Predicting how ETH will react IF the SEC approves Ethereum ETFs

- Coinbase analyst sees a 30-40% likelihood of approval for Ethereum ETFs.

- Ethereum’s dominance and efficiency are at a low, suggesting a necessity for optimistic improvement quickly.

It’s usually believed that the U.S. SEC is not going to approve any functions for the spot Ethereum [ETH] ETF as a result of a number of components pointing to the truth that the company’s new crypto enemy is Ethereum.

However nonetheless, no actual affirmation has been gotten from the company itself on what it’s planning. So there’s nonetheless an opportunity, regardless of how slim, that the SEC would approve these ETFs.

Nonetheless, in the event that they do, is the market prepared for that affect? How would Ethereum’s value react?

Approval odds for Ethereum ETFs

Coinbase institutional analysis analyst David Han suggests there may very well be a shocking upside.

In Coinbase’s month-to-month outlook report revealed on the fifteenth of Could, Han talked about that the percentages of approval are between 30-40%.

Bloomberg ETF analyst Eric Balchunas has equally set his approval odds at 35%. In the meantime, the crypto group took a survey from Polymarket and the final estimate is 7% odds of approval.

Larry Fink, CEO of BlackRock, echoed the considerably optimistic sentiment throughout an look on CNBC, saying that the SEC may approve spot ETH ETFs even when it does contemplate Ethereum a safety

What does the info inform us?

Ought to the SEC approve an Ethereum ETF, the market might see an sudden surge. Nonetheless, Ethereum’s dominance and up to date efficiency are trending towards their lowest level ever.

Its SEC-proclaimed standing as a safety has negatively impacted funding sentiment.

Nobody expects an approval, so Ether costs might seemingly see little or no motion within the close to future.

Bitcoin’s [BTC] value hardly reacted to its ETF approvals earlier this 12 months. And the group have been really wanting ahead to it.

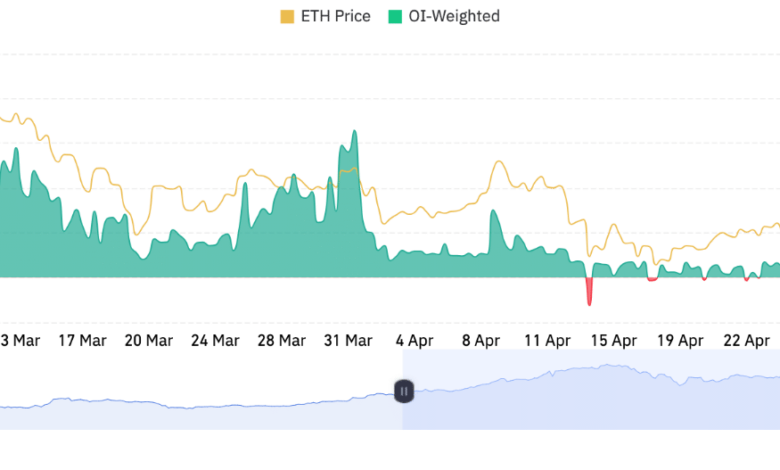

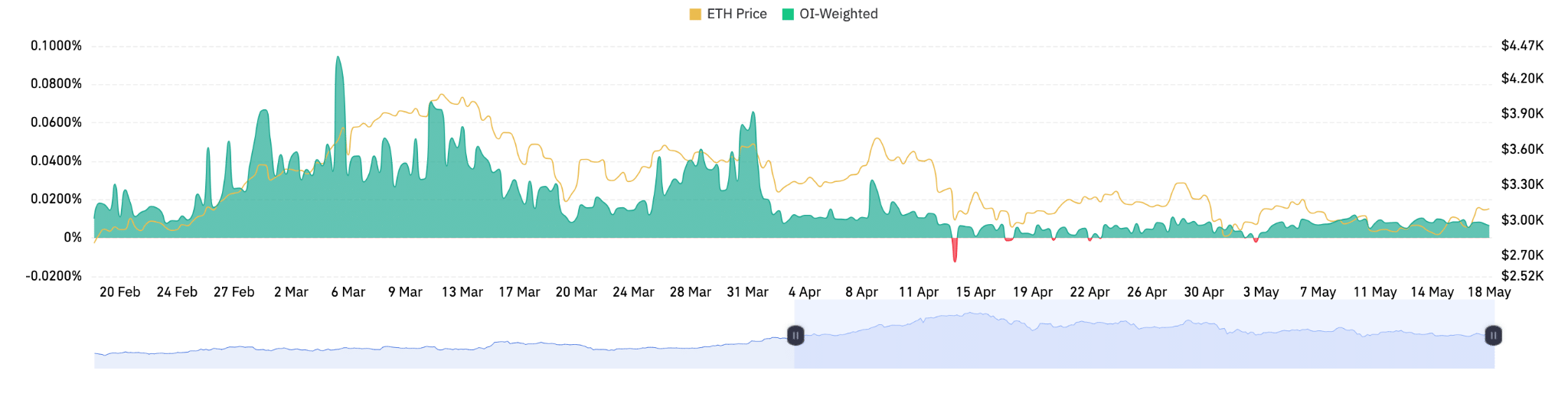

Just lately, the Funding Rate has been comparatively low or adverse, which might suggest a cooling off of bullish momentum or elevated warning amongst merchants, particularly throughout value dips because it occurred in mid-April.

Supply: Coinglass

Furthermore, the rise in Open Curiosity regardless of decrease buying and selling volumes means that merchants could be getting ready for vital value strikes forward, as positions are being constructed up.

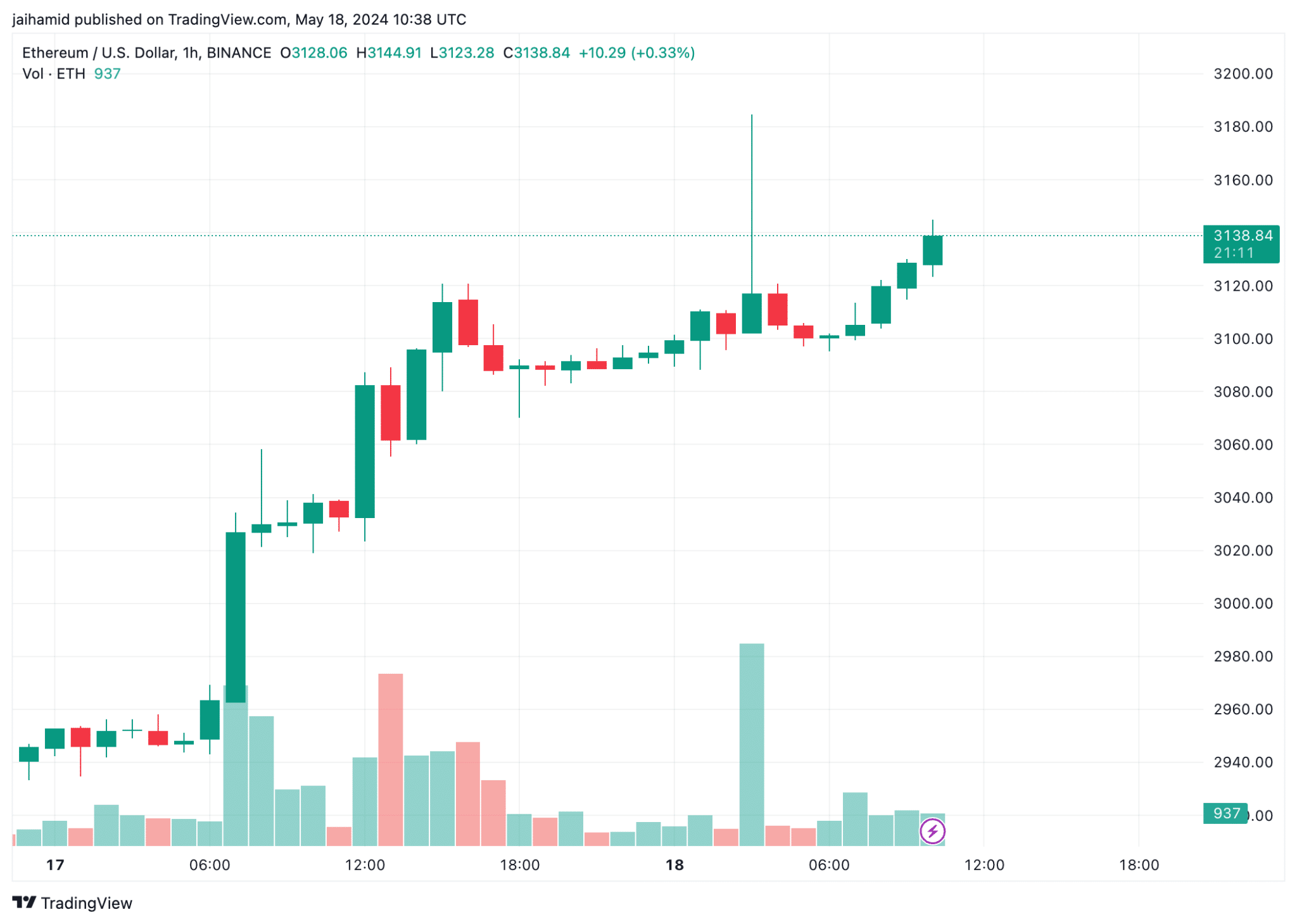

However Ethereum’s buying and selling chart exhibits a constant bullish pattern over a two-day interval. The best value level simply above $3,160 might act as a short-term resistance stage.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

Watching how the value reacts upon retesting this stage may very well be essential for short-term funding methods.

Supply: TradingView

Given the robust upward momentum and profitable value restoration post-retraction, if the market maintains its bullish sentiment, Ethereum might probably break via the present resistance stage.