‘Rich Dad Poor Dad’ author buys more Bitcoin amid rally – Here’s why

- Kiyosaki purchased extra BTC and now, expects an additional rally in direction of $175k-$350k

- Pi Cycle High forecasted a possible market peak in September, close to $235k

Robert Kiyosaki, the creator of ‘Wealthy Dad, Poor Dad,’ has scooped up extra Bitcoin [BTC] after the world’s largest digital asset reclaimed $100k on the value charts.

Kiyosaki is a long-time BTC advocate and has at all times urged his over 2M X (previously Twitter) followers to contemplate the cryptocurrency as an inflation hedge.

BTC to $175k?

Actually, he just lately predicted that Bitcoin may surge to $175k —$350k in 2025, which may clarify his latest further BTC positions. In his New 12 months message, he wrote,

“My worth prediction for BITCOIN 2025: $175,000 to $350,000. Blissful New 12 months”

Other than BTC, the creator has additionally championed asset diversification by together with silver and gold, citing financial mismanagement by key authorities establishments that make U.S dollar-based investments very dangerous proper now.

Supply: X

That being stated, his Bitcoin projection isn’t precisely far-fetched. Particularly because it falls throughout the $150k-$250k vary anticipated by most analysts.

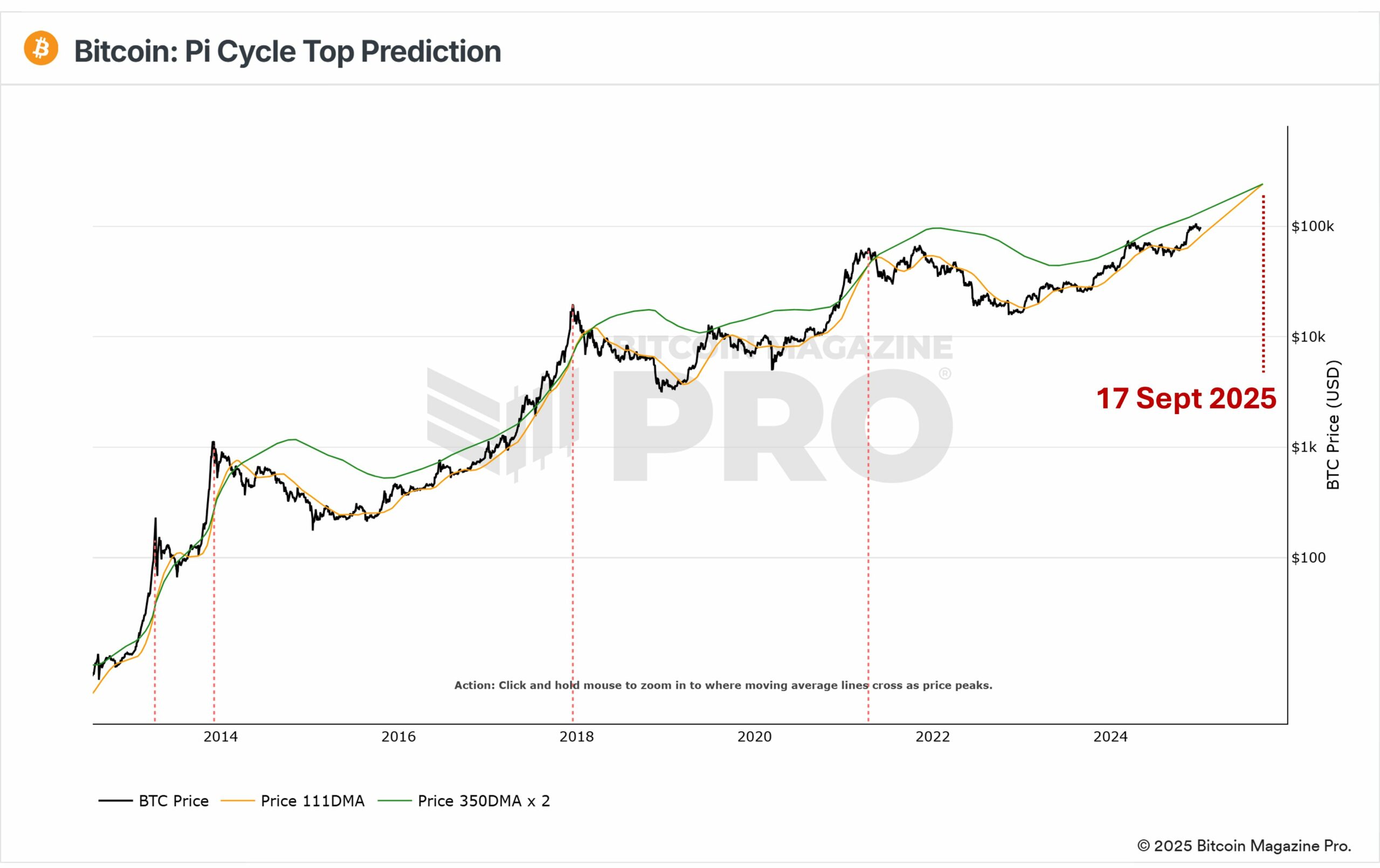

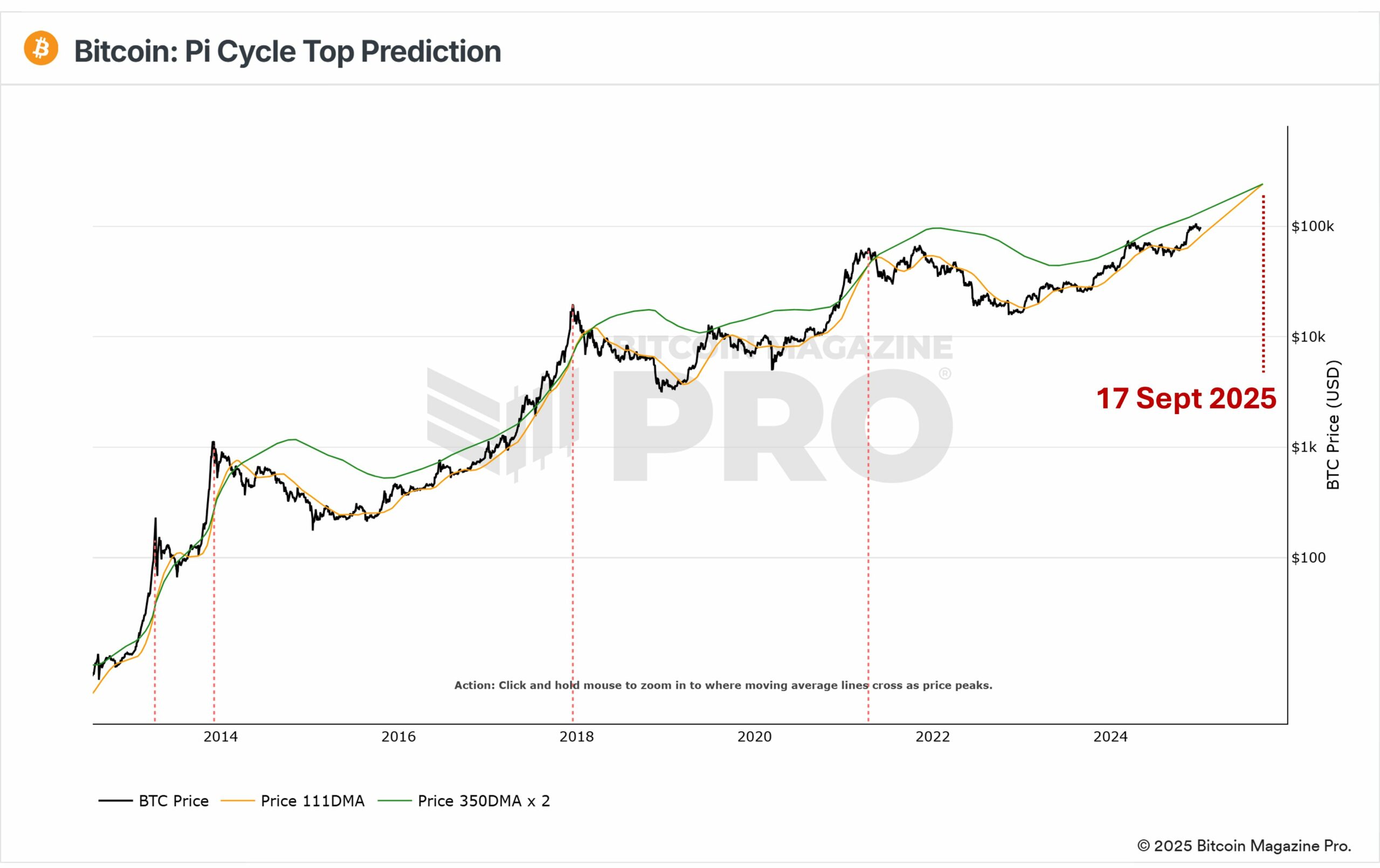

Actually, even one of many key market peak metrics, Pi Cycle High, marked $234k as a possible set off stage for an enormous correction and a probable bear market.

Supply: BM Professional

For these unfamiliar, the metric accurately flagged earlier market peaks in 2013, 2017, and 2021. The sign triggers the market high when the 111-day shifting common (MA, orange) crosses the modified 365-day MA.

If the developments repeat and the standard cycle patterns play out, the continued bull run may fizzle out by the tip of Q3 2025 and usher in a bear section of prolonged correction.

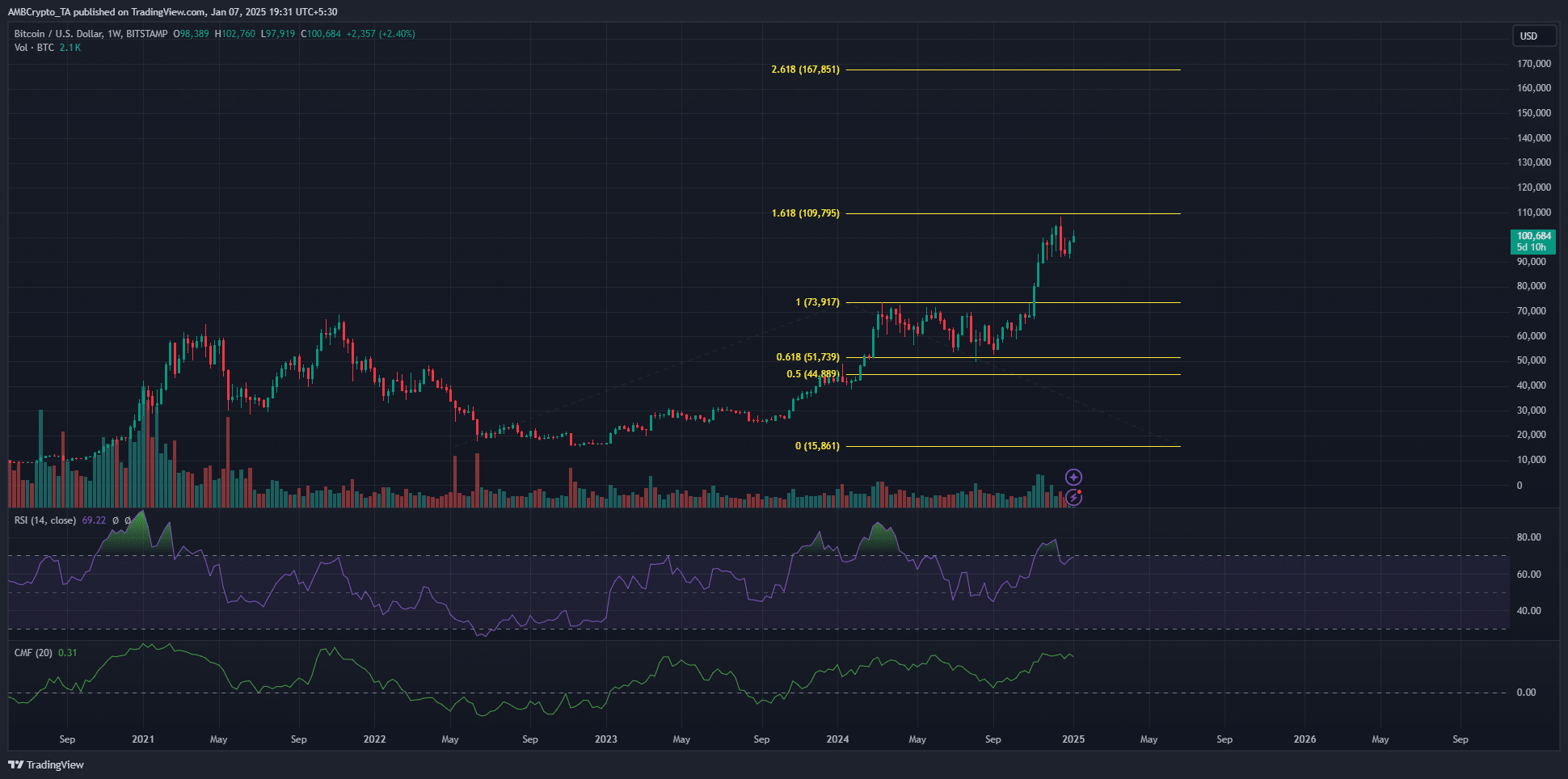

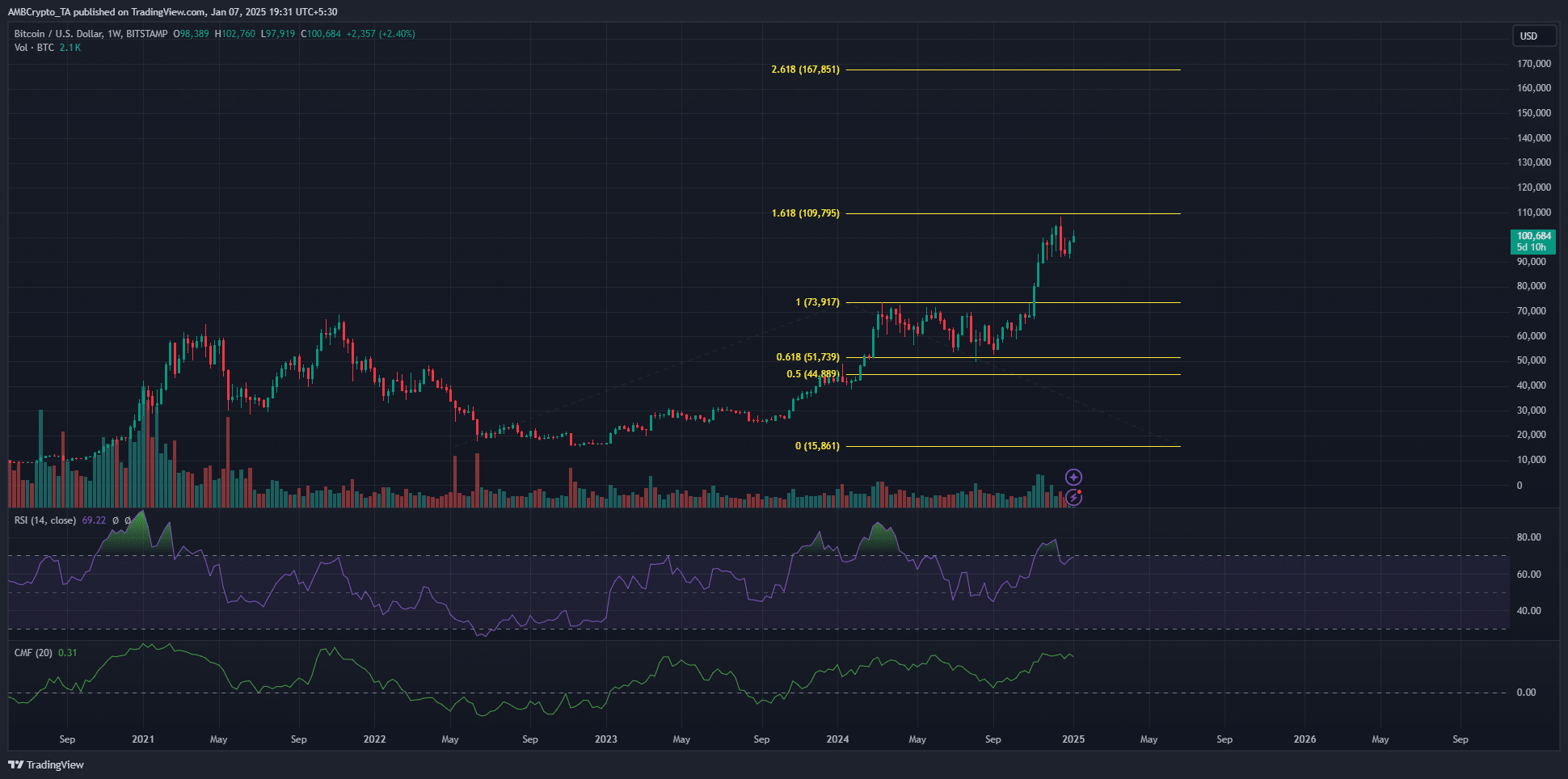

Within the meantime, the Pattern-Primarily based Fibonacci Extension instrument, traced from the 2022 market backside, indicated that BTC may surge to $167k within the medium time period.

Supply: BTC/USD, TradingView

Price noting, nonetheless, that earlier than the wild run above $150k, most market pundits projected a possible native high in March earlier than a rebound in direction of a cycle peak later within the 12 months.