Solana long liquidations topple $57M as SOL tumbles – What now?

- Solana lengthy liquidations soared to $57 million on tenth December, inflicting an increase in promoting exercise.

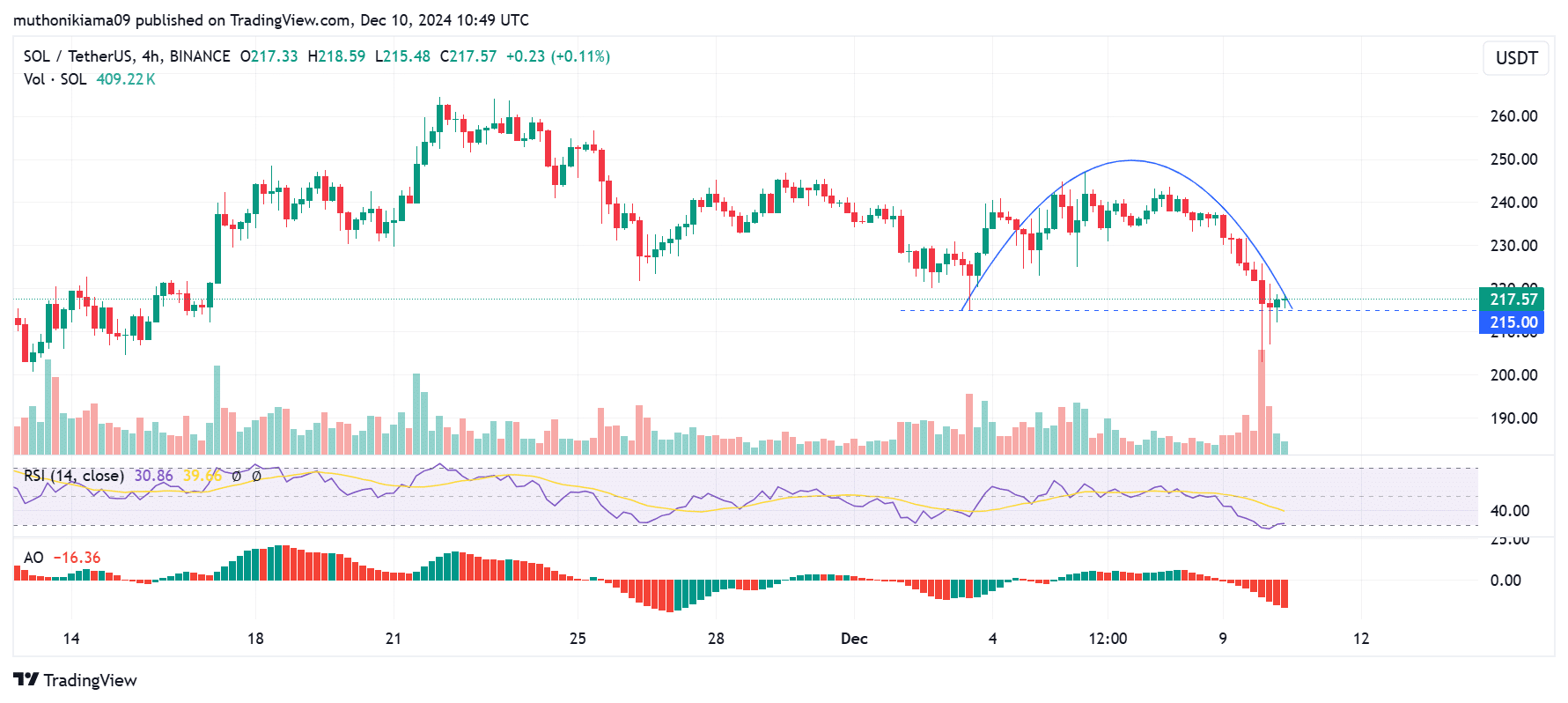

- A rounded prime sample on Solana’s four-hour chart suggests a bearish continuation.

Solana [SOL] has succumbed to the bearish sentiment throughout the broader cryptocurrency market after a 5.39% drop in 24 hours to commerce at $217 at press time. Its market capitalization additionally briefly dropped beneath $100 billion for the primary time in three weeks.

The heightened volatility witnessed within the final 24 hours comes amid a surge in liquidations within the derivatives market, with Solana bulls registering large losses.

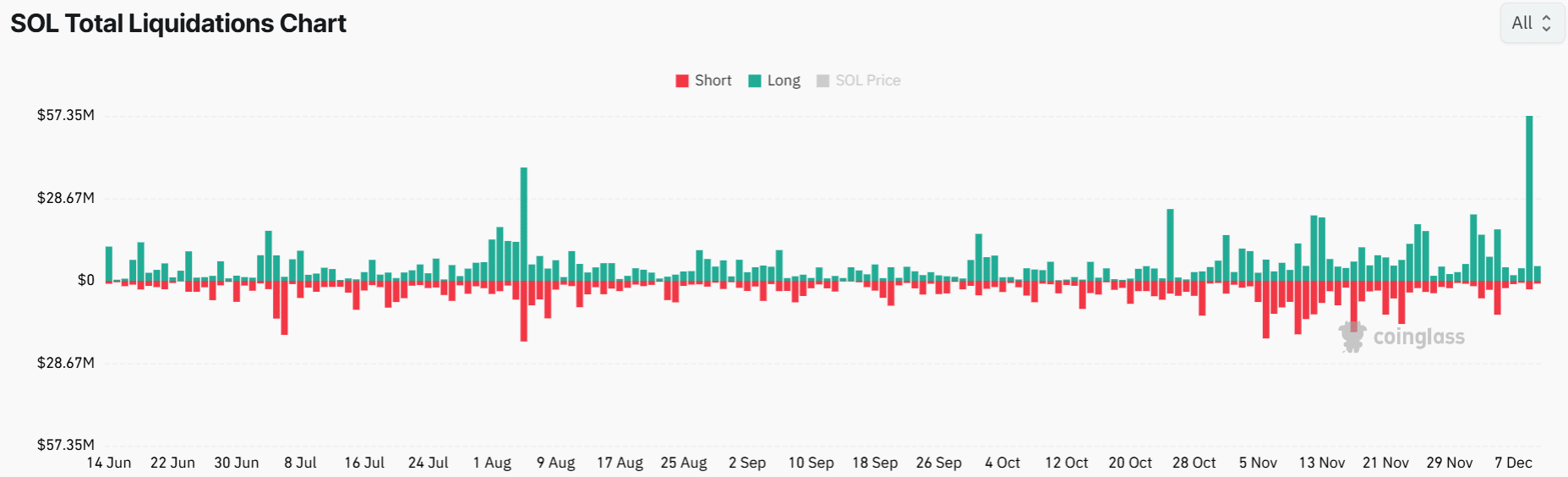

Solana lengthy liquidations hit report highs

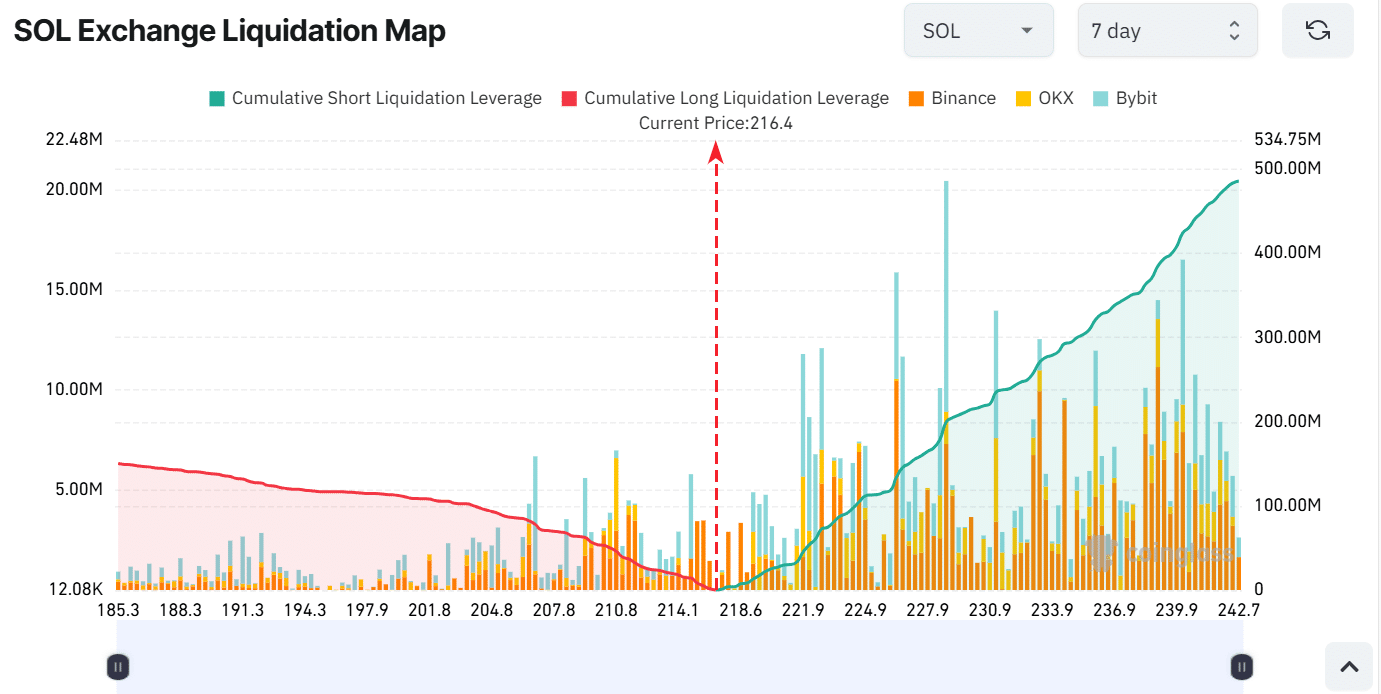

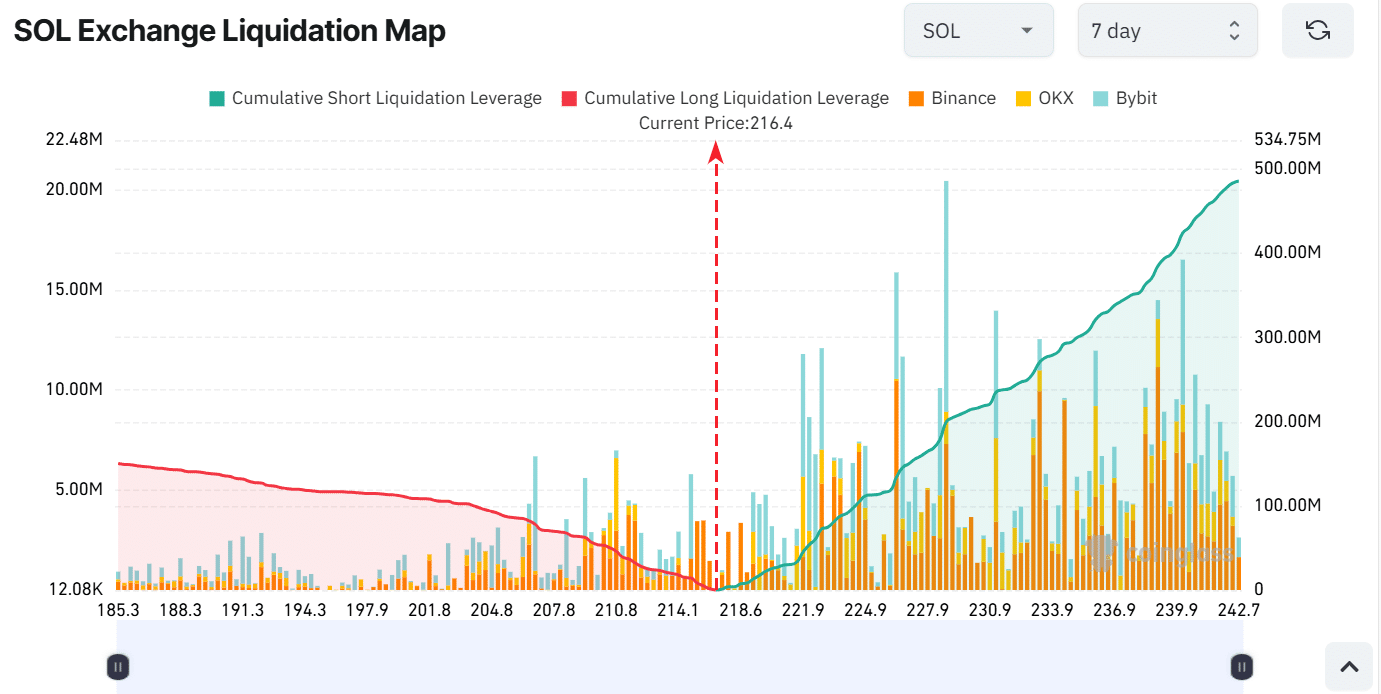

Information from Coinglass confirmed that on tenth December, the full liquidations for leveraged lengthy positions on Solana reached $57 million. This marked the very best quantity of SOL lengthy liquidations in over 5 months.

Supply: Coinglass

Lengthy liquidations have a tendency to extend promoting exercise, inflicting Solana to drop. Nevertheless, this cascade of liquidations may need worn out the overleverage round Solana, giving the altcoin room to recuperate.

Alternatively, there are nonetheless different liquidation clusters beneath the present worth. If Solana fails to recuperate from the present bearish developments, and the worth hits these ranges, it might trigger additional declines.

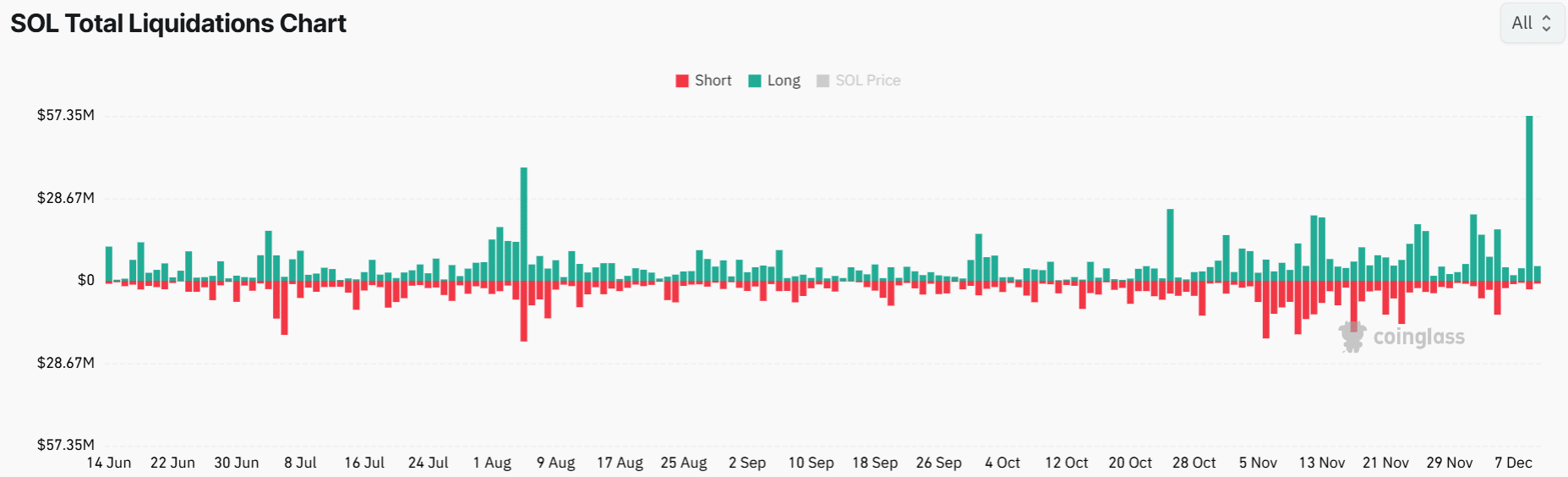

Rounded prime reveals a bearish development

Solana has additionally fashioned a rounded prime sample on its decrease timeframe chart suggesting that bears have been in management. The neckline of this rounded prime sample stands at $215, a degree that SOL has examined severally.

If Solana fails to carry this help and drops, it might ignite a drop beneath $200 to $183, triggering extra lengthy liquidations.

Supply: Tradingview

The Relative Power Index (RSI) has a worth of 30 suggesting that SOL is leaning in the direction of being oversold. Whereas this might stir some beneficial properties, a sustained uptrend will occur if the RSI line crosses above the sign line.

The Superior Oscillator (AO) additional highlights the bearish momentum due to the pink histogram bars, which affirm that SOL is in a downtrend.

Will SOL drop additional?

These bearish indicators present that SOL is poised for extra dips if there isn’t a shift in purchaser sentiment.

Learn Solana’s [SOL] Worth Prediction 2024–2025

Merchants ought to be careful for a drop beneath the neckline of the rounded prime at $215, as that might speed up the downtrend. Furthermore, a drop beneath $200 might trigger extra ache for patrons because of lengthy liquidations.

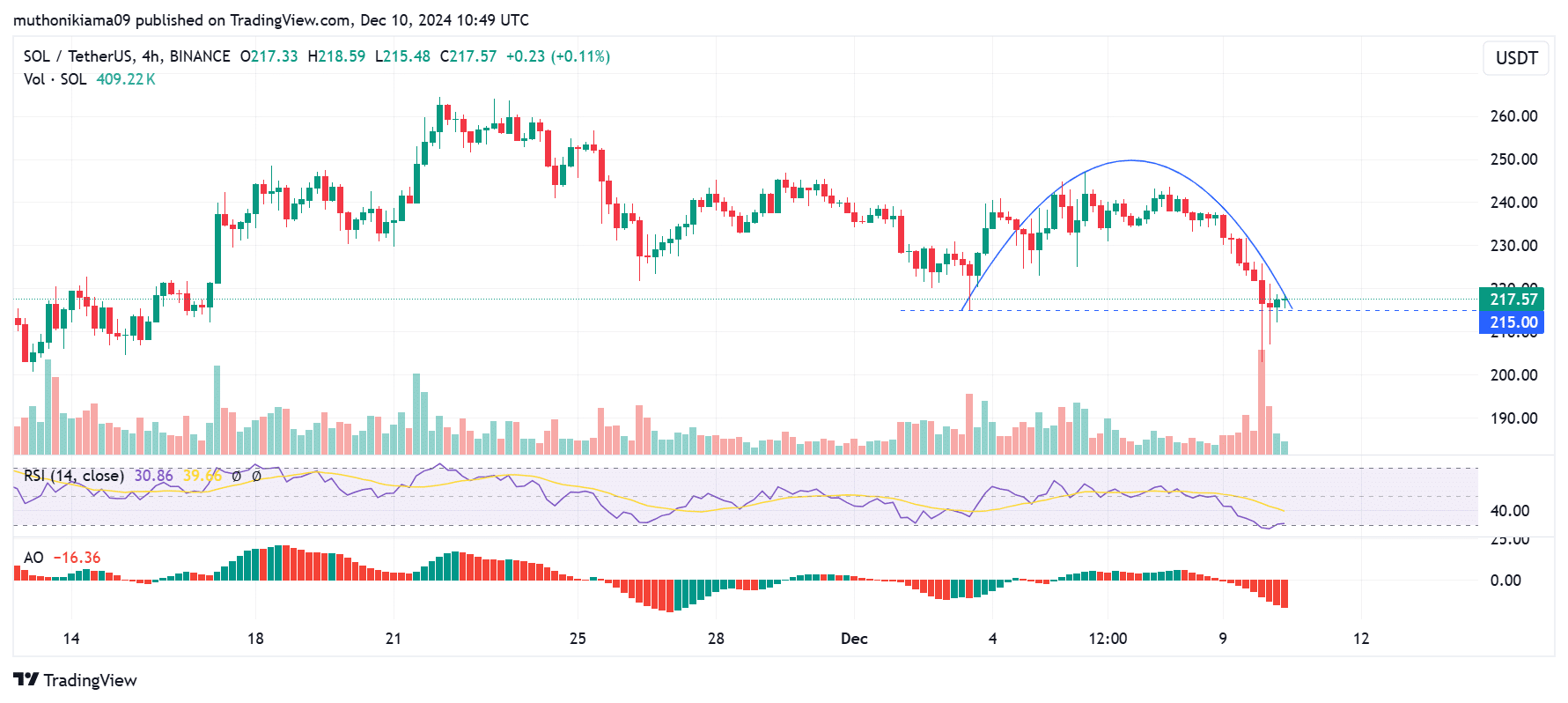

Supply: Coinglass

Solana’s liquidation map on Coinglass reveals that the lengthy liquidation leverage for SOL beneath $200 is considerably excessive, and if these positions are forcibly closed, it might trigger additional declines.