Sector rotation ‘tailwind’ for L2s: Kaiko

It is a phase from the Empire e-newsletter. To learn full editions, subscribe.

What’s a great way to gauge how crypto’s faring with out relying an excessive amount of on worth motion?

In case you ask Kaiko, it’s L2s.

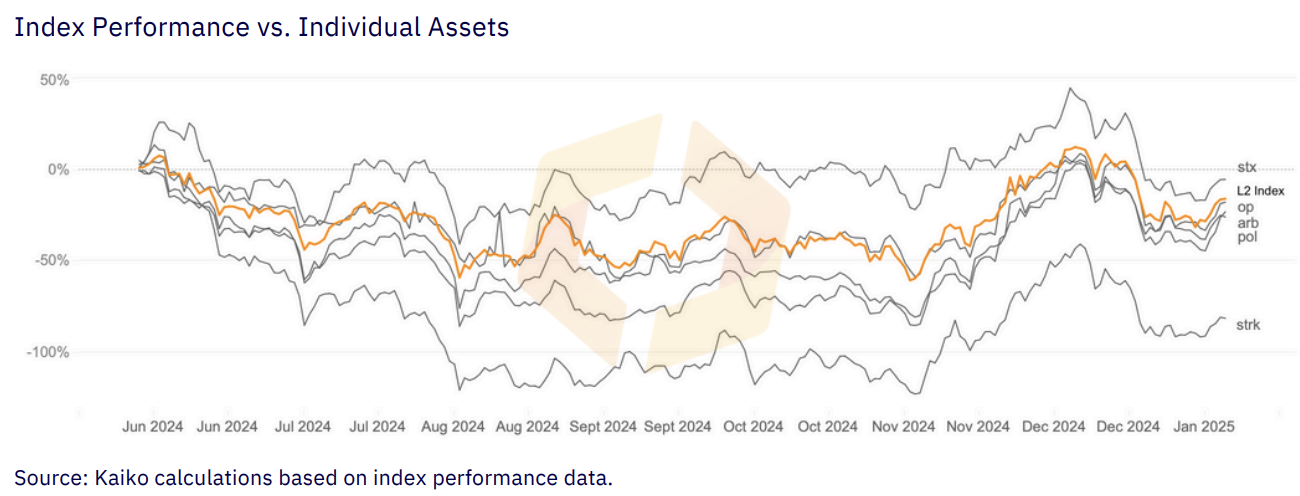

To date, for the reason that election, the analysis agency’s L2 index has traded greater, which is — admittedly — maybe not a enormous shock, given that each one of crypto took on an optimistic outlook beginning in November.

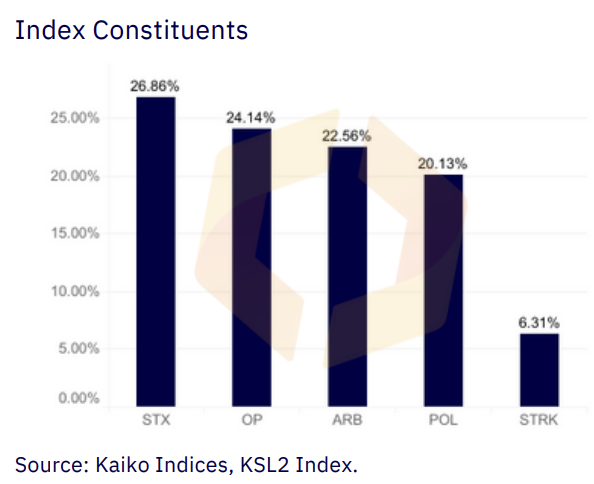

The index tracks 5 L2s throughout Bitcoin and Ethereum. It additionally tracks Polygon.

As you possibly can see above, we have now Stacks, Optimism, Arbitrum, Polygon and Starknet in the identical bucket.

Understand that L2s are making a comeback to date after falling behind the market final 12 months. And there’s been loads of dialogue round whether or not we have now too many L2s.

That’s to not say that there isn’t nonetheless demand although.

Take, for instance, a Galaxy report from November that initiatives that $47 billion of bitcoin might be “bridged into bitcoins L2s by 2030” — or roughly 2% of bitcoin’s circulating provide.

Anyway, again to the information: There is perhaps some extra constructive catalysts in retailer for L2s, particularly if bitcoin doesn’t dominate the narrative as a lot transferring ahead.

“Sector rotation is one other potential tailwind for L2 property. BTC dominated the crypto market in 2024, setting document highs earlier than and after the U.S. election as institutional traders poured billions into spot BTC exchange-traded funds. Nonetheless, the rally hasn’t but prolonged past BTC, as has traditionally been the case. Whereas the crypto market construction has advanced, a rotation to smaller property stays seemingly as traders search greater upside potential by way of high-beta tokens,” Kaiko analyst Adam McCarthy wrote.

Making an allowance for that the altering regulatory headwinds play an enormous issue right here — particularly in Polygon’s case on condition that the SEC beforehand labeled MATIC a safety — and maybe the long run’s wanting a bit brighter.

Whereas investing in bitcoin is accessible to the plenty, it’s exhausting to seek out alternatives past it, McCarthy wrote.

“Whereas the broader crypto bull market has but to totally prolong to altcoins, evolving regulatory dynamics might function a catalyst for renewed curiosity. As coverage shifts in Washington and traders discover alternatives past Bitcoin,” L2s are “positioned for vital progress in 2025,” he continued.

Man, it’s exhausting to be pessimistic in crypto proper now.