Sky Mavis co-founder reveals crypto gaming’s biggest hurdles

This can be a section from The Drop publication. To learn full editions, subscribe.

An attention-grabbing thread retains popping up in conversations I’ve been having right here on the crypto facet of the Recreation Builders Convention.

What I’m listening to is that players and builders have come full circle and adjusted their stance on Axie Infinity, a 2D creature-battler generally criticized for being overly simplistic or having repetitive gameplay.

However lately, normal sentiment towards it’s extra constructive than it’s been in years.

A number of years in the past, aspiring crypto recreation devs needed to make a brand new fame for the area, for which Axie Infinity had set the stage. AAA recreation ambitions had been operating excessive — and lots of devs needed to remain as removed from making a recreation like Axie as potential. They needed to drag in mainstream players and persuade sufficient Fortnite, League of Legends and Name of Responsibility gamers that crypto gaming may provide you with the whole lot in a conventional online game, plus the supposed advantages from “true asset possession.”

However now, issues have modified. AAA-budget video games like Deadrop and Shrapnel have confronted controversy, albeit for various causes. Deadrop was shut down fully, partly as a result of the group ran out of cash and confronted a scandal with certainly one of its founders, whereas Shrapnel was wracked by civil warfare from inside as traders sued the corporate’s then-CEO.

Buzz round Shrapnel — which was so constructive and hopeful in years previous — has quieted down. Shrapnel was a kind of video games I had been really enthusiastic about. At this time, it looks like the one higher-budget video games crypto gaming influencers are actually trying ahead to now are Off The Grid, Star Atlas, and Wildcard.

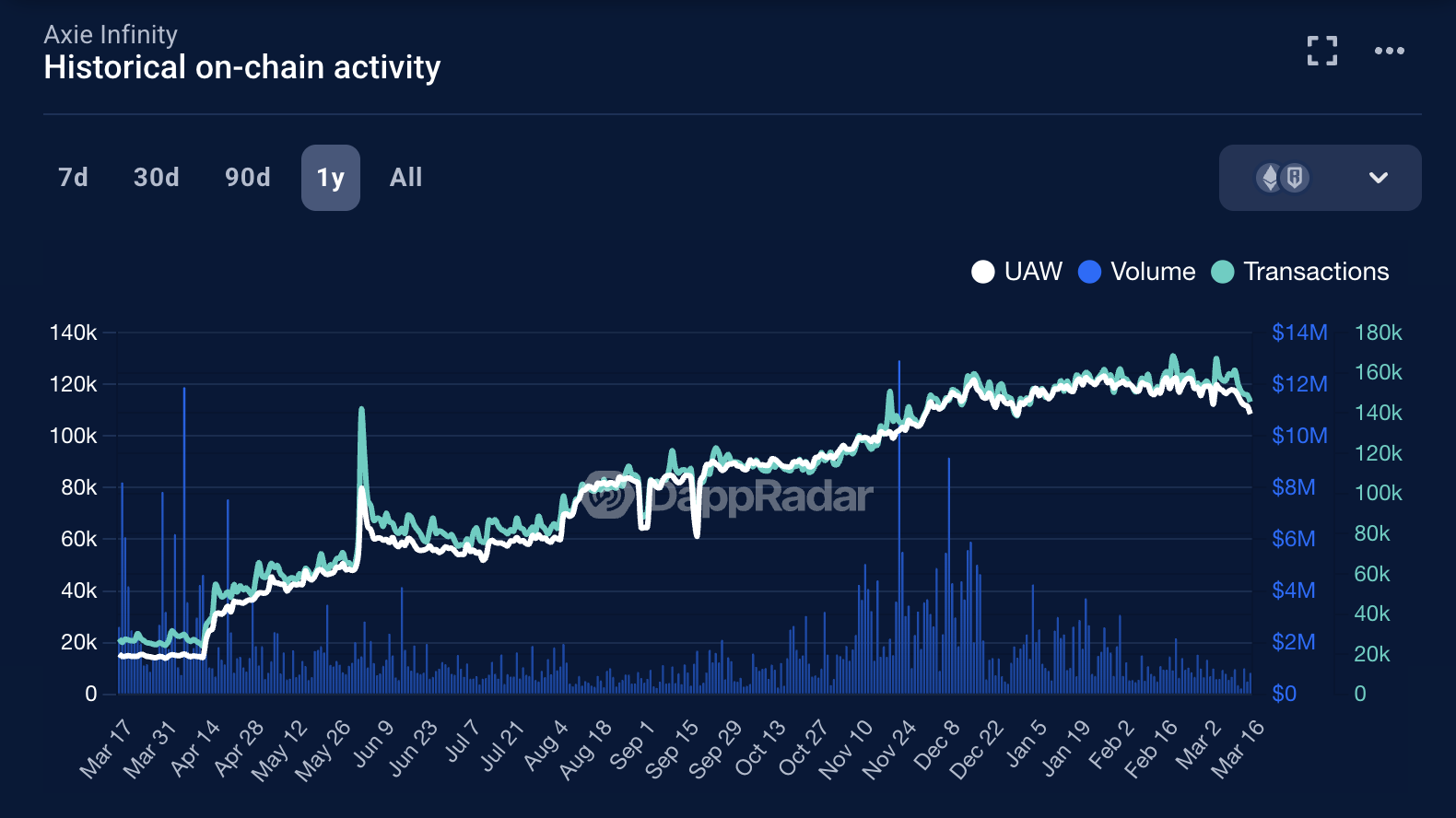

However there’s been continued curiosity in pushing cell video games ahead — and determining the right way to steadiness a recreation’s monetary and gameplay parts. Ronin has drawn continued curiosity due to the pixelated MMORPG Pixels, and the unique basic Axie recreation has seen an uptick in distinctive lively wallets (UAWs) since March of final yr.

Whereas wallets don’t precisely equate to gamers, up to now day, Axie has seen 160,000 transactions and 100,000 distinctive lively wallets. That places it into the highest 15 video games by UAWs, per information from DappRadar. Pixels has roughly double these numbers, with greater than 200,000 UAWs and over 200,000 transactions up to now day, making it the fifth-largest crypto recreation by UAWs.

In an interview at GDC in Sky Mavis’s spot on the 4 Seasons resort, Ronin co-founder Aleksander Larsen shared why he thinks Axie Infinity’s success says one thing about how exhausting it’s to win within the crypto gaming area.

“What does that inform us about blockchain video games? It’s actually tough to get proper, and even for us, proper, it was tremendous tough. We’ve shipped Axie Origins after, we shipped Homeland. None of these had been as profitable as the unique Axie basic recreation,” Larsen defined.

Supply: Axie Infinity is making a little bit of a comeback

Larsen argued that if you happen to’re constructing a blockchain recreation, you in the end have to choose between graphics, gameplay, and monetary economic system — and that one recreation can solely excel in two of these areas proper now.

The Axie group has centered on recreation economic system and gameplay as a result of, for them, these are an important parts for a crypto recreation to get good. Good graphics are a nice-to-have, however are much less important as a result of what attracts a variety of gamers to crypto video games are the monetary parts, together with the tradeability of in-game objects.

Crypto gaming has additionally seen a motion towards extra indie and cell video games, with a bigger share of crypto video games being “small indie” video games than ever earlier than, in line with analysis from Game7. I believe that is largely as a result of VC funding has declined considerably from the 2021 and 2022 crypto increase.

“VC cash has dried up,” Larsen stated. “However the expectation, the issue right here can be that there’s a variety of bag holders, I suppose, from 2021 with these NFTs which are anticipating a payout when the token lastly comes.”

Sky Mavis has largely weathered this storm, regardless of RON, SLP, and AXS remaining far beneath all-time highs. The Ronin Pockets has seen over 10 million downloads, however the firm laid off 24% of its workers final yr, Sky Mavis CEO Nguyen Thnah Trung introduced again in November.

“Individuals used to say the one approach that we will justify Axie Infinity’s market cap is that if we worth it as like a rustic, as a brand new nation,” Larsen stated, including: “That was loopy. So it was too early, proper? The expectation of the sport economic system and the rising nation is simply too huge. However what really did occur is that it gave us capital to maintain growing even within the down cycles.”