GameStop to ape Strategy’s Bitcoin Reserves plan – Will GME explode?

- GameStop plans to repeat Technique’s Bitcoin playbook

- Will meme inventory GME explode like Metaplanet and MSTR did?

On Tuesday, American online game retailer GameStop’s (GME) board ‘unanimously’ accepted adopting Bitcoin [BTC] reserves as a part of its company technique. Because of this, it could be part of the rising record of public corporations which have copied Technique’s (previously MicroStrategy) BTC playbook to spice up shareholders’ worth.

The replace got here just a few weeks after a number of figures, together with Try Asset Administration CEO Matt Cole, urged the agency’s CEO, Ryan Cohen, to purchase BTC with its extra money reserves.

Market reactions

There have been combined reactions to the replace although. Michael Saylor, the pioneer of BTC technique, termed it a “step in the suitable course.” In line with experiences, the gaming agency has $4.6 billion in money reserves proper now.

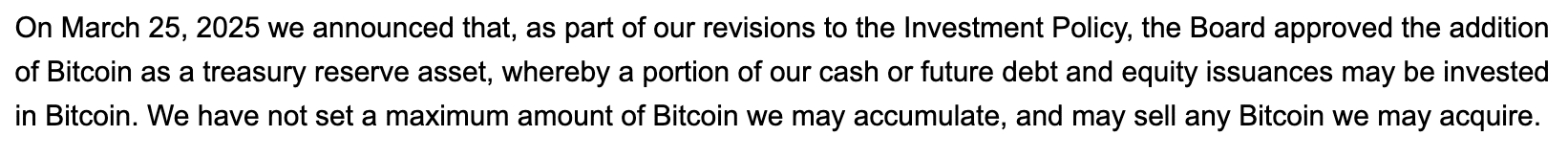

In actual fact, in keeping with GameStop’s 10-Ok filing with the SEC, its groundwork for BTC adoption mirrors Technique’s (MicroStrategy), together with by means of debt and inventory issuance.

Supply: SEC (excerpt of 10-Ok submitting)

In line with Bitcoin Treasuries, 88 public corporations control a whopping 665,030 BTC as a part of their Bitcoin technique. In actual fact, they’re the second largest class of BTC holders after funds like ETFs, which have over 1.29M BTC.

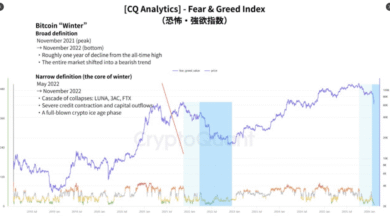

Though some view the FOMO amongst corporations as a internet optimistic for BTC’s worth as a consequence of rising demand, some had reverse opinions. In line with analyst Checkmatey, the rising variety of companies leaping on the bandwagon is a probable high sign.

“I made a declare that zombie corporations like Gamestop ‘pulling a Saylor’ as a get out of jail card can be a transparent topping sign.”

That being stated, most companies which have adopted this technique have seen large pumps on their shares. Technique’s MSTR, for instance, has rallied by over 2000% since adopting BTC in 2020, outperforming the crypto by 3.3x.

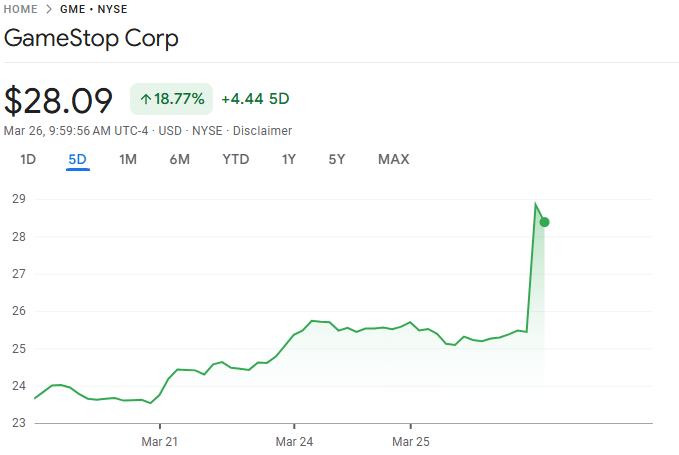

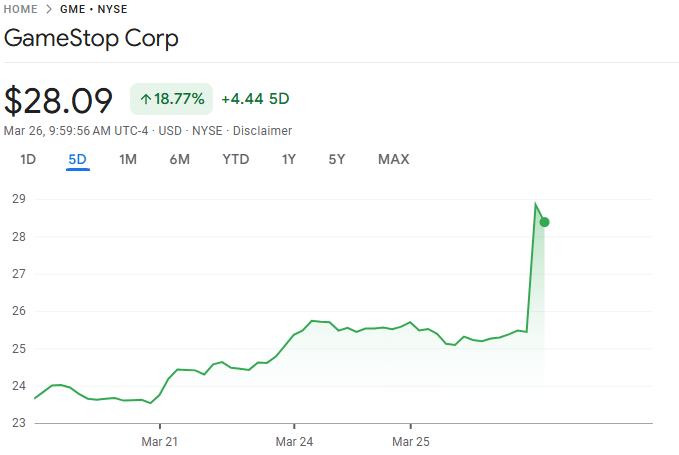

Equally, Metaplanet’s inventory pumped by 2,240% since adopting BTC in April 2024. Will traders within the meme inventory GME profit from the same windfall development? Properly, that is still to be seen. Nonetheless, the inventory was up 10% barely after the U.S market opened on Wednesday.

Supply: Google Finance