Will the optimism around Bitcoin help prices post 2024 halving?

- BTC’s worth motion on the time of publication was similar to its trajectory throughout 2016 and 2020.

- Almost 75% of the provision was within the custody of diamond fingers, akin to the 2016 and 2020 cycles.

The month of August could also be drawing to a detailed, however not earlier than witnessing the elusive volatility making a comeback into crypto markets. After a mid-month free fall, Bitcoin [BTC] pumped earlier within the week amidst rising anticipation surrounding its spot exchange-traded fund (ETF) functions.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Maximalists believed that this optimism would maintain the king coin in fine condition resulting in the all-important halving event, which is round eight months away.

Will historical past be repeated?

The quadrennial incidence cuts miners’ block rewards in half, eliminating the variety of tokens in circulation. Traditionally, these occurrences have preceded bull markets, thus elevating hopes for a 2021-like situation subsequent 12 months.

Furthermore, the continued tendencies additionally revealed some resemblance to earlier pre-halving intervals.

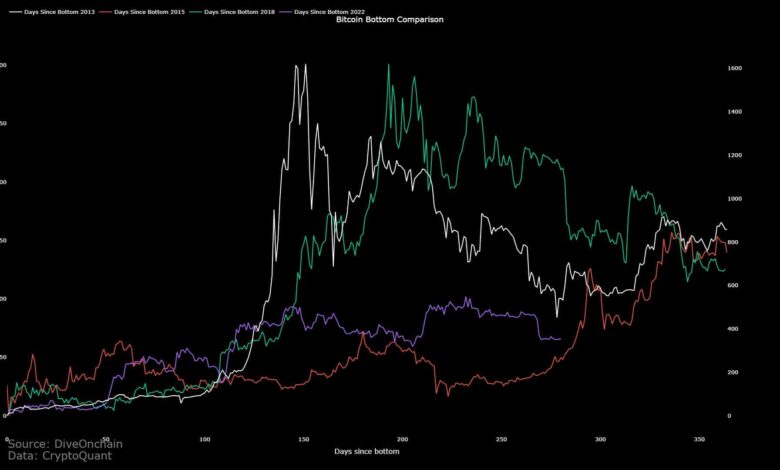

Based on CryptoQuant analyst JA Maartun, BTC’s worth motion on the time of publication was similar to its trajectory throughout 2016 and 2020. Maartun predicted that the relative stability would proceed till the halving.

Supply: CryptoQuant

Aside from the worth motion, the buildup exercise by long-term holders (LTH) was additionally like historical past repeating itself. Almost 75% of the provision was within the custody of those diamond fingers, akin to the 2016 and 2020 cycles.

Supply: CryptoQuant

Moreover, Bitcoin’s hash fee, or the computational energy dedicated to create blocks on the community, rose steadily through the years.

As their total earnings from every block would drop from 6.25 to three.125, miners can be tempted to make use of most of their assets to reap the upper rewards till the halving. This, in flip, may push the hash fee even additional.

Supply: CryptoQuant

Is HODLing mentality right here to remain?

Having famous the above patterns, a captivating new discovering got here to mild. For the reason that final halving in Might 2020, Bitcoin’s provide on exchanges underwent a pattern reversal. Because the HODLing sentiment gained extra foreign money, LTH customers began to withdraw their cash in favor of self-custody.

How a lot are 1,10,100 BTCs price at this time?

Due to this fact, it might be fascinating to see how this pattern shapes us after the subsequent halving. Will LTH promote a significant portion of their holdings within the occasion of a bull market, or will they proceed to retailer BTC as a safe-haven asset?

On the time of writing, BTC was priced at $27,254, per Santiment knowledge. The constructive weighted sentiment underscored the bullish temper amongst market individuals.

Supply: Santiment