Solana showdown: Will SOL burst past $133 or slide to $120 this week?

- The 1-day market construction regarded bearish.

- Solana’s efficiency towards Ethereum and heightened demand had been bullish indicators.

Solana [SOL] noticed elevated transaction exercise on-chain and short-term bullish impetus that propelled costs above $120.

Nonetheless, the presence of a robust provide zone round $140 meant that the bulls would have a tricky job to provoke a real long-term restoration.

The Solana community outpaced the Ethereum [ETH] one on a number of fronts. The SOL/ETH pair made new highs, and SOL noticed elevated inflows in comparison with the Ethereum community, amongst others. Might these elements be sufficient to drive a sustained value rally?

Elevated shopping for strain provides SOL traders hope

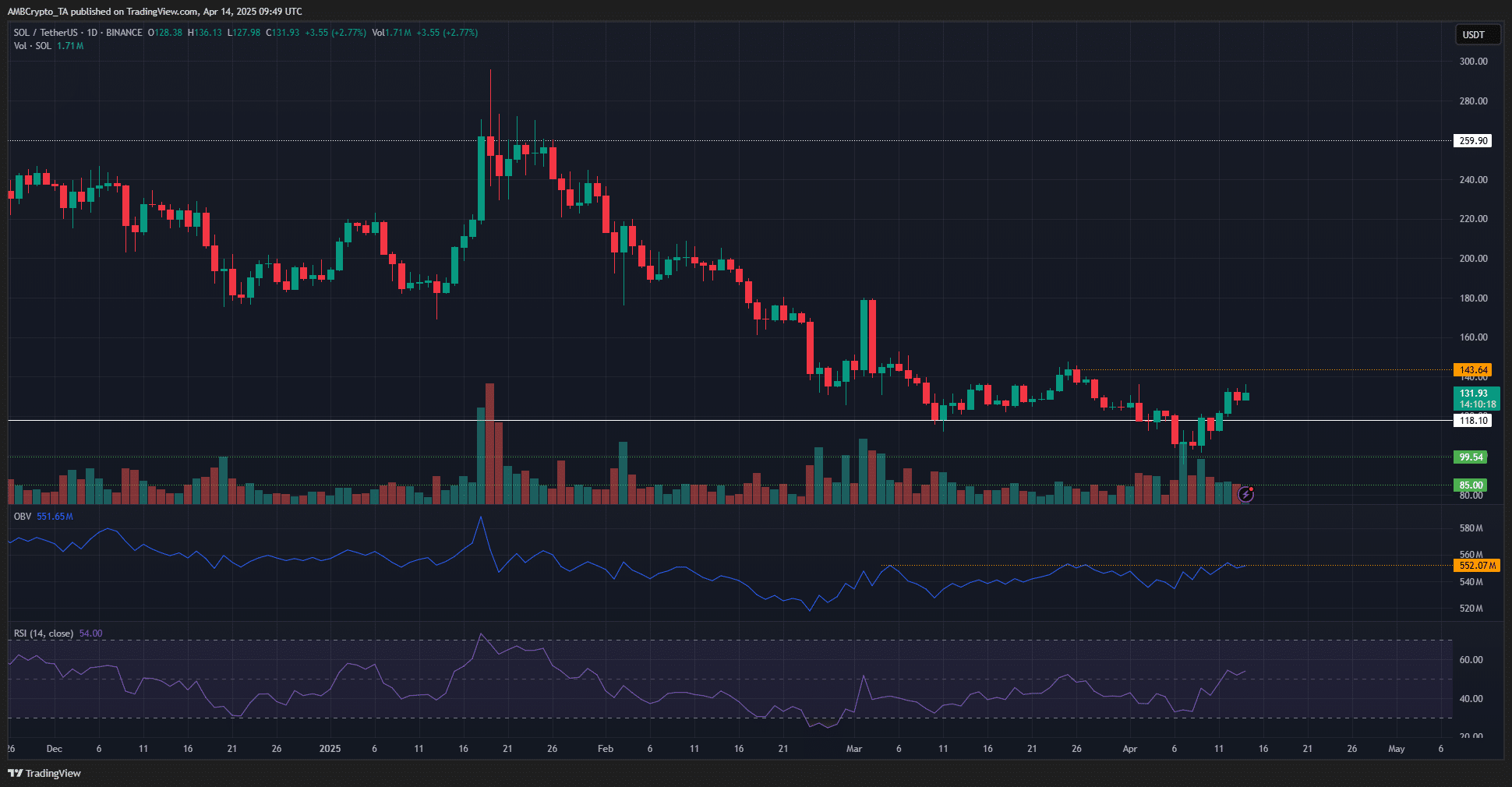

Supply: SOL/USDT on TradingView

The $143 degree marked the decrease excessive of the downtrend of the previous three months. This was the extent that wanted to be breached to flip the 1-day market construction bullishly. There have been early indicators that this end result can be achieved over the subsequent week or two.

The RSI climbed above impartial 50 to mark a bullish momentum shift. It was nonetheless early, nevertheless it had stayed above 50 for 3 days, the longest interval since January. Moreover, the OBV was difficult the highs set in early March.

Again then, the worth of Solana was round $180. Due to this fact, it indicated rising shopping for strain, which may propel costs past $143. Nonetheless, till it does, merchants and traders can stay cautious.

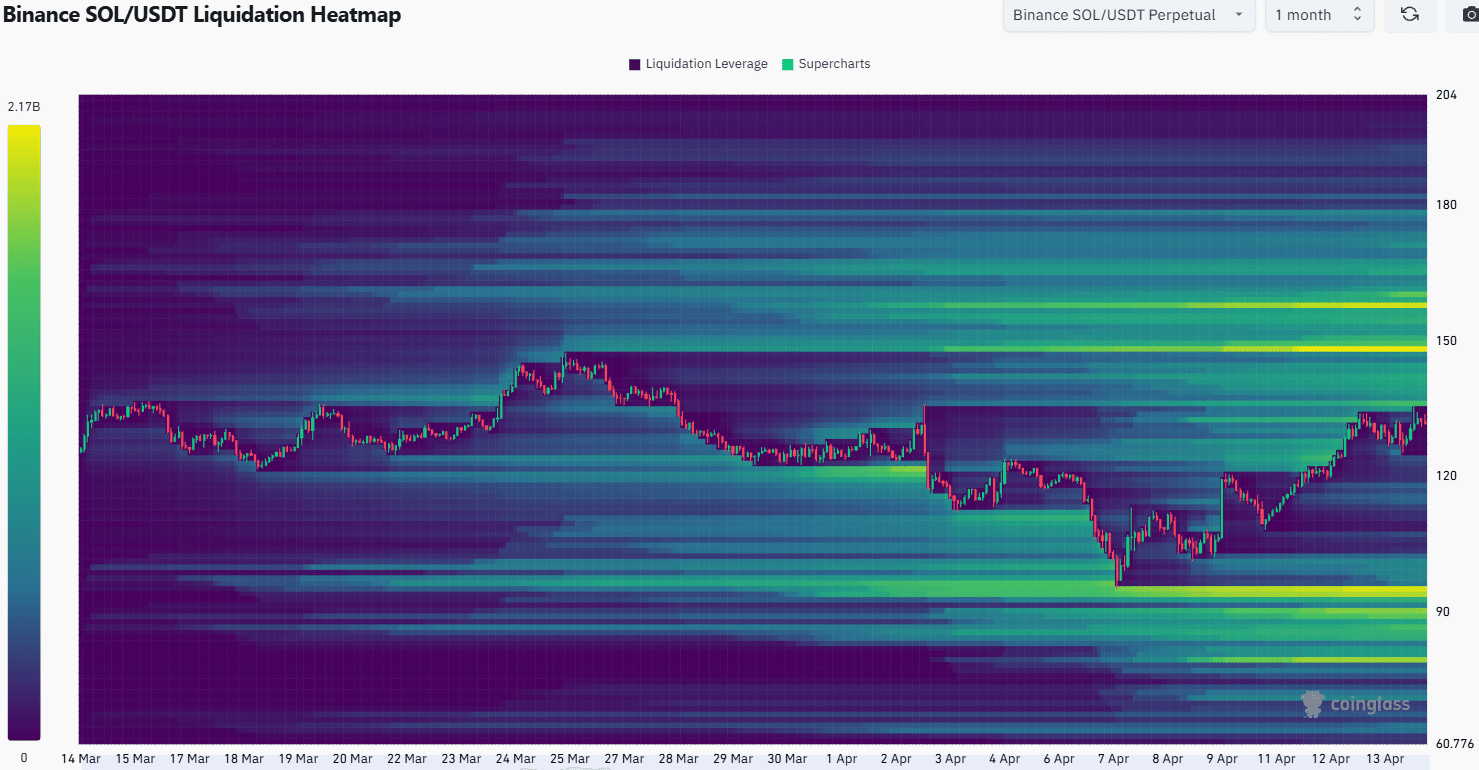

The liquidation heatmap, with a 1-month look again interval, highlighted $150 and $158 as essentially the most important magnetic zones close by. These ranges contained over $2 billion in liquidations. The $136-$142 vary additionally fashioned a substantial liquidity cluster.

Additional south, a notable liquidation pocket was noticed at $95. Nonetheless, its distance makes it unlikely to be a short-term value goal. Primarily based on the heatmap and technical indicators, a transfer towards $150-$160 seems possible within the coming days.

Whether or not bulls can maintain the $140 degree as assist and keep their place stays unsure.

Success at this degree may sign the beginning of a bullish pattern, contingent on a Bitcoin [BTC] restoration and optimistic sentiment within the broader crypto market.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion