Post-halving, Bitcoin hits this record – but how long will it last?

- Bitcoin posted sturdy charges post-halving.

- BTC remained in a bear pattern regardless of an over 1.7% improve.

The Bitcoin [BTC] halving, anticipated to decrease miner charges, has occurred. Opposite to expectations, charges hit a document excessive post-halving. Nonetheless, indications recommend it may be non permanent.

Bitcoin data highest common transaction charge

The Bitcoin halving happened within the early hours of Saturday, the twentieth of April. Nonetheless, by the tip of that day, community charges had soared to a document excessive, opposite to expectations from the halving.

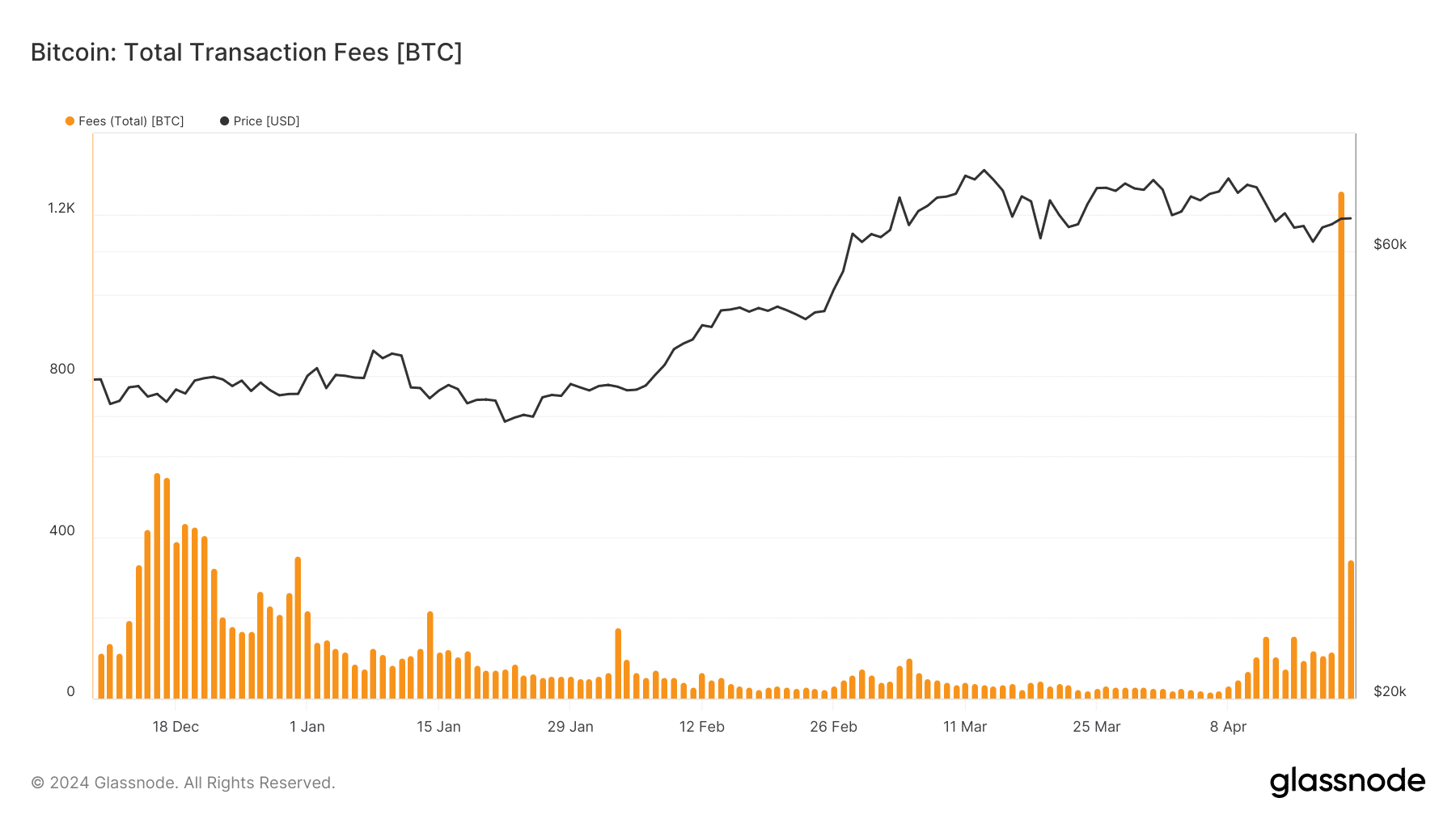

Evaluation from Glassnode revealed that on the twentieth of April, charges spiked to over 1,257 BTC, equal to over $81 million on the time.

This marked the best day by day charge recorded in years, a major improve for the platform and its miners.

Supply: Glassnode

Additional examination of the typical charges paid on the community indicated a rise to roughly $128 per transaction on the twentieth of April.

Additionally, wanting on the charge chart on Crypto Fees, Bitcoin exhibited the best charges prior to now seven days. The typical charge was over $20.2 million, in comparison with Ethereum’s [ETH] closest common of just about $5 million.

Nonetheless, as of the time of writing, day by day charges had declined. In keeping with Glassnode, charges dropped to 344 BTC, equal to round $22.3 million.

This substantial fluctuation in charges coincided with a lower within the variety of day by day new customers.

Bitcoin addresses fall to lowest in over a 12 months

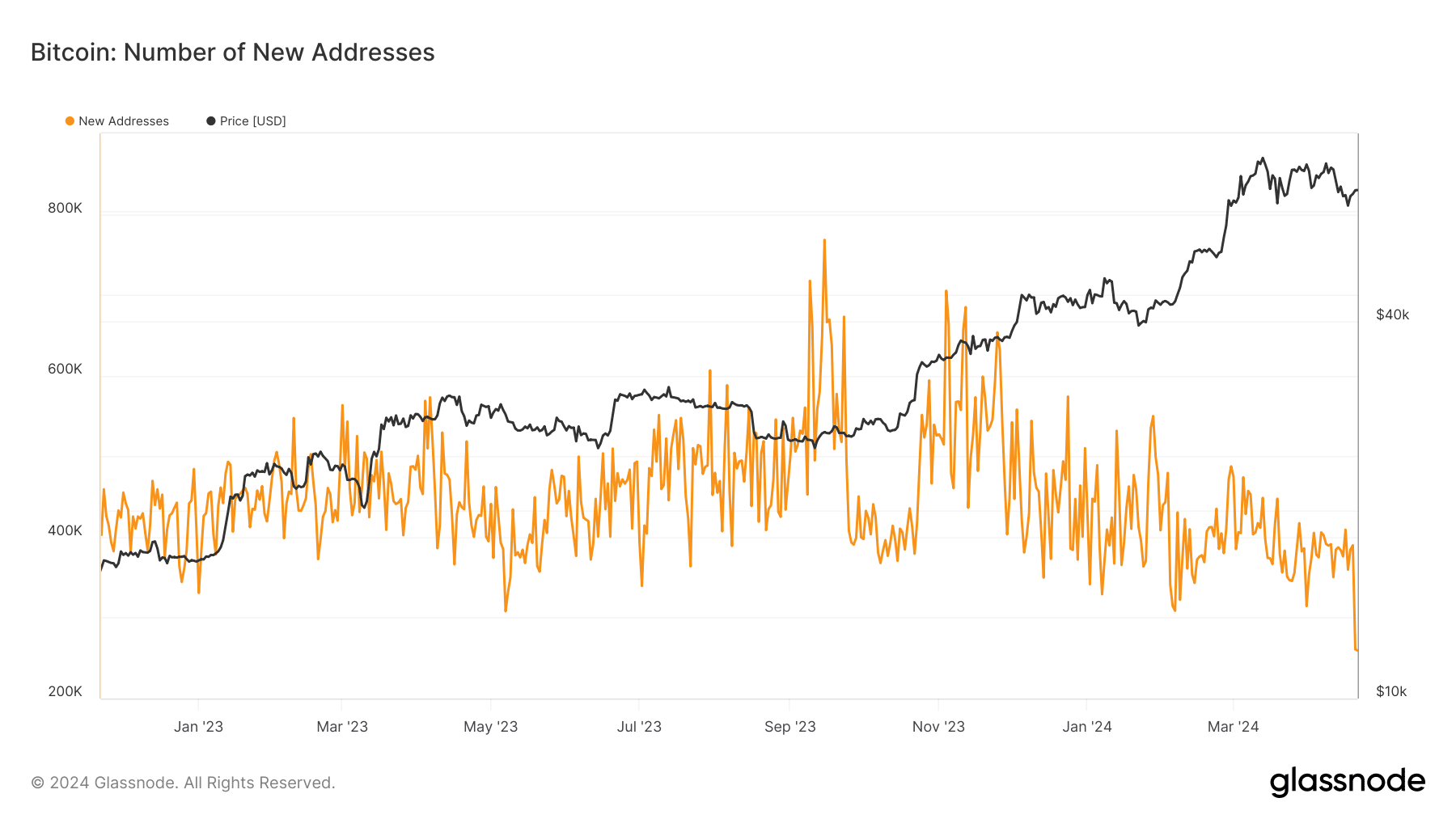

Whereas charges have been reaching document highs, the variety of day by day new Bitcoin addresses was shifting in the other way.

AMBCrypto’s evaluation of Glassnode revealed a notable lower in deal with creation. As of press time, the quantity stood at 259,431, a drop from the 300-400,000 vary seen days earlier.

Supply: Glassnode

This pattern recommended {that a} important inflow of latest customers didn’t drive the charge surge. As an alternative, the Runestone improvement probably performed a task, with the next charge drop supporting this speculation.

A rise in charges and new customers signifies heightened exercise, probably impacting BTC value positively.

BTC goes again to $66,000

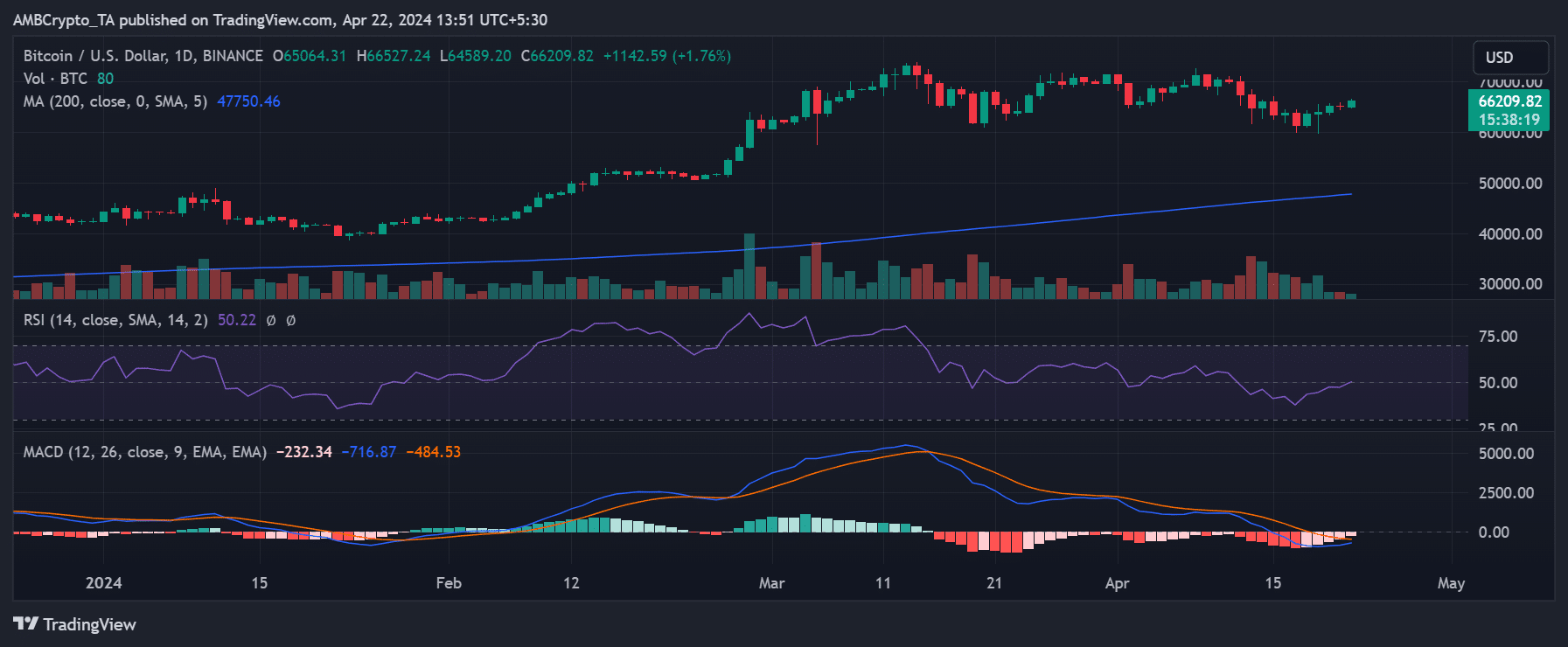

On the twenty first of April, Bitcoin skilled a slight dip however rapidly rebounded, as indicated by its day by day timeframe value chart.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

AMBCrypto’s take a look at the chart revealed that on the time of writing, BTC was buying and selling at roughly $66,200, reflecting a 1.7% improve.

Nonetheless, its rally was not but full, because it nonetheless maintained a bearish pattern. Breaking above this value vary would signify a shift again right into a bullish pattern.

Supply: TradingView