Predicting Bitcoin’s post-halving gains as BTC eyes $80K ATH

- Bitcoin was consolidating round a key psychological degree at $70k.

- The long-term holders grew quiet in early April, much like November.

Bitcoin [BTC] continued to witness monumental inflows to the Trade Traded Funds (ETFs).

A Santiment post on X (previously Twitter) famous that dealer exercise has been constantly greater than the turning level in February when demand started to go sky-high.

BTC had a powerful begin to the week, gaining 4.8% on the day at press time.

The halving occasion is across the nook, and mixed with the regular ETF inflows, a powerful bullish efficiency is anticipated throughout the market.

But, the instant aftermath of the halving occasion might nonetheless be tumultuous.

Right here’s why we’d see a powerful rally within the subsequent six weeks

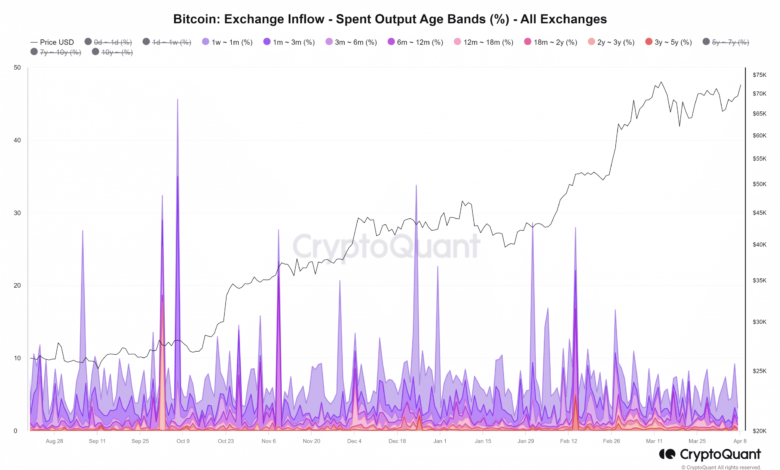

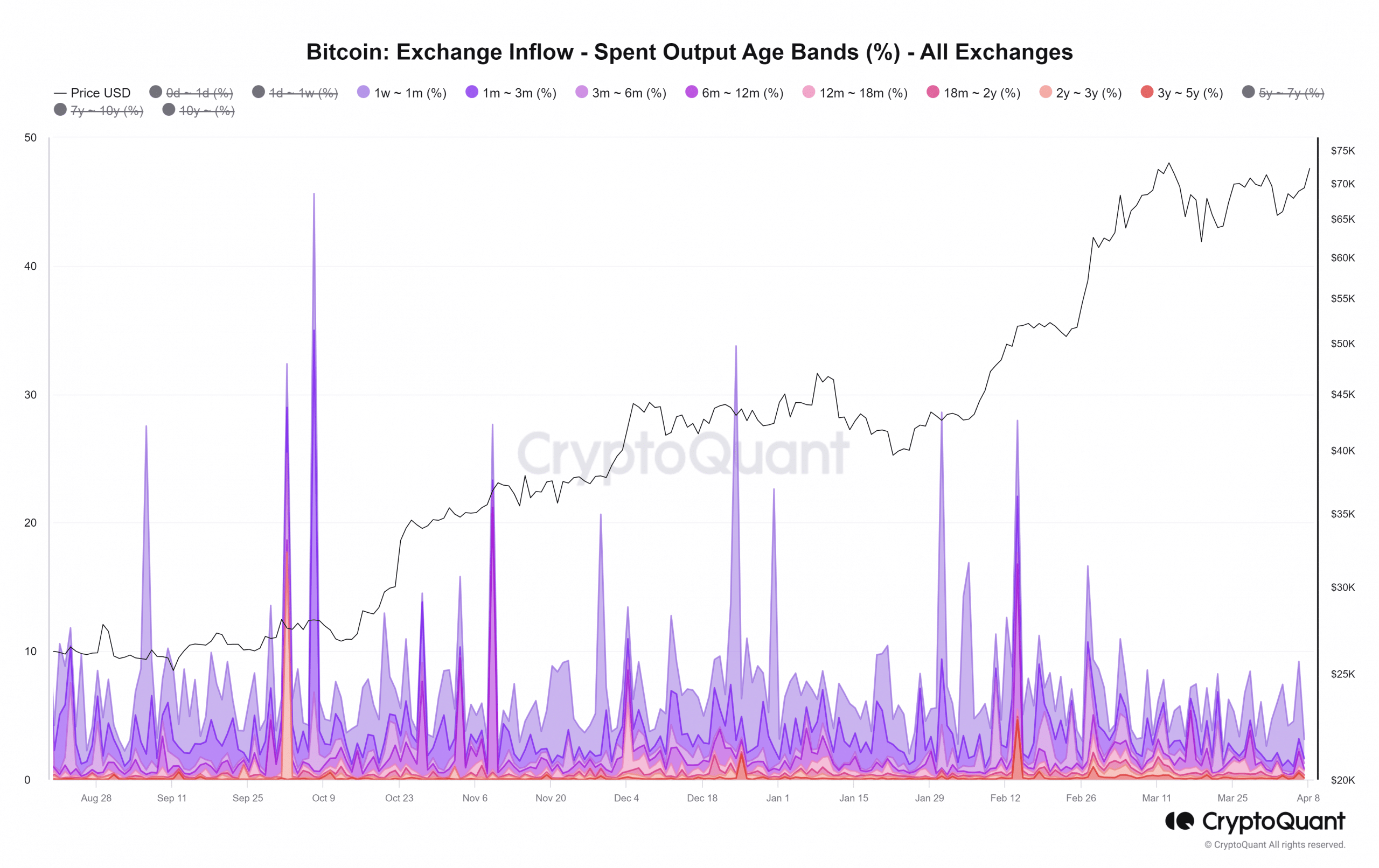

Supply: CryptoQuant

The spent output age bands confirmed that the age bands above one month noticed subdued exercise because the twenty fourth of March, in comparison with the remainder of 2024.

The interval from the twelfth to the twenty ninth of November additionally noticed the same lull in spent outputs.

Whereas holders whose BTC was aged lower than a month have been lively, the older ones obtained quieter throughout that interval.

On the thirtieth of November, there was a flurry of exercise amongst the 1-month to 3-month holders as costs crossed the psychological $40k mark.

Due to this fact, it was attainable that the current dormancy could possibly be adopted by a sizeable rally within the short-term.

The BTC consolidation part could possibly be prolonged additional

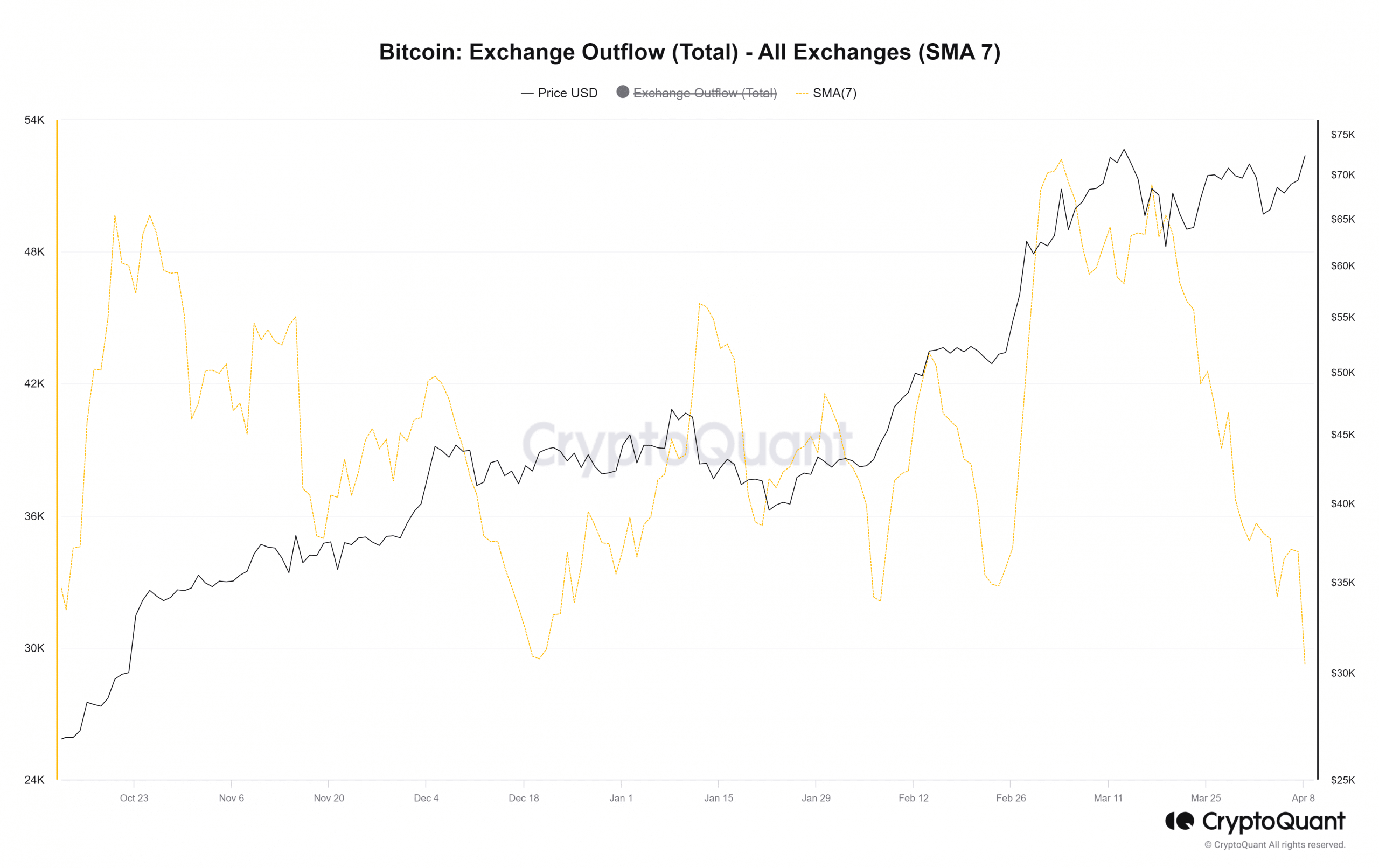

Supply: CryptoQuant

Since mid-March, BTC has hovered between the $64k-$70k area for essentially the most half. But, throughout this consolidation interval, the 7-day easy shifting common of the alternate outflow noticed a major drop.

This doesn’t imply that promoting stress was rising. Nonetheless, the swift drop in outflows steered that the consolidation didn’t go hand in hand with accumulation from centralized exchanges.

The uncertainty across the market’s response to the halving occasion may be a motive why. As soon as the metric begins to development greater, prefer it did after 18th December 2023, additional worth good points could possibly be anticipated.

Bulls eagerly anticipate the following ATH- will $80k be it?

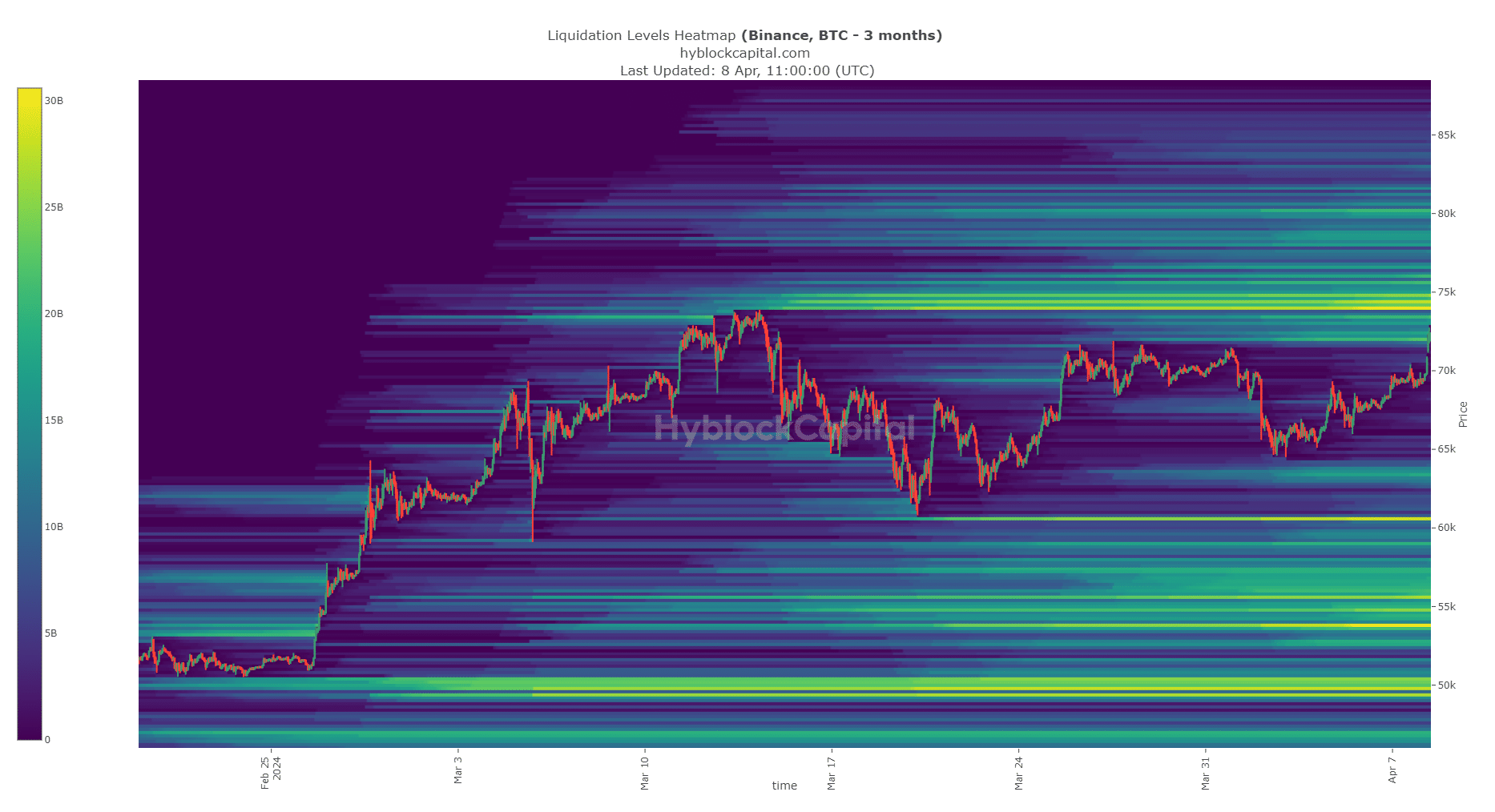

Supply: Hyblock

The liquidation heatmap confirmed that the $75k space is a powerful magnet for Bitcoin. The massive variety of liquidations in that area might entice costs to it earlier than a bearish reversal.

Alternatively, the $80.4k area, which was the following greatest pocket of liquidity to the north, may be visited.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Placing issues collectively, the halving occasion offered a big uncertainty to merchants in its instant aftermath.

Buyers, then again, can be jubilant, because the metrics confirmed extra good points might arrive after the market settled down following the halving.