Solana whale offloads $10.7M in SOL from $192M vault – Are investors on edge?

- Solana rallied 11% on macro reduction, however a significant whale offload sparks warning

- Trump’s tariff pause and Atkins’ SEC appointment reignite crypto threat urge for food, fueling early altcoin momentum

Solana [SOL] is again within the highlight. In per week marked by shifting regulatory winds and a stunning pause in international commerce tensions, SOL has surged 11%, catching the eye of merchants and analysts alike.

However beneath the floor of this rally, a significant whale transfer has raised a number of eyebrows – and questions.

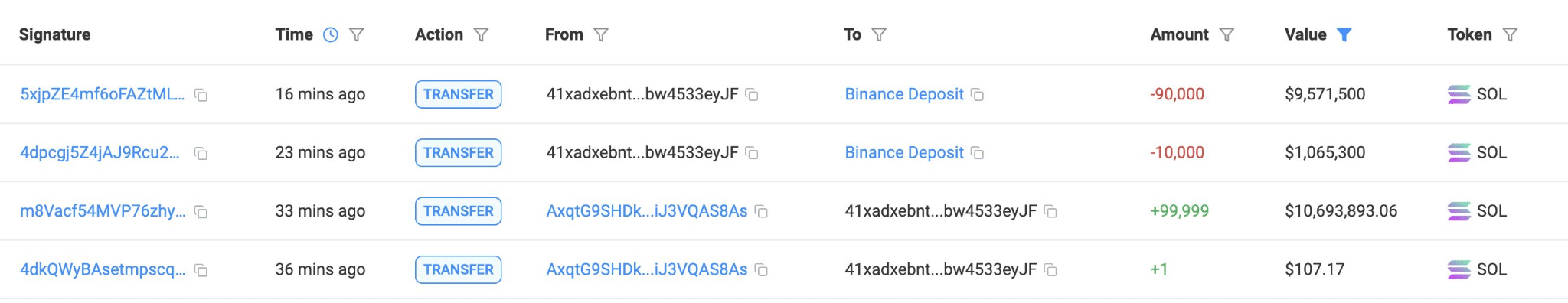

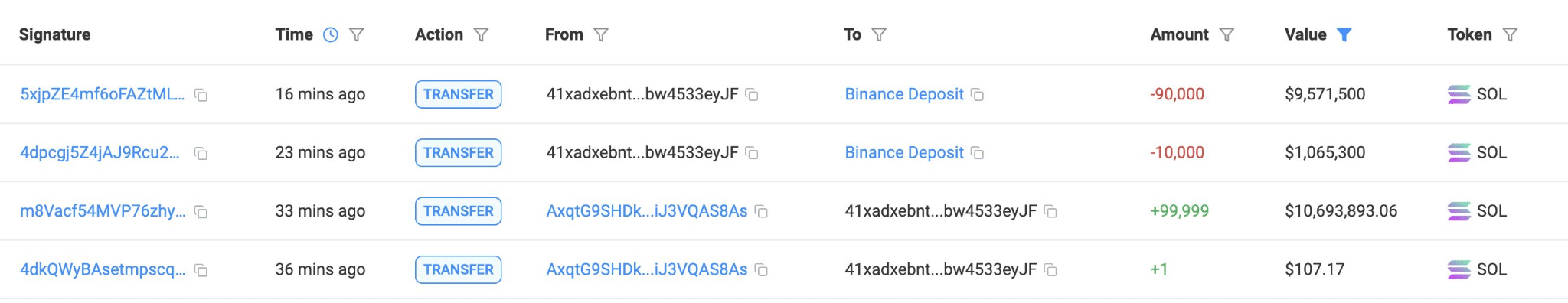

SOL large exits

One in all Solana’s largest whales — who lately unstaked 1.32 million SOL — has begun offloading. Roughly 100,000 SOL price $10.7 million was despatched to Binance only a day in the past.

This transfer seems to be linked to repaying a $20 million USDC mortgage, secured after depositing 1.2 million SOL into Kamino.

The whale’s motion coincides with SOL’s ongoing rally, intensifying investor scrutiny for attainable exit indicators. This growth may considerably affect market sentiment within the close to time period.

Supply: X

Macro tailwinds — A breather for threat belongings?

President Donald Trump’s 90-day tariff pause and Paul Atkins’ affirmation as SEC Chair have delivered a one-two punch of reduction for threat markets.

The tariff rollback gives a break from commerce tensions, traditionally a bullish sign for crypto. Main cryptocurrencies have surged within the hours for the reason that announcement.

Supply: X.

In the meantime, Atkins’ pro-market stance and rollback of enforcement-driven SEC insurance policies sign a friendlier regulatory atmosphere.

Collectively, these developments are reigniting urge for food for higher-beta belongings like Solana, with traders deciphering the second as a inexperienced gentle for capital rotation into crypto.

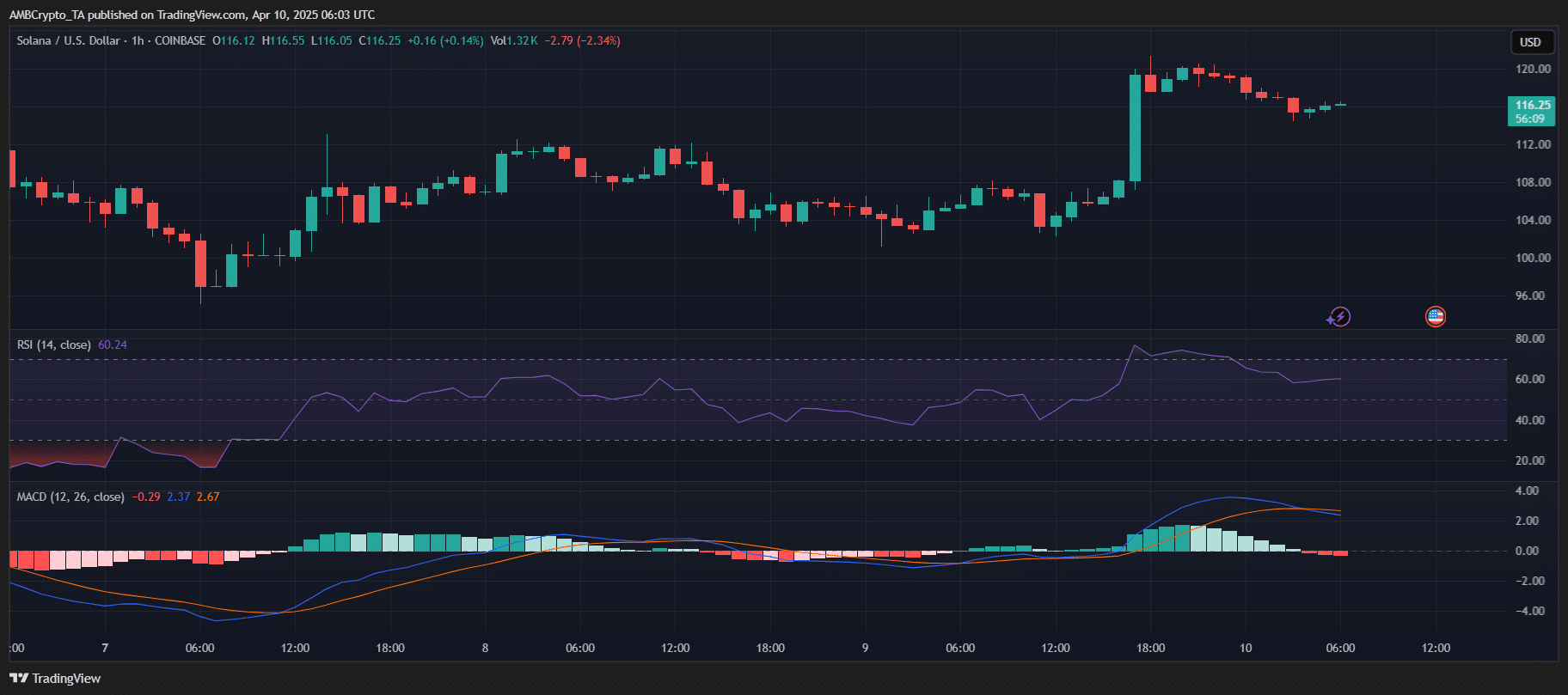

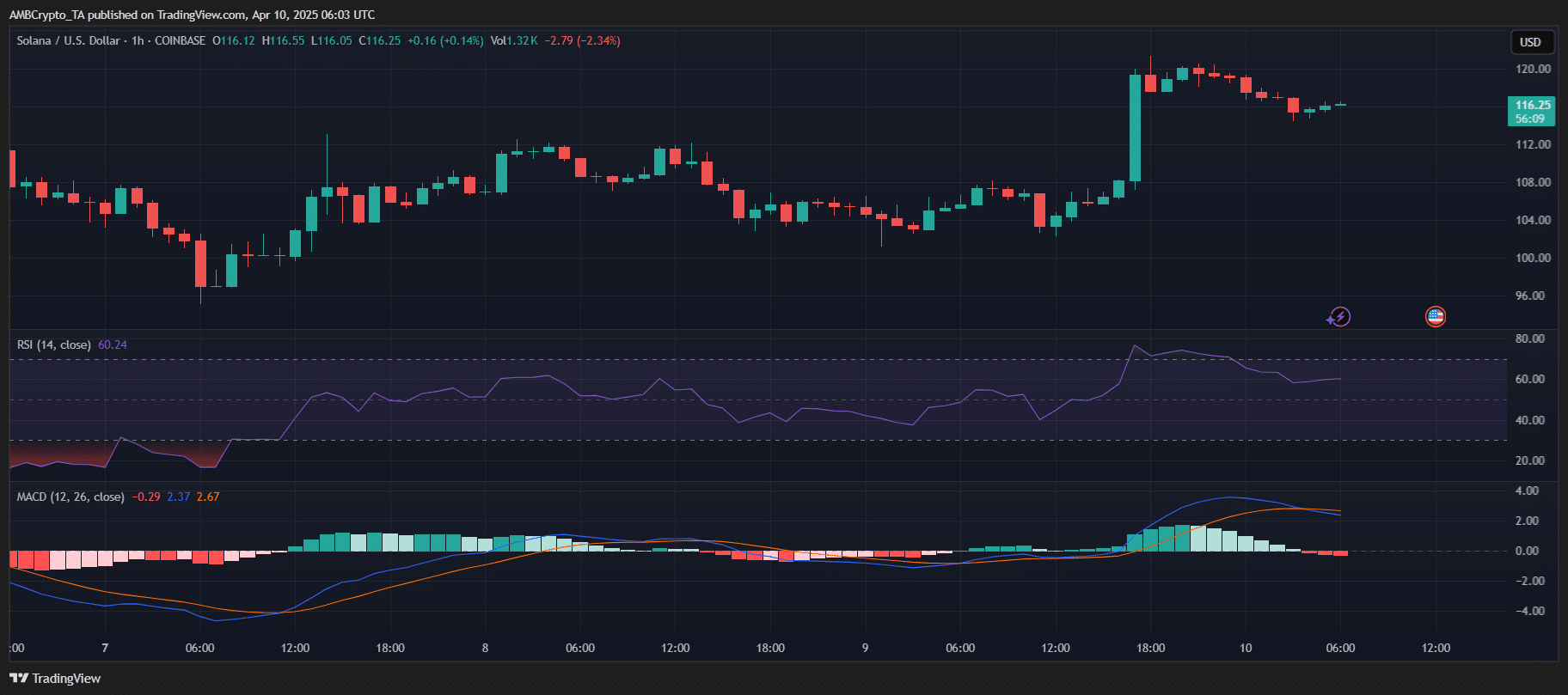

Technical setup publish tariff pause

Supply: TradingView

Following President Trump’s tariff pause on the ninth of April, Solana is exhibiting resilience — holding above $160 help with reducing the promoting stress.

The each day chart suggests a symmetrical triangle forming, hinting at a possible breakout above $180.

Supply: TradingView

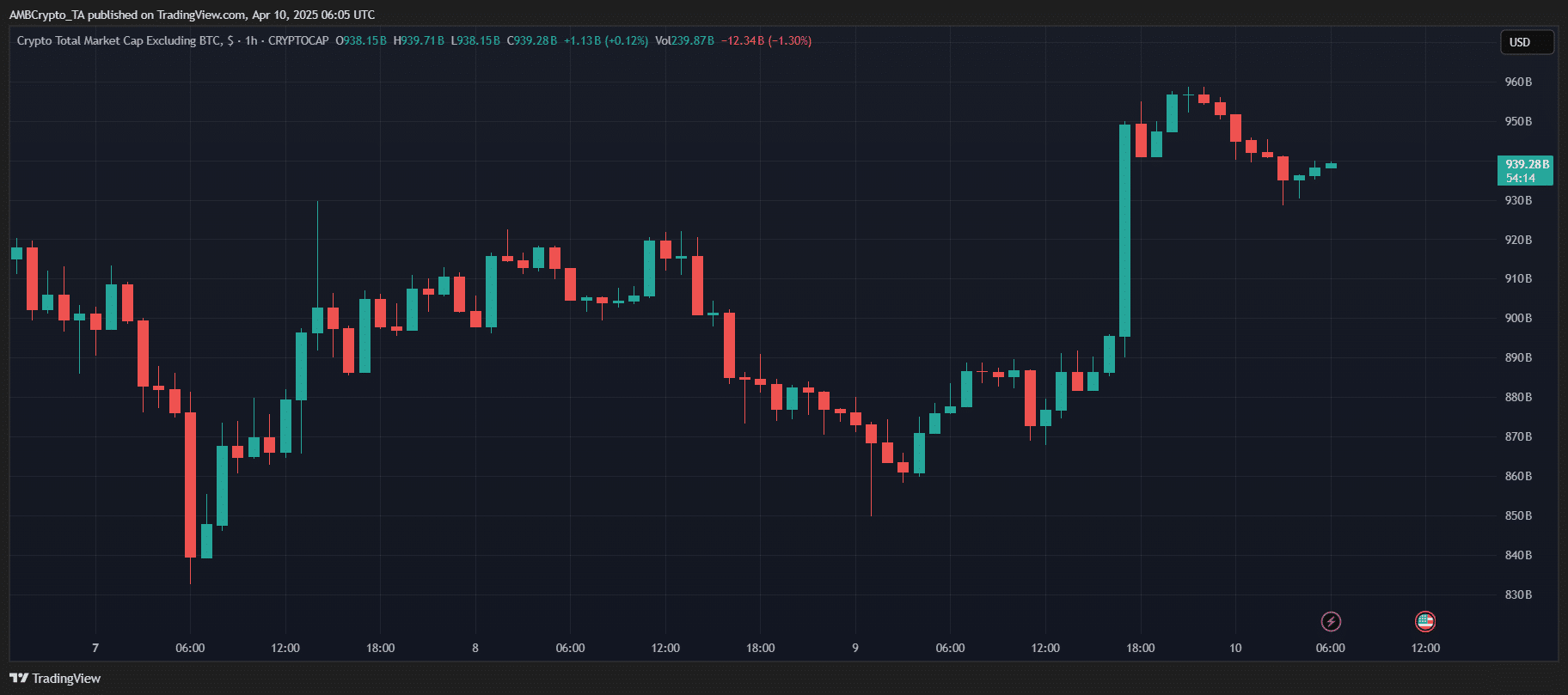

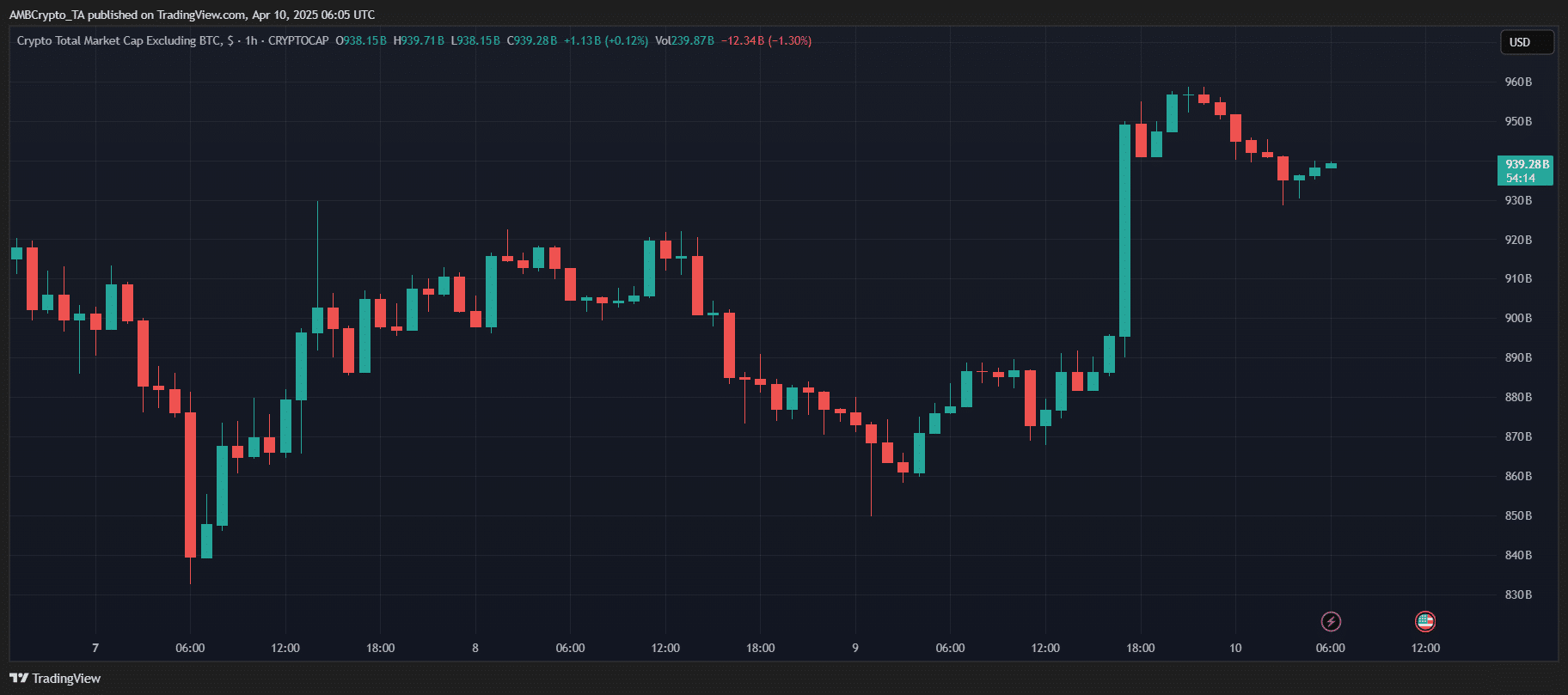

Altcoin market cap has steadily climbed post-announcement, urgent in opposition to resistance close to $1.17 trillion, signaling renewed investor threat urge for food.

This aligns with the macro reduction sparked by the tariff delay.

Supply: TradingView

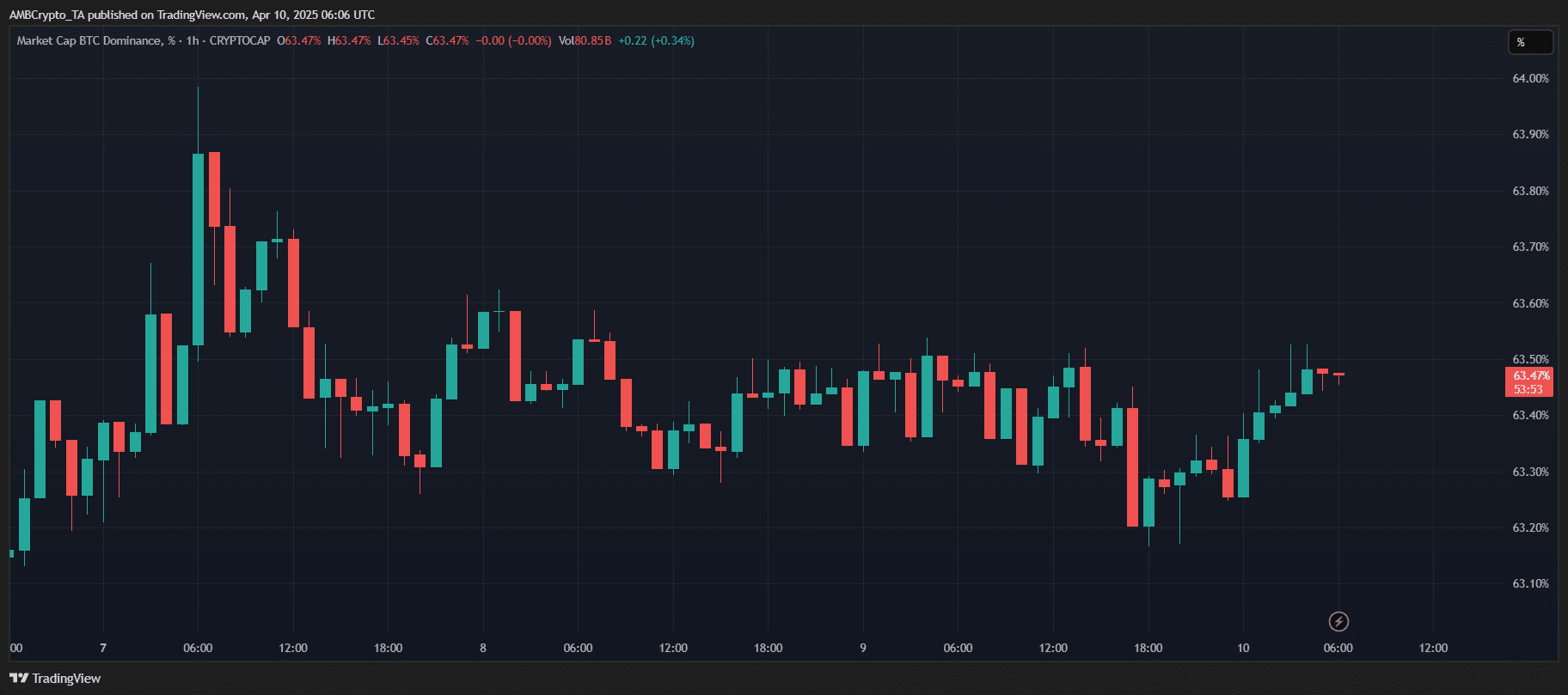

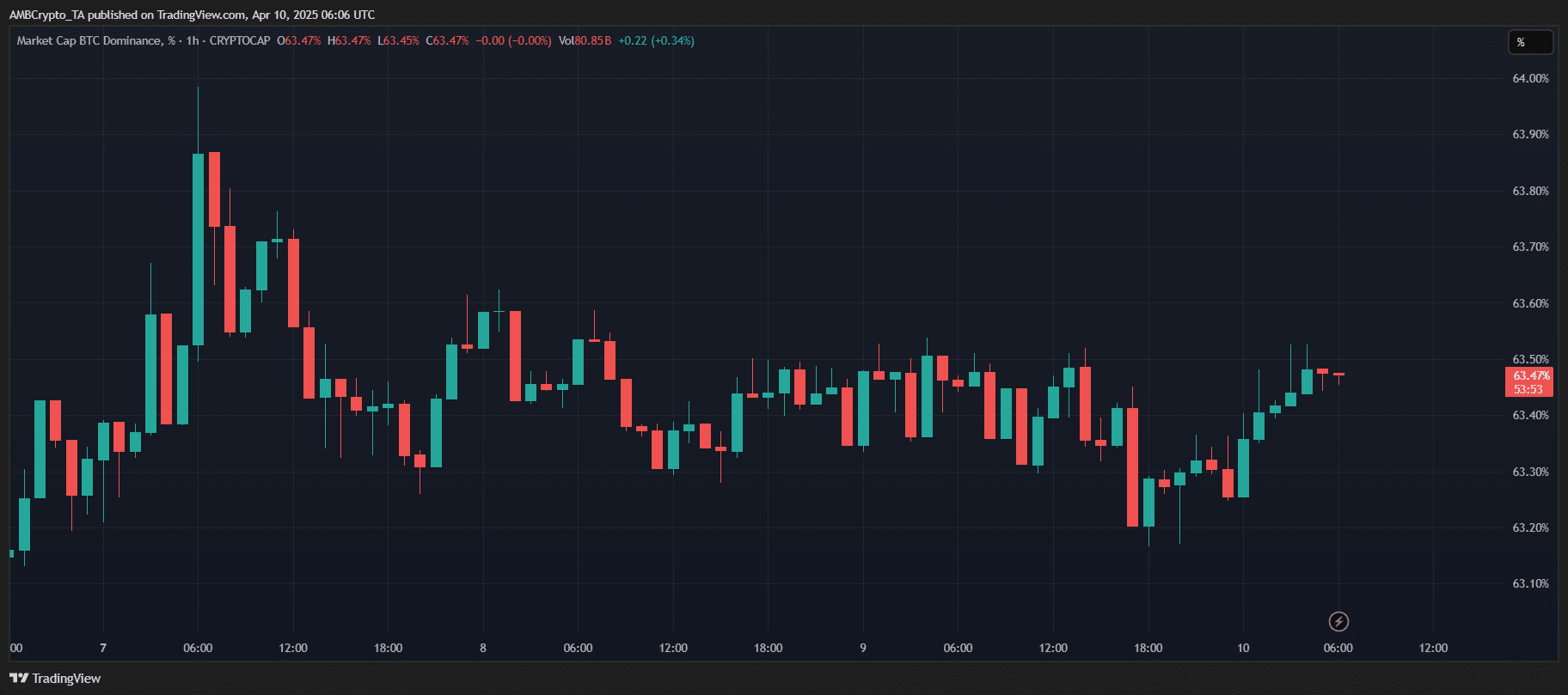

Moreover, on the time of writing, BTC.D was stalling close to 55%, with indicators of a possible double high formation. A decline under 54.5% may verify a shift in capital towards altcoins.

General, the charts point out a cautiously optimistic outlook, suggesting an early-stage altcoin resurgence fueled by geopolitical reduction.

What may deter SOL’s rally?

Solana’s upward momentum is going through a number of macroeconomic and market dangers. The U.S. CPI report on the eleventh of April may heighten issues about persistent inflation, doubtlessly delaying Federal Reserve price cuts.

Moreover, President Trump’s tariff insurance policies—corresponding to a common 10% levy and as much as 125% on Chinese language items—might additional gasoline inflation and unsettle markets over time.

On-chain, the altcoin market cap has barely cooled for the reason that tariff pause rally. If Bitcoin dominance continues to rise, traders’ threat urge for food might shift again to BTC, weakening Solana’s relative power.