Render is breaking out from the consolidation after a 14% surge

- RNDR has spiked by 14.5% over the previous 24 hours.

- Render was breaking out from the consolidation, positioning for a transfer towards $6.

Over the previous day, Render [RNDR] has made a robust upswing on its value charts. Over this era, the altcoin has surged from a low of $3.2 to an area excessive of $3.8.

On the time of writing, Render was buying and selling at $3.79, reflecting a 14.51% day by day improve. On the weekly charts, the altcoin has gained 18.96%. Moreover, Render’s buying and selling quantity has surged by 73.42%, reaching $67.34 million.

Given the latest value motion, Render seems poised for a breakout from its present consolidation section.

Is Render lastly able to rally?

In keeping with AMBCrypto’s evaluation, Render was experiencing a robust upward momentum as patrons dominated the market.

Supply: TradingView

For starters, this shopping for exercise will be noticed by means of the rising Chaikin Cash Movement (CMF). As such, CMF has turned constructive, hitting 0.04 over the previous 48 hours.

When CMF turns constructive, it means that patrons are dominating the market. This was additional validated by a rising and constructive MACD line.

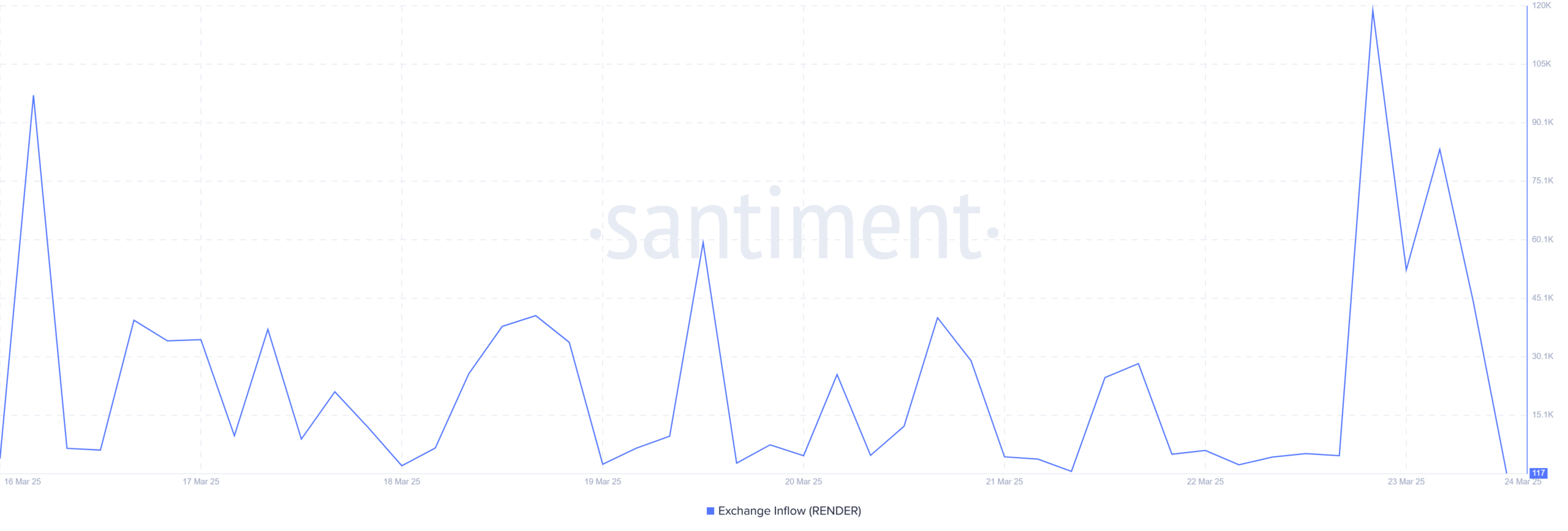

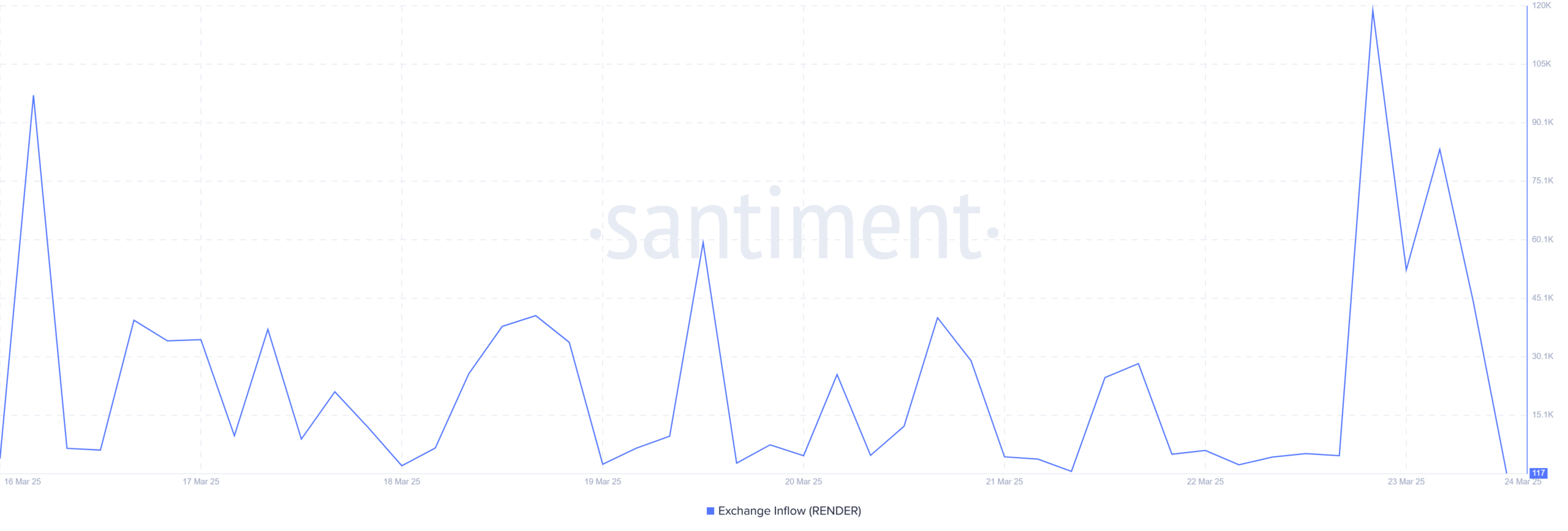

Supply: Santiment

Render has skilled a big drop in trade influx, with Santiment information indicating a pointy decline to a low of 117.7 tokens over the previous day.

This diminished influx means that holders are selecting to retain their tokens fairly than promote them. In distinction, increased influx ranges typically sign promoting intent, which may result in elevated promoting strain.

Moreover, a constructive order imbalance additional helps this pattern. The dominance of purchase orders over promote orders signifies that patrons are at present in charge of the market, reflecting robust buying exercise.

In consequence, extra purchase orders are being executed in comparison with promote orders.

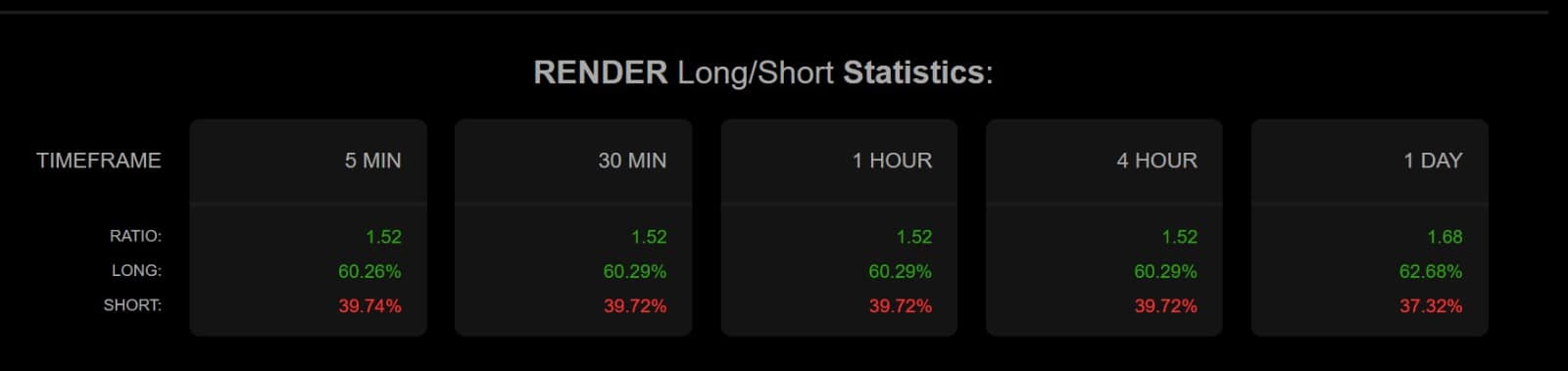

Supply: MobChart

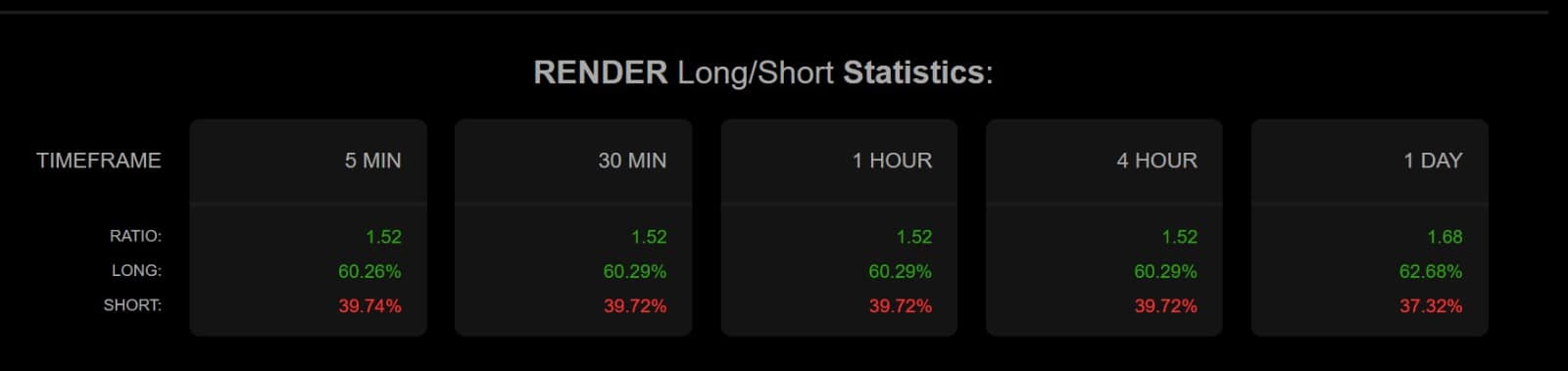

Lastly, these patrons are getting into the market primarily to open lengthy positions. The Lengthy/Quick Ratio reveals that lengthy positions dominate, with 62.68% of accounts being lengthy, in comparison with 37.32% holding brief positions.

Such a ratio signifies that almost all of buyers are optimistic, anticipating a near-term value restoration.

Supply: Coinalyze

What subsequent for RNDR

In conclusion, present market situations recommend that Render (RNDR) is well-positioned for additional positive factors. With patrons dominating and powerful bullish sentiment prevailing, RNDR seems poised for important upward motion.

If a day by day breakout from consolidation is adopted by a profitable retest and a detailed above $3.8, it will validate the bullish transfer. Render may then goal $4.5, probably constructing momentum to problem the $6 resistance degree.

Nevertheless, if the try fails and the value closes under $3.5, RNDR could endure a correction, retracing to $3.2.