Radiant Capital falls prey to this security hack, details here

- Radiant Capital confronted a cyber assault, leading to a lack of over $4.4 million.

- The breach prompts a brief pause, resulting in a decline in sentiment for each Radiant Capital and Arbitrum.

Radiant Capital [RDNT] is a platform that seeks to unify fragmented liquidity throughout varied lending protocols and chains within the decentralized finance (DeFi) area. Nevertheless, current occasions have forged a shadow on its integrity because the platform fell sufferer to a malicious assault.

An attacker on the free

Cyvers, a cybersecurity agency geared up with an AI-powered system, unearthed the nefarious actions concentrating on RDNTCapital.

The suspicious transactions flagged by their system pointed to a worth manipulation subject, leading to a staggering loss exceeding $4.4 million.

The attackers’ handle was recognized by a number of rugpull transactions on Arbitrum, unraveling the complexity of the exploit.

ALERT

Our AI-powered system has recognized a number of #rugpull transactions on #ARB linked to this handle: https://t.co/GZKVDypuAh. The handle has been concerned in creating quite a few tokens.

The handle has bridged 500K $USDT to $ETH, then swapping it to $DAI earlier than depositing… pic.twitter.com/4l8JmdXmcd—

Cyvers Alerts

(@CyversAlerts) January 2, 2024

The modus operandi of the assault concerned the handle bridging 500,000 USDT to ETH, executing a swap to DAI, and finally depositing the funds into TornadoCash.

A swift response

Radiant Capital promptly addressed the breach through Twitter, acknowledging a report in regards to the newly established native USDC market on Arbitrum.

The Radiant DAO Council swiftly responded by briefly halting lending and borrowing markets on Arbitrum for an intensive investigation. Radiant Capital assured customers that no present funds have been jeopardized by the incident.

Immediately, we acquired a report of a difficulty with the newly created native USDC market on Arbitrum. After validation by Radiant builders and the broader Internet 3 safety group, the Radiant DAO Council paused lending/borrowing markets on Arbitrum briefly whereas that is…

— Radiant Capital (@RDNTCapital) January 3, 2024

Because the investigation unfolds, Radiant Capital emphasizes that no consumer motion will be taken till the markets are reactivated on Arbitrum. A complete postmortem report will observe, providing transparency as soon as regular operations on the protocol resume.

Phrase on the road

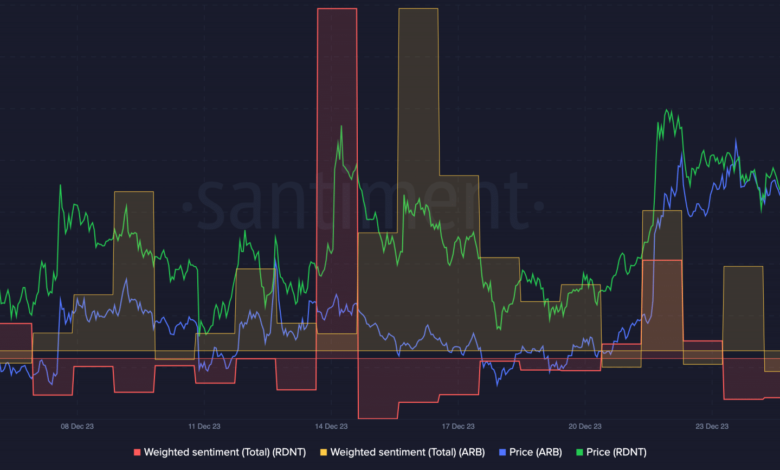

The aftermath of this breach has repercussions not just for Radiant Capital but additionally for Arbitrum. The weighted sentiment surrounding each platforms skilled a decline, reflecting a unfavourable perspective within the social area.

The cyber assault has prompted a reevaluation of safety measures and vulnerabilities inside these DeFi ecosystems.

Real looking or not, right here’s ARB’s market cap in BTC phrases

Regardless of the breach’s influence on sentiment, RDNT’s worth remained resilient, buying and selling at $0.327795 with a modest development of 1.45% within the final 24 hours.

Arbitrum’s native token, ARB, demonstrated a extra important development, buying and selling at $1.92 with an 11.24% enhance in the identical timeframe. The market’s response urged that, not less than on the time of writing, the breach has not considerably affected the perceived worth of the tokens.

Supply: Santiment