Solana shows signs of heating up as TVL soars to new 2024 highs

- Solana community exercise maintains constructive trajectory the bearish market circumstances.

- Assessing the probabilities of SOL getting into restoration mode after a bearish week.

The Solana [SOL] blockchain remains to be demonstrating indicators of sturdy community exercise regardless of the current market quiet down. The bears are liable for subduing the market pleasure beforehand noticed in November and earlier this month.

It’s enterprise as ordinary for Solana as evident by its newest spike in exercise. For context, the community’s TVL simply hit a brand new 2024 excessive at 55.37 million SOL. The TVL efficiency is extra correct by way of SOL reasonably than in greenback worth due to SOL worth fluctuations.

supply: DeFiLlama

Optimistic TVL progress is usually related to long run optimism and wholesome community exercise. Solana on-chain quantity remained excessive regardless of the current bearish sentiments available in the market. It averaged over $3 billion in day by day quantity within the final two days.

Solana transaction knowledge additionally indicted rising community exercise. Transactions have been on an uptrend for months and peaked at 67.77 million TXS within the final 24 hours. This was the very best recorded transaction rely on the Solana community within the final 11 months.

Supply; DeFiLlama

Is SOL prepared for a bullish comeback?

The current surge in community exercise may sign a surge in natural demand for the Solana native crypto. Nevertheless, the general market efficiency has been bearish particularly this previous week, and Solana’s native crypto was not spared.

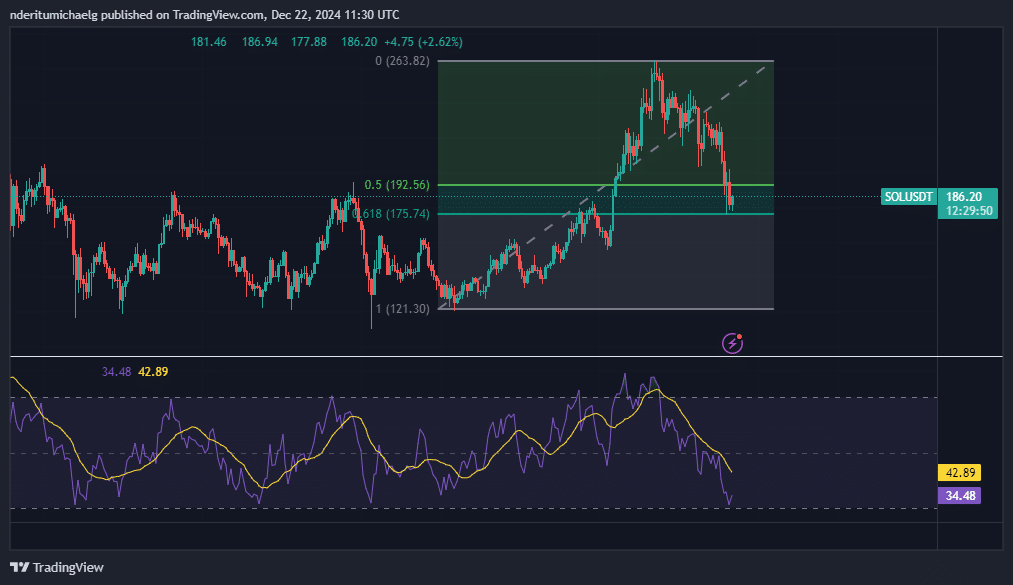

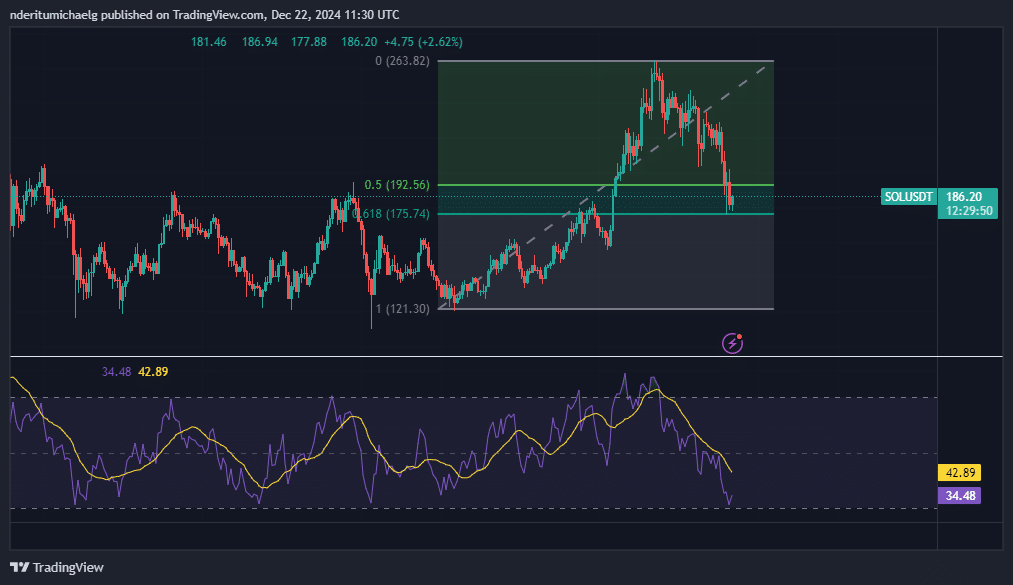

SOL dipped by 23% from its highest to lowest stage final week. Nevertheless, this additionally meant that it retested an necessary stage. Value has been hovering throughout the 0.5 and 0.618 Fibonacci retracement stage primarily based on its September lows and its November peak.

Supply: TradingView

The RSI virtually dipped into oversold territory within the newest dip. This might point out the potential of extra draw back within the coming days. Nevertheless, worth was already displaying indicators of bearish exhaustion on the time of writing.

If a bullish restoration from the Fibonacci vary is on the playing cards, then merchants ought to count on indicators. Up to now the bearish assault has cooled down. Nevertheless, spot flows had been nonetheless unfavorable though it’s value noting that the depth of outflows declined within the final 4 days.

supply: Coinglass

The declining spot outflows could pave the best way for some restoration. Nevertheless, the derivatives market additionally revealed that SOL could not but be prepared for a robust comeback.

Is your portfolio inexperienced? Try the SOL Revenue Calculator

Open curiosity weighted funding charges had been unfavorable within the final 2 days. This was the primary time that SOL funding charges had been unfavorable within the final 6 weeks.

supply: Coinglass

Word nonetheless that Solana funding charges began to indicate indicators of shifting again into the constructive facet within the final 24 hours.