Bitcoin profit-taking plummets 93% since December – What’s next for BTC?

- Bitcoin HODLers exited the cycle after cashing in on big features.

- Is the daybreak of a ‘new cycle’ round, or are we witnessing the tip?

Bitcoin[BTC] kicked off November at $68K, however simply two months later, it soared to a brand new all-time excessive of $109K – an enormous 60% surge.

With such features, profit-taking was sure to occur, and in December alone, traders cashed out a staggering $3 billion in earnings.

Now, the market awaits a restoration. In any other case, even holding Bitcoin at $100,000 might grow to be a nightmare.

FOMO or Greed: Which aspect will dominate?

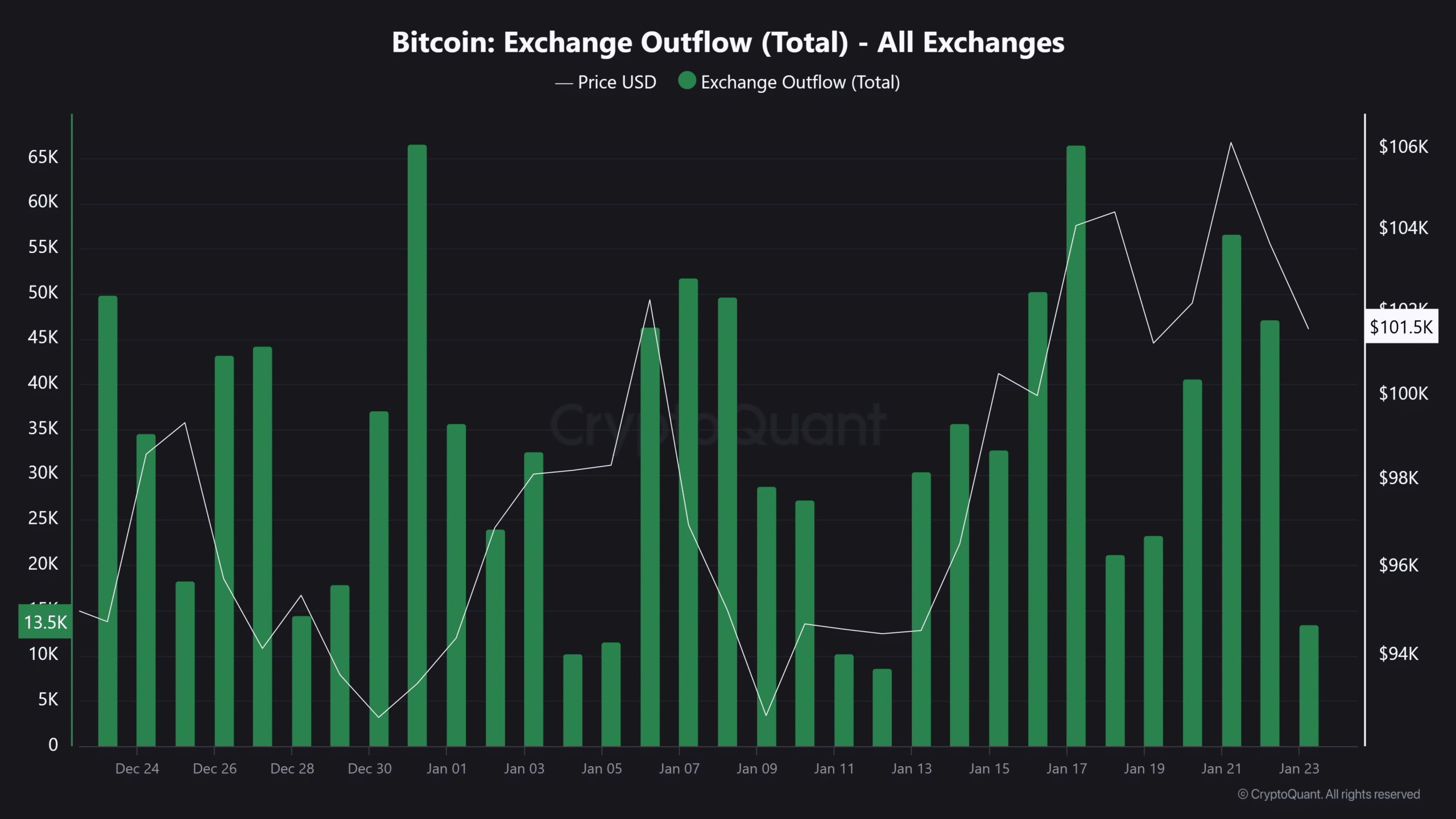

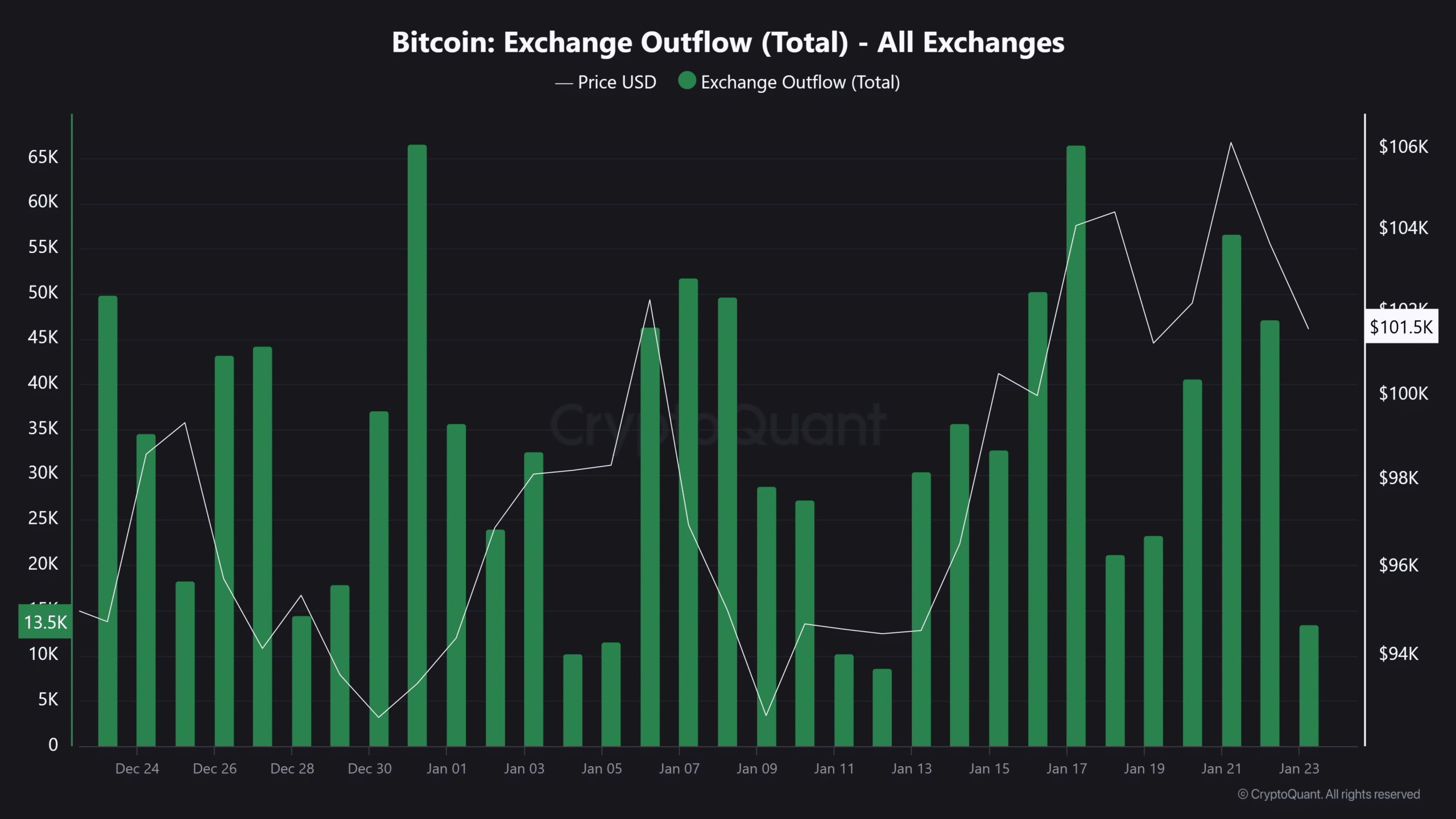

Merchants are getting much less dangerous within the derivatives market, the place the leverage ratio is shrinking quick. This exhibits they’re uncertain the place Bitcoin’s value will go subsequent. Additionally, fewer individuals are transferring Bitcoin off exchanges.

In truth, the change outflows noticed a staggering 16% drop in a single day.

Supply: CryptoQuant

Collectively, these components counsel that FOMO is fading. Nonetheless, the greed has bounced again from “excessive” ranges – a bullish signal. Why? Revenue-taking could be nearing its peak, as indicated by a Glassnode report.

As per the report, profit-taking is method down, falling from $4.5 billion in December to simply $316 million now – a 93% drop. In line with AMBCrypto, if FOMO returns whereas extreme greed subsides, it might set the stage for a big value enhance.

A have a look at the Bitcoin market

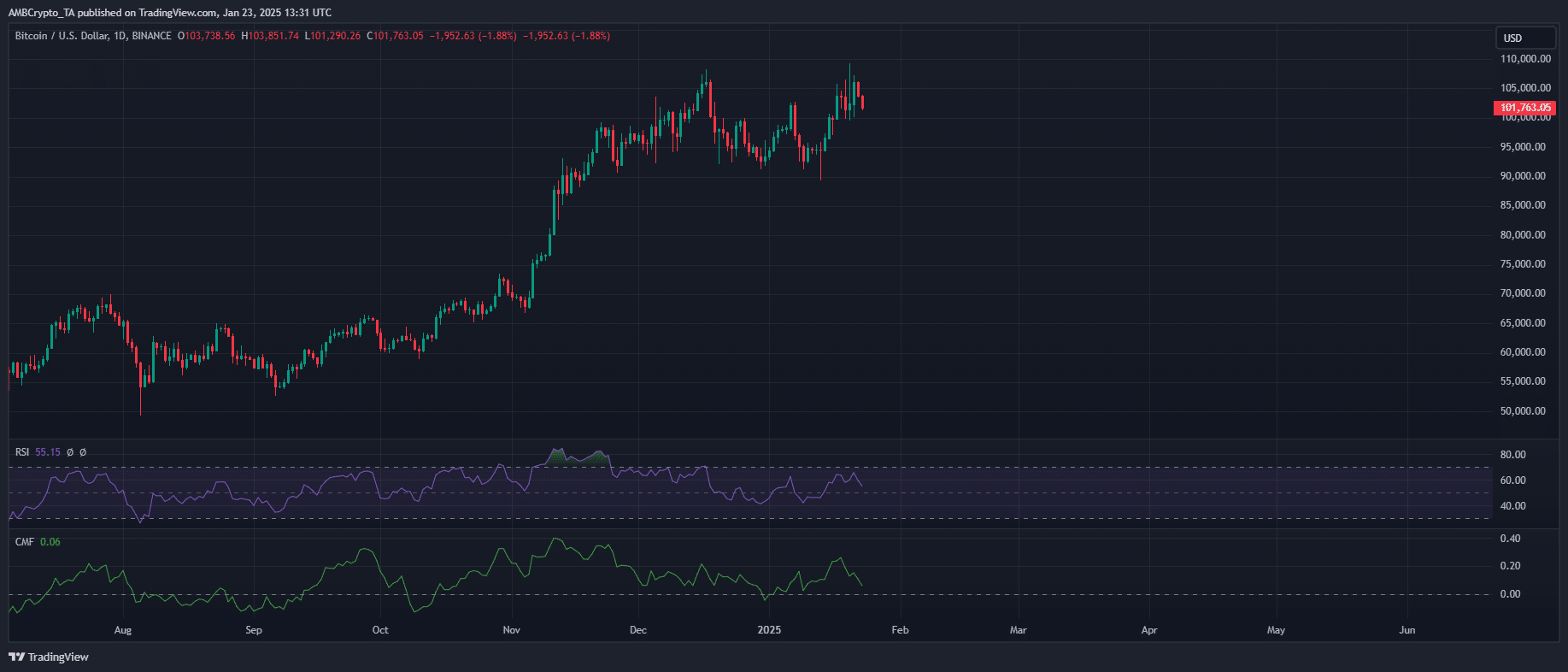

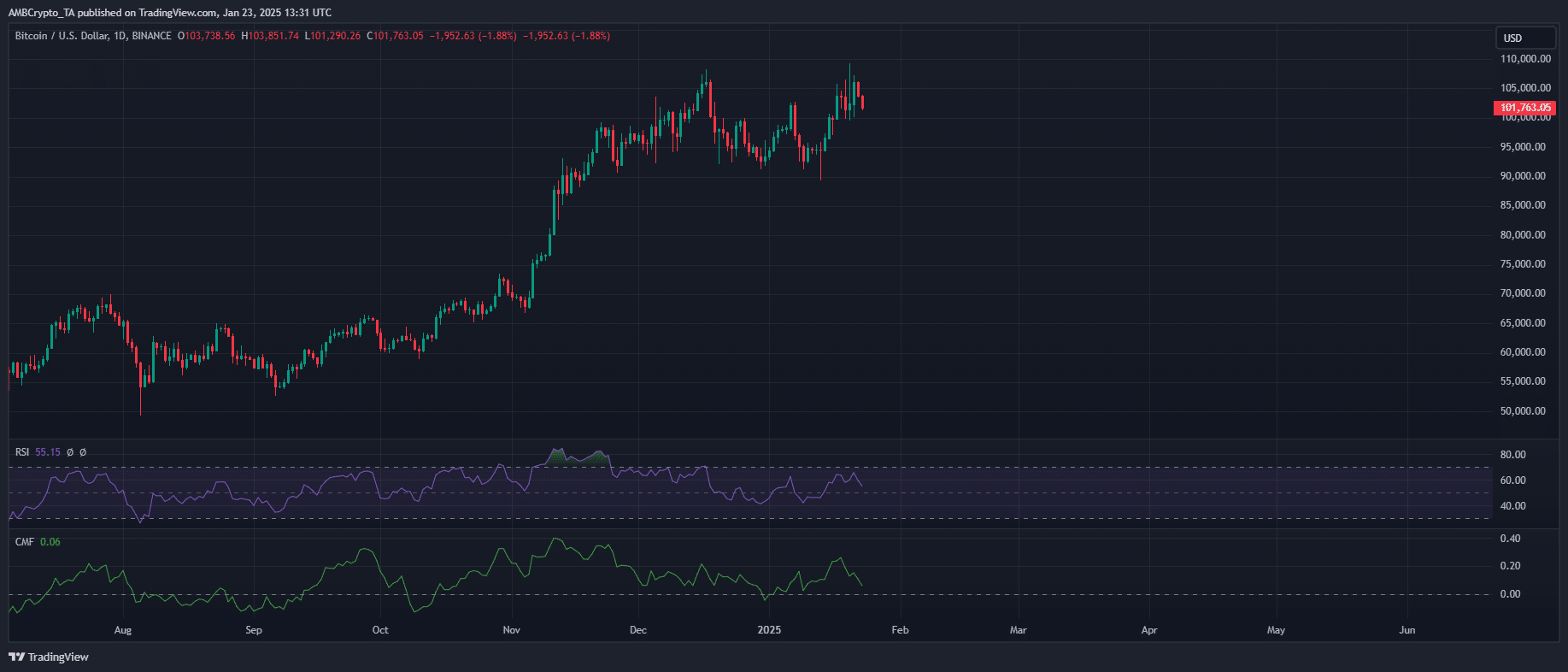

Bitcoin dropped 3.26% in a day, however the market isn’t overheating. This implies sturdy shopping for, possible fueled by FOMO, is required to push the value again up.

Supply: TradingView

Nonetheless, the upcoming FOMC assembly might considerably impression Bitcoin’s restoration. With the assembly only a week away, uncertainty is prone to persist, making a powerful rebound much less possible within the close to time period.

Apparently, this consolidation interval could be a optimistic signal. It might permit establishments to quietly accumulate Bitcoin whereas the market stabilizes after a interval of great profit-taking.

The secret is what the Fed does. In the event that they reduce charges, issues might get fascinating. But when they shock us, Bitcoin may dip additional.

Learn Bitcoin’s [BTC] Worth Prediction 2025–2026

For now, the market’s displaying indicators of life. Greed is again, and profit-taking is cooling down. This might ignite a brand new shopping for frenzy, particularly as soon as the Fed mud settles.

Control the U.S. financial calendar – it should finally decide whether or not excessive greed takes over or FOMO makes a comeback.