Questions rise as Justin Sun-linked HTX’s activities remain shrouded in mystery

- Across the time of Worldcoin’s launch, HTX’s market share dramatically spiked from 4% to nearly 20%.

- Intense promoting of USDT in favor of USDC was seen on the change within the final three months.

The identify could have modified however the seeds of suspicion surrounding the newly branded cryptocurrency change HTX [HT] proceed to sprout. The actions of advisor Justin Solar, issues of insolvency, and lack of transparency have made the Seychelles-based buying and selling platform an enormous speaking level in current months.

Learn HT’s Value Prediction 2023-24

The most recent bombshell was dropped by a analysis analyst from digital property market knowledge supplier Kaiko, who drew consideration to some uncommon actions on the change.

Wash buying and selling at HTX?

Earlier in July, the crypto trade witnessed the launch of the controversial however vastly fashionable Worldcoin [WLD]. HTX, then Huobi, was among the many first to record the coin and open it for buying and selling.

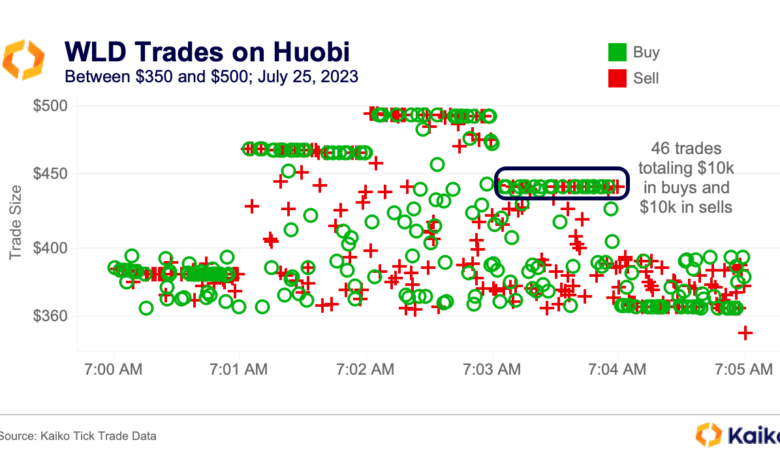

Nevertheless, quickly after itemizing, clusters of matching buys and sells had been found on the change, as indicated under.

In keeping with Kaiko, when trades are completely balanced between buys and sells, it’s a symptom of synthetic quantity, usually referred to as wash buying and selling in buying and selling parlance.

Supply: Kaiko

As is well-known, wash buying and selling includes artificially inflating volumes by shopping for and promoting an asset at the very same time on an change. Exchanges and token tasks have quite a bit to achieve from this market manipulation.

Firstly, a token with the next commerce quantity would appeal to new traders. That is very true for the novice ones who rely extra on buying and selling exercise than analysis earlier than deciding on an asset to spend money on.

Secondly, excessive volumes of token tasks would additionally enhance total quantity figures for the change. This, in flip, would push the change up on the rankings desk, making it look extra fashionable and credible.

New token tasks usually want exchanges with greater volumes to record the token. Thus, exchanges stand to revenue considerably from token itemizing charges, which can be important in a bear market the place volumes are already subdued.

Inorganic bounce in market share

Apparently, across the time of WLD’s launch, HTX’s market share spiked from 4% to nearly 20%. This was although not one of the different main exchanges noticed an analogous surge in quantity.

As there was no different credible rationalization for HTX’s case, the thriller deepened.

Supply: Kaiko

Moreover, the surge was pushed by low cap altcoins i.e., property with an aggregated quantity of lower than $1 billion from March to October. Throughout the aforementioned July section, the quantity of those property surged from $1.4 billion to $3.4 billion in every week.

Comparable conduct was seen within the trajectory of huge cap altcoins, which skilled a 5x bounce in weekly quantity. On the contrary, high property of the market like Bitcoin [BTC] and Ethereum [ETH] weren’t impacted in any respect.

These observations had been in step with arguments made earlier within the article about wash buying and selling employed by newly launched altcoins.

Supply: Kaiko

Enhance in USDT depegs

One other anomaly noticed with HTX was the excessive variety of stablecoin Tether [USDT] depegs. In keeping with the report, the depegs had been a results of intense promoting of USDT in favor of one other stablecoin USD Coin [USDC].

In reality, USDT price $350 million was redeemed for USDC because the starting of July. What created extra doubt was that just about $400 million in USDC flew from HTX’s wallets to Binance across the identical time.

Supply: Kaiko

However what may probably clarify this?

Justin Solar within the eye of the storm

Bitcoin knowledgeable Dylan LeClair took to X a couple of days in the past, accusing HTX advisor Justin Solar of making a ‘net of deception’ to empty USD liquidity from the crypto ecosystem by USDC.

Are your holdings flashing inexperienced? Verify the HT Revenue Calculator

In a scathing thread, LeClair alleged that the founding father of Tron [TRX] used the USDT model to swap it for faux stUSDT whereas it seems as common USDT within the UI/UX on HTX. Be aware that stUSDT was a staked model of USDT, provided by Justin Solar-owned lending platform JustLend.

These doubtful actions have introduced HTX to the middle of limelight. The HTX administration, together with Justin Solar, was but to publicly refute these costs or present clarification on the inorganic buying and selling exercise.