Solana whales dump $46 mln in a day: Assessing the impact on SOL

- A number of Solana whale addresses dumped over $46 million tokens in sooner or later.

- the altcoin may dip additional if broader sentiment stays bearish and key assist ranges fails to carry sturdy.

A wave of whale exercise has shaken the Solana [SOL] market not too long ago.

The altcoin’s on-chain information revealed that on the fifth of April, a number of giant holders unstaked and dumped a large quantity of SOL, sparking fears of a deeper worth correction.

In accordance with Lookonchain latest tweet, pockets deal with HUJBzd led the exodus by dumping 258,646 SOL price roughly $30.3 million.

Following carefully, BnwZvG offered 80,000 SOL ($9.47M) whereas 8rWuQ5 and 2UhUo1 offloaded 30,000 and 25,501 SOL respectively— totaling one other $6.53M in promote strain.

This provides as much as a mixed $46.3 million price of SOL dumped inside a brief window.

Is a deeper correction on the horizon?

Such heavy promoting sometimes hints at bearish sentiment for Solana — particularly when the promoting strain is spearheaded by whales.

Provided that these gross sales occurred quickly after SOL was unstaked, it suggests an absence of curiosity in long-term holding, no less than for now.

On the time of writing, SOL was already struggling to reclaim the $120 resistance degree. With recent sell-offs including strain, there’s an actual probability of a retest of the $1oo assist zone.

If patrons fail to defend that vary, the dip may lengthen additional, presumably towards $98 — a psychological threshold.

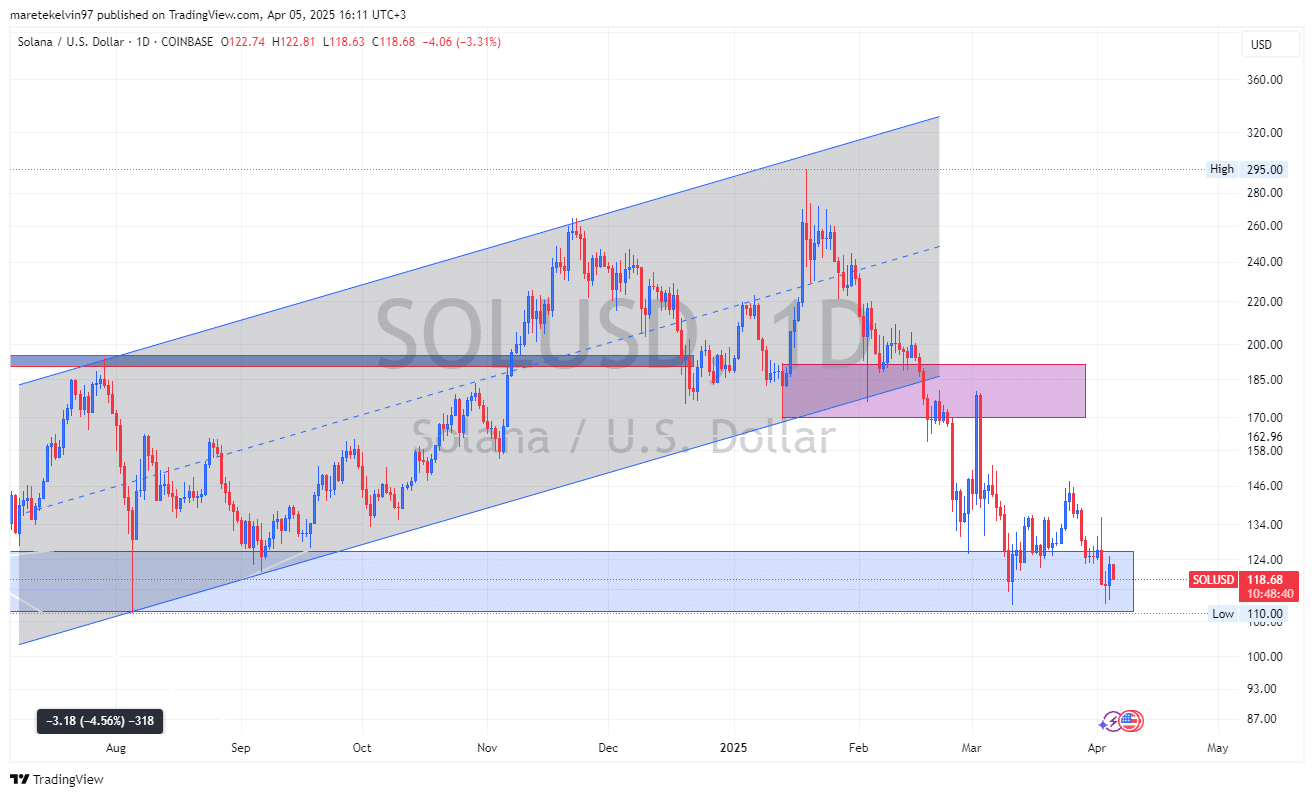

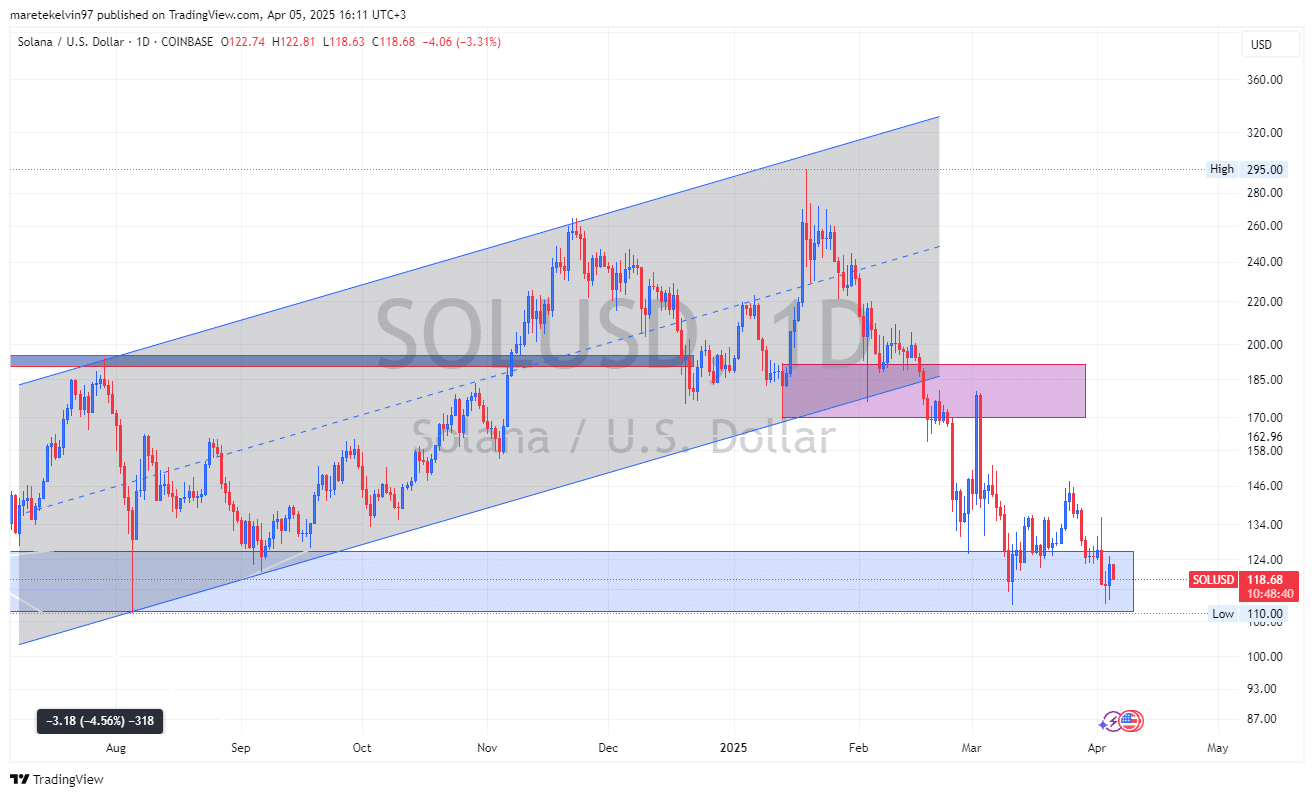

Supply: TradingView

Market sentiment leans cautious for SOL

The broader market shouldn’t be serving to, both. With the king coin nonetheless unstable, altcoins additionally appear to comply with the go well with. As concern creeps again in, retail and institutional buyers alike might keep on the sidelines.

This makes any SOL restoration much less seemingly within the quick time period except a brand new catalyst emerges — maybe from a optimistic ecosystem growth or improved macro developments.

Nonetheless, it’s price noting that whale exercise doesn’t all the time imply doom for SOL. In previous cycles, giant dumps have generally preceded accumulation phases.

Watching whether or not these whales re-enter or if recent wallets choose up the slack shall be key for the market individuals.

Technically, SOL costs try a probable reversal at a key demand zone. The zone has seen a number of rejections and has proved to be sturdy a number of occasions.

If this cyclical sample holds, all shouldn’t be misplaced for SOL regardless of the exodus, and the zone may reject costs to the upside.

For now, merchants and buyers alike ought to control quantity developments and the way SOL behaves close to the present demand zone at round $110.

A high-volume bounce may sign a short-term reversal, whereas weak shopping for may open the doorways for Solana to dip additional under $100 key psychological worth degree.