FLOKI loses 11% as derivative, spot traders drive sell-offs – Details

- A examine of the liquidation chart revealed FLOKI has liquidity clusters beneath its press time worth

- Spot merchants are on a three-week promoting streak proper now, including downward strain on the chart

FLOKI has emerged as among the many market’s prime losers after dropping over 11.43% of its worth within the final 24 hours. Due to the identical, at press time, its weekly losses stood at 23%.

This promoting may intensify as AMBCrypto’s evaluation highlighted declining volumes throughout the board. This confirmed that merchants have been dropping momentum whereas bears, each spinoff and spot merchants, at the moment are stepping step in.

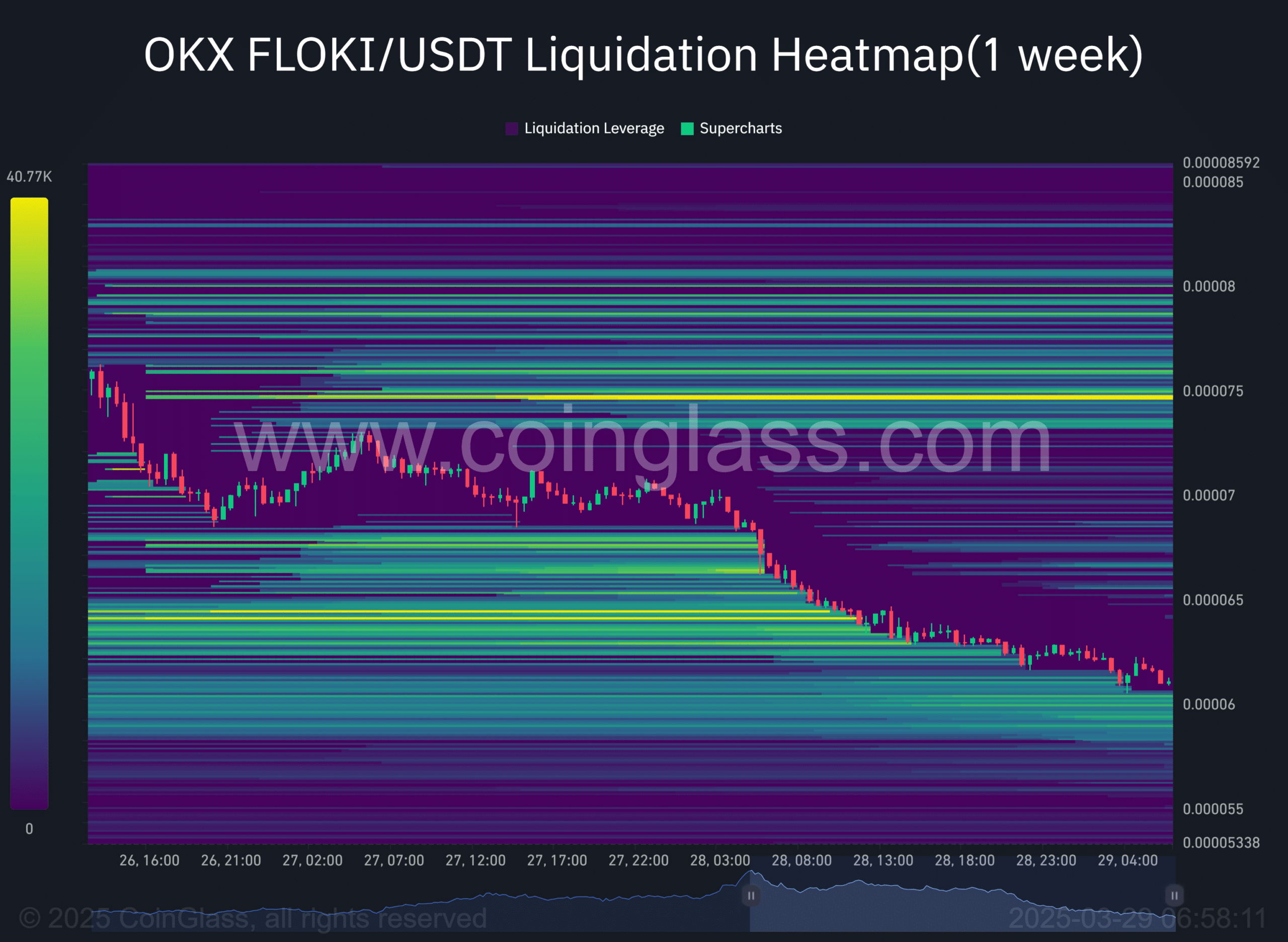

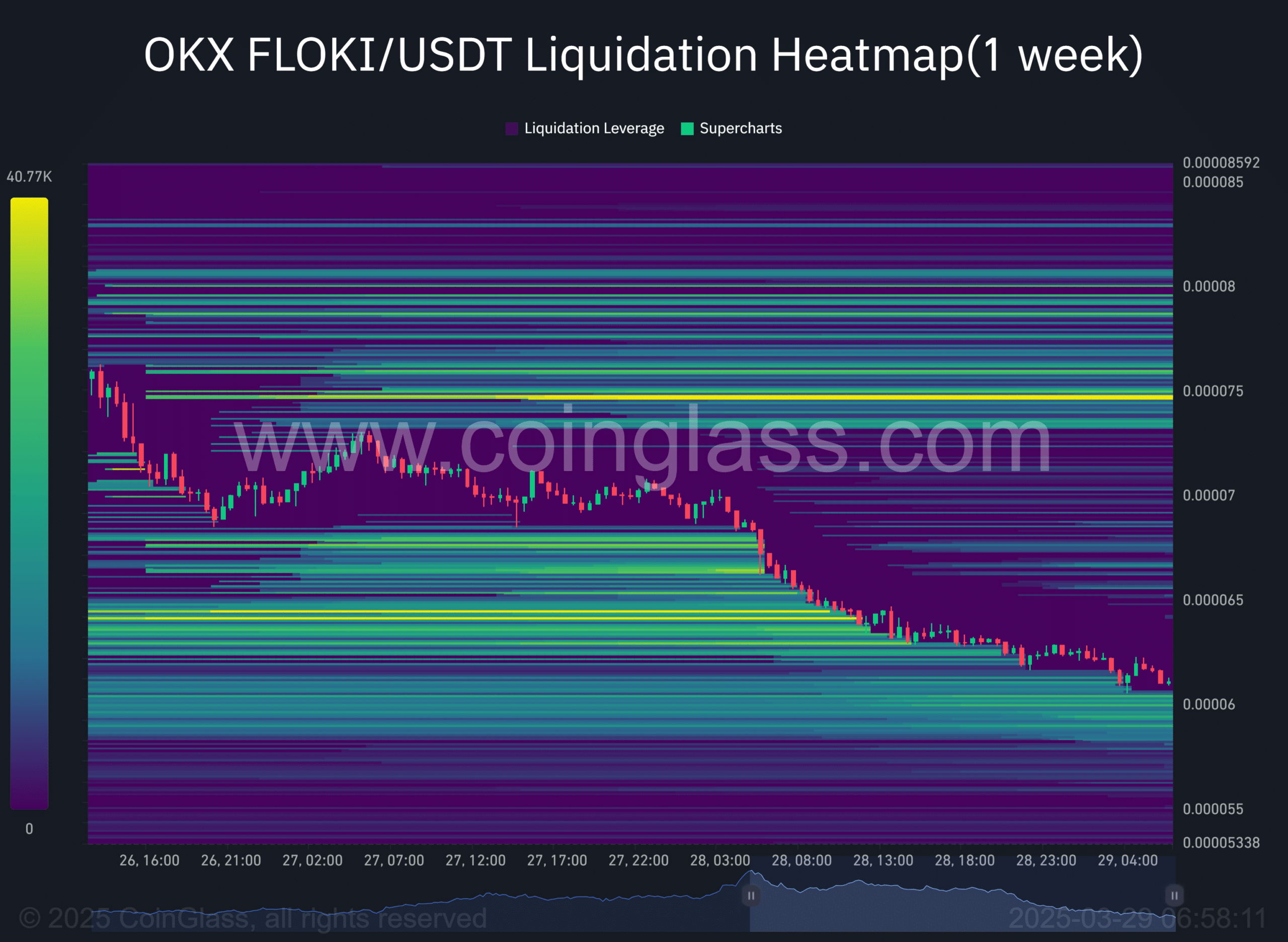

Liquidity clusters and spinoff merchants ignite drop

A press time evaluation of the FLOKI/USDT liquidation heatmap revealed a number of liquidity clusters beneath the press time worth degree of $0.00006075.

Liquidity clusters are ranges on the chart the place unexecuted orders within the spinoff market lie, performing as a magnet pulling the value down.

Supply: Coinglass

Additional evaluation confirmed that these clusters lengthen to $0.000058147 – A degree with zero liquidity hooked up to it. This worth level or ranges barely above it might be the place FLOKI rebounds, making a significant rally transfer.

AMBCrypto discovered that the market decline to this liquidity cluster will likely be pushed by spinoff merchants, as key metrics indicated. Within the final 24 hours alone, the promoting quantity from spinoff merchants has overshadowed shopping for exercise, with the identical evidenced by the long-to-short ratio.

When the long-to-short ratio is beneath 1—the impartial threshold—it means there may be extra promoting than shopping for. On the time of writing, FLOKI had a ratio of 0.7828, considerably beneath 1 – This steered market individuals are actively promoting, slightly than shopping for.

Open Curiosity has fallen accordingly too, particularly as spinoff merchants react to the bearish wave, leaving simply $14.76 million value of unsettled contracts available in the market. This drop has been largely influenced by lengthy positions being forcefully closed.

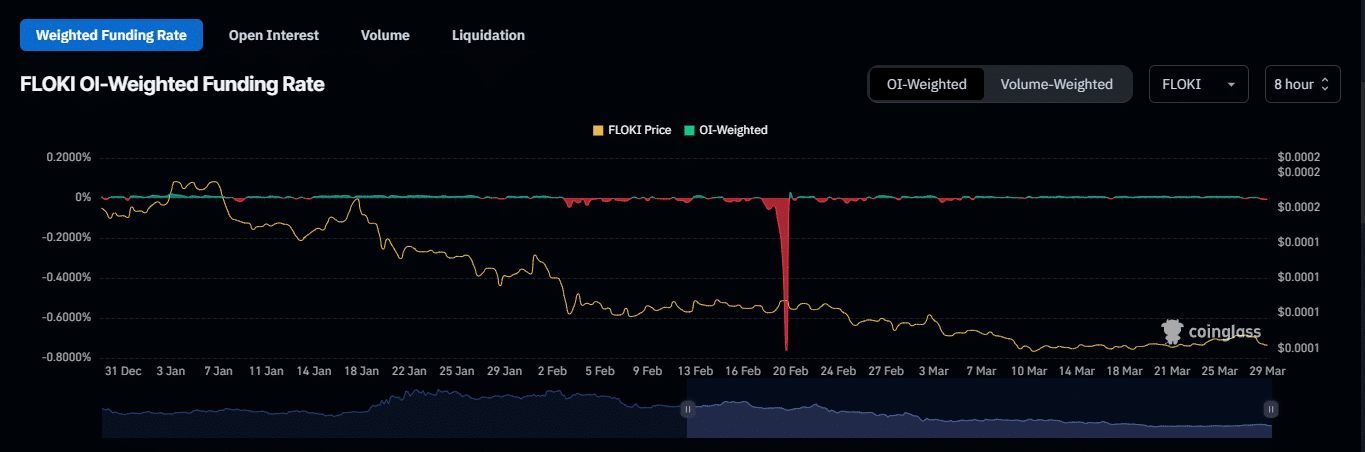

Supply: Coinglass

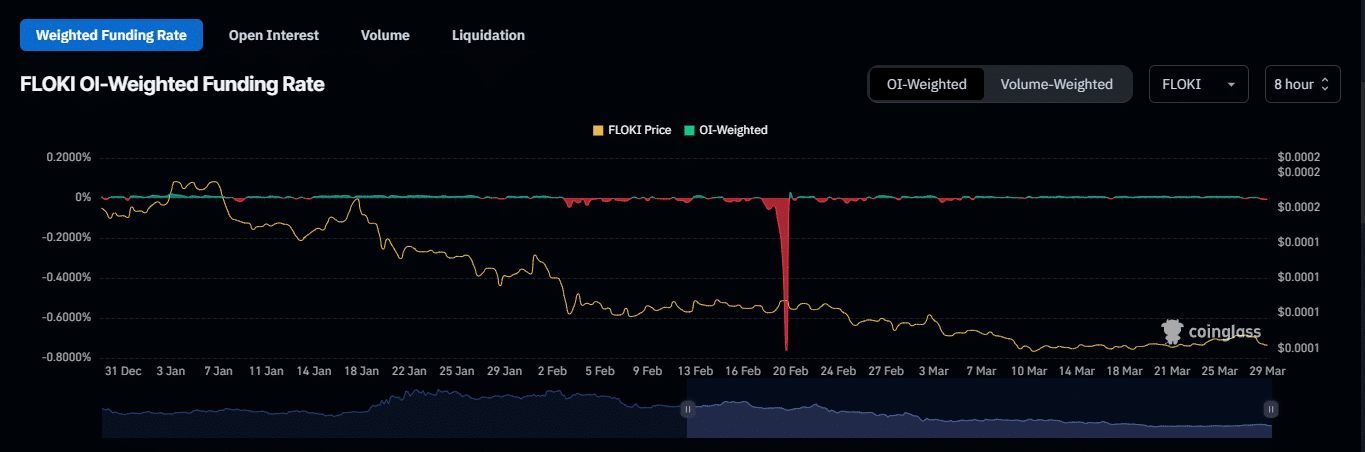

The OI-weighted funding charge gives a transparent image of the market development amongst spinoff merchants, with the identical having a studying of -0.0143%. In accordance with evaluation, that is essentially the most bearish the market has been since 4 March.

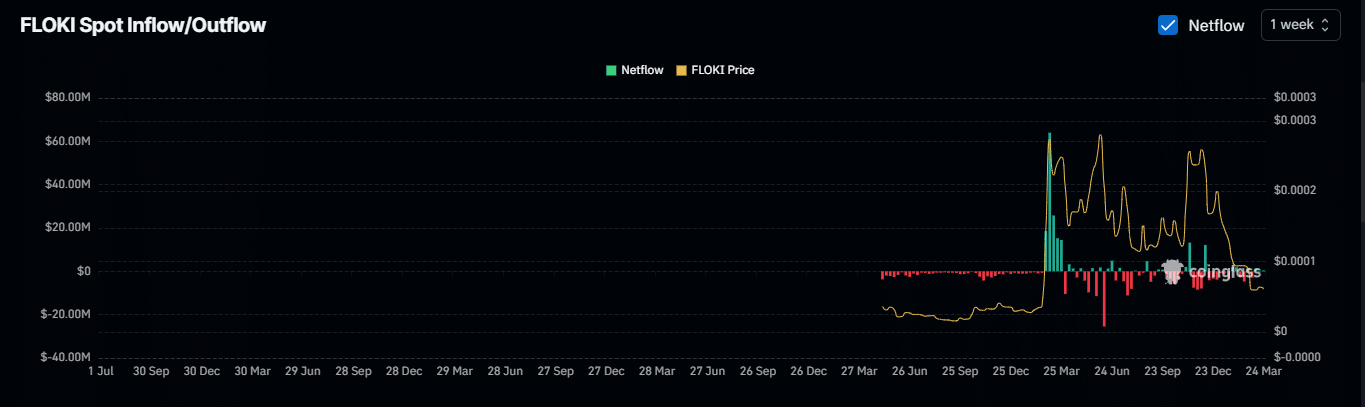

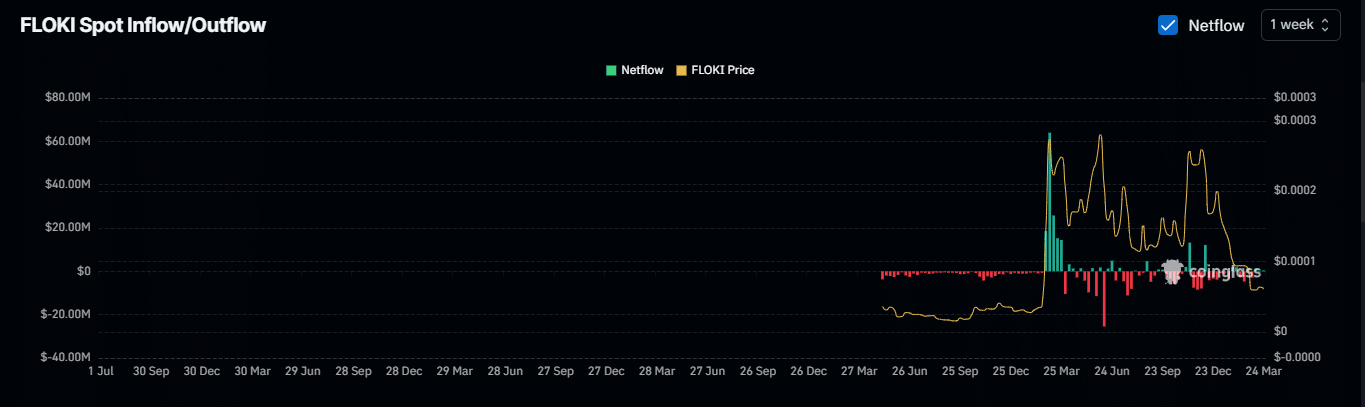

Spot merchants are additionally supporting this decline, sustaining a week-over-week bearish place.

Three-week outflows from spot merchants

Lastly, within the spot market, merchants have persistently offered – A development that started on 10 March . In accordance with knowledge reported by Coinglass, $1.75 million has been offered throughout this era.

Supply: Coinglass

If spot dealer outflows proceed alongside the promoting wave from the spinoff market, FLOKI’s decline may speed up. Regardless of key metric fluctuations, the memecoin stays in a bearish zone proper now.