Solana traders alert! – Uncovering the risks beneath the 30% rally

- Solana climbed to $125, however whale exits and dense provide zones close to $140 raised the chance of a protracted squeeze.

- The latest bounce seemed extra like a short lived reduction rally.

Regardless of Solana’s[SOL] latest restoration to $120, massive holders stay deep within the pink, which impacts the general market sentiment.

On-chain data reveals a serious whale not too long ago liquidated 274,188 SOL at a median worth of $108. With an preliminary value foundation of $148, this capitulation locked in a staggering $11 million in realized losses.

Even with SOL now hovering round $125, marking a 30% bounce from its April 7 low of $95, the whale would nonetheless be underwater.

This conduct displays continued distribution amongst sensible cash, as whales use liquidity spikes to exit somewhat than accumulate. For retail merchants, it’s a warning flag amid a fragile macro and on-chain backdrop.

Key provide zone in focus

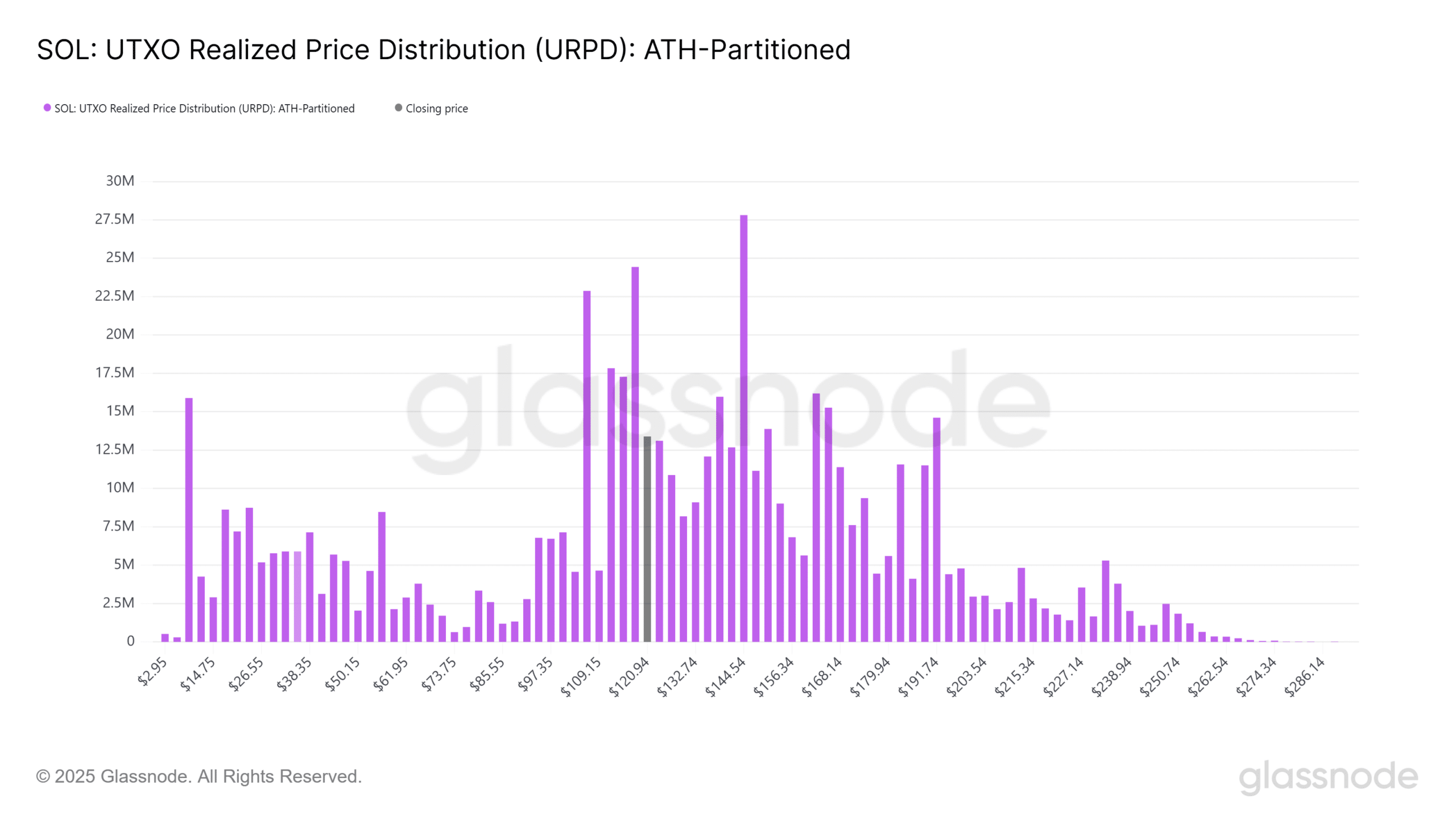

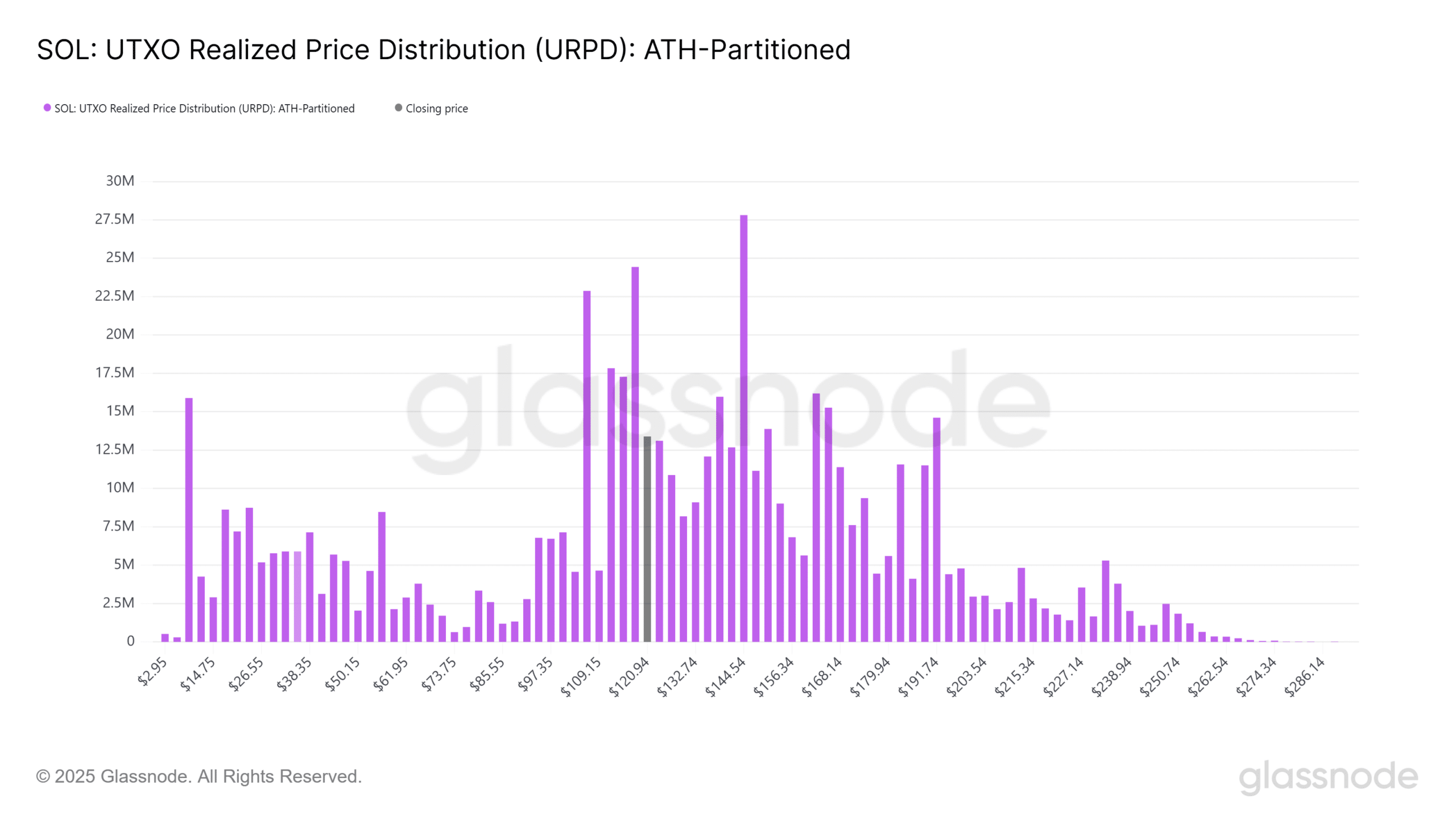

The UTXO Realized Value Distribution (URPD) supplies a granular breakdown of the place Solana cash have been final transacted and mapped in opposition to worth ranges.

For SOL, the info highlights three main provide clusters – round $100, $120, and $140. These concentrations point out {that a} important share of the circulating provide was acquired at these ranges.

Amongst them, the $140 zone stands out, with over 27.8 million SOL concentrated there, accounting for about 4.75% of the whole circulating provide.

This cluster represents a key space of resistance, as many holders are both close to breakeven or dealing with unrealized losses.

Supply: Glassnode

Subsequently, the chance of whale-driven sell-offs stays if SOL fails to reclaim the $140 degree. A worth transfer again to this threshold might result in holders shifting into unrealized earnings, probably triggering a bullish rotation pushed by FOMO and market greed.

Moreover, 38 million SOL stay clustered between $117 and $120, making this vary a possible hotspot for profit-taking as worth breaks this ceiling.

In consequence, till the $140 degree is examined, worth volatility in Solana’s worth motion is prone to persist.

Futures knowledge reinforces Solana’s market outlook

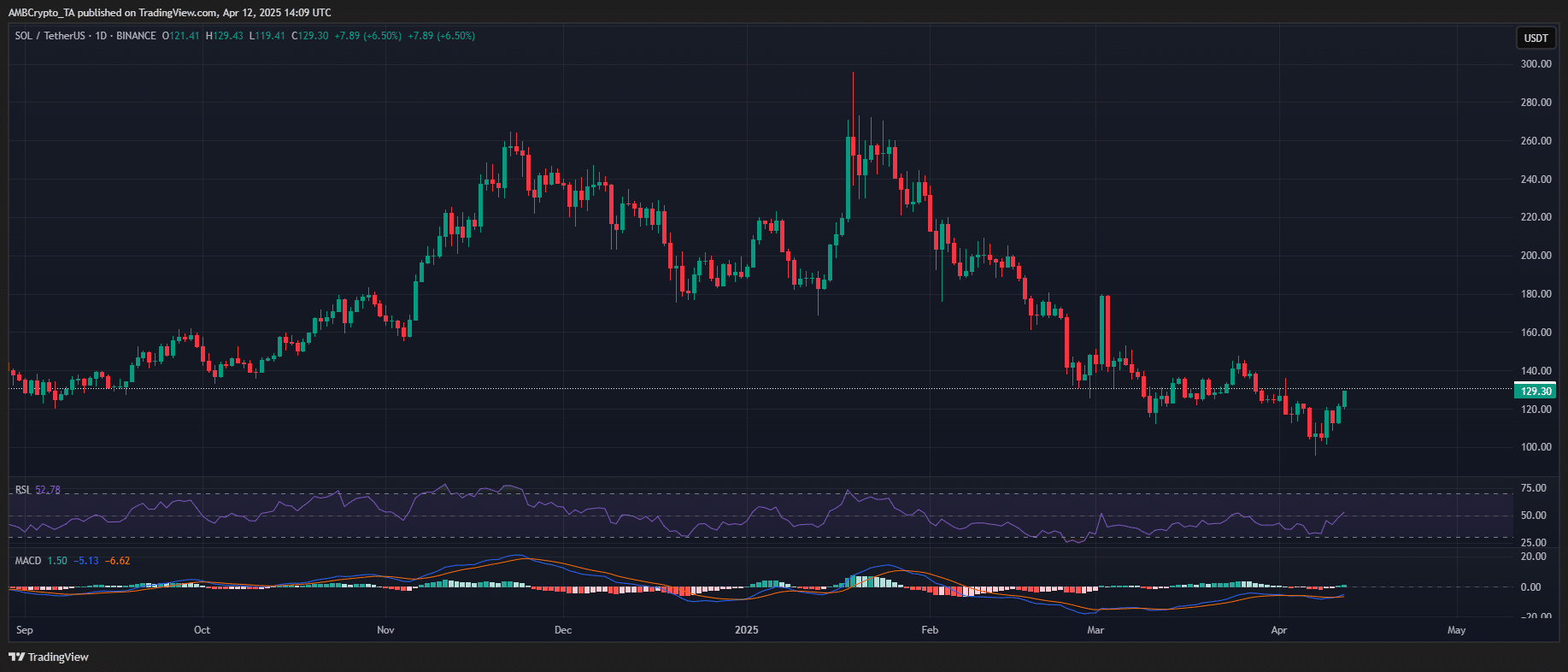

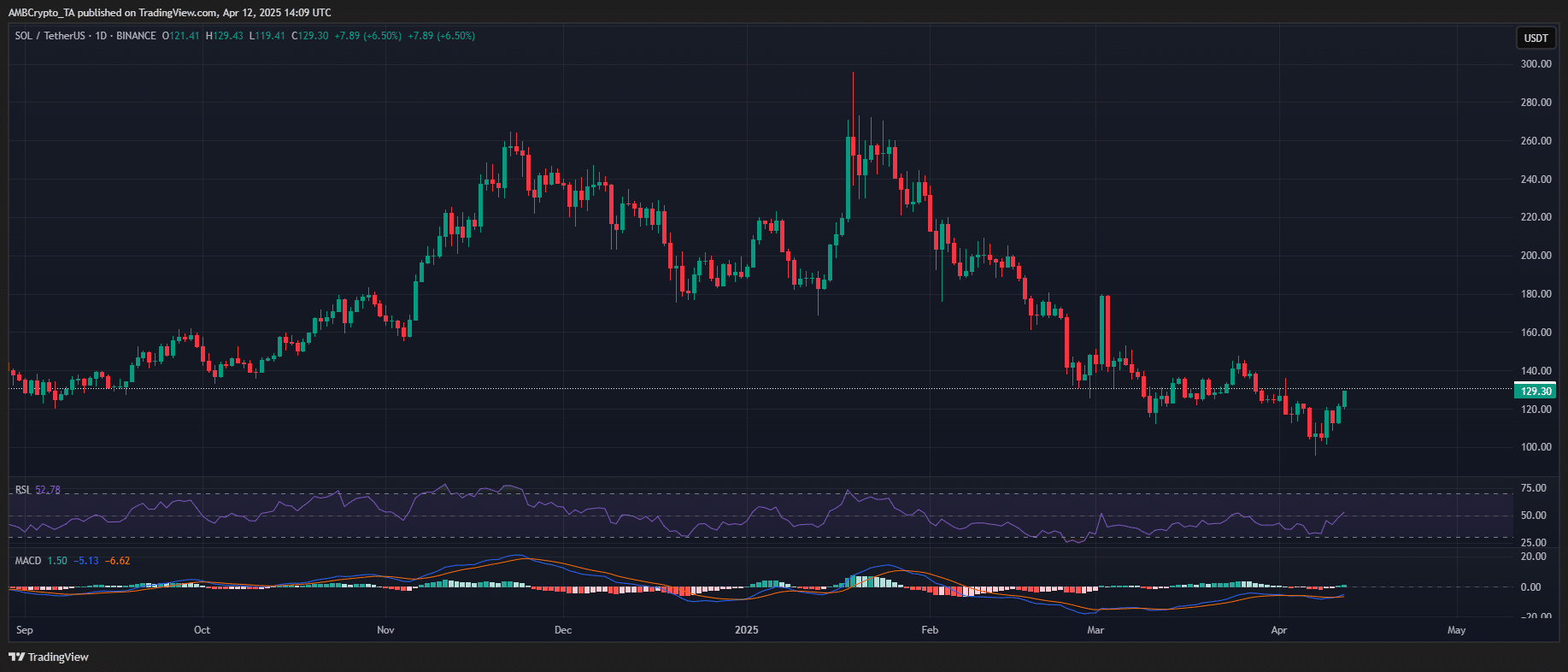

Solana’s 7.07% day by day upswing positions it because the main top-tier asset when it comes to restoration velocity.

This rally isn’t simply spot-driven — Derivatives data confirms aggressive positioning. Open Curiosity (OI) jumped 13.89% to $5.23 billion, signaling a recent wave of leveraged publicity coming into the market.

At first look, this seems bullish. Nonetheless, it additionally introduces fragility.

The whale distribution was nonetheless lively, and Quick-Time period Holders (3–6 months) are nonetheless deep within the capitulation zone. Plus, the latest breach of a high-density provide zone ($117–$120) units the stage for elevated liquidation threat.

Supply: TradingView (SOL/USDT)

Ought to Solana fail to maintain momentum, a cascading lengthy squeeze might set off sharp draw back volatility, significantly as funding charges begin skewing constructive.

In brief, whereas the latest bounce has sparked optimism, this rally bears hallmarks of a liquidity-driven reduction part—not a confirmed development reversal.

Till Solana reclaims and holds above the $140 provide zone with conviction, draw back threat stays firmly on the desk.