Record $236B stablecoins pile-up – Will this send BTC toward $100K?

- Stablecoin provide surges to a file $236.6 billion.

- Bitcoin leads the rally with a ten% weekly surge because the altcoins market cap surges by 16%.

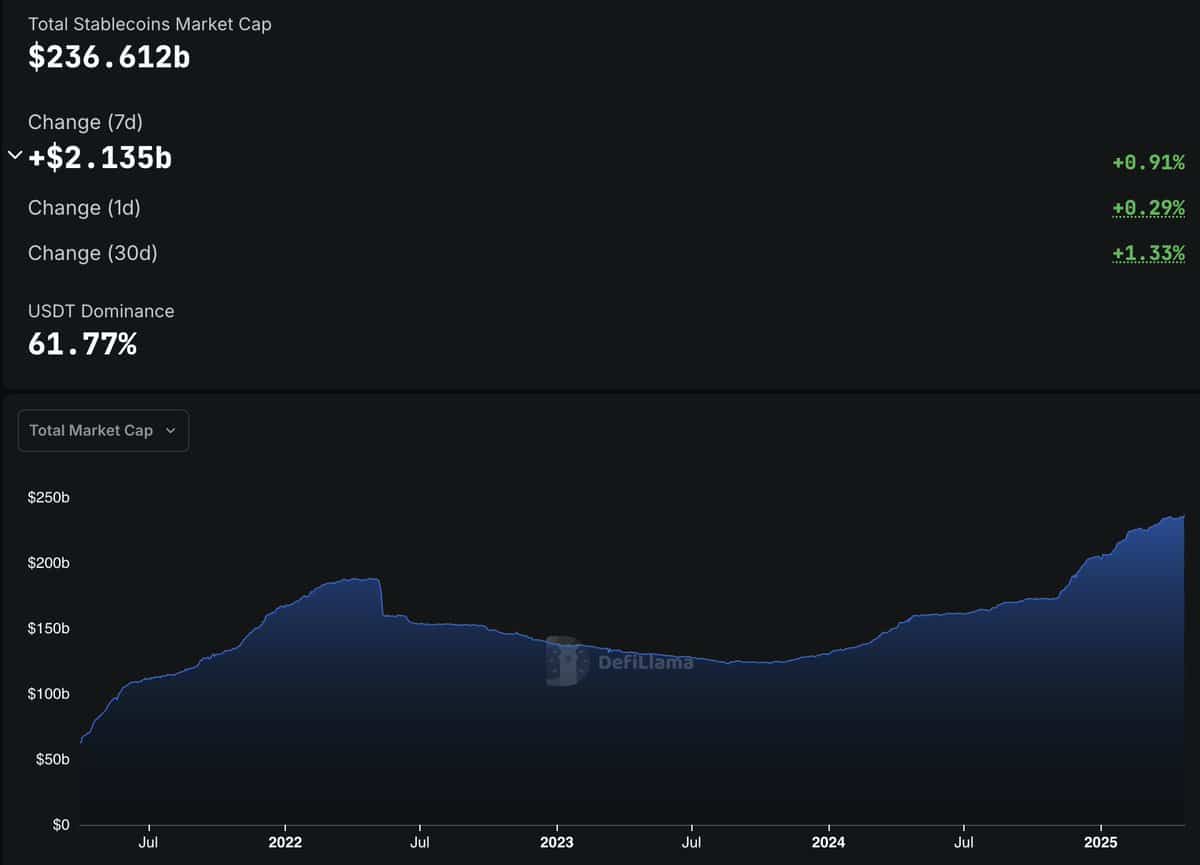

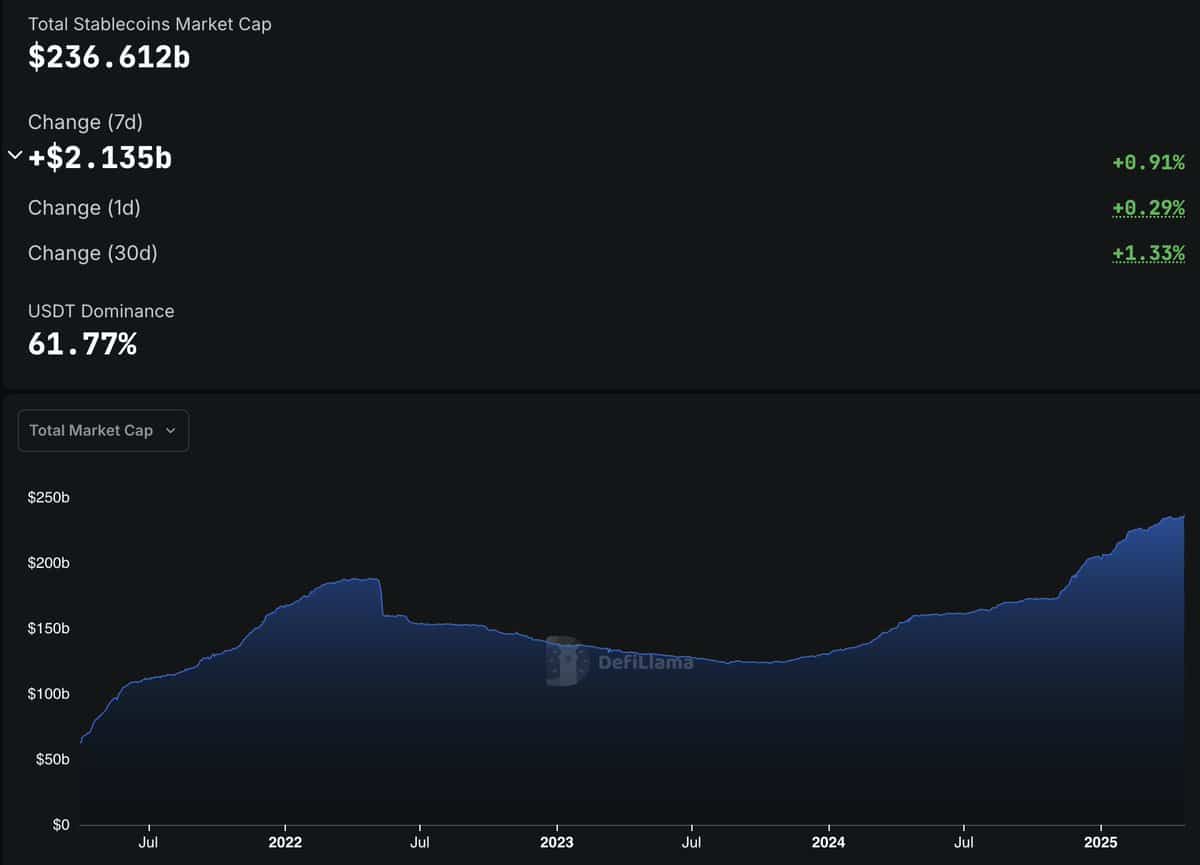

In keeping with DefiLlama information, the overall provide of stablecoins increased by $2.135 billion prior to now week, bringing the cumulative provide to a record-breaking $236.6 billion.

The constant influx of stablecoins signifies rising liquidity, which will be seen as dry powder able to enter danger belongings like Bitcoin [BTC] and altcoins.

Traditionally, an increase in stablecoin provide has typically preceded market rallies, because it displays elevated shopping for energy on the altcoins and BTC.

Supply: DeFiLlama

Bitcoin rallies 10% as bullish momentum holds

Bitcoin surged by 10% to $93K over the previous week, pushed by a robust rebound from a vital technical assist zone.

Naturally, market sentiment round BTC stayed bullish, with contributors now aiming for the $100K psychological milestone. This rally is not only technical, because the rising capital inflows have their leg in.

The inverse correlation between BTC and stablecoin provide additionally helps the view that extra buyers are diversifying their portfolios to take Bitcoin lengthy positions.

Altcoin market follows BTC’s lead

The broader altcoin market has not been left behind. Since bouncing from a weekly demand zone, the complete altcoin market cap surged by 16% on weekly charts.

On the time of writing, the overall altcoin market cap, excluding Ethereum [ETH] and BTC, stood at $821 billion.

Actually, the heavy rebound mirrored Bitcoin’s power and underlined the altcoin market’s reliance on BTC’s directional bias.

Whereas altcoins might lag at first, they often catch up as soon as Bitcoin stabilizes or consolidates. The setup at the moment means that if BTC continues to hold momentum, a stronger altcoin season could also be on the horizon.

Supply: TradingView

Market sentiment turns bullish

With Bitcoin main and stablecoin reserves at file ranges, the general market sentiment leans bullish. Market contributors seem extra constructive, and capital rotation into crypto belongings is choosing up tempo.

Whereas Bitcoin charged towards $100K, altcoins appeared poised to trip the secondary wave.

Having stated that, the interaction between stablecoin inflows, Bitcoin dominance, and altcoin exercise could be vital within the coming weeks.

If the previous cycle repeats, the present pace may mark the start of a broader altcoin rally—one which thrives below the shadow of Bitcoin’s dominance.