Solana surges 12.3% amid FUD and rumors – Just a passing fad?

- Solana jumped 12.3%, because of memecoin exercise and hypothesis round Futures contracts.

- Whales accrued SOL as retail merchants shed holdings amid transaction delays and market FUD.

Solana [SOL] has been on a tear, recording a 12.3% acquire up to now 36 hours, positioning itself as one of many top-performing altcoins amid a risky market.

A mixture of memecoin exercise, retail FUD (Concern, Uncertainty, and Doubt), and rumors a couple of potential futures contract itemizing have contributed to the rally.

Memecoins gasoline community exercise and worth motion

One of many key drivers of Solana’s latest surge has been the rising affect of memecoins like Official Trump [TRUMP].

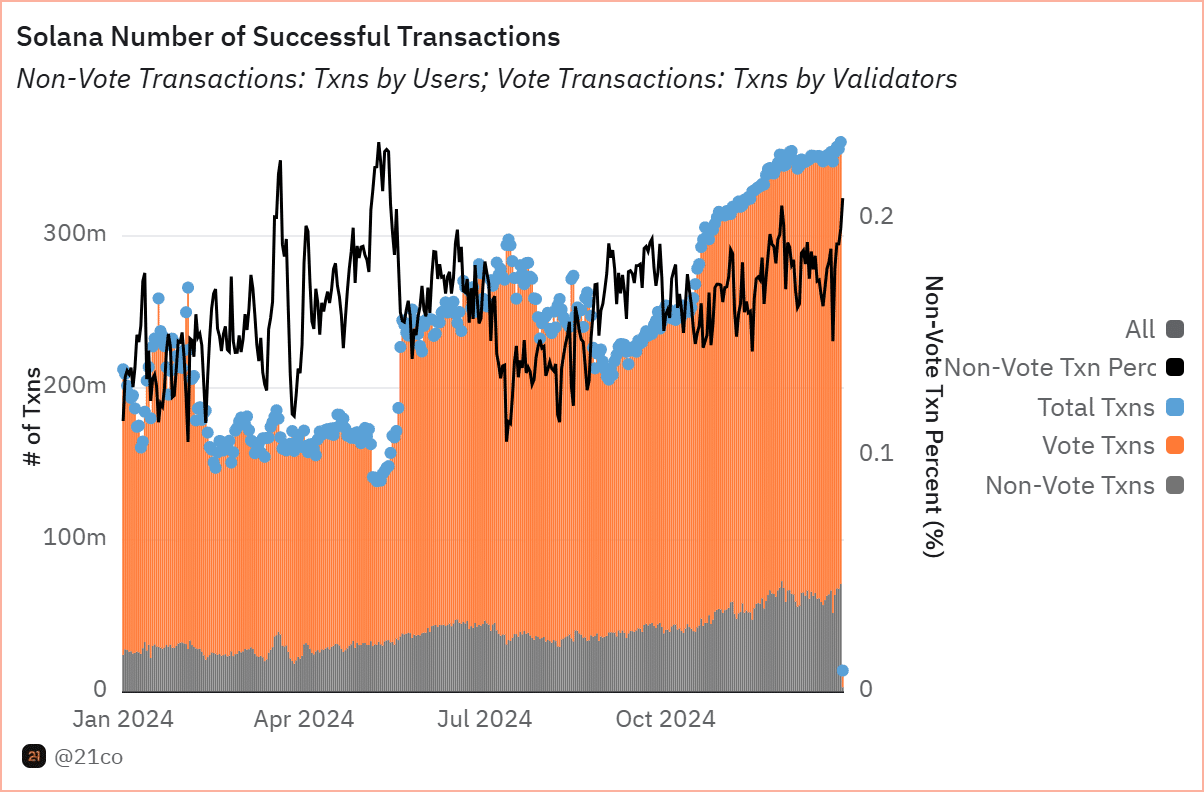

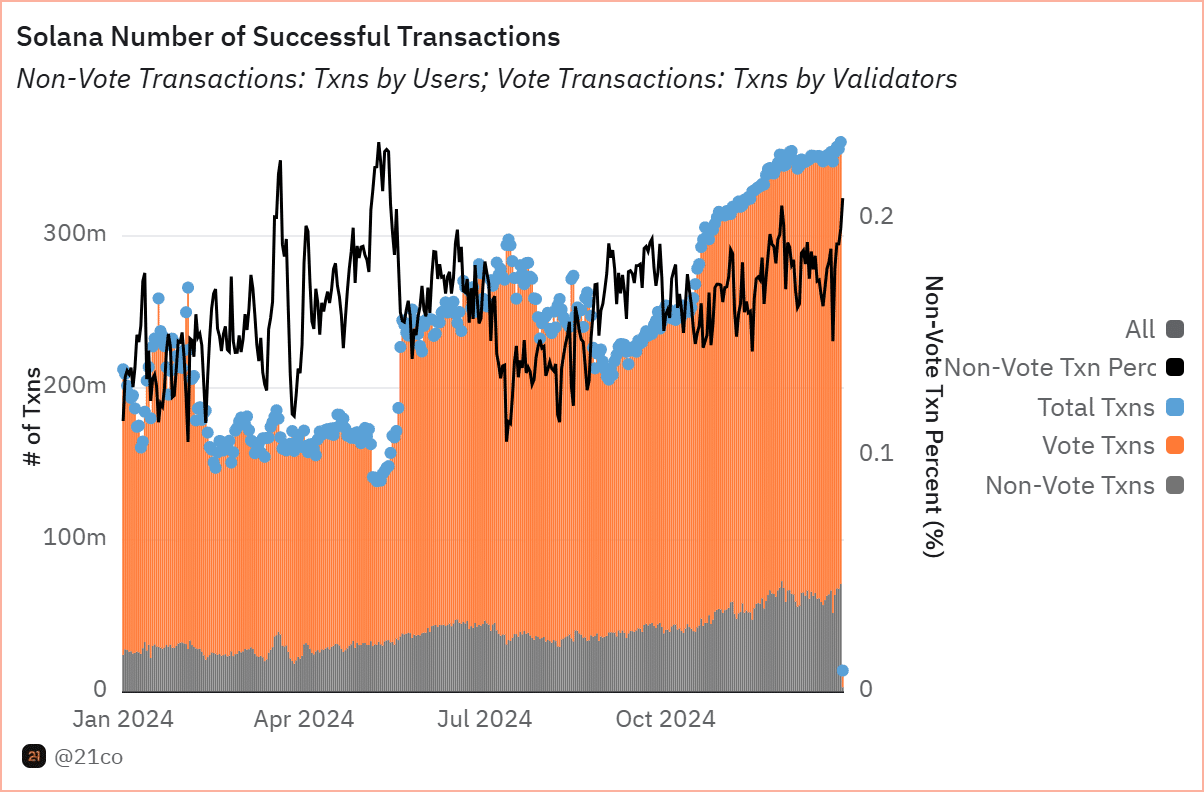

The explosive curiosity in these initiatives has led to a spike in Solana’s community exercise, with transaction delays creating polarized opinions amongst merchants.

Whereas some retail traders have expressed frustration, others see it as an indication of Solana’s rising adoption and relevance within the meme coin area.

Spooked by the delays, retail merchants started offloading their SOL holdings, resulting in a wave of whales and sharks accumulating SOL at discounted costs.

This development is supported by latest on-chain knowledge exhibiting bigger wallets capitalizing on the sell-offs, positioning themselves for potential long-term positive aspects.

Supply: Dune Analytics

Solana Futures itemizing rumors add gasoline

Including to the momentum, a leaked screenshot of a beta web page for XRP and Solana (SOL) Futures contracts surfaced on X (previously Twitter), sparking hypothesis that an trade would possibly listing these funding autos as early because the tenth of February.

Whereas stories counsel the screenshot may very well be a mock-up with no confirmed choice but, the market has reacted positively to the information.

Solana’s worth jumped on the again of the rumors, reflecting merchants’ anticipation of elevated institutional curiosity.

Futures contracts may provide broader publicity to Solana, offering one other increase to its already energetic market.

Shifting sentiments

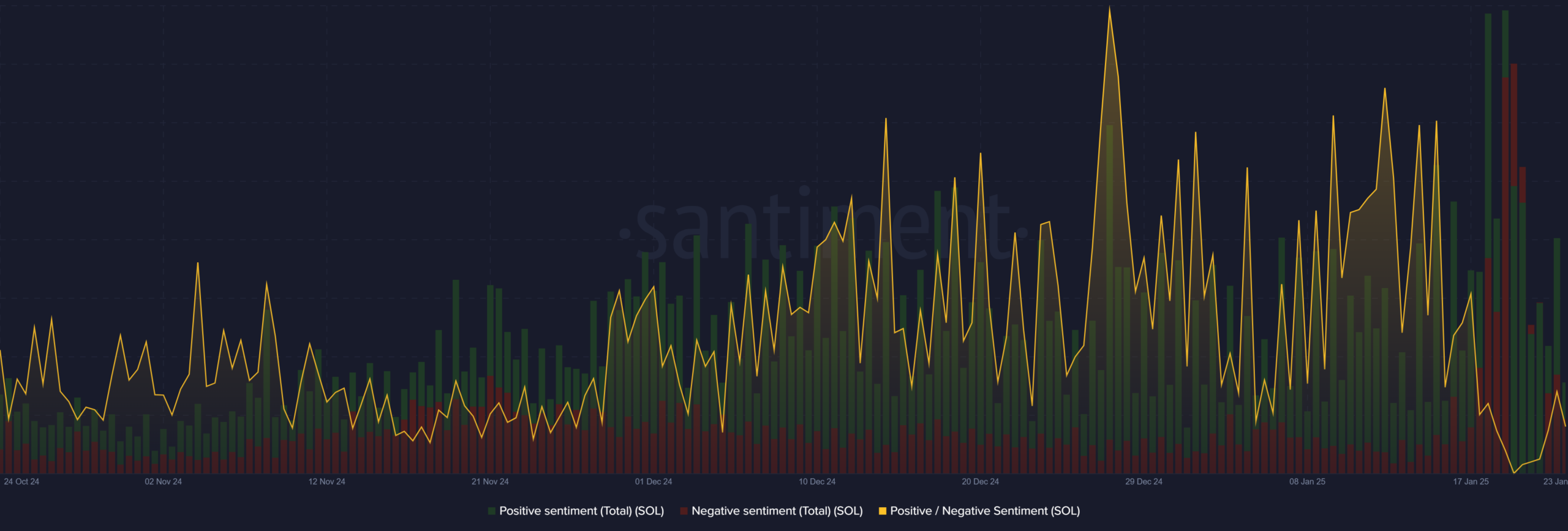

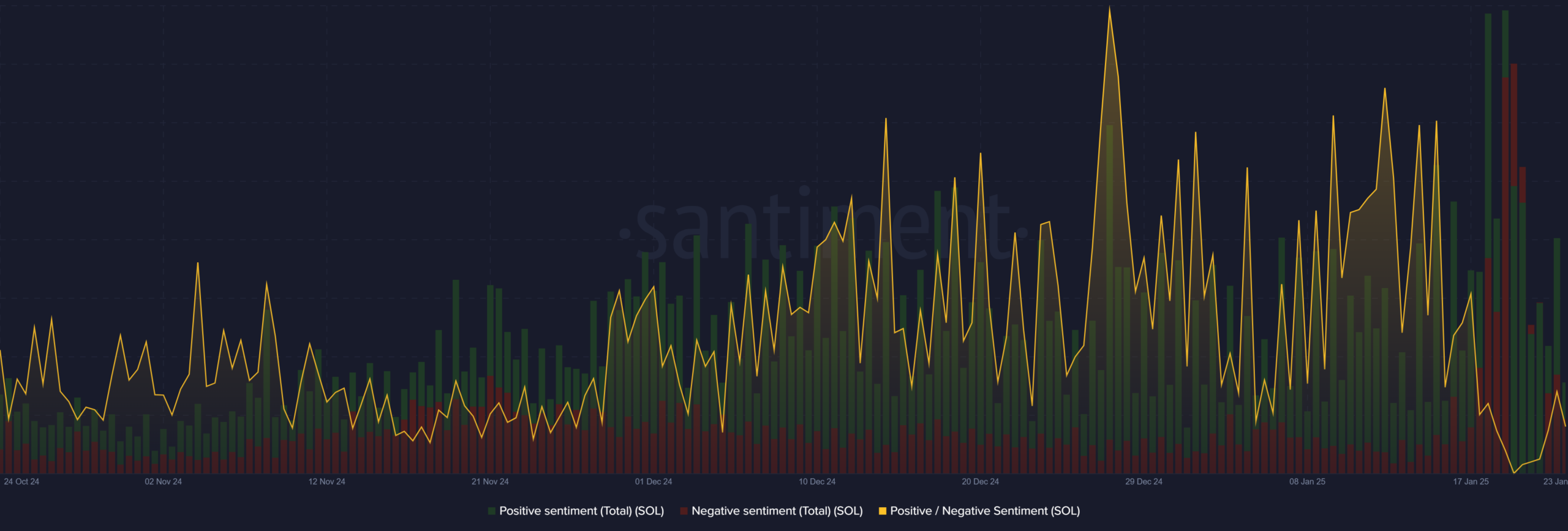

The sentiment evaluation chart painted an intriguing image of Solana’s neighborhood dynamics as properly.

Over the previous month, a noticeable rise in constructive sentiment has been indicated by the spikes in inexperienced bars, which coincide with the meme coin frenzy and rumors about Futures contracts.

Supply: Santiment

Curiously, the unfavorable sentiment has additionally been vital, suggesting a divided neighborhood.

Nevertheless, the web sentiment has remained constructive, reinforcing the notion that merchants are optimistic about Solana’s long-term potential regardless of short-term challenges like transaction delays and FUD.

Key ranges to observe

Solana’s worth was $247.71 at press time, down 3.70% within the newest session after peaking at $258.35. The value chart confirmed a transparent upward development, with SOL sustaining its place above key transferring averages.

The 50-day transferring common of $211.08 has supplied robust help, suggesting sustained bullish momentum.

The 200-day transferring common of $177.55 remained far under the present worth, reinforcing the power of Solana’s restoration.

The amount of over 552,000 SOL traded within the final session highlighted elevated market exercise, possible pushed by memecoin-related transactions and Futures rumors.

Supply: TradingView

An important help stage lies at $244, which Solana should maintain to keep away from slipping again right into a consolidation part. On the upside, breaking above $260 may set off additional positive aspects, doubtlessly focusing on the $280-$300 vary.

Navigating the hype and hypothesis

Solana’s latest efficiency reveals its resilience and talent to navigate risky market circumstances. Nevertheless, it additionally faces notable challenges.

The memecoin-driven hype, whereas useful within the brief time period, carries dangers of speculative bubbles and volatility.

Moreover, the Futures itemizing rumors being debunked may result in a short-term correction as speculative merchants exit their positions.

Is your portfolio inexperienced? Try the Solana Revenue Calculator

On the flip aspect, whale accumulation and rising community exercise sign long-term confidence in Solana’s ecosystem.

If Futures contracts are formally introduced, Solana may see elevated institutional participation, additional bolstering its market place.