Pundit Warns Bitcoin Is Setting Up Liquidity Traps As It Campaigns For New ATHs

Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A seasoned crypto analyst has warned that the recent Bitcoin (BTC) price action could also be setting the stage for main liquidity traps, echoing patterns seen in previous cycles. Because the main cryptocurrency aims for new all-time highs, the pundit means that market makers might be intentionally engineering situations for bear traps earlier than triggering a robust breakout.

Bitcoin Path To ATH Riddled With Liquidity Traps

Crypto market professional Luca has shared intriguing insights into Bitcoin’s newest value conduct, arguing that the market could also be coming into a traditional liquidity entice section allegedly orchestrated by market makers. The analyst stated in an X (previously Twitter) put up that Bitcoin’s value motion since topping out in late Might 2025 has adopted a suspicious sample. He famous that regardless of experiencing a number of value rallies, not a single native excessive has been swept prior to now few weeks.

Associated Studying

Luca means that this uncommon value construction might be a deliberate setup, giving the phantasm of stability and providing false conviction in bearish positions. The analyst warns that market makers have presumably influenced this market conduct by baiting shorts into coming into or holding positions with the idea that Bitcoin might proceed to be capped under resistance. Ideally, this underpins the idea that bear traps are doubtlessly being set as BTC gears up for its subsequent bullish rally.

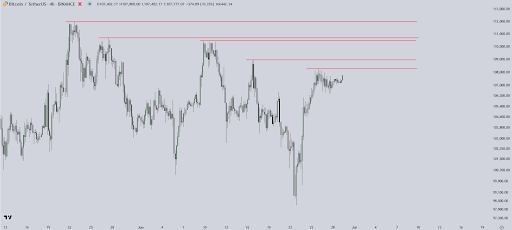

Notably, a number of key resistance ranges at the moment are stacked tightly between $109,000 and $112,000, as highlighted on the analyst’s 4-hour Bitcoin chart. Whereas BTC has been consolidating just under these ranges, forming what seems to be a possible base, Luca argues that this value conduct shouldn’t be a coincidence. Quite than market weakness, he believes the subdued value motion displays a calculated effort by market makers to encourage bearish complacency.

The pundit interprets the deliberate avoidance of liquidity above these resistance strains as a sign that deeper bear traps are presumably being laid. Luca has revealed that this setup might be laying the groundwork for a sudden short squeeze, doubtlessly igniting a pointy transfer towards a brand new all-time excessive for Bitcoin.

Analyst Says BTC 2024 Breakout Again In Play

Including historic context to his evaluation, Luca compares the present market construction to a prolonged consolidation phase noticed all through 2024. On the second 8-hour chart, a transparent trendline of resistance will be seen capping Bitcoin’s upside for a lot of the earlier yr.

Associated Studying

The chart reveals that value motion persistently failed to interrupt above the descending barrier, with a number of makes an attempt being rejected between March and October. Every rejection was marked by unswept highs—just like the present market setup and suggesting that shorts had been systematically being protected.

This compression lastly resolved in November 2024, when Bitcoin erupted via the resistance and launched a parabolic transfer to new highs. That breakout was fueled by the precise mechanism Luca now believes is in movement. With historic patterns now resurfacing, the analyst maintains that Bitcoin’s ongoing suppression and untouched highs are a part of a blueprint that signifies a attainable bullish transfer towards uncharted value territory.

Featured picture from Pixabay, chart from Tradingview.com