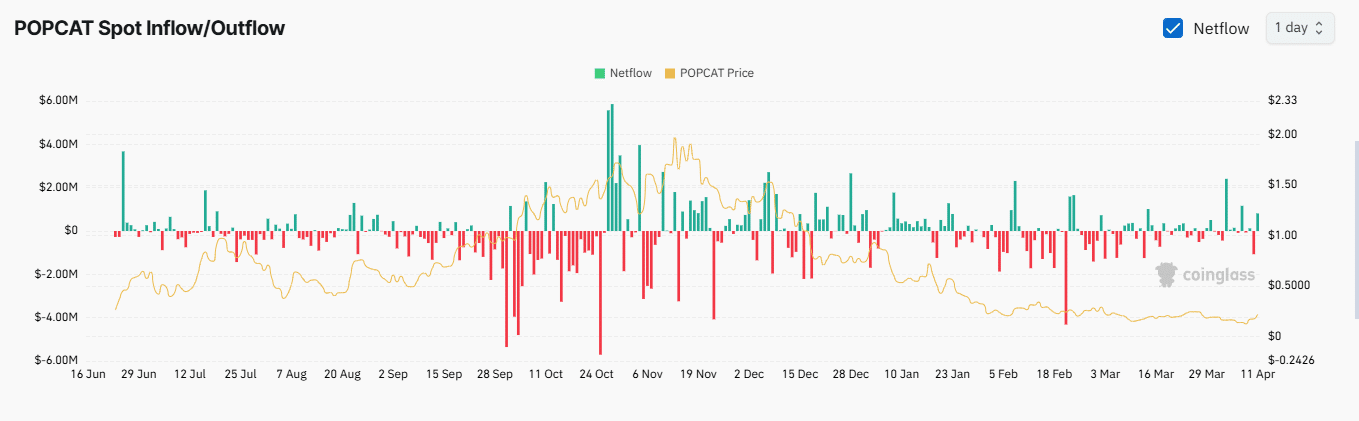

Value mentioning, nonetheless, that the bullish sentiment didn’t align with spot merchants available in the market. At press time, there was notable promoting exercise amongst spot merchants – Reaching roughly $850,000 as per the alternate netflows.

Supply: Coinglass

When a significant quantity of an asset is bought like this amidst a bullish market setup, it implies that long-term merchants are doubtless securing revenue. Particularly as they transfer their POPCAT from personal wallets into exchanges to promote.

If this development continues amongst long-term spot merchants, it might impede POPCAT’s potential breach of the higher resistance degree on the chart. This might decelerate the bullish outlook, as predicted.