Potential Spot Bitcoin ETF Greenlight Has Already Been ‘Partially Priced In,’ Says Top Coinbase Researcher

A Coinbase researcher says the impression of a possible regulatory greenlight for a US spot Bitcoin (BTC) exchange-traded (ETF) has already been “partially priced in” for the highest crypto asset.

In a brand new evaluation, David Duong, head of institutional analysis on the crypto trade, says that the divergence between the efficiency of Bitcoin and the altcoin market means that market contributors are already anticipating the approval of a number of BTC ETFs.

In keeping with Duong, Bitcoin could not rally as onerous as merchants count on it to when a spot-based ETF will get the nod because the extremely anticipated occasion is already partially priced in.

“That makes it much less clear how far more Bitcoin may outperform if a good U.S. Securities and Trade Fee (SEC) determination happens.”

Duong additionally says that if a BTC ETF is accredited, it would take a while for important inflows to materialize, evaluating the state of affairs to a earlier gold ETF approval.

“For instance, the SPDR Gold Shares ETF (GLD) was a pioneer within the US gold exchange-traded merchandise market when it launched on November 18, 2004, virtually 19 years in the past. In hindsight, GLD has been a extensively profitable monetary product with whole belongings of $51.4 billion right this moment, based on Bloomberg. Nevertheless, if we have a look at its metrics, GLD attracted solely $1.9 billion in internet inflows (inflation-adjusted to right this moment’s {dollars}) throughout the first 30 days of launch and solely grew that to $4.8 billion throughout the first 12 months of its life.”

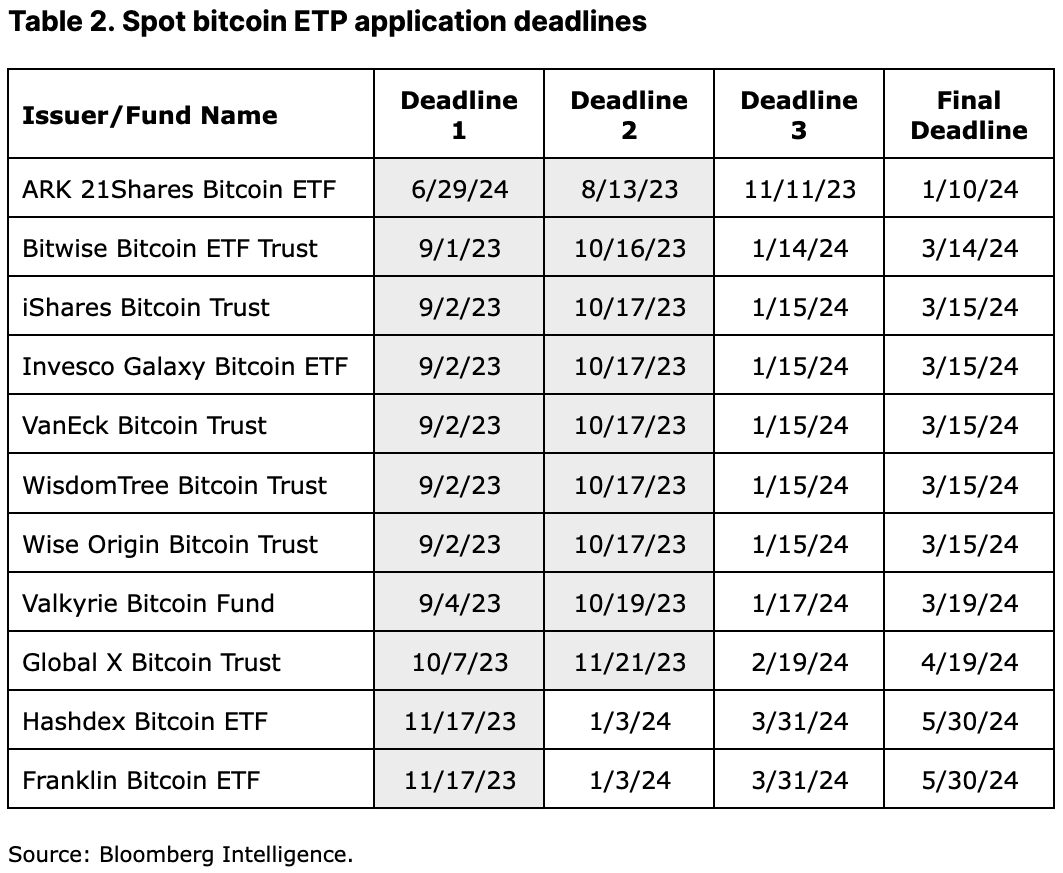

The U.S. Securities and Trade Fee (SEC) delayed decisions on a slew of spot BTC ETF purposes, together with BlackRock’s, in late September.

Nevertheless, the ultimate deadline for the SEC to assessment one utility, the ARK 21 Shares Bitcoin ETF, is on January tenth.

Duong says that the ARK 21 Shares Bitcoin ETF deadline may encourage the SEC to subject selections on numerous purposes this 12 months.

“We consider that barring a US authorities shutdown, it’s solely potential that we might even see the SEC decide earlier than the top of 4Q23. In any other case, that places the SEC within the awkward place of presumably deferring its determination on a subset of filings on January 3, 2024, proper after the vacations, solely to handle a last deadline determination for one ETF submitting days in a while January 10. To keep away from sending combined messages, we expect the SEC may determine to collectively deal with these purposes in December 2023.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Generated Picture: Midjourney