Reasons behind MATIC’s decoupling from market trends

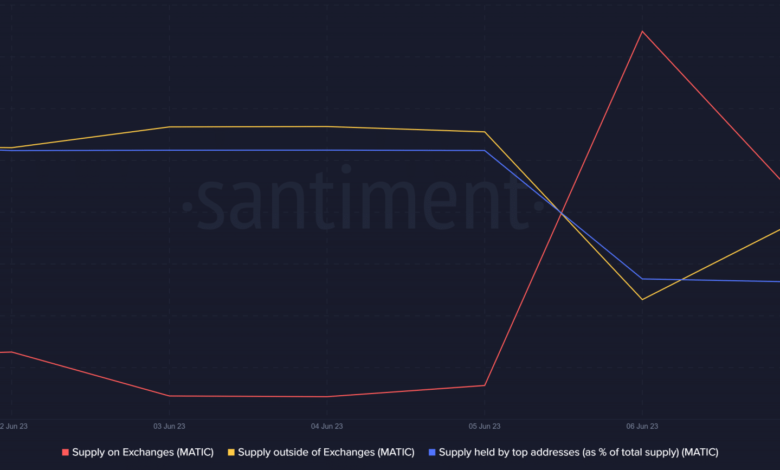

- Polygon’s provide on exchanges elevated whereas its provide exterior of exchanges declined.

- Although the RSI was oversold, the remainder of the indications supported the bears.

A number of cryptocurrencies rebounded on 7 June after a value correction, however Polygon’s [MATIC] actions had been completely different. Based on CoinMarketCap, MATIC’s value declined by greater than 14% and 5% within the final week and the previous 24 hours, respectively.

Learn Polygon’s [MATIC] Worth Prediction 202324

Santiment’s newest tweet identified a potential motive behind this value pattern. Nevertheless, there was one thing else to stay up for, as a key metric instructed a pattern reversal within the coming days.

Promoting stress on Polygon will increase

Santiment’s tweet posted on 7 June revealed that the large gamers within the crypto house had been really promoting their MATIC holdings. About 115 million MATIC had been moved to exchanges in a single shot.

📊 Though many belongings loved a stable rebound day, $MATIC has hit a wall of late. The newest setback seems to be a $95M switch from a whale chilly pockets to #Binance because the #10 market cap asset fell beneath $0.80 for the primary time since January sixth. https://t.co/7i2FJI1yIP pic.twitter.com/VHo7FjYV72

— Santiment (@santimentfeed) June 7, 2023

As per the tweet, the most recent setback seemed to be a $95 million switch from a whale’s chilly pockets to Binance. The rise in promoting stress resulted in an additional value drop.

On the time of writing, MATIC was buying and selling at $0.7627 with a market capitalization of over $7 billion, making it the tenth largest crypto.

Santiment’s chart instructed that the promoting stress was nonetheless on. Polygon’s provide on exchanges elevated whereas its provide exterior of exchanges went down. Moreover, the provision held by high addresses additionally declined, suggesting that traders had been promoting.

Supply: Santiment

Is a pattern reversal potential?

Whereas the aforementioned metrics regarded bearish, CryptoQuant’s data revealed a bullish metric. As per the info, MATIC’s Relative Energy Index (RSI) was in an oversold place.

When RSI turns into oversold, it’s typically adopted by a rise in shopping for stress. Nevertheless, aside from RSI, the opposite metrics continued to be bearish.

As an illustration, MATIC’s change reserve was growing, whereas every day energetic addresses declined. MATIC’s MVRV Ratio plummeted sharply. This, coupled with the rise in 1-week value volatility, instructed an additional value drop.

Supply: Santiment

The present pattern would possibly proceed

MATIC’s social quantity elevated, indicating it has been a subject of dialogue these days. Nevertheless, its weighted sentiment was down, which implies that destructive sentiment round MATIC dominated the market.

Supply: Santiment

Is your portfolio inexperienced? Verify the Polygon Revenue Calculator

Coinglass’ chart additional revealed that Polygon’s open curiosity registered a slight uptick. A rise in open curiosity means that the continuing value pattern will proceed. Due to this fact, the probabilities of MATIC’s value declining additional appeared fairly possible.