As Bitcoin nears $105K, will BTC cross a new all-time high? – Assessing…

- BTC’s 3-month momentum has turned inexperienced – however comparable setups have resulted in sharp reversals.

- Funding Charge and RSI counsel rising optimism, however quantity and resistance at $105K demand warning.

Bitcoin [BTC] is again within the inexperienced on a three-month timeline, displaying a possible shift in market momentum. However whereas the uptick has sparked cautious optimism, seasoned merchants aren’t celebrating simply but.

Previous setups like this have led to sharp reversals, conserving merchants cautious.

With Bitcoin approaching the essential $104,000-$105,000 zone, the subsequent few days can be pivotal—will the rally maintain or fade rapidly?

Bitcoin: Why the 3-month momentum issues

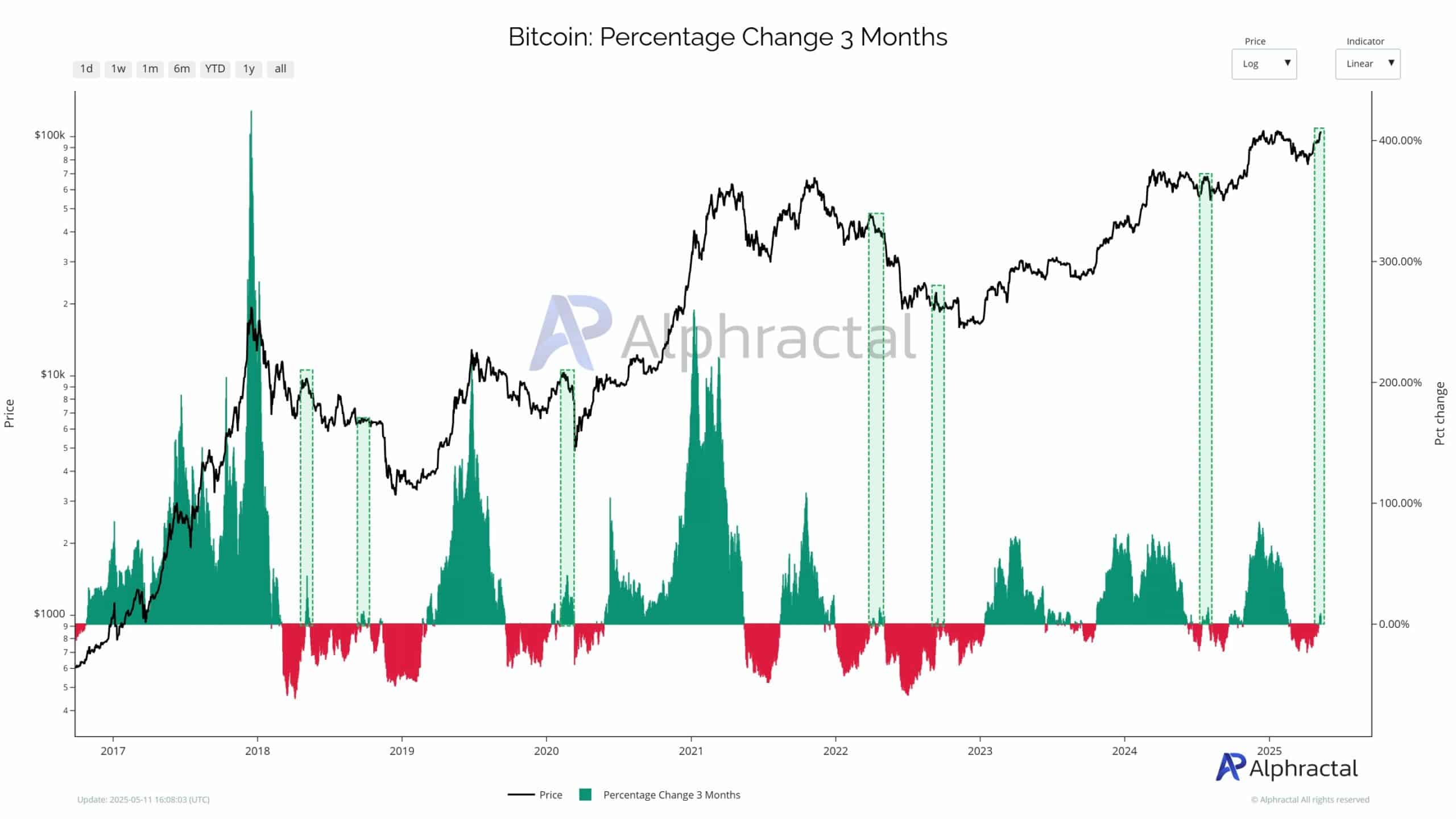

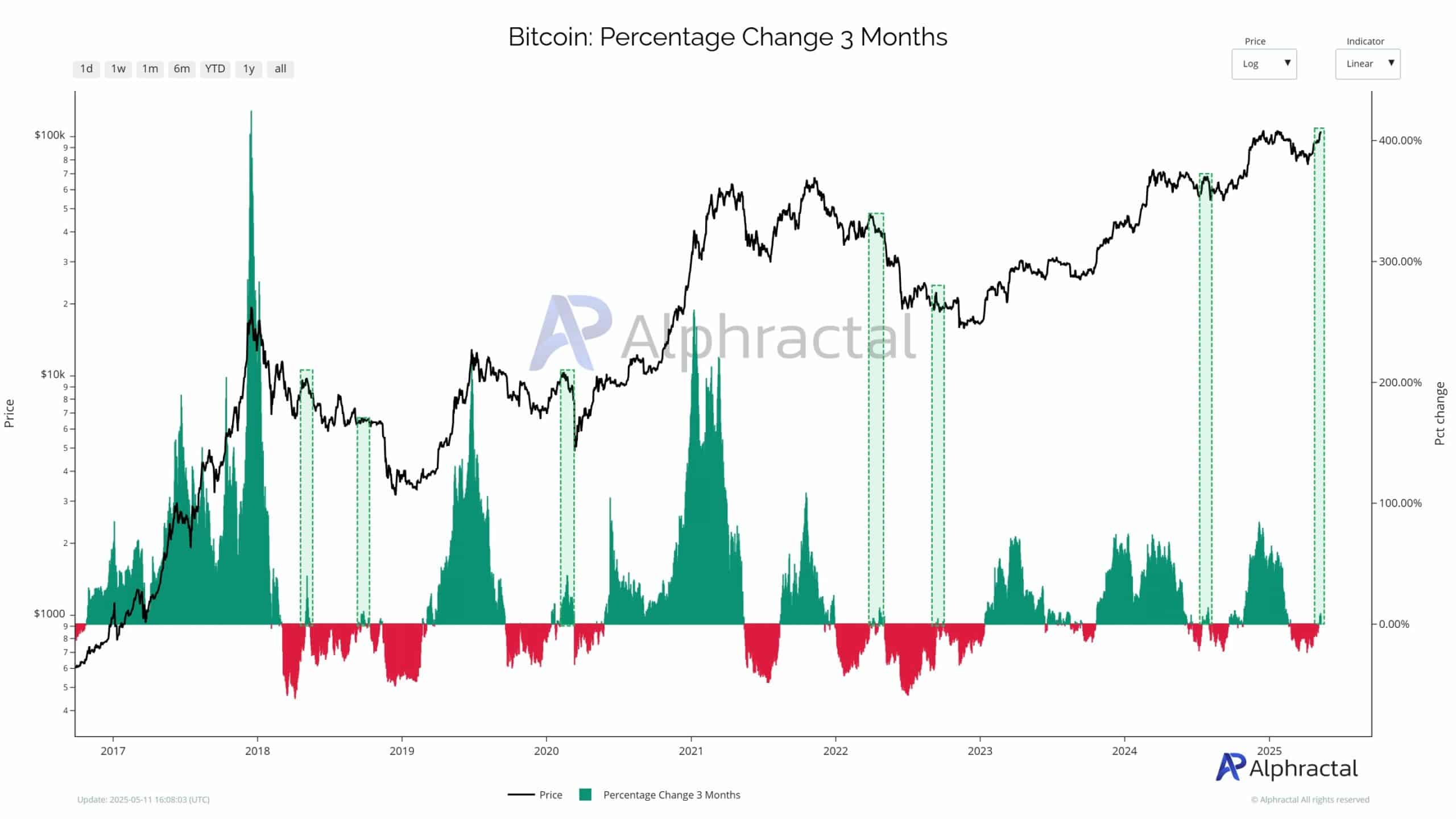

Latest information reveals Bitcoin’s 3-month percentage change flipping decisively into constructive territory – a sign that has traditionally preceded main market strikes.

Whereas this uptick can trace at brewing momentum, it’s not at all times bullish.

Supply: Alphractal

Previous cycles reveal that comparable inexperienced flips typically occurred proper earlier than sharp rug pulls, catching merchants off guard. The chart reveals these share modifications beneath the BTC worth line, clearly marking moments of abrupt reversals.

In brief: the present setup calls for warning. Momentum is constructing, however with out sustained follow-through, particularly above the $104K–$105K degree, it might as soon as once more be a bull lure in disguise.

Historic precedents and dealer sentiment

The constructive flip traditionally cuts each methods.

In early 2018, mid-2019, and late 2021, comparable inexperienced reversals preceded sharp downturns, trapping momentum merchants in painful rug pulls. At present’s setup is analogous, making warning important.

Complementing this backdrop, the aggregated funding fee has been steadily rising, peaking at 0.0132 at press time.

Supply: Coinalyze

This means rising bullish sentiment as merchants lean lengthy, although not but at euphoric ranges. If the funding fee continues climbing, the market might develop into risky.

The 104K-105K barrier

Bitcoin was testing the $104K-$105K resistance zone at press time, with momentum indicators displaying uncertainty.

The RSI reached overbought territory at 74.46, suggesting a potential pullback until bulls maintain strain. In the meantime, the OBV remained subdued, indicating that quantity isn’t totally supporting the rally.

Supply: TradingView

Each the 50-day and 200-day SMAs sit comfortably under, displaying that long-term assist stays intact.

If BTC breaches $105K with robust quantity, a breakout towards new highs is feasible. However with no quantity surge, rejection and consolidation stay probably.