Solana ETF yet to launch, but SOL still outperforms market – Here’s how!

- Solana’s ETP inflows surged 7,600% regardless of a broader market downturn.

- Solana outperformed Bitcoin and Ethereum in year-to-date efficiency, exhibiting important resilience.

Regardless of the broader crypto market experiencing a downturn in September, some cash have demonstrated notable resilience.

Whereas many property struggled, sure cryptocurrencies stood out by sustaining stability and even gaining traction throughout this difficult interval.

Solana outperforms

As highlighted within the newest CoinShares report, Solana [SOL] emerged as the highest performer within the crypto funding panorama.

SOL’s Change-Traded Merchandise (ETPs) noticed a staggering 7,600% improve in inflows inside only a week, hovering from $100,000 to $7.6 million.

This outstanding surge brings the full year-to-date inflows for Solana to $39 million, a big restoration following the $26.7 million in outflows the asset skilled in August.

Solana vs. others

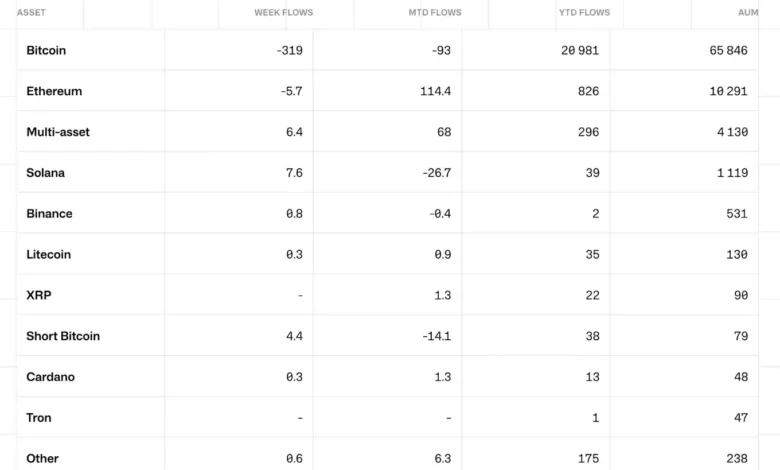

The report highlights a stark distinction in weekly flows among the many high three cryptocurrencies.

Bitcoin [BTC] skilled important outflows of $319 million, Ethereum [ETH] adopted with $5.7 million in outflows, whereas SOL stood out with spectacular inflows of $7.6 million.

Supply: etp.coinshares.com

When year-to-date efficiency, Solana has emerged as the highest performer amongst digital property, surpassing all others besides BTC and ETH.

This positions SOL as a number one contender within the crypto market, showcasing its resilience and rising attraction to traders.

That is significantly noteworthy provided that Solana ETF has but to launch.

Different ETFs efficiency analyzed

Bitcoin ETFs have considerably boosted adoption since their introduction, contributing to BTC’s surge above $70,000 in March.

Nevertheless, Bitcoin is presently experiencing a wave of outflows.

Ethereum ETFs, in the meantime, have confronted challenges since their debut, struggling to drive ETH above $4,000.

Regardless of this, current updates counsel indicators of renewed inflows, hinting at potential enhancements sooner or later.

Influence on Solana

On the worth entrance, SOL saw a 2.02% increase prior to now 24 hours, buying and selling at $134.68.

Regardless of this rise, technical indicators such because the RSI and MACD level to ongoing bearish sentiment.

For Solana to shift to a bullish development, it might want to break by the resistance degree at $150.

Supply: TradingView

Remarking on the identical, TheoTrader mentioned,

“I dont care what you imagine, Solana will attain $400 subsequent yr & there’s nothing you are able to do about it.”

Supply: TheoTrader/X