Avalanche: Retail sells $821K of AVAX, smart money holds on – What next?

- Good Cash traders have made important income from AVAX and are nonetheless holding their positions, which continues to impression retail sentiment.

- Market individuals have begun offloading their property, but the worth chart reveals a transparent path for a possible rally.

Avalanche [AVAX] recorded a 2.62% acquire prior to now 24 hours—its first optimistic efficiency after a month-long decline of 26.22%.

Evaluation reveals that these good points come as Good Cash traders reap huge income from early bets on AVAX. Nonetheless, the important thing query stays: will this spark renewed confidence or set off a sell-off?

Good cash income however holds AVAX

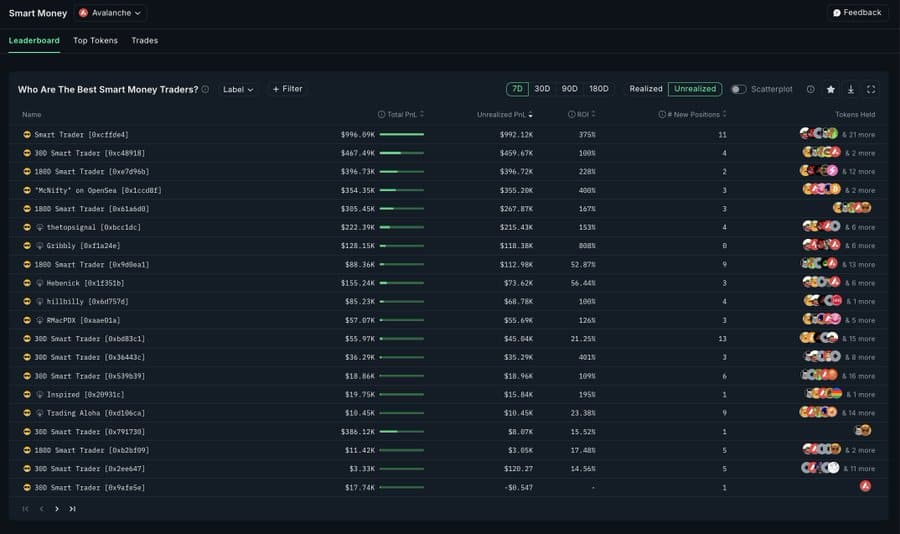

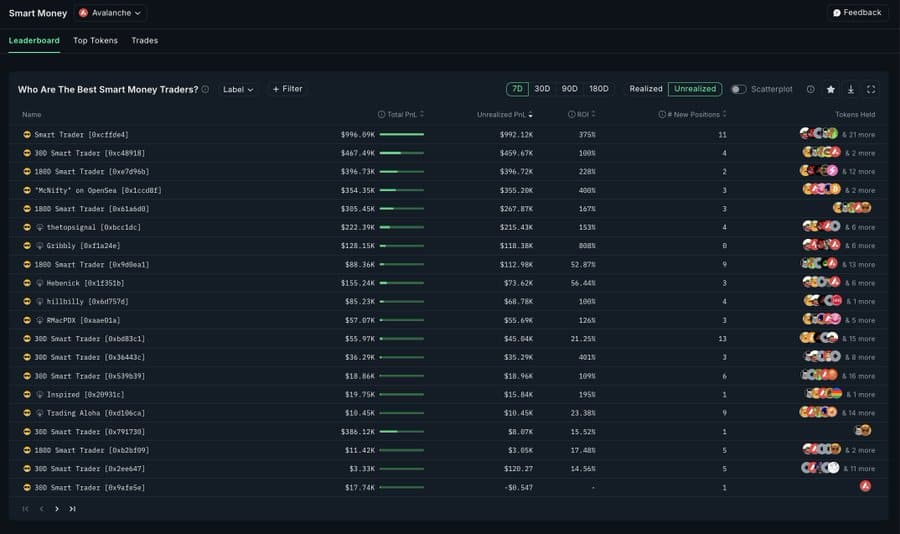

Insights from Nansen revealed that good cash traders in AVAX have made important income, regardless of a 13% general decline in value.

For context, Good Cash refers to traders identified for making worthwhile bets, shopping for low, and promoting excessive.

Supply: Nansen

Experiences point out these traders have earned income of as much as 375% throughout this era, with unrealized good points nearing $1 million throughout 11 positions.

With such substantial returns, these traders are sometimes anticipated to dump their holdings and money out.

Nonetheless, at press time, they proceed to carry their positions. In distinction, retail traders are taking a special method, promoting their property.

Retail knowledge indicators bearish bias

Based on CoinGlass, retail traders have began cashing out, capitalizing on latest value good points.

On the time of writing, spot retail traders have reversed their shopping for conduct from the earlier week—once they gathered $11.9 million value of AVAX—and have now began promoting.

Supply: CoinGlass

Up to now 24 hours alone, these traders have bought $821,000 value of AVAX, placing downward strain on the worth.

Equally, by-product retail merchants have begun opening brief positions, betting on an additional decline in AVAX’s value.

This pattern was confirmed utilizing the Open Curiosity Weighted Funding Price—a metric used to research sentiment within the derivatives market, indicating whether or not merchants are shopping for or promoting.

Supply: CoinGlass

As of now, this metric has dipped into destructive territory, posting a studying of -0.0022% after remaining optimistic in earlier days.

The bearish stance from each spot and by-product retail traders highlights the prevailing destructive sentiment within the AVAX market.

AVAX chart indicators breakout, however resistance ranges stay

On the chart, AVAX confirmed a bullish path because it broke out of the resistance degree within the descending channel sample.

Usually, a breakout like this might lead the worth to revisit the height of the channel it emerged from, providing important good points for merchants.

Supply: TradingView

Nonetheless, rising promoting strain might make this transfer more and more troublesome. Furthermore, key resistance ranges lie forward.

If the worth manages to interrupt the primary resistance, it might sign that the bullish pattern stays intact.

Nonetheless, one other main hurdle stands at $19.81. Surpassing this degree might propel the worth to the $22 vary, representing a 27% acquire from the preliminary breakout level.

Market reveals impartial sentiment

At press time, the Complete Worth Locked (TVL) has stayed stagnant, exhibiting no important inflows or outflows within the final 24 hours.

Supply: DeFiLlama

Present market conduct displays investor indecision, which might weigh on AVAX’s general momentum.

As broader sentiment shifts destructive, AVAX might face a possible pullback, difficult the power of its latest upward transfer.