Key Bitcoin indicator flashes again — Will BTC rally to new highs?

- Aggressive shopping for returns as Bitcoin hovers close to all-time highs, however whale conduct exhibits divergence.

- RSI indicators overbought ranges, whereas MACD momentum weakens — BTC wants to interrupt $105K or threat pullback.

Bitcoin’s [BTC] momentum is constructing as soon as once more, as aggressive patrons flood the market.

The Taker Purchase/Promote Ratio has surged to 1.02 – a degree not seen since previous to a number of historic breakouts — exhibiting rising conviction amongst market individuals.

On-chain knowledge exhibits massive wallets ramping up accumulation, positioning forward of what many speculate may very well be a last push towards new all-time highs.

With sentiment heating up and BTC hovering just under its earlier peak, is the following leg of the rally about to start?

A surge in market confidence?

In line with a current CryptoQuant report, the Taker Purchase/Promote Ratio has damaged decisively above the 1.00 mark, hitting 1.02 – a degree traditionally linked to breakout moments in Bitcoin’s worth motion.

Supply: Cryptoquant

Related spikes have been recorded close to the $15K-$20K accumulation zone in late 2022 and simply earlier than the $30K breakout in October 2023.

With BTC now hovering close to all-time highs, the return of aggressive shopping for exhibits rising conviction — nevertheless it additionally raises the stakes, as this threshold has beforehand preceded each rallies and sharp reversals.

Mega holders have paused

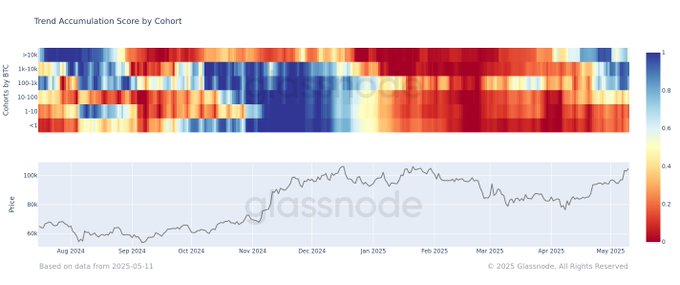

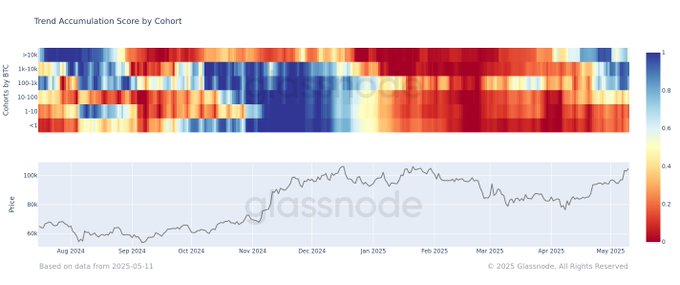

Whereas general accumulation traits stay bullish, a more in-depth look reveals a refined shift in conduct.

In line with Glassnode, ultra-large whales holding over 10,000 BTC have cooled their shopping for exercise, returning to a impartial accumulation rating round 0.5.

In distinction, mid-sized cohorts — wallets holding between 1,000 and 10,000 BTC — stay lively patrons, with scores close to 0.9.

Supply: Glassnode

Even smaller, institutional-sized wallets present continued power. Retail, nonetheless, continues to distribute.

Whereas bullish momentum persists, the rally is more and more being pushed by mid-tier whales reasonably than the deepest pockets.