Sinking Bitcoin ETF flow has THIS impact on BTC’s move to $70K

- Bitcoin ETF flows have dropped closely because the starting of the week.

- Liquidity stock ratio rose, that means provide may help demand for lengthy.

Bitcoin [BTC] has exhibited sideways motion over the past ten days, wobbling within the vary between $61,ooo to $65,000, information from CoinMarketCap confirmed. Even the latest halving did not exert a decisive upward thrust to its trajectory.

ETF demand stagnating?

Julio Moreno, Head of Analysis at on-chain analytics agency CryptoQuant, attributed this partly to diminishing inflows to U.S. spot ETFs.

Certainly, web outflows of $217 million had been recorded as on the twenty fifth of April, and the funds have bled practically $147 million because the week started, AMBCrypto famous utilizing SoSo Value information. The final week noticed greater than $200 million price of Bitcoins getting drained out.

Notice that since their launch in early January, these funding autos have been one of many key drivers of Bitcoin’s worth motion. Internet constructive days have invariably pushed costs up and vice versa.

Out there provide may meet demand for an extended interval

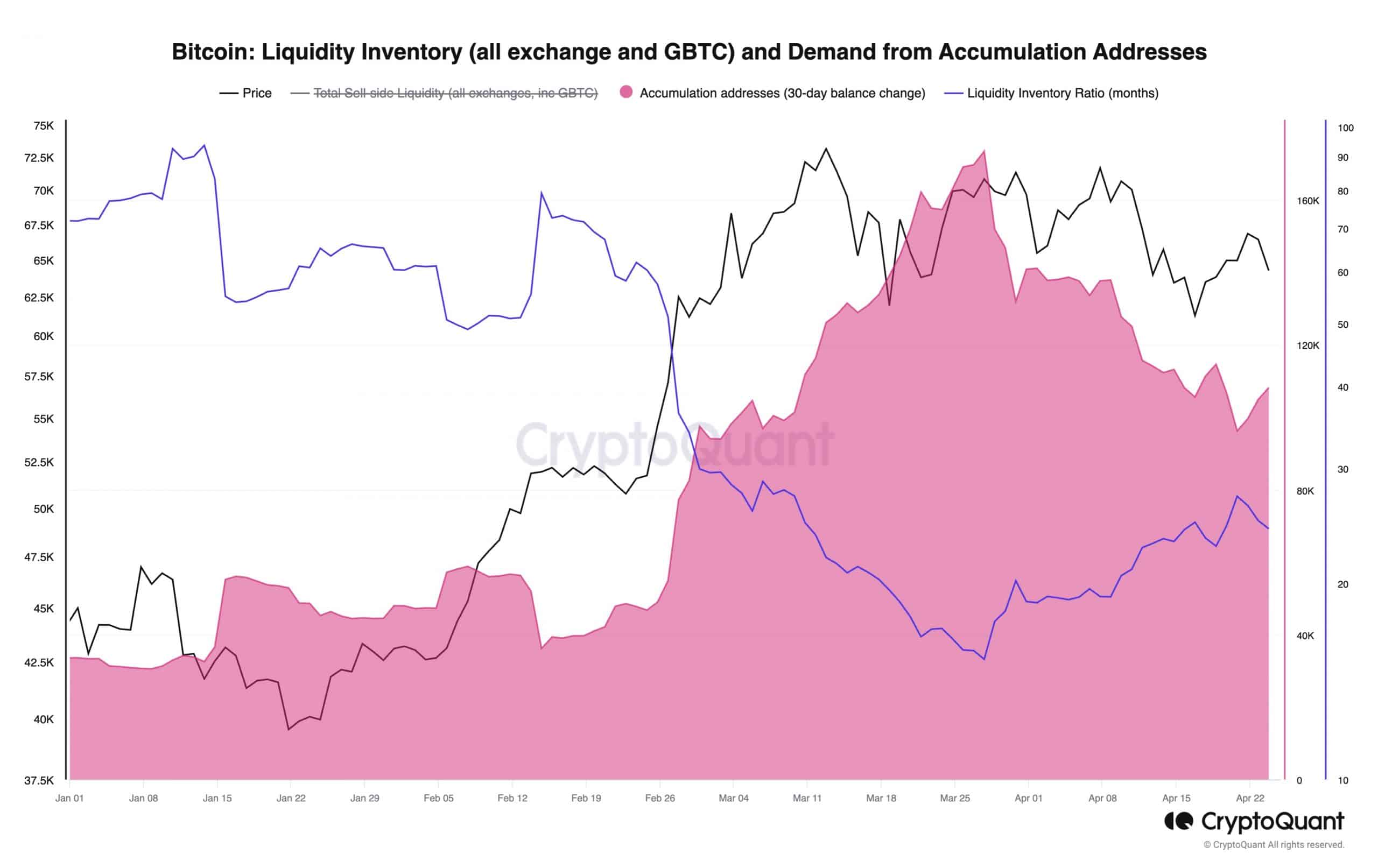

The declining demand was additionally obvious within the steep drop in accumulation addresses since late March. For the curious, accumulation addresses are those who have a historical past of solely shopping for BTC however no historical past of promoting.

ETFs, which soak up BTCs to again their shares, come underneath this class.

Consequently, the liquidity stock ratio, which measures the sell-side liquidity of the asset towards its demand, rose sharply from 15 months throughout late March to 24 months as of this writing.

What this meant in layman phrases was that the obtainable BTC provide would last more given the thinning demand.

Supply: CryptoQuant

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Shivam Thakral, CEO of Indian cryptocurrency alternate BuyUcoin, predicted that the upcoming itemizing of Hong Kong’s spot ETFs may assist provoke demand for the king coin. In an announcement shared with AMBCrypto, he mentioned,

“After the Hong Kong ETF launch, we are able to anticipate an analogous worth momentum to that of January for Bitcoin, which may probably push the most important crypto to a brand new ATH within the upcoming months.”