Solana price at risk? Whale dump $45.7 million worth SOL

- Solana may drop by 11% to achieve the $156 degree if it falls under the $175 mark.

- Merchants over-leveraged at $182.1 on the decrease facet and $193.2 on the higher facet.

Solana [SOL], the world’s fifth-largest cryptocurrency by market capitalization, seems to weaken day-to-day as a result of ongoing market uncertainty.

Whale dumps $45.7 million value of SOL

Amid this market decline, the blockchain-based transaction tracker Whale Alert posted on X (previously Twitter) {that a} crypto whale had dumped a big 246,064 SOL, value $45.76 million, to Binance.

As of now, the whale’s pockets deal with stays unknown, elevating issues amongst buyers a couple of potential sell-off.

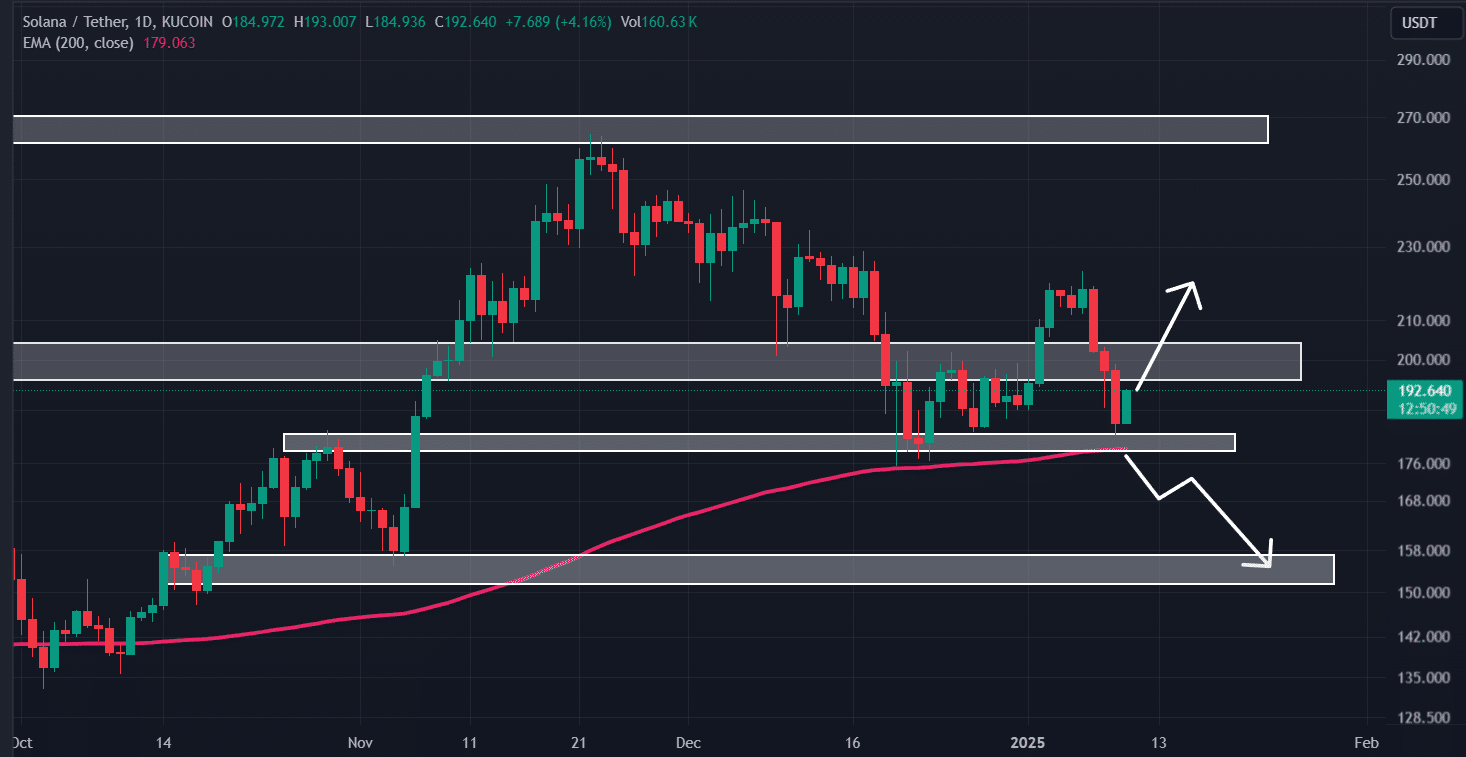

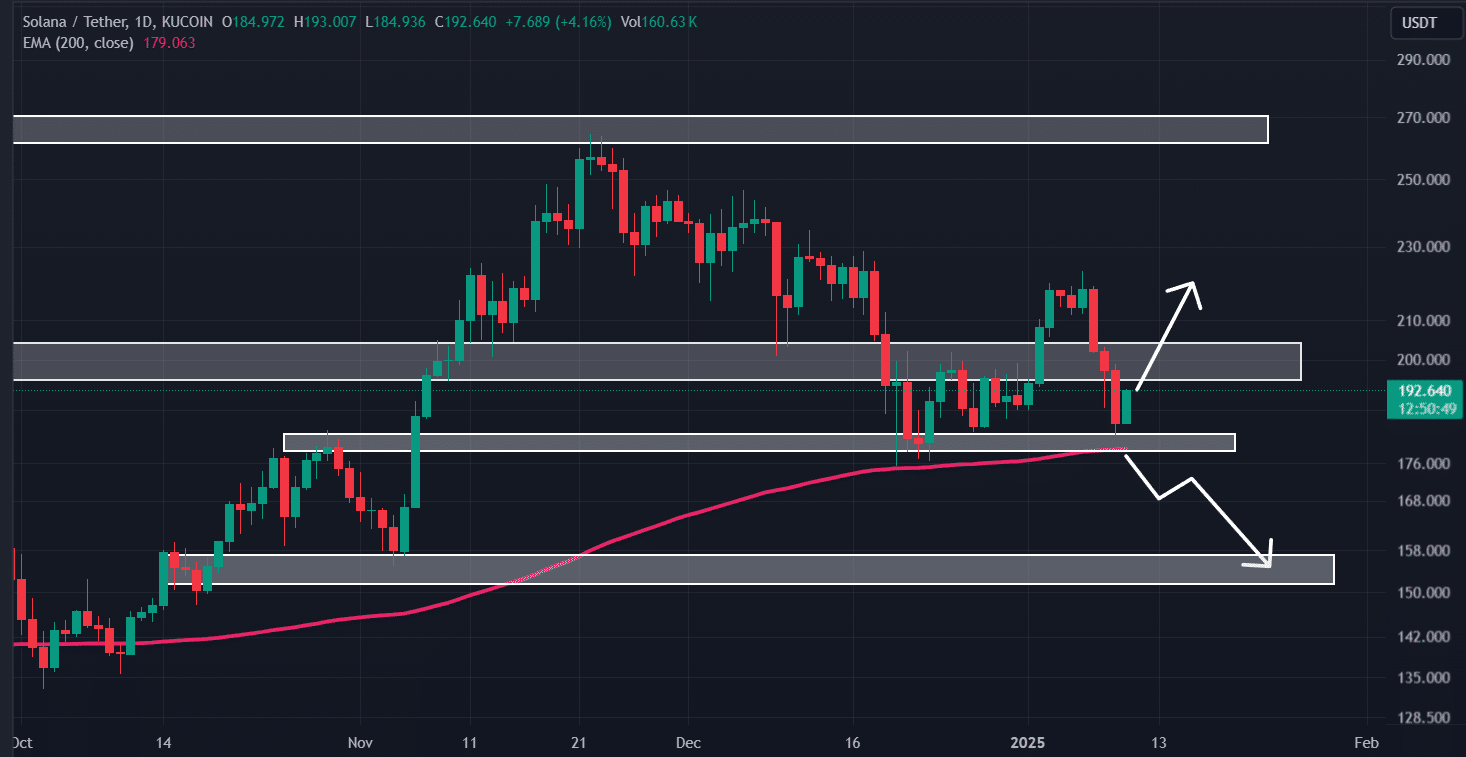

Moreover, the numerous dump on Binance occurred because the SOL value reached an important horizontal help degree of $176 and the 200-day Exponential Transferring Common (EMA).

Solana’s technical evaluation and key ranges

This significant help degree is a make-or-break scenario for SOL. Skilled technical evaluation exhibits that if the altcoin breaches the 200 EMA and closes a every day candle under $174.5, there’s a robust risk of an 11% drop.

It may probably attain the $156 degree sooner or later.

Supply: TradingView

Conversely, if SOL manages to carry above the 200 EMA, it may as soon as once more exhibit upside momentum towards the $220 mark.

On-chain metrics blended sentiment

Analyzing the market sentiment and the technical outlook for SOL, buyers and long-term holders look like dumping their holdings onto exchanges, as reported by the on-chain analytics agency Coinglass.

Knowledge from Spot Influx/Outflow metrics reveal that exchanges have witnessed an outflow of over $61 million value of SOL previously 24 hours.

The outflow in such a scenario signifies a possible sell-off sign and has the potential to create promoting stress, resulting in an extra value decline within the altcoin.

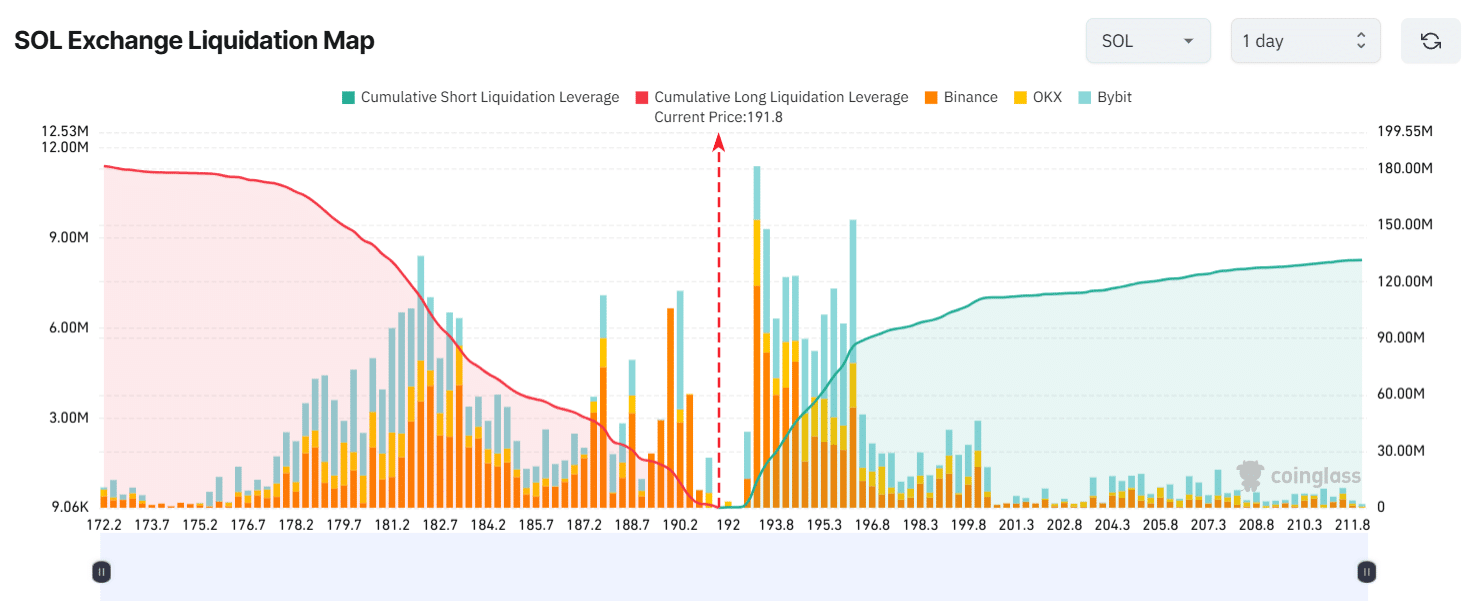

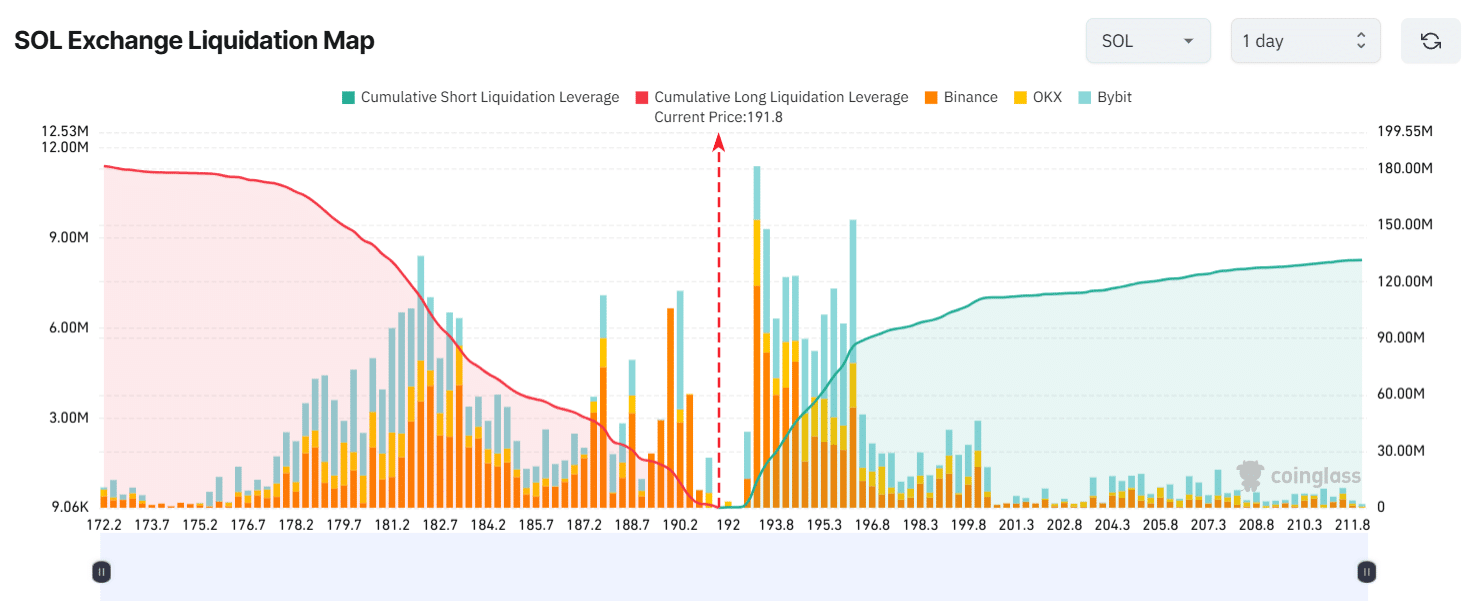

Main liquidation areas

As of now, the most important liquidation ranges are at $182.1 on the decrease facet and $193.2 on the higher facet, with intraday merchants, over-leveraged at these ranges, in accordance with Coinglass knowledge.

Supply: Coinglass

If the market sentiment stays unchanged and the worth reaches the $182.1 degree, almost $111.61 million value of lengthy positions might be liquidated.

Conversely, if the sentiment shifts and the worth rises to the $193.2 degree, roughly $14.19 million value of brief positions might be liquidated.

When combining these on-chain metrics, it seems that merchants holding lengthy positions are probably stronger than brief sellers.

Learn Solana’s [SOL] Worth Prediction 2025–2026

At press time, SOL was buying and selling close to $192 and recorded a modest value surge of 1.10% previously 24 hours.

Nonetheless, throughout the identical interval, its buying and selling quantity dropped by 5.5%, indicating decrease participation from merchants and buyers in comparison with the day before today.