Record $16.5B BTC options expiry on Friday: Can Bitcoin leap above $90K?

- BTC should overcome sturdy resistance on the $88K–$90K vary to keep up bullish momentum amid the $16.5B choices expiry.

- A excessive focus of Bitcoin name choices close to $90K and declining quantity trace at potential profit-taking or a pause within the rally.

A record-breaking $16.5 billion price of Bitcoin [BTC] choices are set to run out on the twenty eighth of March, sparking intense hypothesis concerning the asset’s subsequent main transfer.

As merchants brace for this vital occasion, the choices market and technical indicators flash essential indicators that would form Bitcoin’s near-term route.

Choices market sees bullish tilt, however heavy clusters stay

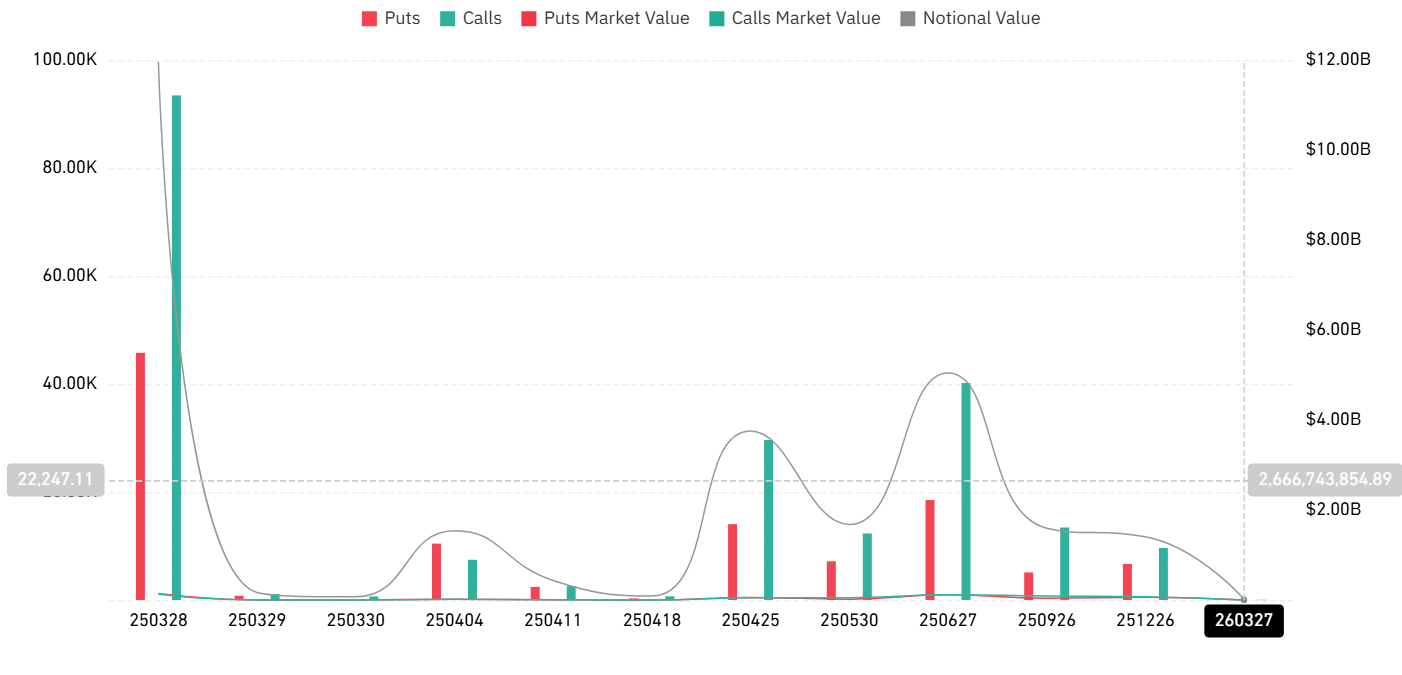

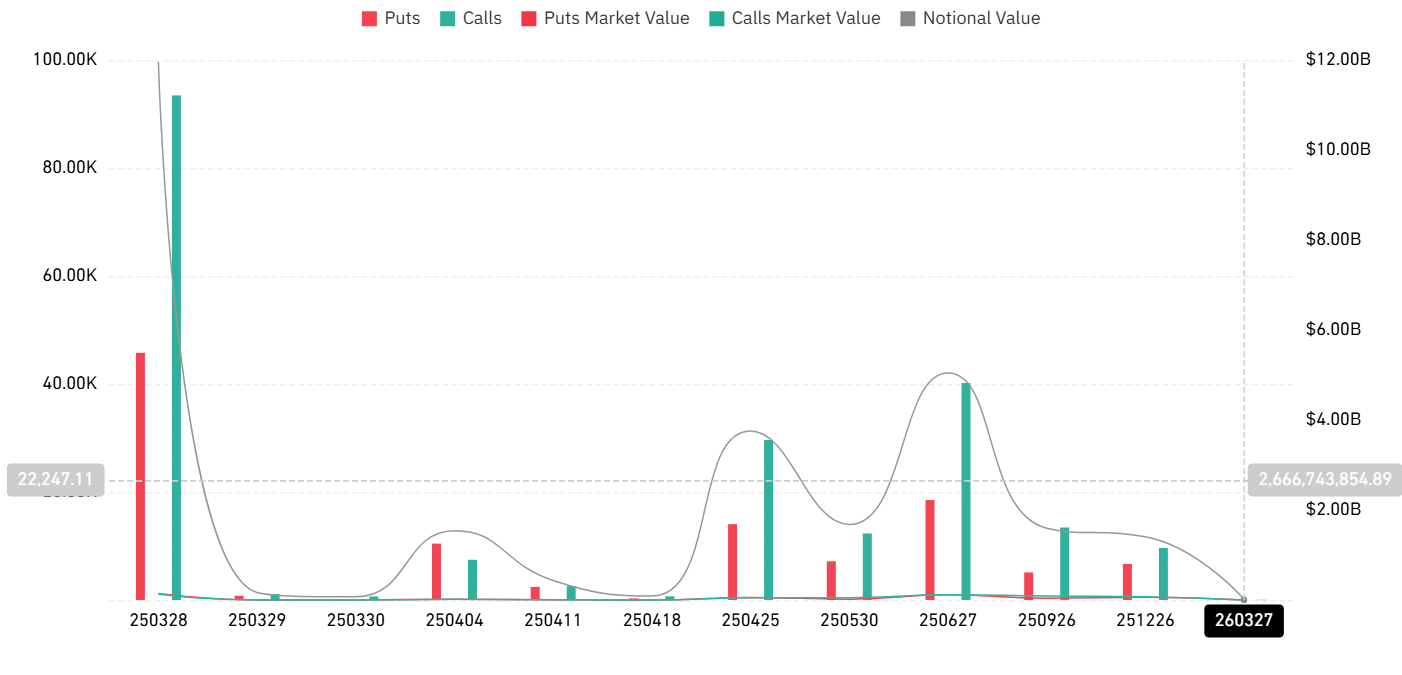

Information from Coinglass reveals large Open Curiosity (OI) close to the $90K strike worth, with a notable tilt towards name choices.

The notional worth of the excellent contracts has reached an all-time excessive, highlighting elevated market publicity.

Supply: Coinglass

Curiously, a big focus of name choices lies across the $90K and $95K marks, suggesting that bulls are betting on a breakout past these resistance ranges.

Nonetheless, there’s additionally a large put cluster close to the $80K-$82K vary, which implies a failure to climb above $90,000 may set off downward strain if merchants hedge their positions aggressively.

Bitcoin’s technical setup hints at warning regardless of momentum

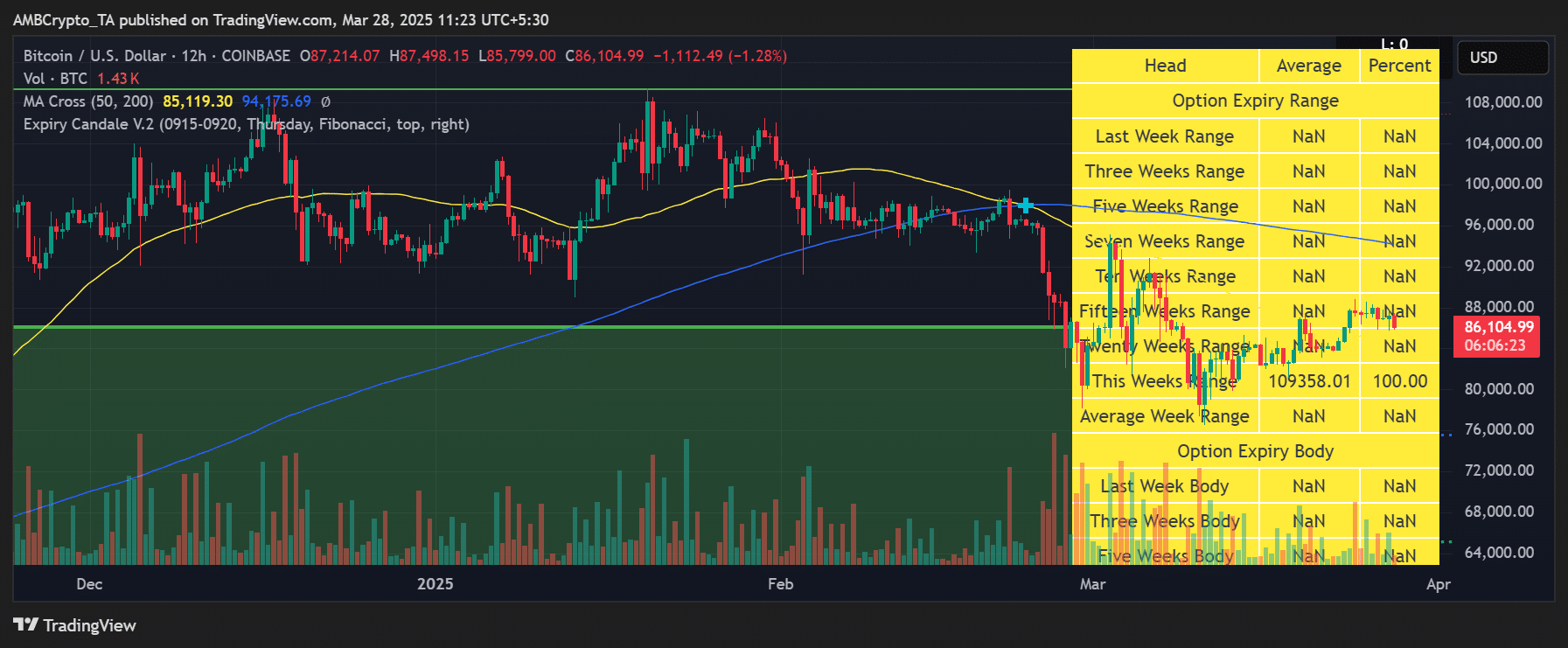

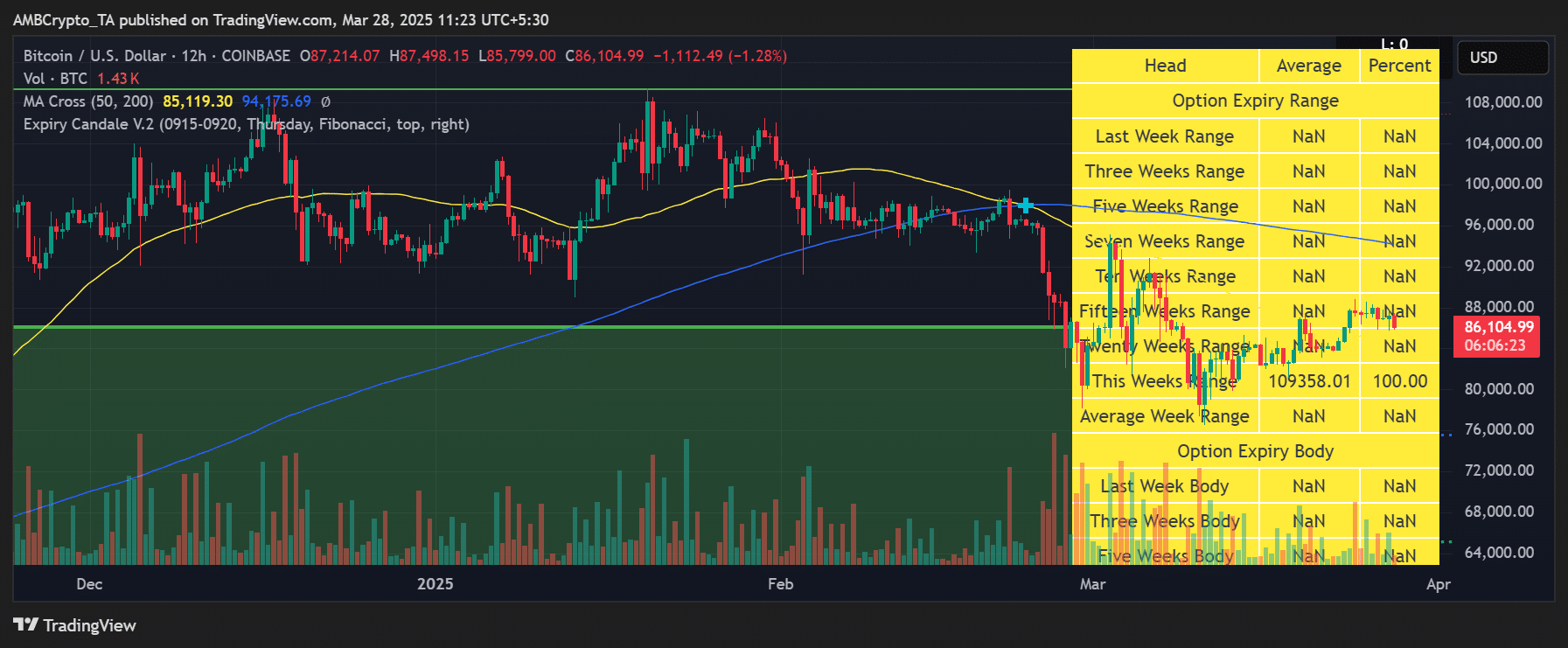

On the 12-hour BTC/USD chart, Bitcoin traded round $86,100, struggling to keep up upward momentum.

The 50-day MA at $85,119 acted as near-term assist, whereas the 200-day MA at $94,175 loomed overhead as a key resistance.

Supply: TradingView

Including to the uncertainty is the Expiry Candle indicator, which marks the present weekly expiry vary at $109,358, properly above the present worth.

Traditionally, possibility expiry occasions can introduce volatility spikes however typically fail to push BTC past key psychological ranges until quantity follows by means of.

Low quantity and excessive danger: Can Bitcoin bulls maintain the push?

Quantity metrics counsel weakening participation, as mirrored within the comparatively muted buying and selling exercise regardless of elevated OI.

This divergence signifies that whereas positions are stacked, precise conviction stays low. Even minor worth shifts can spark liquidations and exaggerated strikes in such an atmosphere.

In the meantime, on-chain information reveals some assist close to the $85K area. If Bitcoin manages to carry this degree by means of expiry, it may function a launchpad for a $90K retest. Nonetheless, a break beneath may invite short-term promoting, particularly with closely skewed leverage.

Conclusion

As Bitcoin approaches the upcoming $16.5B choices expiry, all eyes are on whether or not bulls can reclaim $90K or if expiry-induced volatility will drive a brief pullback.

With heavy OI, combined indicators, and skinny quantity, the following 48 hours may show decisive for BTC’s development in Q2 2025.