Solana overtakes Ethereum in fee activity, but Ethereum remains on top in…

- SOL has seen extra actions in the previous couple of days.

- ETH nonetheless holds the lead in different key metrics.

The competitors between Solana [SOL] and Ethereum [ETH] is intensifying, significantly in transaction charges, as Solana sees a outstanding surge.

Current information reveals that Solana’s charges have surpassed Ethereum’s day by day totals, reflecting rising exercise on the community.

Nonetheless, regardless of this spike in Solana’s charges and whole worth locked (TVL) development, Ethereum stays the dominant blockchain by way of general market worth and locked belongings.

Solana’s payment surge outpaces Ethereum

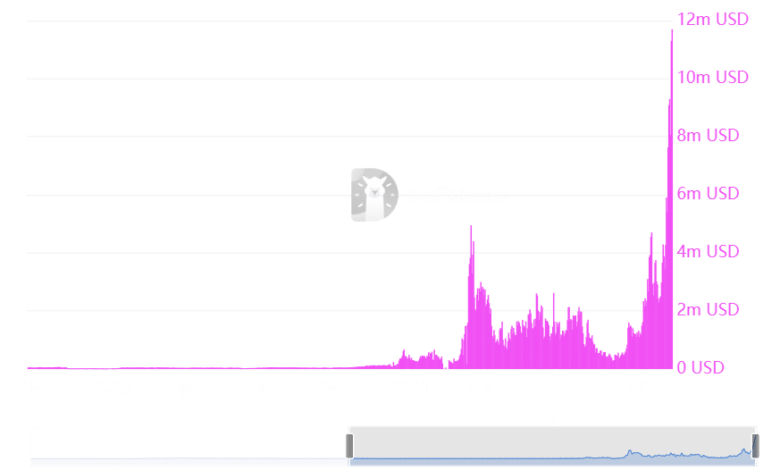

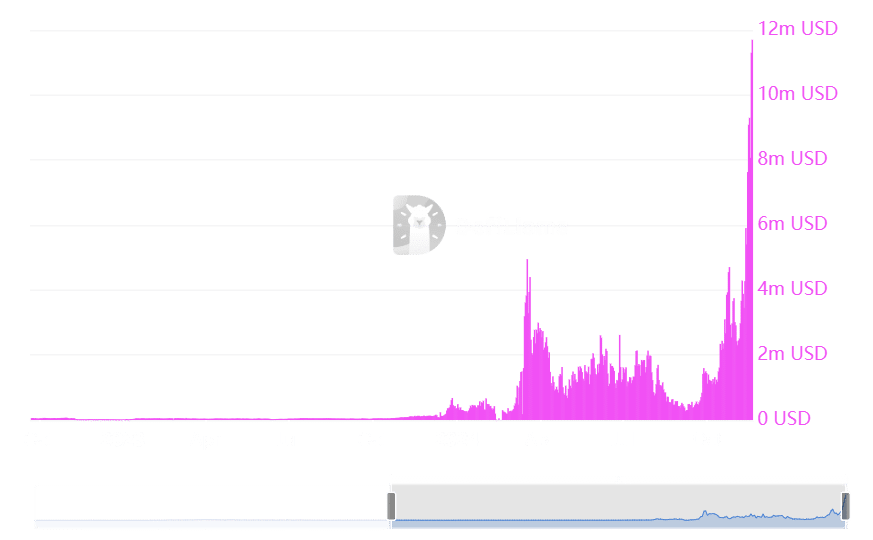

Solana has skilled important development in transaction charges over the previous week. DefiLlama’s newest evaluation ranks Solana and its decentralized functions (DApps) above Ethereum in day by day payment exercise.

Raydium, a significant DApp on the Solana community, reported almost $12 million in charges, making it the second-highest fee-generating platform in the course of the interval.

Solana itself generated roughly $11.3 million in charges, whereas Jito, one other Solana DApp, added virtually $11 million to the community’s whole.

Supply: DefiLlama

Ethereum, against this, recorded about $6 million in day by day charges, putting it behind Solana within the rankings. Ethereum’s payment pattern has proven little fluctuation over the previous week, with a constant sample of stability.

Solana, alternatively, has seen a number of payment spikes, culminating in a brand new all-time excessive of $11.7 million on nineteenth November. This record-breaking exercise highlights Solana’s rising momentum in community utilization and adoption.

Supply: DefiLlama

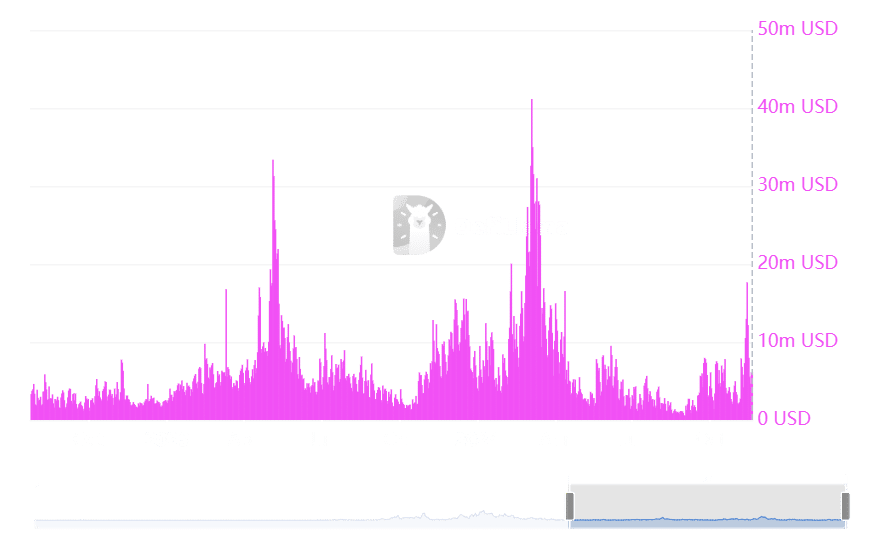

Ethereum retains management in TVL

Whereas Solana has gained floor in transaction charges, Ethereum continues to steer in Whole Worth Locked, a key metric in decentralized finance (DeFi).

Solana’s TVL has climbed considerably in current days, reaching $8.4 billion. This represents a robust restoration for Solana, bringing it nearer to the highs it achieved in 2022.

Nonetheless, Ethereum stays the clear chief in TVL, with a staggering $60 billion locked in its ecosystem. This determine accounts for greater than half of the overall DeFi market’s $110.5 billion TVL.

Worth actions replicate broader developments

Solana is buying and selling at roughly $244, exhibiting a 1% improve. The $200 help degree has confirmed to be a robust basis for its current upward pattern.

Lifelike or not, right here’s SOL market cap in BTC’s phrases

Ethereum, alternatively, is buying and selling at simply above $3,000 with a 2% decline. Regardless of this, the cryptocurrency has held regular inside this value vary, and new help seems to be forming at round $2,900.