SEC approves first Bitcoin ETF – king coin hype amplifies

- The SEC has authorised the primary leveraged Bitcoin Futures ETF within the US.

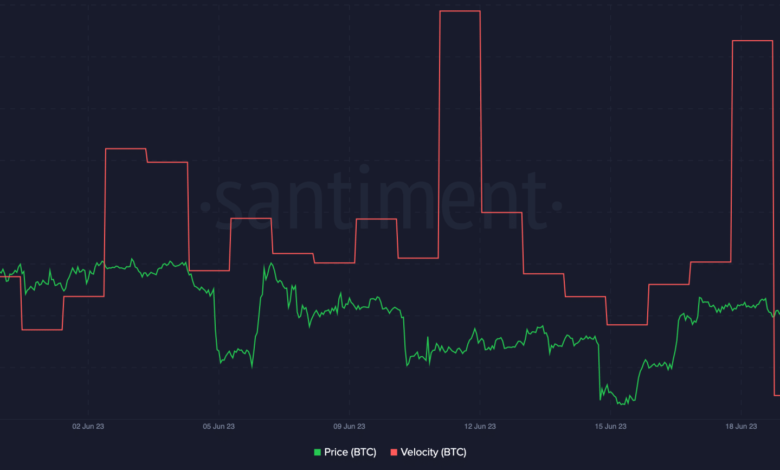

- BTC’s worth witnessed an uptick, velocity declined.

The US Securities and Alternate Fee (SEC) has made a big transfer by granting approval for the first-ever leveraged Bitcoin [BTC] Futures ETF. This groundbreaking improvement marked the inaugural ETF of its form accessible in the US, with buying and selling set to start on Tuesday.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Excessive leverage, excessive rewards

For context, an ETF or Alternate Traded Fund is a sort of funding automobile that tracks the efficiency of particular property. Right here, the BITX ETF focuses on Bitcoin.

What makes this ETF distinctive is its leveraged technique, aiming to amplify Bitcoin returns by an element of two. This leverage is achieved by using monetary derivatives and different devices. Thus, traders can doubtlessly profit from each upward and downward actions of Bitcoin’s worth.

The registration of this futures-based ETF straight outcomes from developments inside the business, with particular consideration given to BlackRock’s initiative to introduce Bitcoin Spot ETFs.

BlackRock, the world’s largest asset administration agency overseeing property value over $10 million, filed a registration assertion for a spot Bitcoin Alternate Traded Fund (ETF). Notably, the BTC ETF falls beneath the iShares unit of the funding firm.

Moreover, Coinbase, a distinguished US-based cryptocurrency alternate, will function the custodian for the Belief’s Bitcoin holdings.

Cold and hot

The SEC is anticipated to approve BlackRock’s ETF request as nicely. Whereas this information seems favorable for the cryptocurrency market, the SEC’s latest actions have contradicted this sentiment. The regulatory physique’s lawsuits towards Coinbase and Binance have had a detrimental impression on a number of altcoins, because the SEC classifies a lot of them as securities.

Solely time will inform what the impression of the conduct of SEC may have on the overall state of the crpto market.

Influence on Bitcoin

Regardless that the way forward for regulation and its impacts on altcoin stays unsure, the worth of Bitcoin has been having fun with a rally on account of latest occasions.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

On the time of writing, BTC was buying and selling at $30,690.44. Its worth skilled a big surge in latest weeks following BlackRock’s announcement.

Nonetheless, the rate of Bitcoin transactions noticeably declined. This indicated lowered buying and selling exercise as people held onto their BTC throughout this era.

Supply: Santiment