Bitcoin’s retail demand remains flat – Here’s how it can affect BTC’s bull run!

- Trade outflows climbed as reserves dropped

- Giant transactions have been dominant, however retail quantity and deal with exercise appeared weak

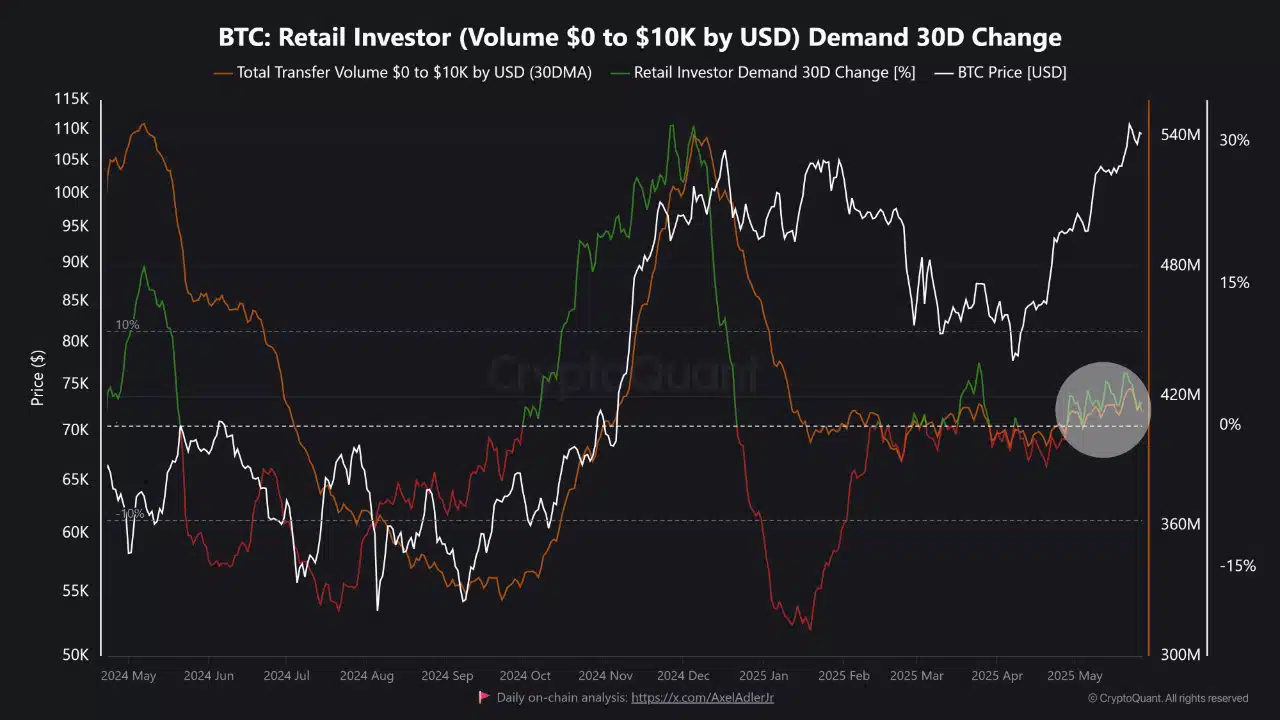

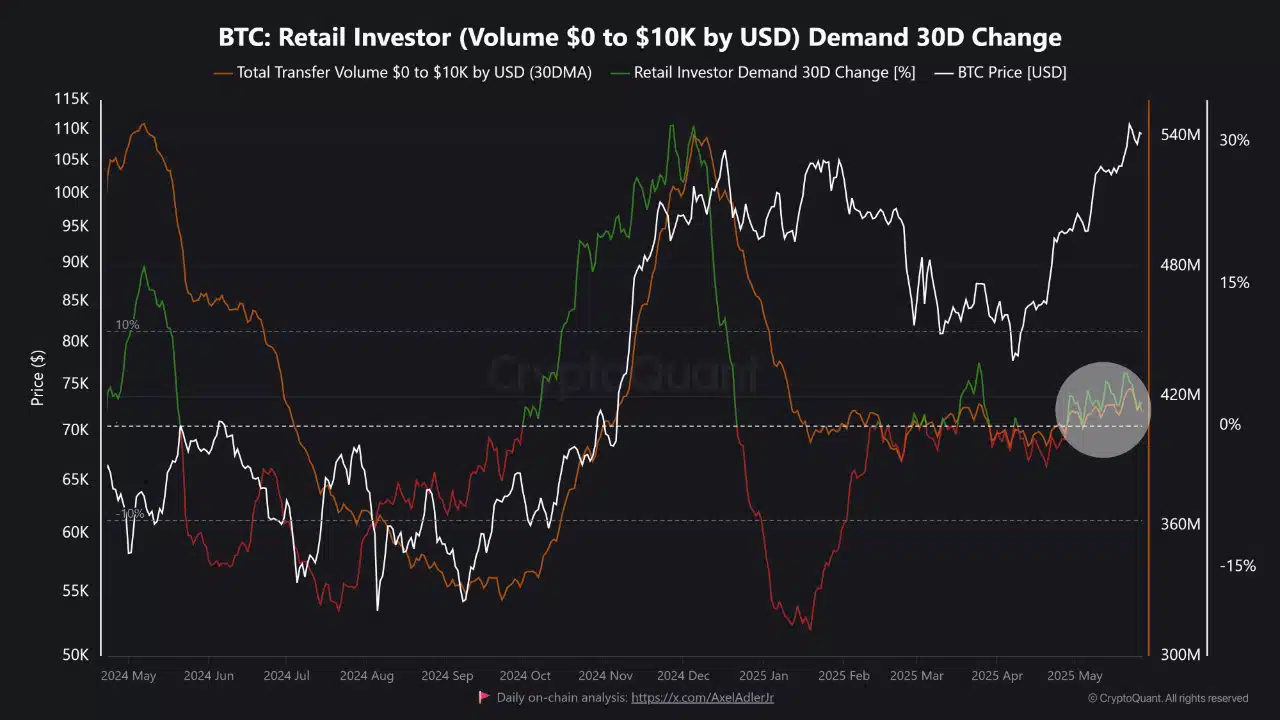

Bitcoin [BTC]’s 30-day share change in small investor exercise has stayed flat, regardless of sturdy upward worth momentum on the charts.

This divergence could also be an indication that establishments or whales are main the rally. Traditionally, sustained bull markets have relied on broader participation, with retail traders fueling mid-to-late cycle accelerations.

With out this layer of demand, the prevailing momentum might lack the depth required for long-term enlargement. Regardless of the value remaining elevated above $100k.

Supply: CryptoQuant

Valuation metrics trace at overextension

Spot alternate flows on 28 Could mirrored sturdy outflows of $721.44 million in opposition to inflows of $616.51 million.

Moreover, alternate reserves dropped by 0.96%, with the identical sitting at $266.49 billion at press time. This steered that traders have been withdrawing BTC from exchanges, usually a precursor to long-term holding or institutional custody.

Such a sample has traditionally preceded sturdy worth traits, as lowered liquid provide can tighten order books.

Supply: Coinglass

In reality, valuation indicators appeared to obviously present early indicators of cooling, regardless of Bitcoin’s sturdy worth trajectory. The NVT Golden Cross—used to evaluate worth in opposition to on-chain transaction quantity—dropped by 26.06% to 1.075.

In the meantime, the Puell A number of, which evaluates miner income in opposition to historic norms, fell by 11.22% to 1.297.

These findings implied that the value progress could also be outpacing each community worth and miner-based valuation anchors.

Retail presence fades as community exercise drops, whales take management

Regardless of the hike in worth, Bitcoin’s community progress has stalled considerably. Over the previous 7 days, new addresses declined by 5.93%, lively addresses fell by 6.46%, and nil steadiness addresses dropped by 9.79%.

These metrics mirrored falling onboarding and transactional exercise. In a strong bull run, these numbers usually surge, indicating heightened demand and speculative curiosity.

Such a disconnect might be an indication that the continuing rally has not been organically supported by a broader consumer base.

Supply: IntoTheBlock

Bitcoin’s transaction profile revealed important imbalances too. Transactions beneath $100 fell sharply, with the $0–$1 bracket down 66.38% and the $10–$100 bracket down 6.90%.

Conversely, transactions above $10 million soared by 59.26%, whereas these between $1 million and $10 million climbed by 13.26%.

This hinted at a rally led by high-net-worth traders or institutional members – All whereas retail remained largely on the sidelines.

Though giant gamers can transfer costs rapidly, sustained rallies usually require quantity and assist throughout all transaction sizes.

Supply: IntoTheBlock

Will BTC’s breakout be sustainable with out retail participation?

Bitcoin’s latest worth surge has been clearly pushed by institutional flows and long-term holding sentiment, as evidenced by the shrinking alternate reserves and robust outflows.

Nonetheless, cooling valuation indicators, declining deal with exercise, and shrinking retail transaction volumes steered the rally lacks a broad basis. With out renewed retail curiosity, the momentum might weaken or develop into more and more fragile.

For Bitcoin to interrupt decisively right into a sustainable bull cycle, retail members should return with confidence, liquidity, and quantity.