$18 Million Ethereum Loss Sends Whale Running To Gold

A big crypto pockets that lately took a pointy loss on Ethereum has restructured its holdings, shifting away from risky tokens and rising publicity to stablecoins and tokenized gold, based on on-chain monitoring information.

Associated Studying

The tackle drew consideration after an aggressive Ethereum buy late final 12 months went mistaken. Between November 3 and November 7, 2025, the pockets spent about $110 million to amass 31,005 ETH at a median worth of $3,581.

As costs slid, the place was unwound. Practically your entire holding was bought for roughly $92.19 million, locking in a loss near $18 million inside two weeks. At present costs close to $3,020, that very same Ethereum stack would now be valued at round $93.6 million.

Shift Away From Ether After Pricey Exit

Based mostly on reviews from blockchain monitoring platforms, the sell-off marked a transparent change in habits. The pockets, as soon as closely tied to Ethereum, now not holds a big directional wager on the asset. As an alternative, balances have been unfold throughout cash-like tokens and commodities. The transfer displays warning quite than an try and rapidly get well losses.

An unknown whale, who misplaced $18.8M on $ETH in simply 2 weeks, has deserted $ETH and rotated into #gold.

The whale has spent $14.58M to purchase 3,299 $XAUT at $4,421 over the previous 7 hours.https://t.co/hit6agWmHd pic.twitter.com/X7k94zV0iQ

— Lookonchain (@lookonchain) January 2, 2026

Gold Shopping for Exhibits Desire For Decrease Volatility

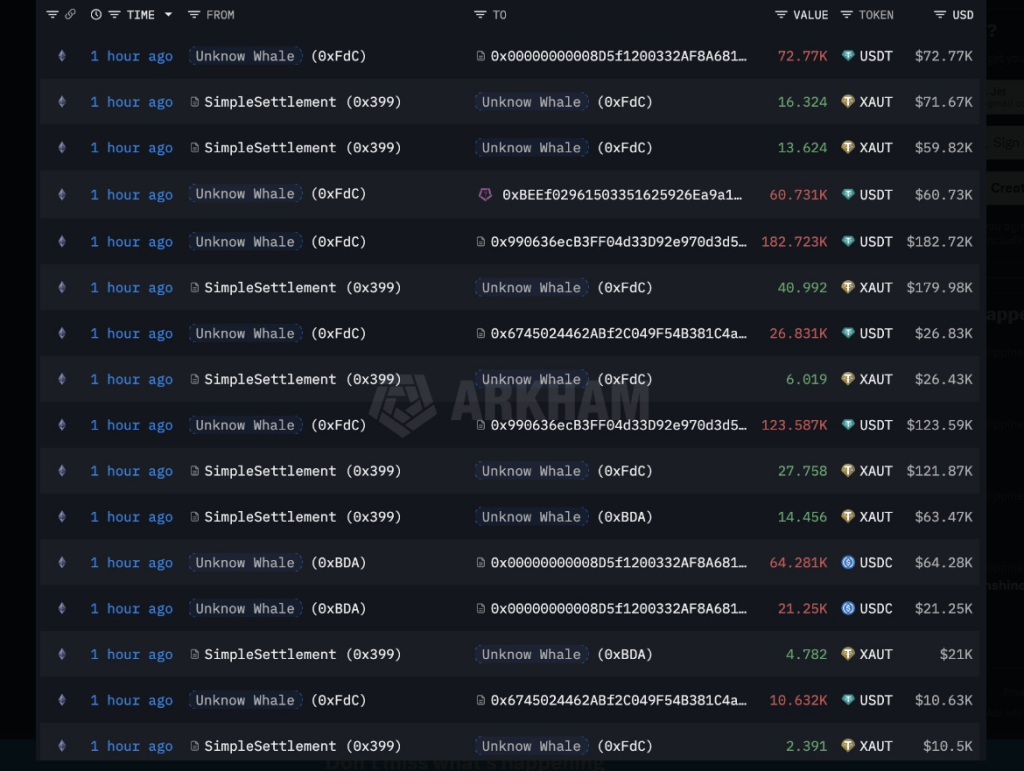

In keeping with on-chain information, the tackle started constructing a place in Tether’s tokenized gold product, XAUT. Beginning on Friday, the pockets spent $14.58 million in USDT to purchase 3,299 XAUT throughout a number of transactions.

The typical buy worth got here in close to $4,421 per token. This was not the primary gold purchase. A smaller XAUT acquisition was made on December 13, roughly three weeks earlier. As of the newest information, the pockets holds 3,386 XAUT tokens price about $14.92 million.

The broader portfolio now totals near $91 million. About $58 million sits in USDT, one other $18 million is held in USDC, whereas the rest is cut up between XAUT and a diminished Ethereum stability. The composition factors to capital safety quite than high-risk positioning.

Metals Outperform Crypto In 2025

Returns from final 12 months assist clarify the change. Experiences have disclosed that Bitcoin fell by 6% in 2025, whereas Ethereum dropped 11%. Over the identical interval, gold surged over 60%, and silver rose a fair steeper 147%.

Associated Studying

Main inventory indexes such because the S&P 500, Dow Jones, and Nasdaq 100 additionally posted stronger efficiency than a lot of the crypto market. With these ends in view, some traders seem extra snug holding property linked to metals or money.

In the meantime, analysts at asset supervisor VanEck have pointed to 2026 as a attainable restoration 12 months for the crypto market. Their view contrasts with the present habits of enormous wallets shifting into stablecoins and gold-linked tokens.

The divide reveals how unsure sentiment stays after a 12 months when metals and conventional property delivered stronger positive factors than main cryptocurrencies.

Featured picture from Unsplash, chart from TradingView