Shiba Inu (SHIB) Price Prediction for December 18

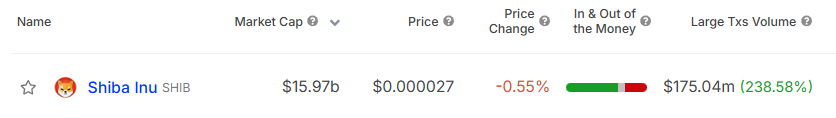

Regardless of ongoing worth consolidation in Shiba Inu (SHIB), the favored second-largest crypto meme coin by market cap has gained important consideration from crypto giants, as reported by the on-chain analytics agency IntoTheBlock. At the moment, December 18, 2024, IntoTheBlock revealed that the big transaction quantity of SHIB has skyrocketed by 238.58% up to now 24 hours.

Shiba Inu (SHIB) Bearish Outlook

This notable quantity appeared as SHIB started experiencing promoting stress and the formation of a bearish worth motion sample close to a resistance stage. Nonetheless, the meme coin’s bearish outlook emerged throughout a interval when main cryptocurrencies like Bitcoin (BTC) and XRP witnessed notable upside rallies.

SHIB Technical Evaluation and Upcoming Degree

In response to CoinPedia’s technical evaluation, SHIB has fashioned a bearish inverted cup and deal with worth motion sample on the each day time-frame and is at the moment on the verge of a breakdown. Nonetheless, it is a resistance stage the place the meme coin has fashioned this worth motion sample.

Primarily based on historic worth momentum, if SHIB breaks down from the bearish sample and closes a each day candle beneath the $0.0000258 stage, there’s a robust risk it may drop by 20% to achieve the $0.0000206 stage within the coming days.

Nonetheless, it has been greater than a month since SHIB has skilled any important worth achieve or drop; it appears to be in steady worth consolidation. However the latest worth motion signifies potential draw back momentum, promoting stress, and a worth decline within the coming days.

On the optimistic aspect, SHIB’s Relative Energy Index (RSI) at the moment stands at 55, indicating that it’s nonetheless beneath the overbought space. This technical indicator means that the asset has sufficient room to soar within the coming days.

Present Worth Momentum

At present, SHIB is buying and selling close to $0.000026 and has skilled a worth decline of two.65% up to now 24 hours. Throughout the identical interval, its buying and selling quantity dropped by 17%, indicating decrease participation from merchants and buyers amid a bearish outlook.