Record losses in crypto: Traders liquidate over $1.7B in 24 hours

- Over the previous 24 hours, the market recorded its largest single-day liquidation, with merchants experiencing vital setbacks.

- ETH and DOGE holders had been among the many hardest hit, as costs tumbled through the sell-off.

The worldwide cryptocurrency market cap dropped by 4.11%, falling to $3.47 trillion. Buying and selling quantity, nevertheless, surged by 114.40%, reaching $352.9 billion as traders reacted to the volatility.

Market analysts notice that the long-anticipated altcoin rally could face delays, given the present shift in sentiment and unsure market situations.

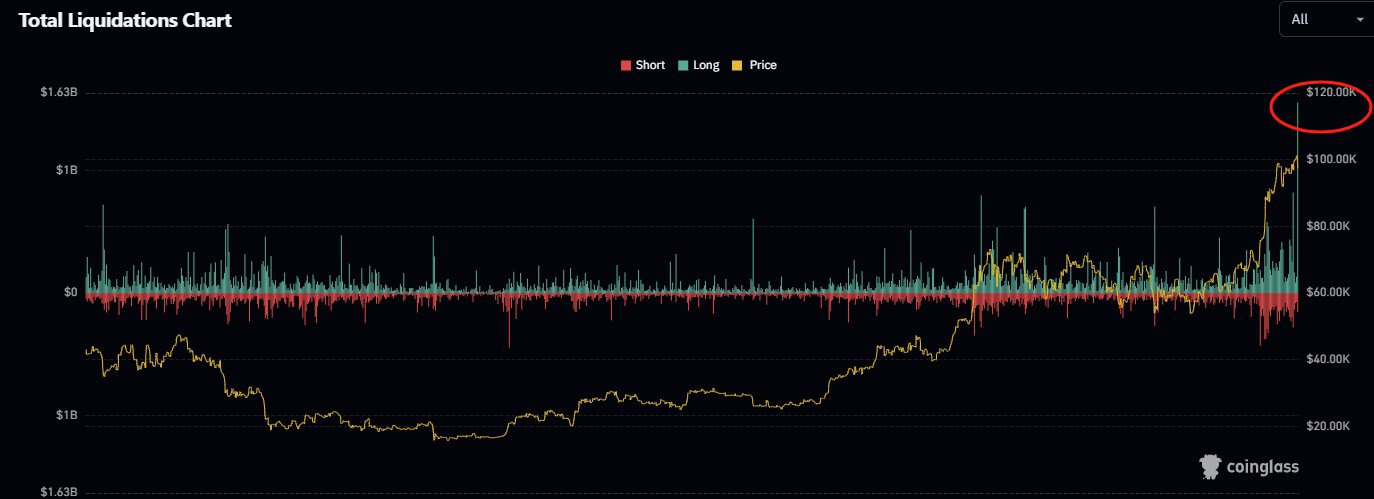

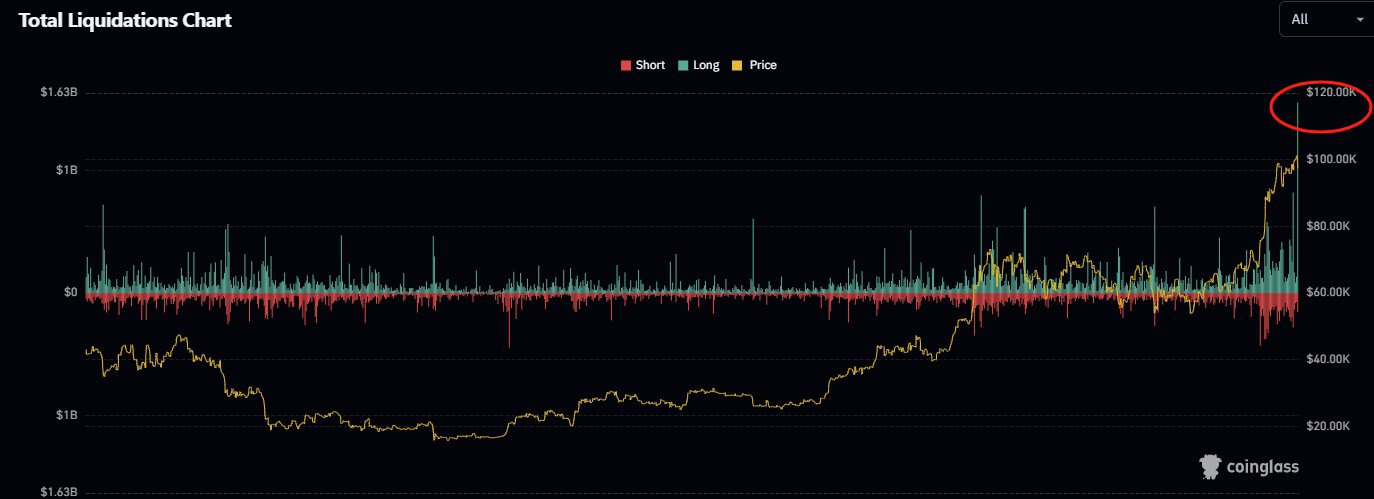

Market sweep: $1.71 billion liquidated

The crypto market’s newest downturn has triggered unprecedented losses, leaving merchants in disarray.

Insights from Coinglass reveal that the previous 24 hours marked the best single-period liquidation and the most important variety of affected merchants because the begin of the present market cycle.

Coinglass reported:

“Up to now 24 hours, 569,214 merchants had been liquidated, with whole liquidations amounting to $1.71 billion.”

Supply: X

This aggressive market response alerts a possible for continued declines, particularly amongst altcoins. The widespread panic promoting has eroded market confidence as merchants rush to protect earnings amid mounting volatility.

Analysts warning that altcoins could take time to regain momentum, as sentiment signifies the market will not be but primed for a restoration.

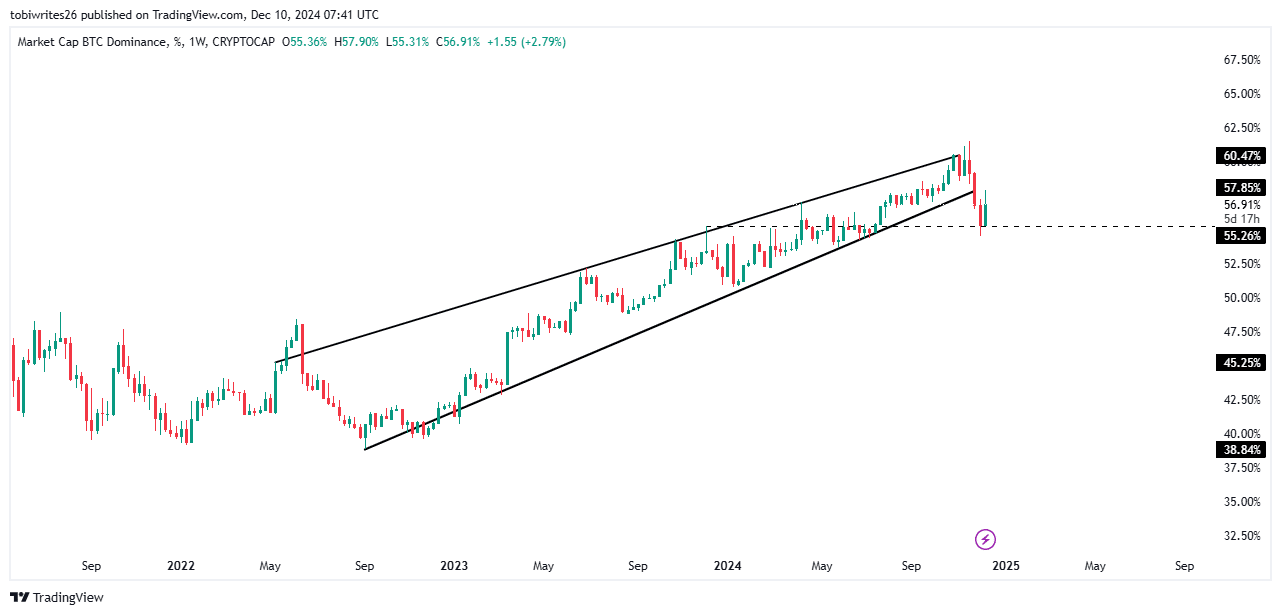

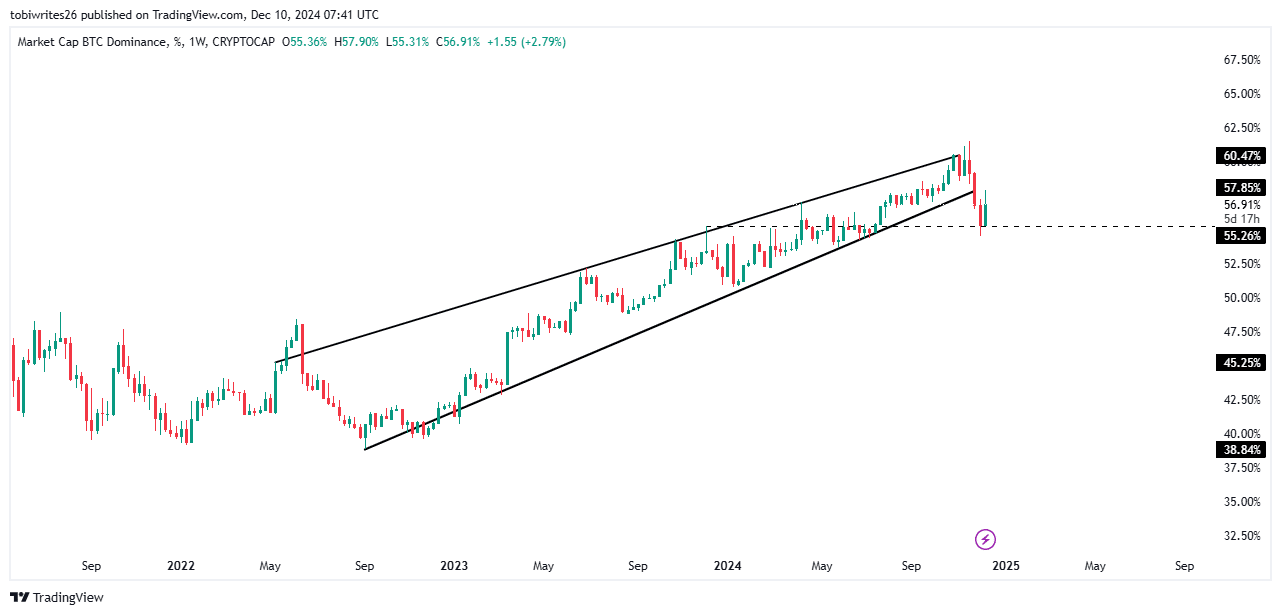

Altcoins weaken as Bitcoin dominance climbs

Bitcoin [BTC] dominance (BTC.D) has surged over the previous 24 hours, reaching a excessive of 57.90%, up from 56.86%. This rise displays a shift in market dynamics, with Bitcoin asserting higher management over the crypto market.

The rise in Bitcoin dominance was triggered by a bounce off the 55.26% help stage, which held agency and acted as a catalyst for Bitcoin’s renewed power.

Supply: TradingView

Sometimes, a drop in BTC.D signifies altcoin power, typically resulting in rallies. In distinction, a rising dominance chart signifies capital flowing again to Bitcoin, leaving altcoins struggling to take care of momentum.

If Bitcoin dominance continues its upward development, altcoins are more likely to face additional losses, extending the present bearish outlook.

ETH, DOGE lead with $350 million liquidated

Ethereum [ETH] and Dogecoin [DOGE] bore the brunt of the current market downturn, recording the best liquidation losses amongst altcoins, based on information from Coinglass.

Mixed, the 2 belongings noticed $350.56 million worn out, with ETH accounting for $249.48 million and DOGE contributing $101.08 million. These liquidations occurred because the market moved sharply in opposition to dealer expectations, forcing positions to shut.

Learn Dogecoin [DOGE] Worth Prediction 2024-2025

Lengthy merchants had been essentially the most affected, dropping $213.28 million on ETH and $83.13 million on DOGE. This highlights a market closely skewed in favor of bearish sentiment.

A possible restoration would require renewed demand for these belongings, probably pushed by massive traders (whales) seizing the chance to build up at decrease costs. If such exercise materializes, a rebound might happen earlier than anticipated.