Bitcoin defies doubts at $98K, so why are investors still cautious?

- Bitcoin’s rally above $98K contrasts sharply with persistently damaging investor sentiment; disbelief could sign alternative.

- Substantial ETF inflows are boosting BTC, however 2022-style dangers might nonetheless derail the momentum.

Regardless of Bitcoin’s [BTC] spectacular maintain above the $98K mark, investor sentiment has taken a pointy flip decrease. This brings alongside a wave of doubt that feels oddly misplaced in a bull market.

Is the market caught in disbelief, priming for a euphoric breakout? Or do these alerts mirror the 2022 bear market?

With BTC’s current surge reigniting momentum, the present local weather could also be pushed as a lot by psychology as by fundamentals.

A bull run clouded by doubt

Latest information revealed a hanging divergence between Bitcoin’s value and prevailing sentiment on X (previously Twitter) and information platforms.

Even with BTC buying and selling confidently above $98K, the 7-day common sentiment remained firmly damaging – a sample traditionally related to native bottoms and contrarian shopping for alternatives.

Supply: Alphractal

This persistent disbelief means that the market is psychologically lagging behind value motion.

Whereas such sentiment drops have beforehand preceded bullish reversals, it’s value remembering the cautionary story of 2022, the place prolonged negativity coincided with a protracted bear part.

The institutional engines behind BTC

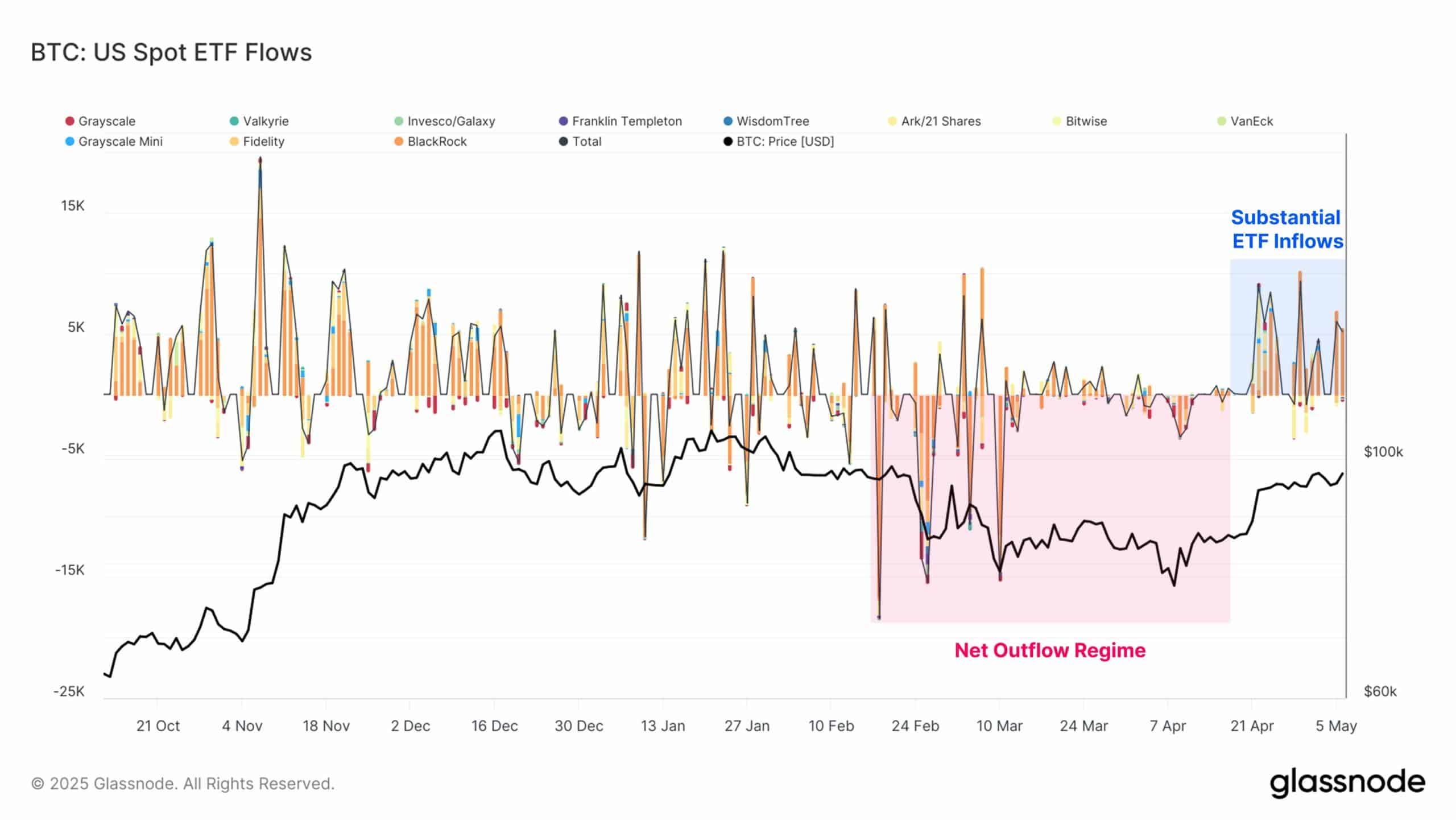

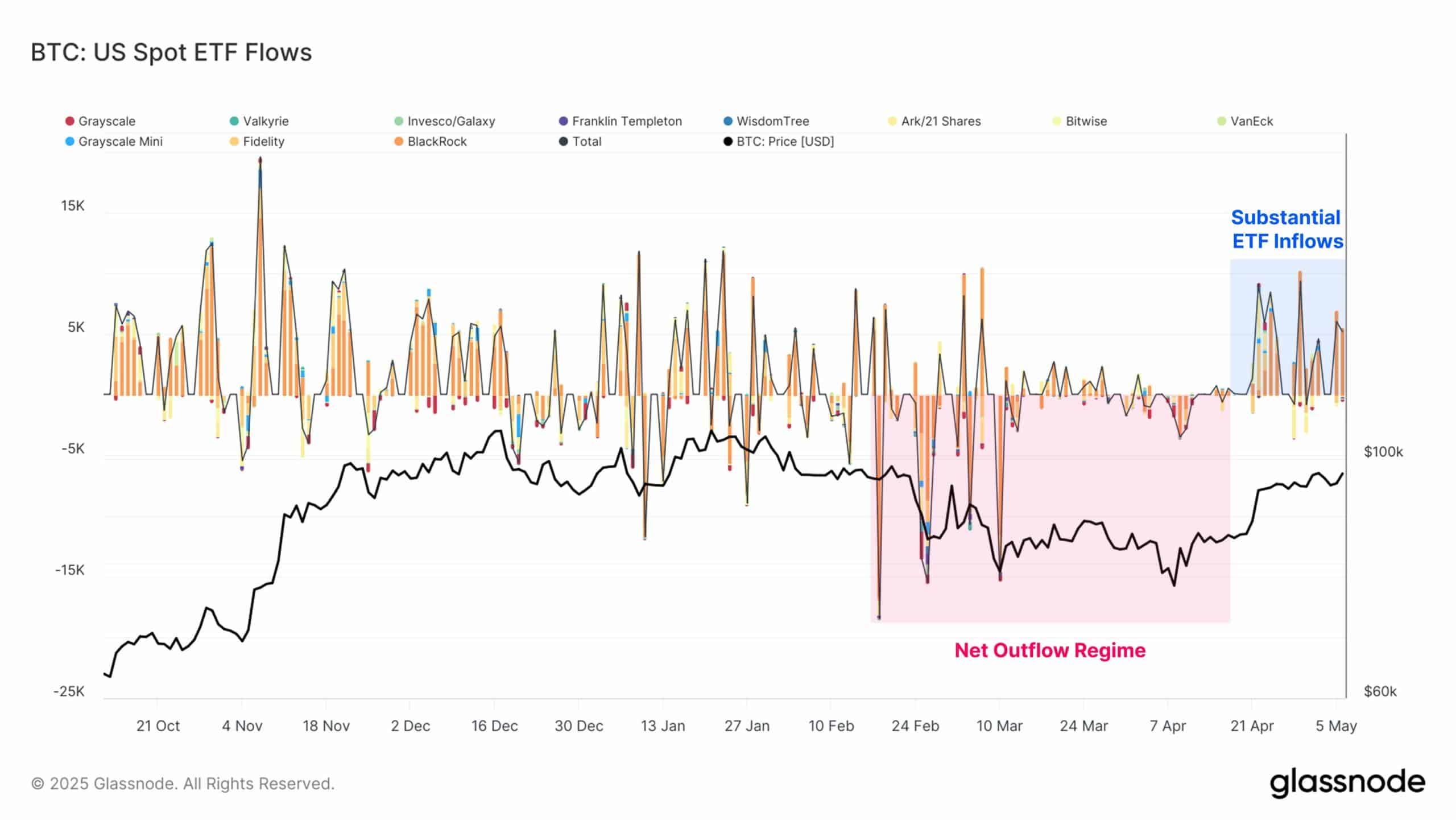

A pointy shift is seen on the ETF flow chart: after weeks of constant outflows, April ushered in a regime of considerable spot ETF inflows.

This renewed institutional curiosity, primarily led by giants like BlackRock and Constancy, seems to have reignited Bitcoin’s upward momentum, pushing it previous the $98K mark.

Supply: Glassnode

Not like the unstable flows of earlier months, this part reveals regular day by day web inflows, signaling robust long-term conviction.

Institutional confidence often is the key pressure behind the surge, whilst retail sentiment stays cautious.

What might go fallacious?

Whereas ETF inflows sign optimism, historical past reminds buyers to remain cautious.

In 2022, bullish sentiment, pushed by institutional merchandise and macro traits, collapsed attributable to liquidity shocks and extra leverage.

A sudden shift in danger urge for food or regulatory pressures might set off speedy outflows, reversing current beneficial properties.

Though ETFs supply transparency, they don’t protect Bitcoin from market volatility. If inflows sluggish or flip to redemptions, Bitcoin might face sell-offs just like previous cycles.