SEC Chair gives another warning as decision on spot Bitcoin ETF approaches

- SEC Chairman took to X the second time inside the previous 24 hours to warn of the hazards of the crypto market

- The warning comes proper when the market expects a number of spot Bitcoin ETFs to begin buying and selling by the tip of this week

US Securities and Exchanges (SEC) Chairman – Gary Gensler appears to be having a meltdown on X. This comes proper because the market is abuzz concerning the soon-approaching approval of a number of spot Bitcoin ETFs. Taking issues to X for a second time this week, Gensler stated,

“Should you’re contemplating an funding involving crypto belongings, be cautious. Crypto asset securities could also be marketed as new alternatives however there are critical dangers concerned.”

Notably, the second warning comes inside lower than 24 hours from the primary warning. Within the first warning, put out on January eighth, Chairman Gensler warned that the “crypto asset investments/ companies” providing may not adjust to securities legal guidelines.

He added that crypto asset investments could be “exceptionally dangerous & typically unstable”. Moreover, the Chairman warned that fraudsters continued to take advantage of and lure buyers by numerous schemes.

Warning comes on the eve of a possible spot Bitcoin ETF approval

Curiously, the back-to-back warning comes days earlier than the choice day for spot Bitcoin ETF functions. Throughout a CNBC interview, VanEck CEO – Jan van Eck acknowledged approval for spot Bitcoin ETF was anticipated to come back by the tip of Wednesday i.e., January tenth. Moreover, the CEO expects the merchandise to begin buying and selling available in the market by Thursday morning.

Notably, van Eck expects the SEC to approve 10 ETFs filed by a number of firms, with Blackrock – the funding administration big – being considered one of them. And, this approval is speculated to herald billions of {dollars} inside the first few months of itemizing.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

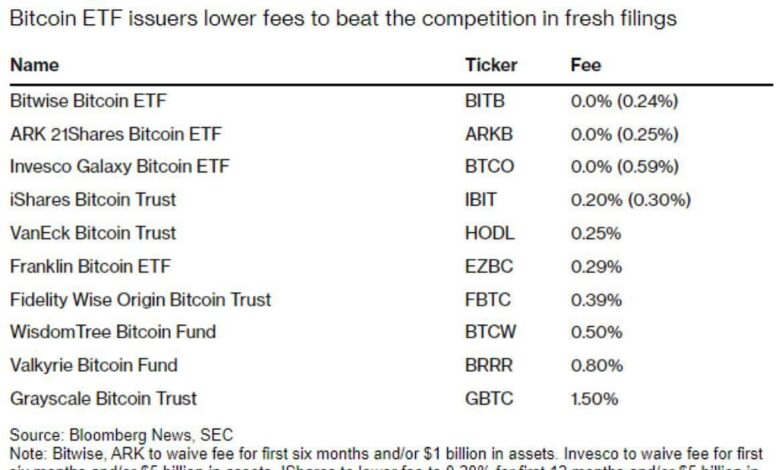

Amidst a assured sentiment of approval, high spot Bitcoin ETF contenders have publicised the payment for his or her product within the newest amended functions. Bitwise at the moment has the bottom charges, set at 0.20%. Notably, this charges can be utilized after the primary six months of itemizing or till the fund has $1 billion in belongings. Earlier than that, there can be no charges on its spot BTC ETF.

No matter long run plans, the depth of this bitcoin ETF bidding conflict is telling me the issuers imagine that the winner’s low charges can be compensated by HUGE $$ inflows. pic.twitter.com/tzEmHzPsWU

— Tuur Demeester (@TuurDemeester) January 9, 2024

Spot BTC ETF charges | Supply: X

Blackrock, alternatively, has set a payment of 0.2% for the primary 12 months or until the fund reaches $5 billion in belongings. Submit this, the charges will enhance to 0.3%. Most different firms are additionally providing little to no charges on their BTC merchandise for the primary few months or till the product has reached a set benchmark of belongings.