Solana vs Ethereum: Is SOL’s lead a sign of a new crypto pecking order?

- Solana has capitalized on Bitcoin’s pullback, pulling forward of Ethereum.

- With momentum shifting, can ETH make a comeback?

Loosely dubbed the “Ethereum Killer,” Solana [SOL] has demonstrated spectacular resilience on this bull cycle. It has earned this title not simply by market cap, however by persistently rating among the many prime weekly gainers whereas Ethereum [ETH] stays flat.

On this cycle, SOL is flourishing as BTC hits key psychological ranges, attracting traders trying to shift capital to mitigate danger – an edge that ETH as soon as held.

SOL is taking lead over ETH

Regardless of ETH’s main market cap of $300 billion, considerably outpacing SOL’s $81 billion, current shifts present that SOL’s market cap has elevated by over 5% whereas ETH has declined by 3%.

This development is especially noteworthy because it coincides with Bitcoin’s current surge to almost $70K, marking a 16.67% achieve in simply ten days.

Sometimes, an overheated market attracts liquidity into high-cap altcoins, as risk-averse traders search to redistribute earnings.

Subsequently, when BTC reached market tops, ETH would expertise important positive aspects. Nevertheless, in contrast to earlier cycles, SOL appears to have taken the lead this time round.

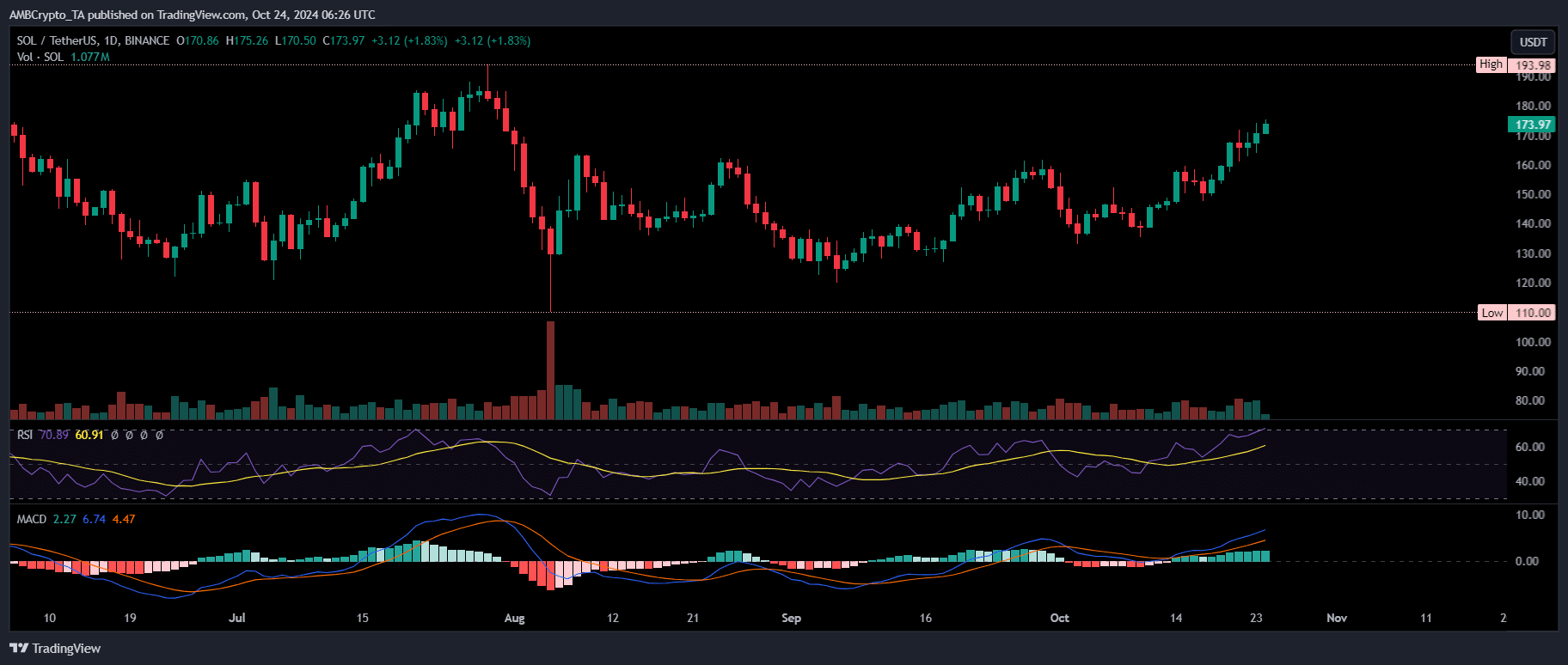

Supply : TradingView

Simply 4 days in the past, as BTC confronted resistance as its value moved above the four-month outdated hunch, SOL posted a day by day achieve of 4% – the very best previously week – marking a vital turning level.

The following day, BTC skilled a 2% pullback, establishing $70K as the brand new native excessive. In response, ETH mirrored this conduct, falling practically 3% and persevering with its retracement.

Conversely, SOL bulls have successfully prevented an identical pullback. Actually, SOL has been surging after breaking the $160 resistance, reaching this milestone on its fourth try following three earlier failures.

At the moment buying and selling at $173, SOL could also be due for a correction, because the RSI exhibits an overbought situation. With 83% of value motion within the final two weeks being upward, a trend reversal could possibly be on the horizon.

Might this shift investor consideration again to ETH?

A development reversal could possibly be close to, however be careful for this

Earlier, a report by AMBCrypto highlighted ETH’s present pullback as a strategic transfer by merchants aimed toward flushing out weak fingers.

This dip may set the stage for an imminent breakout, attracting new consumers and inspiring whales to proceed their accumulation – probably driving ETH above $2,700.

Nevertheless, ETH’s rebound on this cycle is intently tied to SOL. Whereas ETH could possibly be poised for a short-term reversal because it hits assist, reaching a breakout will rely on fastidiously monitoring SOL throughout numerous metrics.

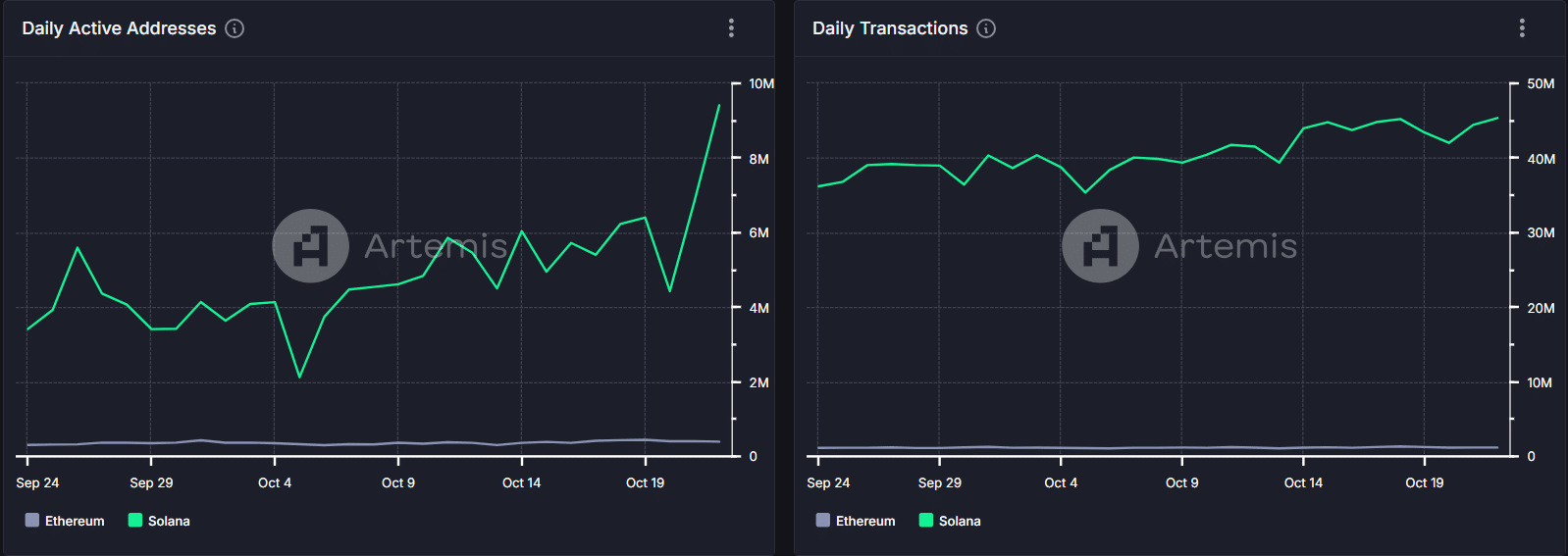

Supply : Artemis Terminal

Prior to now month, day by day energetic addresses on Solana have surged by 175%, whereas Ethereum has solely seen a modest double-digit improve.

This spike in exercise is not any coincidence. Solana has strategically positioned itself to outpace ETH by leveraging its excessive throughput, enabling quicker and extra reasonably priced transactions.

To date, this technique has paid off. SOL has successfully capitalized on ETH’s rising prices, producing outstanding momentum this cycle and attracting important curiosity from BTC traders as effectively.

Learn Solana’s [SOL] Value Prediction 2024–2025

In different phrases, SOL’s total outlook seems far brighter than ETH’s, establishing it because the main altcoin for the long term.

Whereas a correction may carry SOL beneath $170, it’s nonetheless poised to outshine ETH, probably difficult ETH’s path to simply hitting $2.7K.