SOL transaction revenue and MEV tips surpasses Ethereum

- Solana’s transaction income and MEV ideas have outpaced Ethereum.

- Solana complete worth locked surged by 25%, however ETH remained dominant.

The crypto market has been experiencing excessive volatility of late, and Solana [SOL] isn’t any exception. Nevertheless, this month has seen SOL change fortunes in buying and selling quantity, market cap, and meme-coins adoptions.

Two days in the past, Solana hit the headlines after flipping Binance Coin [BNB] on market cap, as the previous’s market cap surged to $85B. On the identical time, BNB declined to $83B, in keeping with CoinMarketCap.

Solana continues its progress with greater buying and selling quantity, DEXes, and surpassing Ethereum [ETH] in charges and MEV.

Solana DEX buying and selling quantity hits $2B

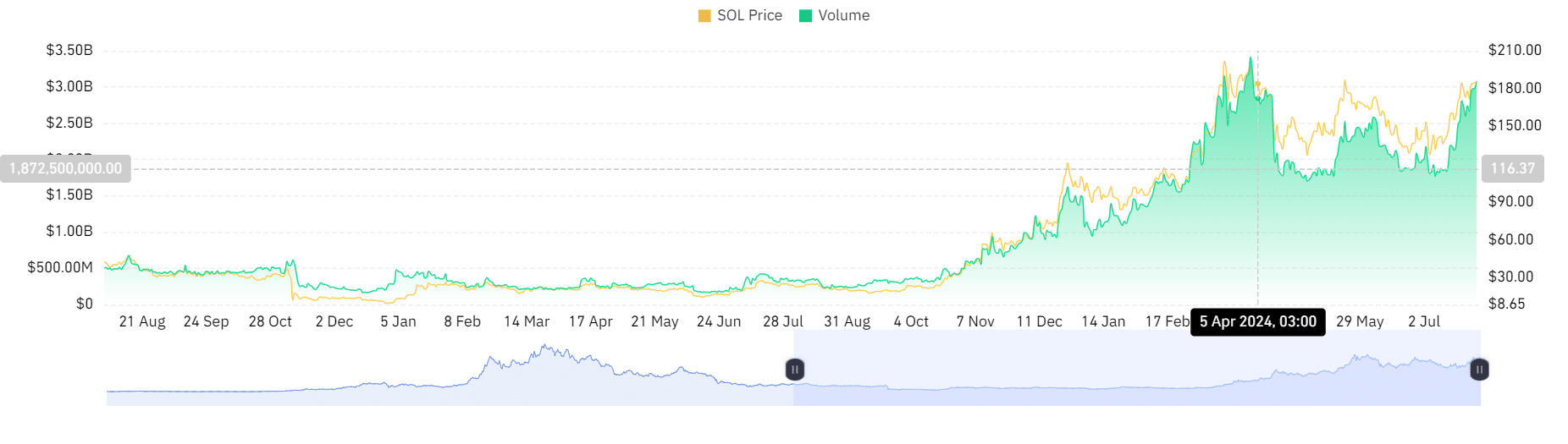

SOL is rising, and its decentralized alternate (DEX) buying and selling quantity has surged to a file $2B. Within the final 24 hrs, Solana’s DEX buying and selling quantity rose 50% to $3.09B from $2.7B, outpacing each ETH and BNB, per Coinglass.

Supply: Coinglass

SOL beats ETH in transaction charges

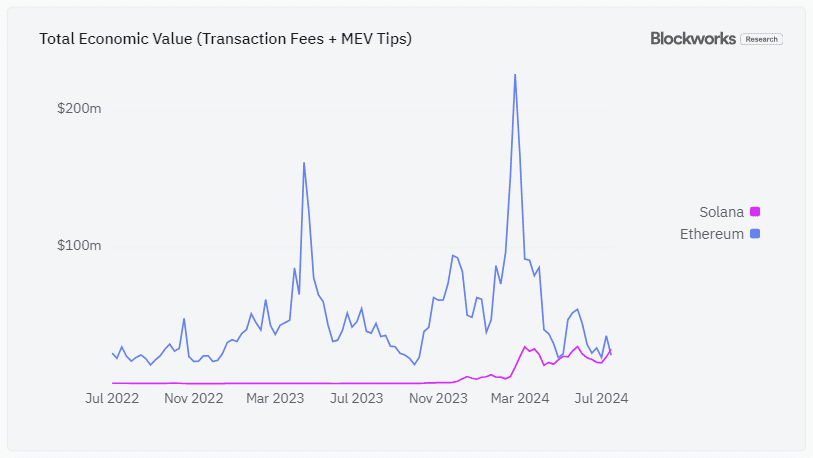

Wanting additional, Solana has tried to dethrone Ethereum in key metrics, together with complete charges and MEV.

On weekly charts, Solana generated $25M in transactional charges (income), whereas ETH reported $21M in the identical interval.

Supply: X

Dan Smith shared the event by way of his X (previously Twitter) web page, stating that,

“For the primary time ever, Solana surpassed Ethereum in complete transaction charges and MEV recommendations on the weekly timeframe ($25M vs $21M). Solana validators and stakers are completely consuming this cycle.”

Supply: Blockworks

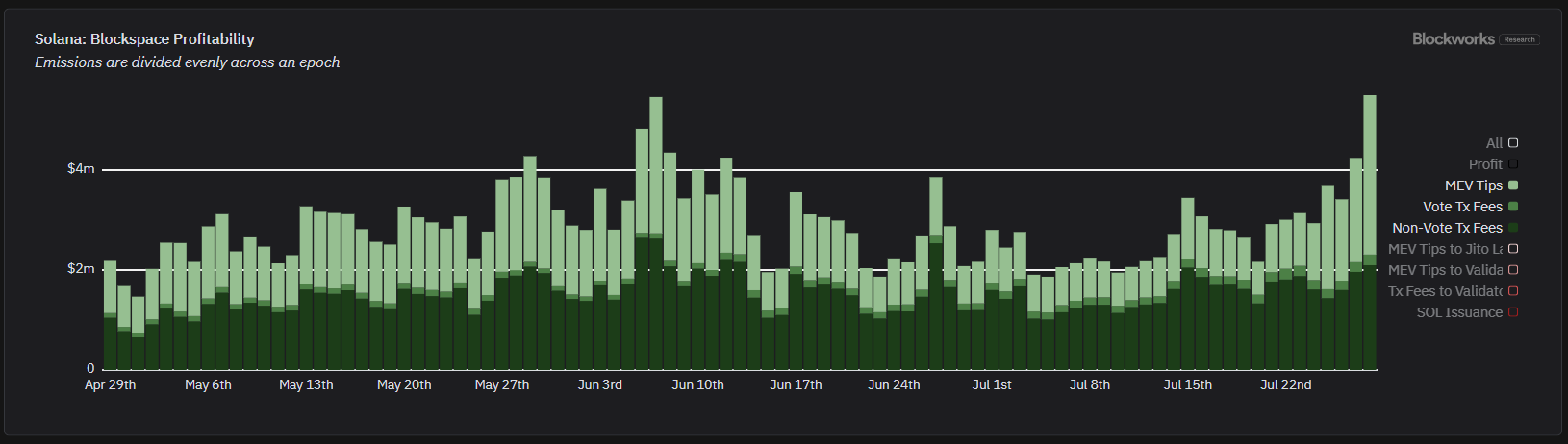

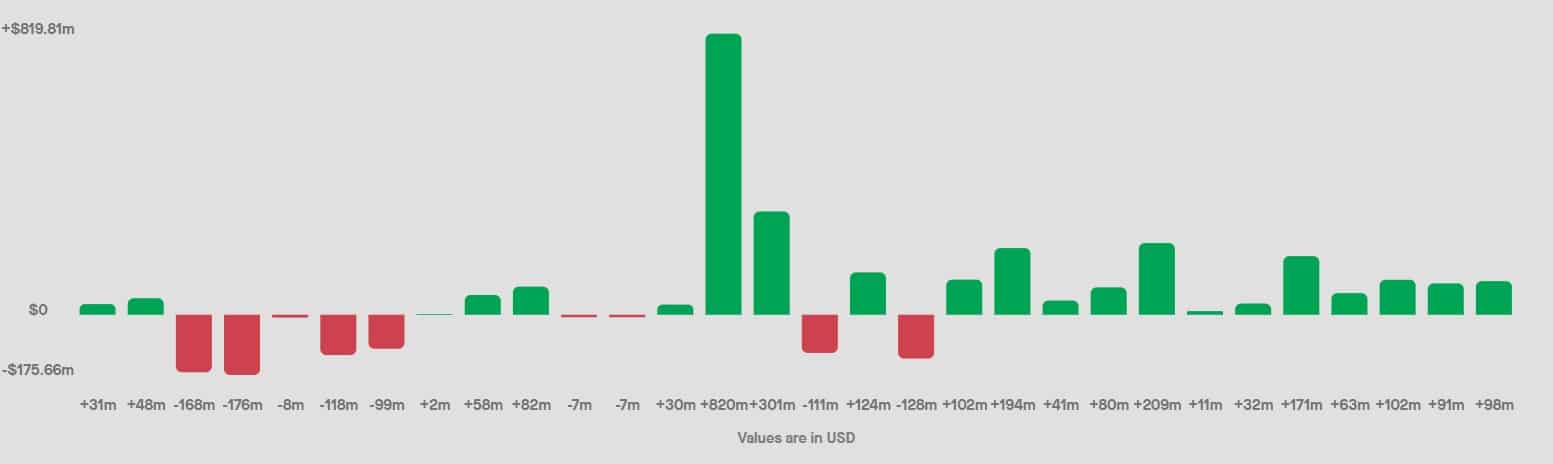

Solana generated a lot of its revenues from spot DEX buying and selling. Within the final 24 hrs, it generated 58% of the worth from MEV ideas and 37% from charges. The $5.5M income has been the very best over the previous two months.

Supply: Dune

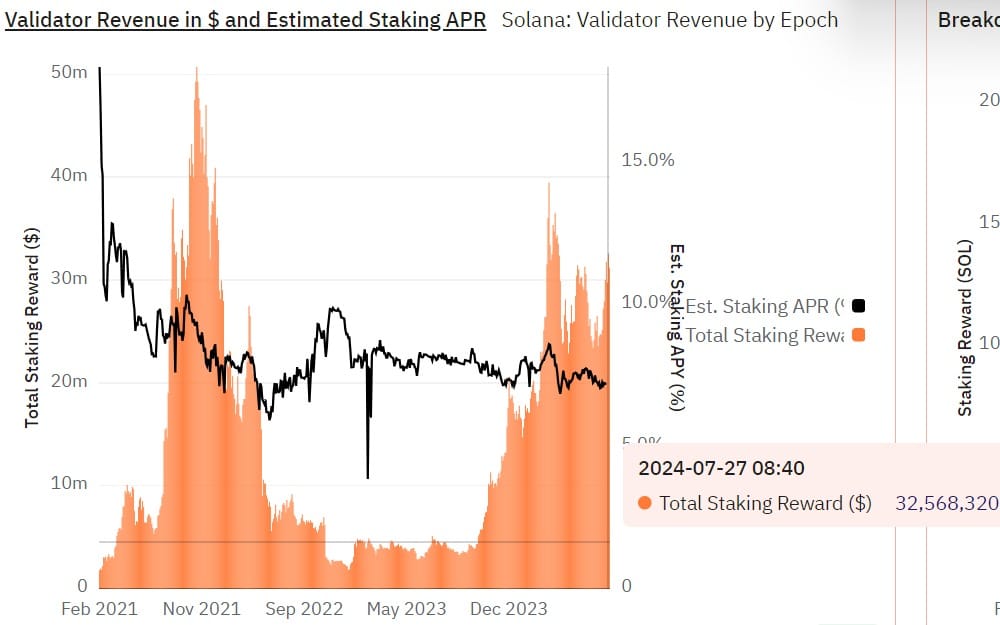

Moreover, Solana stakes have loved an intensive rise in income, incomes $32M previously. This incomes outpaced ETH, which has solely generated 3%, whereas SOL stakes earned 7%.

Supply: Staking Rewards

Due to this fact, the rise in funding returns is taking part in a key position in attracting buyers, thus elevating Solana’s energetic tackle and buying and selling quantity.

Supply: Defillama

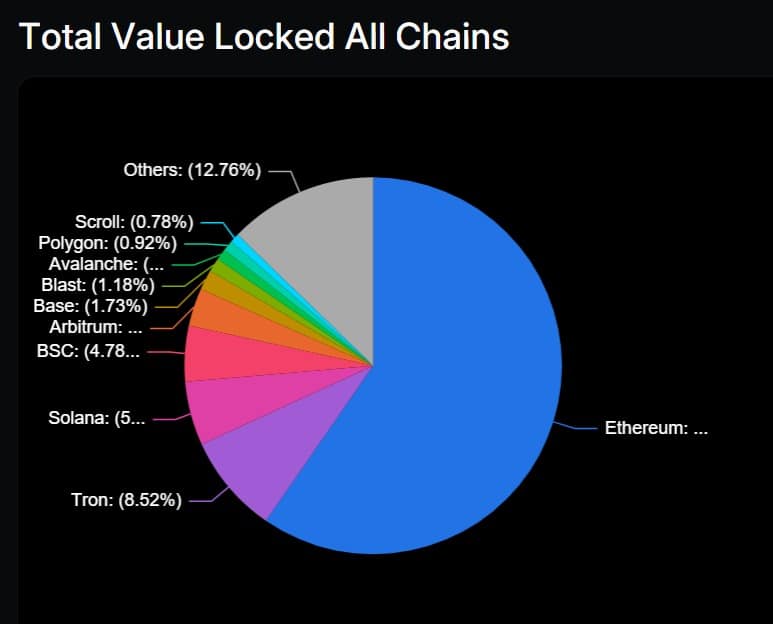

Though Solana has skilled a surge in MEV ideas and income, it nonetheless lags behind in complete worth locked. It rose by 25% on month-to-month charts to $5.5B.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

On this side, ETH stays on the high, with a complete worth locked at $58B. Nevertheless, Solana surpassed ETH in Complete Financial Worth with greater than $2.2M in comparison with ETH’s $1.97M.

These shifts in market trajectories place SOL to turn out to be the true ETH killer, because it’s referred to as.