Solana, Ethereum, are best for ‘mainstream stablecoins’ – Here’s what it means

- Stablecoins are set to be “mainstream,” per Bitwise exec.

- Exec suggests Ethereum, Solana as beginning factors for stablecoins investments.

Asset supervisor Bitwise sees the booming $159.5 billion stablecoin market as one other crypto frontier value traders’ consideration.

In Q1 2024 alone, Tether [USDT], the main stablecoin issuer by market cap, netted a report $4.5 billion in income. How can others profit from the subsector if they don’t seem to be stablecoin issuers?

Per Bitwise, trying on the focus of stablecoins is the important thing. In a memo to funding professionals, Bitwise CIO Matt Hougan noted that,

“You may’t count on appreciation from holding stablecoins straight—in spite of everything, they’re designed to carry a steady worth. However you possibly can put money into the “picks and shovels.” On this case, meaning Layer 1 blockchains like Ethereum and Solana, which host each stablecoins and the DeFi apps that work together with stablecoins.”

Ethereum, Solana for stablecoin ventures?

For starters, Bitwise’s inclination was knowledgeable by the excessive probabilities of the US passing stablecoin laws in late 2024 or early 2025.

This might result in the “mainstreaming of stablecoins,” per Hougan.

To again his arguments, Hougan claimed that stablecoins are good for the US since they’re pegged to the US greenback and are one of many largest US Treasuries patrons. Hougan emphasised,

“Second, stablecoins are large patrons of U.S. Treasuries. In actual fact, stablecoins are already the sixteenth largest “sovereign holder” of Treasuries on this planet, and that’s earlier than we see the influence of this mainstream push.”

However Bitwise’s primer for selecting Ethereum [ETH], Solana [SOL], and their respective DeFi ecosystems is predicated on stablecoin dominance and utilization.

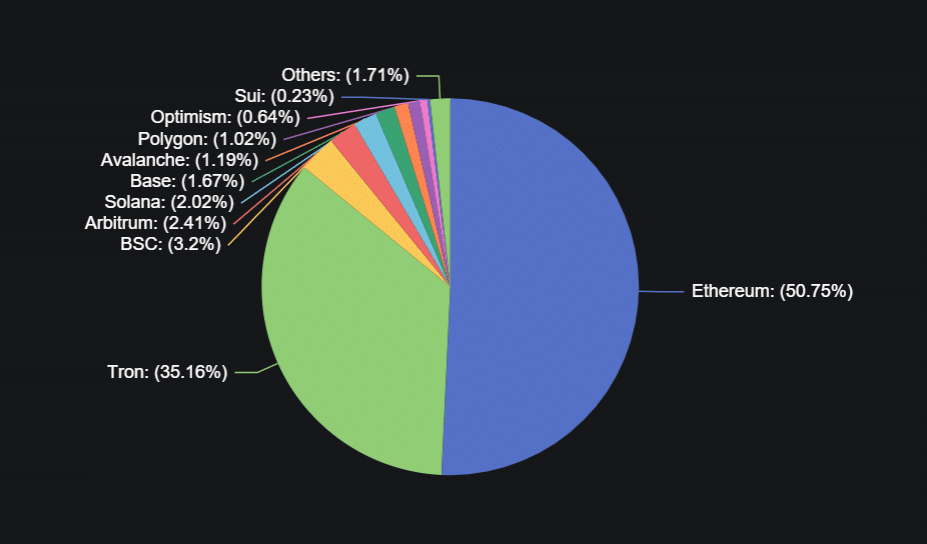

DeFiLlama data confirmed that the Ethereum chain commanded the best stablecoin dominance and managed 50.75% of the market share.

It was adopted by Tron [TRX], BSC, Arbitrum [ARB], Solana, and the remaining in that order.

Supply: DefiLlama

The chief didn’t reveal a lot about the best way to strategy the dominant stablecoin chains and DeFi platforms.

One may assume that the exec meant accumulating native tokens of the dominant L1 chains and platforms.

However, as with every part in crypto, Bitwise’s alpha shouldn’t be taken as monetary recommendation until you’ve finished your thorough due diligence.