Raredex offers rare earth metal exposure for investors on Arbitrum

Raredex is now stay on the Arbitrium blockchain. This marks a big shift in accessibility to an asset class, which had been lengthy reserved for institutional buyers till now.

Raredex is a blockchain-based platform on the Arbitrum community permits buyers entry to uncommon earth metals. Uncommon earth metals, wanted for companies starting from creating know-how to renewable vitality, have historically been tough for retail buyers to entry, hindered by the excessive entry prices — usually above $10,000. Raredex solves this by enabling fractional possession utilizing blockchain-based tokenization, the place every token represents one kilogram of bodily steel.

Louis O’Connor, chief govt officer of Raredex, highlighted the democratization potential, saying “Early adopters” will now be capable to entry an asset class that was “usually reserved for governments” or the “well-connected, rich” people, that means that buyers on a smaller scale can now enter the market, with far much less capital required.

You may additionally like: RWA platform Allo secures $100m Bitcoin-backed credit score facility

How does Raredex work?

Raredex retains its bodily metals in a bank-grade vault operated by Tradium in Germany to entry custody and availability. Buyers can confirm the provenance of their tokens as a result of each is tagged with intensive source-of-origin information. By using blockchain know-how, an unchangeable file of possession is made, thus lowering the possibilities of fraud and rising transparency.

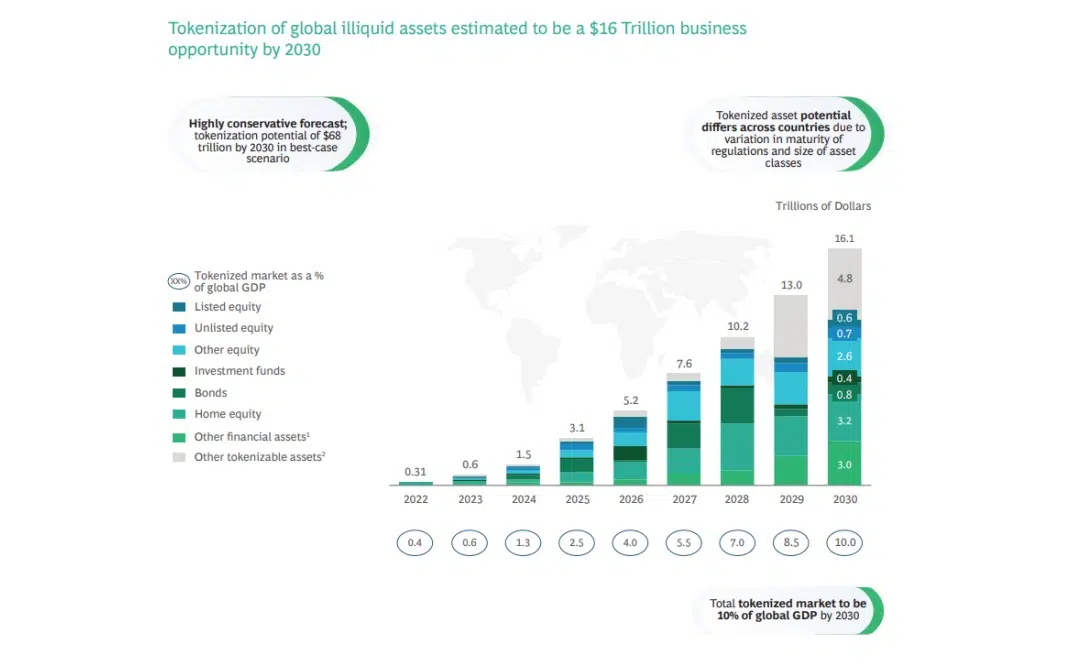

The launch of the platform comes at a time of elevated curiosity in RWA tokenization. This replace comes on the again of a bigger pattern to tokenize real-world property. In 2023, RWAs class had grown by 700%, bringing $860 million in income. In accordance with Boston Consulting Group and ADDX, RWAs are anticipated to be a $16 trillion market by 2030. The decentralized, tamper-proof nature of blockchain will improve transparency and belief, whereas fragmentation opens up new methods to entry and spend money on useful property.

You may additionally like: Digital asset funding merchandise attain file $44.2b in 2024, CoinShares says

The chart estimates tokenization of worldwide illiquid property to succeed in $16.1 trillion by 2030, representing 10% of worldwide GDP. This reveals that Raredex working within the RWA class is poised for progress. Sourced from ADDX by crypto.information.

Different related initiatives are UBS Asset Administration’s Ethereum-hosted tokenized funding fund and Archax’s $4.8 billion cash market fund on the XRP Ledger.

As there’s rising demand for uncommon earth metals as a result of improvements in know-how and clear vitality, Raredex’s platform may very well be a mannequin for a wider wave of commodity buying and selling on the blockchain, thereby reworking the interplay of buyers with bodily property.

Learn extra: Constancy Digital Property: Tokenization, Nation-state Bitcoin and extra in 2025